Navigating the complexities of professional business activities necessitates a comprehensive approach to financial documentation and reporting. Among the essentials for ensuring compliance and optimization of one's fiscal responsibilities is the proper completion and submission of the CRA (Canada Revenue Agency) form, specifically the T2032 E, Statement of Professional Activities. This form serves as a crucial tool for individuals in recording, calculating, and declaring their business and professional income, including detailed sections for identification, income computation, expense deduction, and net income adjustment. It not only mandates the listing of personal and business information such as social insurance number, business name, and industry code but also delves into the specifics of income sources, expense allocations, and the particulars of capital cost allowance. The form further outlines the method to account for partnership incomes, business-use-of-home expenses, and other deductible amounts that might not be directly reimbursed by the business entity itself. This careful delineation of financial entries ensures that professionals can accurately assess their financial standing, claim rightful deductions, and ultimately, contribute to their fiscal health and compliance. Additionally, guidance on aspects like motor vehicle expenses and the calculation of capital cost allowance exemplifies the form's comprehensive nature in covering various facets of professional business income reporting.

| Question | Answer |

|---|---|

| Form Name | Cra Forms Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | pd4r discrepancy notice, pd4r form cra, pd4r e, pd4r |

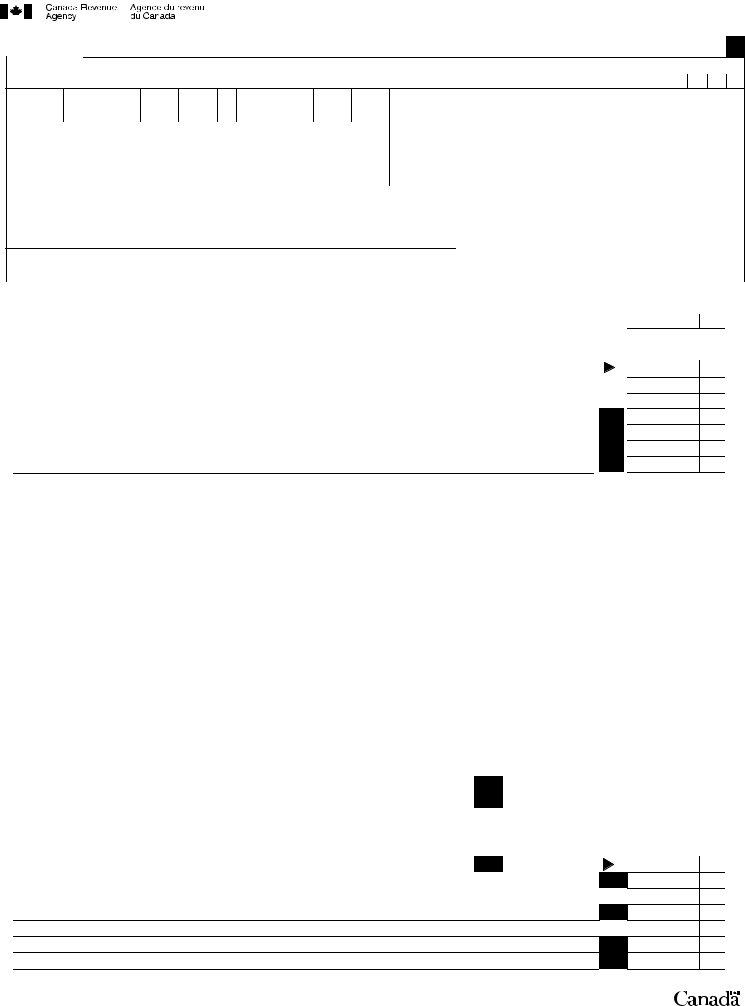

STATEMENT OF PROFESSIONAL ACTIVITIES

For more information on how to complete this form, see the BUSINESS AND PROFESSIONAL INCOME guide.

|

Identification |

|

Your social insurance number |

|

||||||

Your name |

|

|

||||||||

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

3

|

|

Year |

Month |

Day |

|

Year |

Month |

|

Day |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

From: |

|

|

|

|

|

|

|

|

|

|

To: |

|

|

|

|

|

|

|

|

|

|

|

|

Was 2007 the last year of your professional business? |

Yes |

|

No |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Main product or service |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industry code (see the appendix in the |

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUSINESS AND PROFESSIONAL INCOME guide) |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

