Did you know that you can file a CRA Form T2125 with your tax return to claim eligible expenses for your business? This form allows you to deduct miscellaneous expenses related to your business, including office supplies, advertising, and travel costs. In this blog post, we'll go over the basics of the CRA Form T2125 and provide some tips on how to complete it correctly. Stay tuned for more information on this important form!

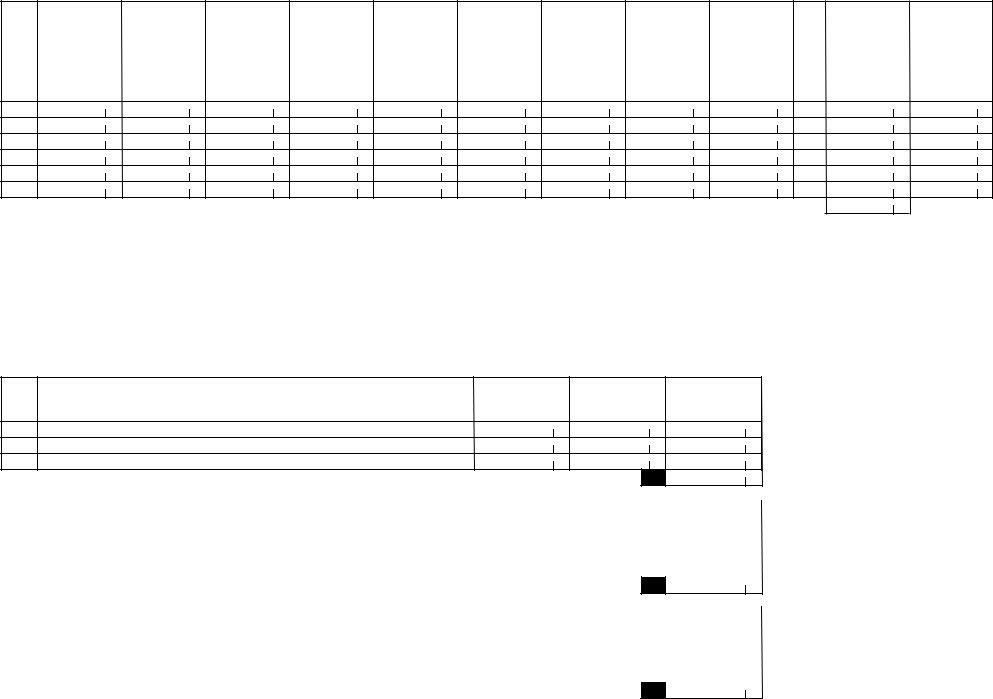

| Question | Answer |

|---|---|

| Form Name | Cra Form T2125 |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | statement form t2125, form t2125, t2125 file, t2125 form pdf |

