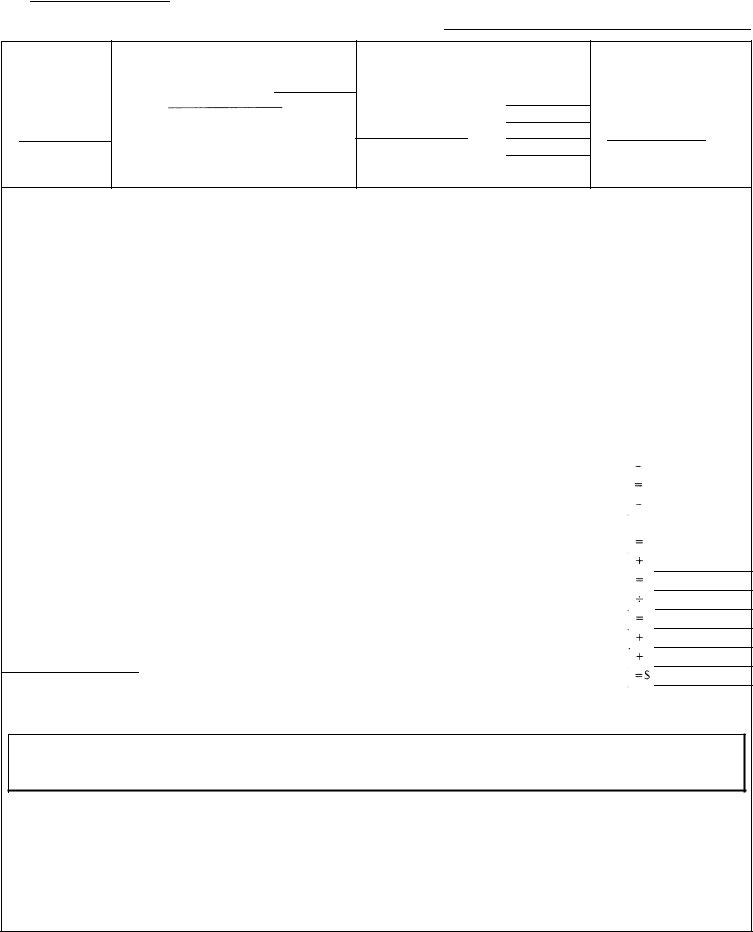

In today's increasingly complex market for vehicle leasing, understanding the intricacies of a lease agreement is crucial for consumers seeking to make informed decisions. Central to this process is the Federal Consumer Leasing Act (CLA) disclosures, embodied in the Appendix A-2 Model Closed-End or Net Vehicle Lease Disclosures form. This comprehensive form outlines essential information including the amount due at lease signing itemized to reflect initial payments, trade-in allowances, and additional fees. It meticulously explains the calculation of monthly payments, incorporating gross capitalized cost, adjustments for capitalized cost reduction, and the determination of base monthly payments through depreciation, amortized amounts, and rent charges. Furthermore, the form addresses critical end-of-lease considerations such as the disposition fee, early termination charges, options for purchase at lease end, and charges for excessive wear and use. These disclosures are designed to offer a transparent overview of the lease terms, empowering lessees with the knowledge to understand their financial commitments over the lease term, their rights upon its expiration, and potential additional costs incurred during the lease period or at its conclusion. Through these detailed disclosures, lessees can navigate the leasing process with greater confidence and clarity.

| Question | Answer |

|---|---|

| Form Name | Federal Consumer Leasing Act Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | federal model close net online, federal disclosure appendix a 2, federal consumer leasing act, consumer leasing act net |

Appendix

Federal Consumer Leasing Act Disclosures

Date

Lessor(s) |

|

Lessee(s) |

Amount Due at Lease Signing

(Itemized below)”

$

Monthly Payments

Your first monthly payment of $

is due on |

|

|

, followed by |

|||

|

payments of $ |

|

|

due on |

||

the |

|

of each month. The total of your |

||||

monthly payments is $ |

|

|

|

|

||

Other Charges (not part of your monthly payment)

Disposition fee (if you do

not purchase the vehicle) $

[Annual tax]

Total $

Total of Payments

(The amount you will have paid by the end of the lease)

$

*Itemization of Amount Due at Lease Signing

Amount Due At Lease Signing: |

|

|

|

|

|

|

How the Amount Due at Lease Signing will be paid: |

|

|||||||

|

Capitalized cost reduction |

$ |

|

|

|

|

|

Net |

$ |

|

|

|

|

||

|

First monthly payment |

|

|

|

|

|

|

Rebates and noncash credits |

|

|

|

|

|

||

|

Refundable security deposit |

|

|

|

|

|

|

Amount to be paid in cash |

|

|

|

|

|

||

|

Title fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registration fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

$ |

|

|

|

|

|

|

|

|

Total $ |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Your monthly payment is determined as shown below: |

|

|

|

|

|

|||||||

Gross capitalized cost. The agreed upon value of the vehicle ($ |

|

|

) and any items |

|

|

|

|

|

|||||||

you pay over the lease term (such as service contracts, insurance, and any outstanding prior loan |

|

|

|

|

|

||||||||||

or lease balance) |

|

. . . . . . . . . . . . . . . . . . . . . . . |

. |

|

. . |

. . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . $. . . . |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

If you want an itemization of this amount, please check this box. ❑ |

|

|

|

|

|

||||||||

Capitalized cost reduction. The amount of any net |

|

|

|

|

|

||||||||||

that reduces the gross capitalized cost |

|

. . . . . . . . . . . . . . . . . . . . . |

|

|

. . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . |

. . . |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||||

Adjusted capitalized cost.The amount |

used in calculating your base monthly |

payment |

. . . |

. . |

|

|

|

||||||||

|

|

|

|

|

|||||||||||

Residual value. The value of the vehicle at the end of the lease used in calculating your base monthly payment |

. . . |

. |

|

|

|

||||||||||

|

|

|

|

|

|||||||||||

Depreciation and any amortized amounts. The amount charged for the vehicle’s decline in value |

|

|

|

|

|

||||||||||

through normal use and for other items |

paid over the lease terrn |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . |

. . . |

|

|

|

||||||||

|

|

|

|

|

|

|

|||||||||

Rent charge. The amount charged in addition to the depreciation and any amortized amounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total of base monthly payments.The depreciation and any amortized amounts plus the rent charge . . . . . . . . . . . . . . . . . . . . . . . . .

Lease term. The number of months in your lease . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Base monthly payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Monthly sales/use tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ...

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total monthly payment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ..

Early Termination. You may have to pay a substantial charge if you end this lease early. The charge may be up to several thousand dollars. The actual charge will depend on when the lease is terminated. The earlier you end the lease, the greater this charge is likely to be.

Excessive Wear and Use. You may be charged for excessive wear based on our standards for normal use [and for mileage in excess

of |

|

miles per year at the rate of |

|

|

per mile]. |

|||

Purchase Option at End of Lease Term. [You have an option to purchase the vehicle at the end of the lease term for $ |

|

|

||||||

[and a purchase option fee of $ |

|

|

].] [You do not have an option to purchase the vehicle at the end of the lease term.] |

|||||

Other Important Terms. See your lease documents for additional information on early termination, purchase options and maintenance responsibilities, warranties, late and default charges, insurance, and any security interest, if applicable