City, province or territory |

|

|

|

|

|

|

|

|

|

|

|

|

Postal code |

|

|

|

|

Partnership filer identification number |

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of person or firm preparing this form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax shelter identification number |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your percentage of the partnership |

|

|

% |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

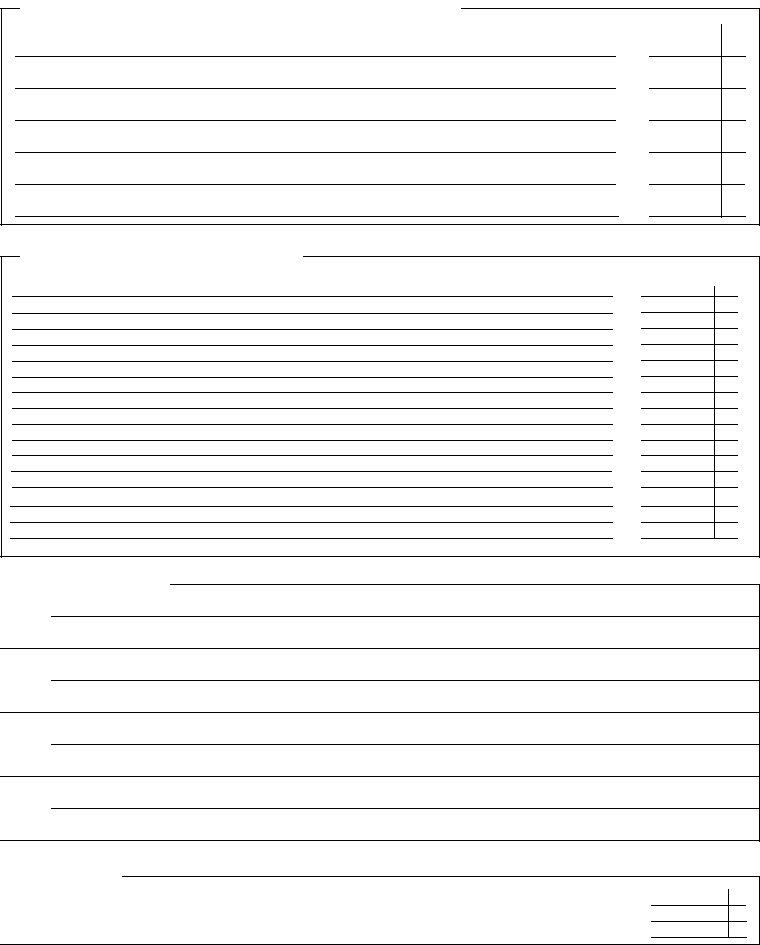

Income

Professional fees (includes |

|

|||||||||

|

|

|

|

|||||||

Minus – Goods and services tax/harmonized sales tax (GST/HST) and provincial sales tax (if included in fees above) |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||

|

|

– |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

||

|

|

Total of the above two lines |

|

|

|

|

|

|||

|

|

|

Subtotal (line a minus line b) |

|

||||||

Plus – |

|

|||||||||

|

|

Adjusted professional fees (total of the above two lines) |

|

|

8000 |

|||||

Reserves deducted last year |

|

8290 |

||||||||

Other income |

|

8230 |

||||||||

|

|

Gross income (total of the above three lines) – Enter on line 164 of your income tax return |

8299 |

|||||||

a

b

c

Expenses (enter business part only)

Advertising |

|

|

|

8521 |

|

|

|

Bad debts |

|

|

|

8590 |

|

|

|

Business tax, fees, licences, dues, memberships, and subscriptions |

|

|

|

8760 |

|

|

|

Delivery, freight, and express |

|

|

|

9275 |

|

|

|

Fuel costs (except for motor vehicles) |

|

|

|

9224 |

|

|

|

Insurance |

|

|

|

8690 |

|

|

|

Interest |

|

|

|

8710 |

|

|

|

Maintenance and repairs |

|

|

|

8960 |

|

|

|

Management and administration fees |

|

|

|

8871 |

|

|

|

Meals and entertainment (allowable part only) |

|

|

|

8523 |

|

|

|

Motor vehicle expenses (not including CCA) (see Chart A on page 4) |

|

|

|

9281 |

|

|

|

Office expenses |

|

|

|

8810 |

|

|

|

Supplies |

|

8811 |

|

|

|||

Legal, accounting, and other professional fees |

|

|

|

8860 |

|

|

|

Property taxes |

|

|

|

9180 |

|

|

|

Rent |

|

|

|

8910 |

|

|

|

Salaries, wages, and benefits (including employer's contributions) |

|

|

|

9060 |

|

|

|

Travel ( including transportation fees, accommodations, and allowable portion of meals) |

|

|

|

9200 |

|

|

|

Telephone and utilities |

|

|

|

9220 |

|

|

|

Other expenses |

9270 |

|

|

||||

|

|

Subtotal |

|

|

|

||

Allowance on eligible capital property |

|

|

9935 |

|

|

||

Capital cost allowance (from Area A on page 3) |

|

|

|

9936 |

|

|

|

Total expenses (total of the above three lines) |

9368 |

|

|

||||

Net income (loss) before adjustments (line c minus line d) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your share of line 9369 above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minus – Other amounts deductible from your share of net partnership income (loss) (from the chart on page 2)