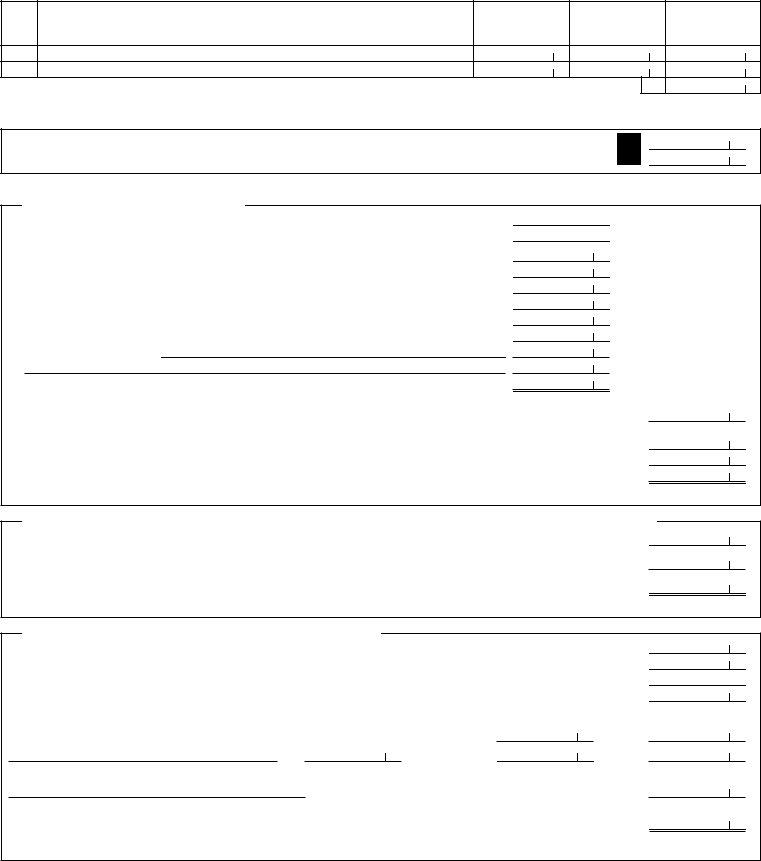

Protected B when completed

Statement of Business or Professional Activities

•Use this form to calculate your

•For each business or profession, fill in a separate Form T2125.

•Fill in this form and send it with your income tax and benefit return.

•For more information on how to fill in this form, see guide T4002,

|

Part 1 – Identification |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Your name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your social insurance number |

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

Prov./Terr. |

Postal code |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal |

|

Date (YYYYMMDD) |

|

|

|

|

|

|

Date (YYYYMMDD) |

|

|

Was this your last year of business? |

|

|

|

Yes |

|

|

|

|

|

|

|

|

No |

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||

period |

From |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Main product or service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industry code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(see the appendix in Guide T4002) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Accounting method |

|

|

|

|

|

|

Cash |

|

|

Accrual |

Tax shelter identification number |

|

Partnership business number |

|

Your percentage |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(commission only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

of the partnership |

% |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Name and address of person or firm preparing this form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Part 2 – Internet business activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

If your web pages or websites generate business or professional income, fill in this part of the form. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

How many Internet web pages and websites does your business earn income from? Enter "0" if none |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

Provide up to five main web page or website addresses, also known as uniform resource locator (URL): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

http:// |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

http:// |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

http:// |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

http:// |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

http:// |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of your gross income generated from the web pages and websites. |

|

% |

(If no income was generated from the Internet, enter "0".) |

T2125 E (19) |

(Ce formulaire est disponible en français.) |

Page 1 of 6 |

Protected B when completed

Part 3A – Business income

Fill in this part only if you have business income. If you have professional income, leave this part blank and fill in Part 3B. If you have both business and professional income, you have to fill out a separate Form T2125 for each.

Part 3B – Professional income

Fill in this part only if you have professional income. If you have business income, leave this part blank and fill in Part 3A. If you have both business and professional income, you have to fill out a separate Form T2125 for each.

Note: New rules allow you to include your work in progress (WIP) progressively if you elected to use billed basis accounting for the last tax year that started before March 22, 2017. Generally, for the first tax year that starts after March 21, 2017, you must include 20% of the lesser of the cost and the fair market value of WIP. The inclusion rate increases to 40% in the second tax year that starts after March 21, 2017, 60% in the third year, 80% in the fourth year, and 100% in the fifth and all subsequent tax years. For more information, see chapter 2 of guide T4002.

Part 3A – Business income

Gross sales, commissions, or fees (include GST/HST collected or collectible) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

GST/HST, provincial sales tax, returns, allowances, discounts, and GST/HST adjustments (included in amount 3A) . . . . . . . . . . . . . . .

Subtotal: Amount 3A minus amount 3B

If you are using the quick method for GST/HST – Government assistance calculated as follows: |

3D |

GST/HST collected or collectible on sales, commissions and fees eligible for the quick method |

GST/HST remitted, (sales, commissions, and fees eligible for the quick method plus

GST/HST collected or collectible) multiplied by the applicable quick method remittance rate |

|

|

3E |

|

|

||

Subtotal: Amount 3D minus amount 3E |

|||

Adjusted gross sales: Amount 3C plus amount 3F (enter on line 8000 of Part 3C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3A

3B

3C

3F

3G

Part 3B – Professional income

Gross professional fees including

GST/HST, provincial sales tax, returns, allowances, discounts, and GST/HST adjustments (included in amount 3H) and any WIP at the end of the year you elected to exclude . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Subtotal: Amount 3H minus amount 3I

If you are using the quick method for GST/HST – Government assistance calculated as follows:

GST/HST collected or collectible on professional fees eligible for the quick method . . . . . . . . . . . . . . . 3K GST/HST remitted, (professional fees eligible for the quick method plus GST/HST collected or

collectible) multiplied by the applicable quick method remittance rate |

|

|

|

3L |

|

|

|

||

. . . . . . . . . |

|

|

|

|

|

Subtotal: Amount 3K minus amount 3L |

|||

Adjusted professional fees: Amount 3J plus amount 3M plus amount 3N (enter on line 8000 of Part 3C) . . . . . . . . . . . . . . . . . . . . . .

Part 3C – Gross business or professional income

Adjusted gross sales (amount 3G) or adjusted professional fees (amount 3O) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8000 Reserves deducted last year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8290

Other income |

8230 |

|

|

|

► |

Subtotal. . . . . . . .: .Line. . . 8290. . . . .plus. . . .line. 8230 |

|

|

|

||

|

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

Gross business or professional income: Line 8000 plus amount 3P |

8299 |

|

|

Report the gross business or professional income from line 8299 on the applicable line of your income tax and benefit return |

|

as indicated below: |

|

•business income on line 13499

•professional income on line 13699

•commission income on line 13899

For Parts 3D, 4, and 5, if GST/HST has been remitted or an input tax credit has been claimed, do not include GST/HST when you calculate the cost of goods sold, expenses, or net income (loss).

Part 3D – Cost of goods sold and gross profit

If you have business income, fill in this part. Enter only the business part of the costs.

Gross business income (line 8299 of Part 3C). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Opening inventory (include raw materials, goods in process, and finished goods) |

8300 |

|

|

|

|

3R |

|

|

|

|

|||

|

|

|

|

|

3S |

|

Purchases during the year (net of returns, allowances, and discounts) |

8320 |

|

|

|

|

|

|

|

|

|

|||

8340 |

|

|

|

|

3T |

|

Direct wage costs |

|

|

|

|

||

|

|

|

|

|||

|

|

|

|

|

3U |

|

Subcontracts |

8360 |

|

|

|

|

|

|

|

|

|

|||

8450 |

|

|

|

|

3V |

|

Other costs |

|

|

|

|

||

|

|

|

|

|||

|

|

|

|

|

3W |

|

Subtotal: Add amounts 3R to 3V |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Closing inventory (include raw materials, goods in process, and finished goods) |

8500 |

|

|

|

|

► |

|

|

|

|

|||

8518 |

|

|

|

|

||

Cost of goods sold: Amount 3W minus line 8500 |

|

|

|

|

||

|

|

|

|

|||

|

|

|

|

|

||

|

|

|

|

|

|

|

Gross profit (or loss): Amount 3Q minus line 8518 |

8519 |

|

3H

3I

3J

3M

3N

3O

3P

3Q

Page 2 of 6

Protected B when completed

Part 4 – Net income (loss) before adjustments

Gross business or professional income (line 8299 of Part 3C) or Gross profit (line 8519 of Part 3D). . . . . . . . . . . . . . . . . . . . . . . . .