Net income (loss) after adjustments (line e minus line f)

Minus –

Your net income (loss) (line g minus line h) (enter on line 137 of your income tax return)

9369

9943

9945

9946

d

e

f

g h

T2032 E (07) |

(Vous pouvez obtenir ce formulaire en français à www.arc.gc.ca ou au |

Other amounts deductible from your share of net partnership income (loss)

Claim expenses you incurred that were not included in the partnership statement of income and expenses, and for which the partnership did not reimburse you.

Total (enter this amount on line f on page 1)

Calculation of

Heat

Electricity

Insurance

Maintenance

Mortgage interest

Property taxes

Other expenses

Subtotal

Minus – Personal use part

Subtotal

Plus – Capital cost allowance (business part only)

– Amount carried forward from previous year

Subtotal

Minus – Net income (loss) after adjustments (from line g on page 1) – If negative, enter "0"

Allowable claim (the lesser of amounts 1 or 2 above) – Enter this amount on line 9945 on page 1

|

|

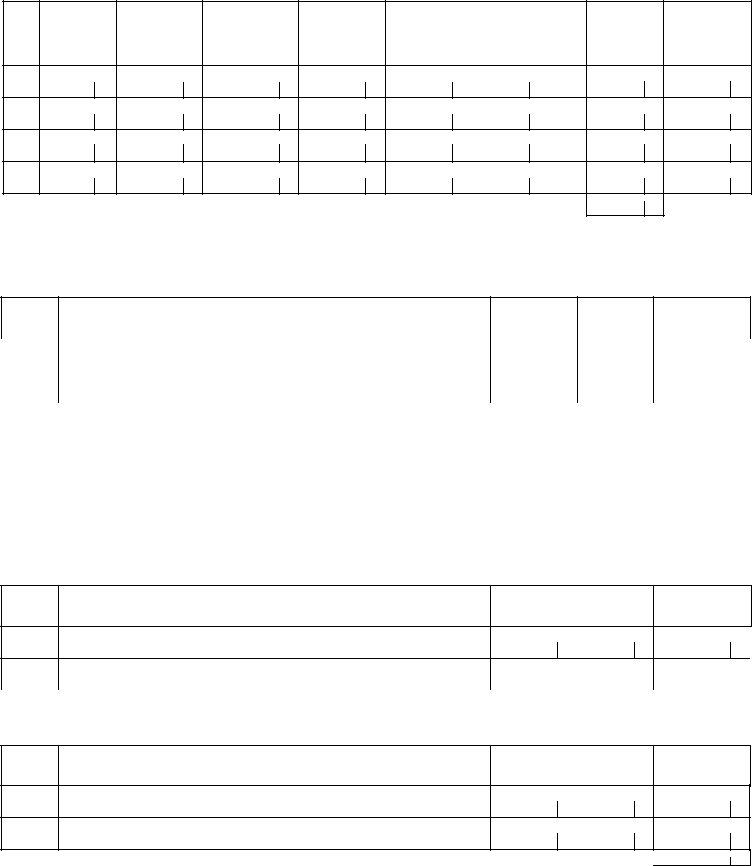

Details of other partners |

|

Share of |

|

|

Percentage of |

|||||

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

net income |

|

|

||||

Name |

|

|

|

$ |

|

partnership |

||||||

|

|

|

or (loss) |

|

||||||||

and |

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

address |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Share of |

|

|

Percentage of |

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

net income |

|

|

||||

Name |

|

|

|

$ |

|

partnership |

||||||

|

|

|

or (loss) |

|

||||||||

and |

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

address |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Share of |

|

|

Percentage of |

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

net income |

|

|

||||

Name |

|

|

|

$ |

|

partnership |

||||||

|

|

|

or (loss) |

|

||||||||

and |

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

address |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Share of |

|

|

Percentage of |

|||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

net income |

|

|

||||

Name |

|

|

|

$ |

|

partnership |

||||||

|

|

|

or (loss) |

|

||||||||

and |

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

address |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Details of equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

|

Total business liabilities |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