Expenses (enter only the business part)

Advertising |

8521 |

|

|

|

4B |

||

|

|

||||||

|

|

|

|

4C |

|||

Meals and entertainment. . . |

|

|

|

||||

|

|

||||||

|

|

|

4D |

||||

Bad debts |

|

|

|

||||

|

|

||||||

|

|

|

4E |

||||

Insurance |

|

|

|

||||

|

|

|

|||||

|

|

|

4F |

||||

Interest and bank charges. . |

|

|

|

||||

|

|

|

|||||

|

|

|

4G |

||||

Business taxes, licences, and memberships |

|

|

|

||||

|

|

|

|||||

8810 |

|

|

|

4H |

|||

Office expenses |

|

|

|

||||

|

|

|

|||||

|

|

|

4I |

||||

Office stationery and supplies |

|

|

|

||||

|

|

|

|||||

8860 |

|

|

|

4J |

|||

Professional fees (includes legal and accounting fees) |

|

|

|

||||

|

|

|

|||||

8871 |

|

|

|

4K |

|||

Management and administration fees |

|

|

|

||||

|

|

|

|||||

|

|

|

|

4L |

|||

Rent |

|

|

|

||||

|

|

|

|||||

|

|

|

4M |

||||

Repairs and maintenance . . |

|

|

|

||||

|

|

|

|||||

|

|

|

4N |

||||

Salaries, wages, and benefits (including employer's contributions) |

|

|

|

||||

|

|

|

|||||

|

|

|

|

4O |

|||

Property taxes |

|

|

|

||||

|

|

|

|||||

|

|

|

4P |

||||

Travel expenses |

|

|

|

||||

|

|

|

|||||

|

|

|

4Q |

||||

Utilities |

|

|

|

||||

|

|

|

|||||

|

|

|

4R |

||||

Fuel costs (except for motor vehicles) |

|

|

|

||||

|

|

|

|||||

|

|

|

|

4S |

|||

Delivery, freight, and express |

9275 |

|

|

|

|||

|

|

|

|||||

9281 |

|

|

|

4T |

|||

Motor vehicle expenses (not including CCA) (amount 15 of Chart A) |

|

|

|

||||

|

|

|

|||||

|

|

|

|

|

|||

Capital cost allowance (CCA). Enter amount i of Area A minus any personal part and any |

|

|

|

|

4U |

||

9936 |

|

|

|

||||

CCA for |

|

|

|

||||

|

|

|

|

4V |

|||

Other expenses (specify): |

|

|

|

|

|

|

|

9270 |

|

|

|

||||

|

|

|

|||||

|

Total expenses: Total of amounts 4B to 4V |

9368 |

|

|

|

► |

|

|

|

|

|

||||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

Net income (loss) before adjustments: Amount 4A minus line 9368 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9369

4A

Part 5 – Your net income (loss)

Your share of line 9369 or the amount from your T5013 slip, Statement of Partnership Income . . . . . . .

GST/HST rebate for partners received in the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9974 Total: Amount 5A plus line 9974

Other amounts deductible from your share of the net partnership income (loss) (amount 6F) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net income (loss) after adjustments: Amount 5B minus line 9943 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Your net income (loss): Amount 5C minus line 9945 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Report the net income amount from line 9946 on the applicable line of your income tax and benefit return as indicated below:

•business income on line 13500

•professional income on line 13700

•commission income on line 13900

5A

►

9943

9945

9946

5B

5C

Page 3 of 6

Protected B when completed

Part 6 – Other amounts deductible from your share of the net partnership income (loss)

Claim expenses you incurred that were not included in the partnership statement of income and expenses, and for which the partnership did not reimburse you. These claims must not be included in the claims already calculated for the partnership.

List details of expenses: |

Expense amounts |

|

|

|

|

|

|

|

|

|

|

Total other amounts deductible from your share of the net partnership income (loss): Add amounts 6A to 6E (enter this on line 9943 of Part 5)

6A

6B

6C

6D

6E

6F

Part 7 – Calculation of

Heat |

|

|

|

|

7A |

||||||

|

|

|

|||||||||

|

|

|

|

7B |

|||||||

Electricity |

|

|

|

|

|||||||

|

|

|

|

||||||||

|

|

|

|

7C |

|||||||

Insurance |

|

|

|

|

|||||||

|

|

|

|

||||||||

Maintenance |

|

|

|

|

7D |

||||||

|

|

|

|

||||||||

|

|

|

|

7E |

|||||||

Mortgage interest |

|

|

|

|

|||||||

|

|

|

|

||||||||

Property taxes |

|

|

|

|

7F |

||||||

|

|

|

|

||||||||

|

|

|

|

7G |

|||||||

Other expenses (specify): |

|

|

|||||||||

|

|

||||||||||

|

Subtotal: Add amounts 7A to 7G |

|

|

|

7H |

||||||

|

|

|

|||||||||

|

|

|

|

7I |

|||||||

|

|

|

|

||||||||

|

Subtotal: Amount 7H minus amount 7I |

|

|

|

7J |

||||||

|

|

|

|||||||||

Capital cost allowance (business part only), which means amount i of Area A minus any portion of |

|

|

7K |

||||||||

CCA that is for personal use or entered on line 9936 of Part 4 |

|

|

|

|

|||||||

|

|

|

|

||||||||

|

|

|

|

7L |

|||||||

Amount carried forward from previous year |

|

|

|

||||||||

|

|

|

|||||||||

|

Subtotal: Add amounts 7J to 7L |

|

|

|

7M |

||||||

|

|

|

|||||||||

Net income (loss) after adjustments (amount 5C) (if negative, enter "0") |

|

|

|

|

7N |

||||||

|

|

|

|

||||||||

|

|

7O |

|||||||||

. . .(if negative, enter "0") |

|

|

|

|

|

||||||

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

7P |

|

Allowable claim: The lesser of amount 7M and 7N above (enter your share of this amount on line 9945 of Part 5) |

|

|

|

|

|||||||

|

|

|

|

||||||||

|

. . . |

. . . . |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

Part 8 – Details of other partners

Do not fill in this chart if you must file a partnership information return.

Name of partner

Address |

Prov./Terr. |

Postal code |

|

|

|

|

|

Share of net income or (loss) |

Percentage of partnership |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||||||

Name of partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

Prov./Terr. |

Postal code |

|

|

|

|

|

Share of net income or (loss) |

Percentage of partnership |

|||||||

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

% |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Name of partner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Address |

Prov./Terr. |

Postal code |

|

|

|

|

|

Share of net income or (loss) |

Percentage of partnership |

|||||||

|

|

|

|

|

|

|

|

$ |

|

|

|

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

Name of partner

Address

Prov./Terr.

Postal code

Share of net income or (loss)

$

Percentage of partnership

%

Part 9 – Details of equity

Total business liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9931 Drawings in the current year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9932 Capital contributions in the current year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9933