9931 |

|

||||

|

Drawings in 2007 |

|

|

|

|

|

|

9932 |

|

|||

|

Capital contributions in 2007 |

|

|

|

|

|

|

9933 |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

1

2

%

%

%

%

Area A – Calculation of capital cost allowance claim

12

Class Undepreciated

number capital cost (UCC) at the start of the year

3

Cost of additions

in the year

(see Areas B and C below)

4

Proceeds of dispositions in the year (see Areas D and E below)

5 *

UCC

after additions and dispositions

(col. 2 plus col. 3

minus col. 4)

6 |

7 |

8 |

Adjustment for current |

Base amount for |

Rate |

year additions |

CCA |

% |

(1/2 x (col. 3 minus |

(col. 5 minus col. 6) |

|

col. 4)) |

|

|

If negative, enter "0" |

|

|

|

|

|

9

CCA

for the year

(col. 7 x col. 8 or

an adjusted amount)

10

UCC at the end

of the year

(col. 5 minus col. 9)

Total CCA claim for the year (enter this amount, minus any personal part and any

CCA for

*If you have a negative amount in this column, add it to income as a recapture on line 8230, "Other income", on page 1. If no property is left in the class and there is a positive amount in the column, deduct the amount from income as a terminal loss on line 9270, "Other expenses," on page 1. Recapture and terminal loss do not apply to a class 10.1 property. For more information, read Chapter 4 of the BUSINESS AND PROFESSIONAL INCOME guide.

**For information on CCA for "Calculation of

Area B – Details of equipment additions in the year

1

Class number

2

Property

details

3

Total cost

4

Personal part (if applicable)

5

Business part (column 3 minus column 4)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area C – Details of building additions in the year |

|

Total equipment additions in the year |

9925 |

|

|

||||||

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

2 |

|

3 |

|

4 |

|

|

5 |

|

|

Class |

|

Property |

|

|

Total |

Personal part |

Business part |

||||

number |

|

details |

|

|

cost |

(if applicable) |

(column 3 minus |

||||

|

|

|

|

|

|

|

|

|

|

column 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area D – Details of equipment dispositions in the year |

|

Total building additions in the year |

9927 |

|

|

||||||

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|||

1

Class

number

2

Property

details

3 |

4 |

|

Proceeds of disposition |

Personal part |

|

(should not be more |

(if applicable) |

|

than the capital cost) |

|

|

|

|

|

|

|

|

5

Business part (column 3 minus column 4)

|

|

|

|

|

|

|

|

|

|

|

|

Note: If you disposed of property from your business in the year, see Chapter 4 in the BUSINESS |

Total equipment dispositions in the year |

9926 |

|

|

|

|

|

||||

AND PROFESSIONAL INCOME guide for information about your proceeds of disposition. |

|

|

|||

|

|

|

|

|

|

Area E – Details of building dispositions in the year

1

Class

number

2

Property details

3 |

4 |

Proceeds of disposition |

Personal part |

(should not be more |

(if applicable) |

than the capital cost) |

|

|

|

5

Business part (column 3 minus column 4)

Note: If you disposed of property from your business in the year, see Chapter 4 in the BUSINESS |

Total building dispositions in the year |

9928 |

|

|

||

AND PROFESSIONAL INCOME guide for information about your proceeds of disposition. |