Page 4 of 6

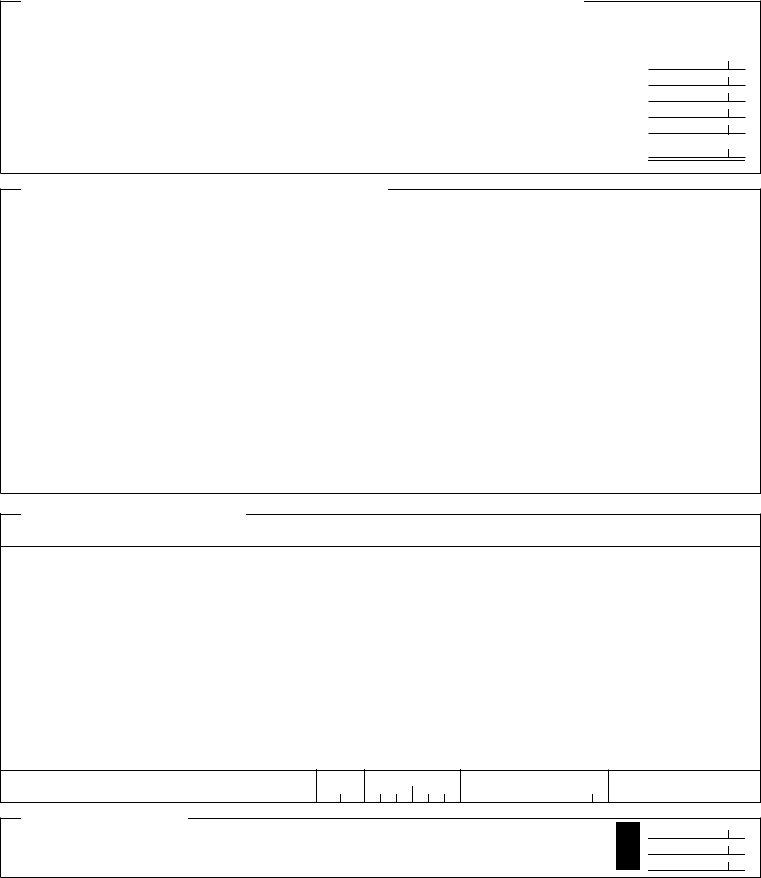

Area A – Calculation of capital cost allowance (CCA) claim

12

Class Undepreciated

number |

capital cost (UCC) |

at the start of the year

3

Cost of additions

in the year

(see Area B and C

below)

4

Cost of additions from

column 3 which are AIIP or

Note 1

5

Proceeds of dispositions

in the year (see

Area D and E below)

6*

UCC after additions

and dispositions (col. 2 plus col. 3 minus col. 5)

7 |

8 |

Proceeds of |

UCC adjustment for |

dispositions available |

|

to reduce additions of |

of AIIP and ZEV |

AIIP and ZEV (col. 5 |

(col. 4 minus col. 7) |

minus col. 3 plus |

multiplied by the |

column 4). If negative, |

relevant factor. If |

enter "0" |

negative, enter "0". |

Note 2 |

Note 3 |

9 |

10 |

|

Adjustment for |

Base amount |

|

for CCA |

||

subject to the |

(col. 6 plus col. 8 |

|

rule |

||

minus col. 9) |

||

|

||

1/2 multiplied by |

|

|

(col. 3 minus col. 4 |

|

|

minus col. 5). |

|

|

If negative, enter "0." |

|

Total CCA claim for the year: Total of column 12 (enter the amount on line 9936 of Part 4, ► amount i minus any personal part and any CCA for

*If you have a negative amount in column 6, add it to income as a recapture in Part 3C on line 8230. If no property is left in the class and there is a positive amount in the column, deduct the amount from income as a terminal loss in Part 4 on line 9270. Recapture and terminal loss do not apply to a class 10.1 property. For more information, read Chapter 3 of guide T4002.

** For information on CCA for "Calculation of

Note 1: Columns 4, 7, and 8 apply only to accelerated investment incentive properties (AIIPs) (see Regulation 1104(4) of the Income Tax Regulations for the definition),

Note 2: The proceeds of disposition of a

Note 3: The relevant factors for properties available for use before 2024 are 2 1/3 (classes 43.1 and 54), 1 1/2 (class 55), 1 (classes 43.2 and 53), 0 (classes 12, 13, 14, 15), and 1/2 for the remaining accelerated investment incentive properties.

For more information on accelerated investment incentive properties, see guide T4002 or go to

Area B – Equipment additions in the year

1

Class

number

2

Property

description

3

Total cost

4

Personal part (if applicable)

5

Business part

(column 3 minus

column 4)

Total equipment additions in the year: Total of column 5

9925

Area C – Building additions in the year

1 |

2 |

3 |

|

4 |

|

5 |

|

Class |

Property |

Total cost |

Personal part |

Business part |

|||

number |

description |

|

|

(if applicable) |

(column 3 minus |

||

|

|

|

|

|

|

column 4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total of building additions in the year: Total of column 5

Area D – Equipment dispositions in the year

9927

1 |

2 |

3 |

|

4 |

|

5 |

|

Class |

Property |

Proceeds of disposition |

Personal part |

Business part |

|||

number |

description |

(should not be more than |

(if applicable) |

(column 3 minus |

|||

|

|

the capital cost) |

|

|

column 4) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equipment dispositions in the year: Total of column 5

9926

Note: If you disposed of property in the year, see Chapter 3 of Guide T4002 for information about your proceeds of disposition.

Page 5 of 6

Protected B when completed

Area E – Building dispositions in the year

1

Class

number

2

Property

description

3

Proceeds of disposition (should not be more than the capital cost)

4

Personal part (if applicable)

5

Business part

(column 3 minus

column 4)

Total building dispositions in the year: Total of column 5 9928

Note: If you disposed of property in the year, see Chapter 3 of guide T4002 for information about your proceeds of disposition.

Area F – Land additions and dispositions in the year |

|

|

9923 |

Total cost of all land additions in the year |

|

|

9924 |

Total proceeds from all land dispositions in the year |

|

Note: You cannot claim capital cost allowance on land. For more information, see Chapter 3 of Guide T4002. |

|

Chart A – Motor vehicle expenses

Kilometres you drove in the fiscal period that was part of earning business income . . . . . . . . . . . . . . . . . .

Total kilometres you drove in the fiscal period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Fuel and oil . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Interest (see Chart B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Licence and registration . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Maintenance and repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Leasing (see Chart C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other expenses (specify):

|

|

|

|

Total motor vehicle expenses: Add amounts 3 to 10 |

|||

Business use |

( |

amount 1 |

: |

|

) × amount 11 : |

|

|

part: |

amount 2 |

: |

|

|

|

||

|

|

|

|||||

1

2

3

4

5

6

7

8

9

10

11

. . . . . . . . . . . . . . . . . . . . . =

12

Business parking fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Supplementary business insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Allowable motor vehicle expenses: Add amounts 12, 13, and 14 (include this total on line 9281 of Part 4) . . . . . . . . . . . . . . . . . . . . .

Note: You can claim CCA on motor vehicles in Area A.

13

14

15

Chart B – Available interest expense for passenger vehicles and

Total interest payable (accrual method) or paid (cash method) in the fiscal period . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. |

||||

$10* |

× |

the number of days in the fiscal period for which interest |

|

. . . . . . . . . . . . . . . . . . . . . |

= |

|

|

|

was payable (accrual method) or paid (cash method) |

|

|||

|

|

|

|

|

|

|

Available interest expense: The lesser of amount 16 and 17 (include this in amount 4 of Chart A) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

* For passenger vehicles bought after 2000.

16

17

18

Chart C – Eligible leasing cost for passenger vehicles**

Total lease charges incurred in your current fiscal period for the vehicle |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . |

Total lease payments deducted before your current fiscal period for the vehicle |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . |

Total number of days the vehicle was leased in your current and previous fiscal periods . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . |

|

Manufacturer's list price |

. . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . |

Use a GST rate of 5% or HST rate applicable to your province. |

|

|

|

Amount 22 or ($35,294 + GST and PST, or HST on $35,294), whichever is more |

|

► |

× 85% = |

[($800 + GST and PST, or $800 + HST) × amount 21] ► |

– |

amount 20: |

= |

30

[($30,000 + GST and PST, or $30,000 + HST) × amount 19]= amount 23

Eligible leasing cost: Whichever is less of amount 24 or 25 (enter in amount 8 of Chart A above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

**Includes a vehicle that would qualify as a

19

20

21

22

23

24

25

26

See the privacy notice on your return.

Page 6 of 6