|

|

|

|

|

|

Area F – Details of land additions and dispositions in the year |

|

|

|

|

|

|

|

Total cost of all land additions in the year |

|

|

9923 |

|

|

|

|

|

|

|

||

|

Total proceeds from all land dispositions in the year |

|

|

9924 |

|

|

Note: You cannot claim capital cost allowance on land. |

|

|

|

|

|

|

|

|

|

|

|

|

|

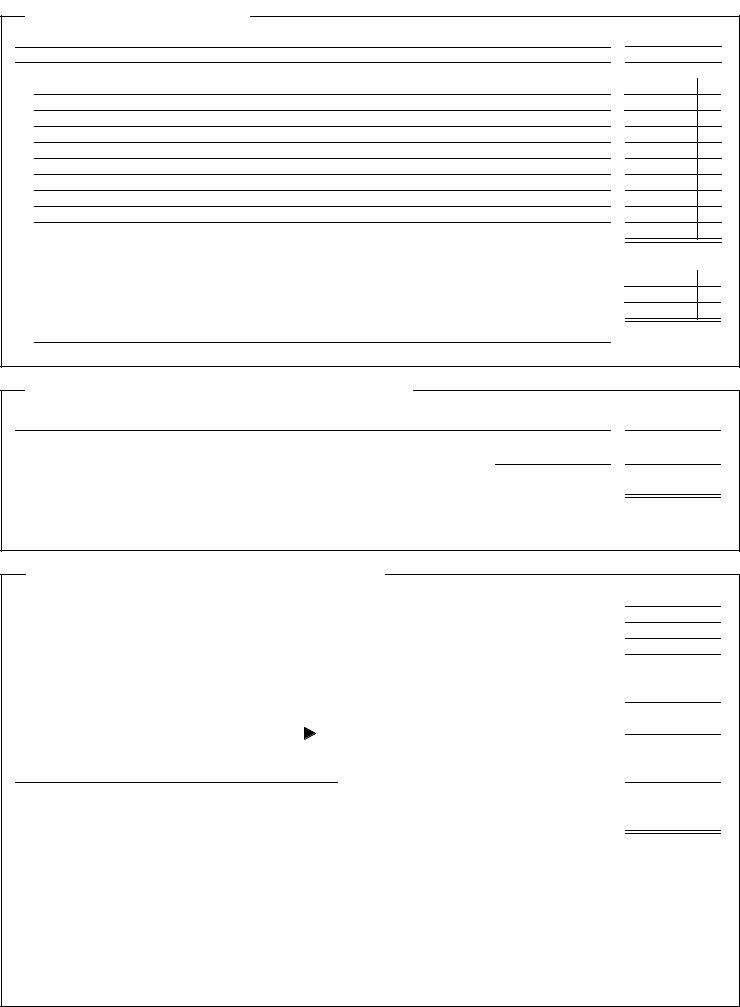

Chart A – Motor vehicle expenses

Enter the kilometres you drove in the tax year to earn business income

Enter the total kilometres you drove in the tax year

Fuel and oil

Interest (see Chart B below)

Insurance

Licence and registration

Maintenance and repairs

Leasing (see Chart C below)

Other expenses (please specify)

Total motor vehicle expenses: Add lines 3 to 10

Business use part: |

( |

line 1 |

) X line 11 |

|

= $ |

|

line 2 |

|

|||||

|

|

|

|

|

|

|

Business parking fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplementary business insurance |

|

|

|

|

|

|

|

|

|

|

|

|

|

Add lines 12, 13, and 14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowable motor vehicle expenses: Enter the amount from line 15 at line 9281 on page 1

Note: You can claim CCA on motor vehicles in Area A on page 3.

Chart B – Available interest expense for passenger vehicles

Total interest payable (accrual method) or paid (cash method) in the fiscal period

$ |

* × |

the number of days in the fiscal period for which interest |

||

was payable (accrual method) or paid (cash method) |

||||

|

|

|

||

Available interest expense: amount A or B, whichever is less (enter this amount on line 4 of Chart A above) $

* For passenger vehicles bought: |

• from September 1, 1989 to December 31, 1996, and from 2001 to 2007, use $10 |

|

• from 1997 to 2000, use $8.33 |

Chart C – Eligible leasing costs for passenger vehicles

Total lease charges incurred in your 2007 fiscal period for the vehicle. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total lease payments deducted before your 2007 fiscal period for the vehicle. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total number of days the vehicle was leased in your 2007 and previous fiscal periods . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

The amount on line 4 or ($35,294 * + GST ** and PST, or HST on $35,294), whichever is more

$ |

× 85% = |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|||||

|

|||||||

|

|

|

|||||

[($800 * + GST** and PST, or HST on $800) × line 3 ] |

|

– line 2: |

|

. . . . . . . . . . . = |

|||

|

30 |

|

|

|

|

||

|

|

|

|

|

|

||

[($30,000 * + GST** and PST, or HST on $30,000) × line 1]. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . = line 5

Eligible leasing cost: line 6 or 7, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (Enter this amount on line 8 of Chart A above)

* If you entered into a lease agreement before January 1, 2001, make the following changes to the chart:

|

|

After 1990 |

|

1998 |

|

|

|

|

|

and |

1997 |

|

and |

|

2000 |

|

|

before 1997 |

|

1999 |

|||

• for line 5, replace $35,294 with: |

$28,235 |

$29,412 |

$30,588 |

$31,765 |

|||

• for line 6, replace |

$800 with: |

650 |

550 |

650 |

700 |

||

• for line 7, replace $30,000 with: |

24,000 |

25,000 |

26,000 |

27,000 |

|||

** Use a GST rate of 7% or HST rate of 15% for the periods before July 1, 2006. Use a GST rate of 6% or HST rate of 14% for the periods after June 30, 2006.

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

A

B

1

2

3

4

5

6

7

Printed in Canada