When you intend to fill out how to file t2 short return online, you won't need to download and install any kind of programs - just try our online PDF editor. FormsPal team is always working to develop the editor and insure that it is much easier for clients with its multiple functions. Enjoy an ever-evolving experience today! To get the process started, take these easy steps:

Step 1: Firstly, access the editor by clicking the "Get Form Button" at the top of this webpage.

Step 2: As you start the editor, you will find the document ready to be filled in. In addition to filling in different fields, you can also perform many other things with the PDF, namely adding your own text, editing the original textual content, inserting graphics, putting your signature on the PDF, and a lot more.

It is actually easy to finish the form following our helpful guide! This is what you should do:

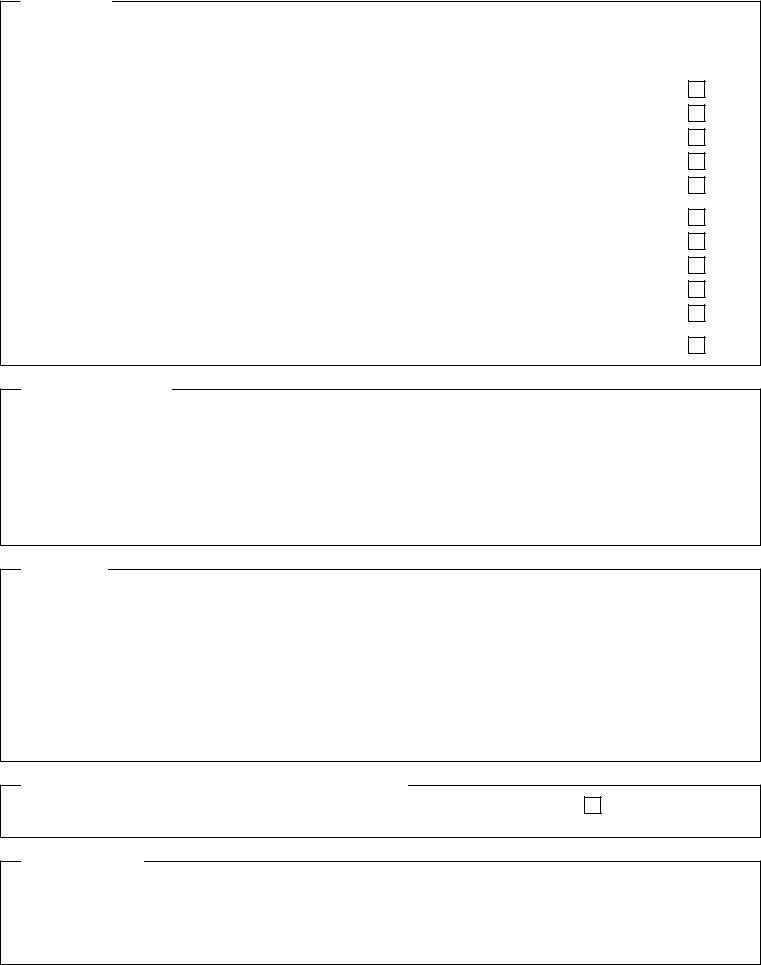

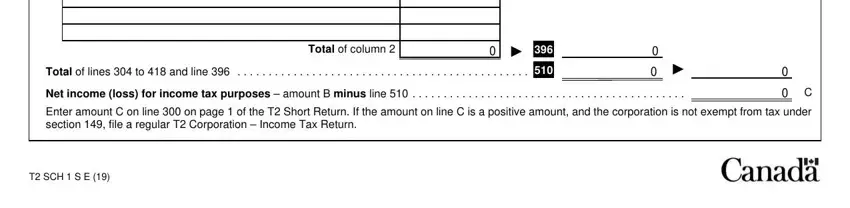

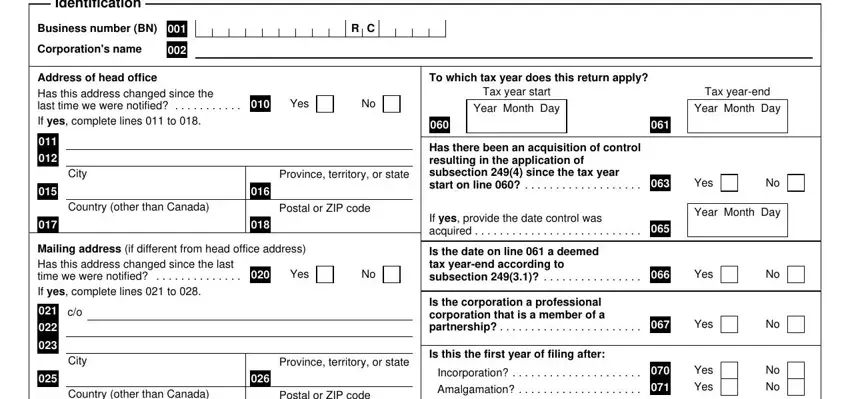

1. Fill out your how to file t2 short return online with a selection of necessary fields. Consider all of the information you need and ensure not a single thing omitted!

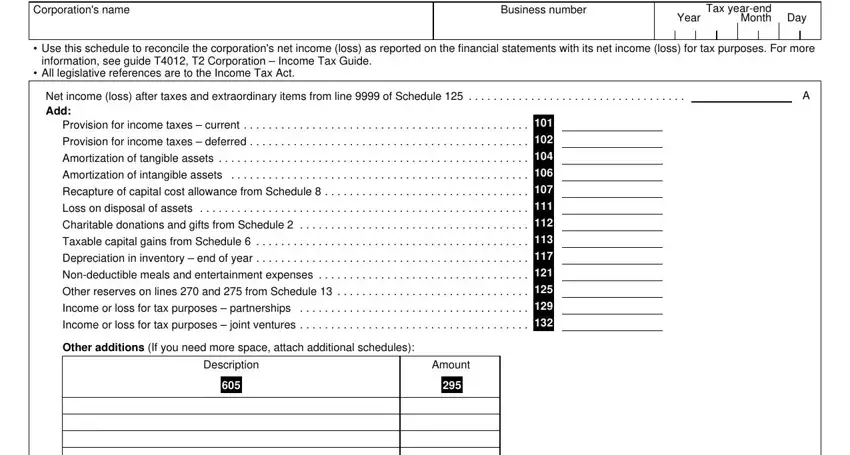

2. Once this section is done, go on to enter the relevant information in all these - cid Total of lines to and line, Total of column, Deduct, Bad debt, Equity in income from subsidiaries, Book income of joint venture, Book income of partnership, Gain on disposal of assets per, Capital cost allowance from, Terminal loss from Schedule, Allowable business investment loss, Holdbacks, Other reserves on line from, Contributions to deferred income, and Incorporation expenses under.

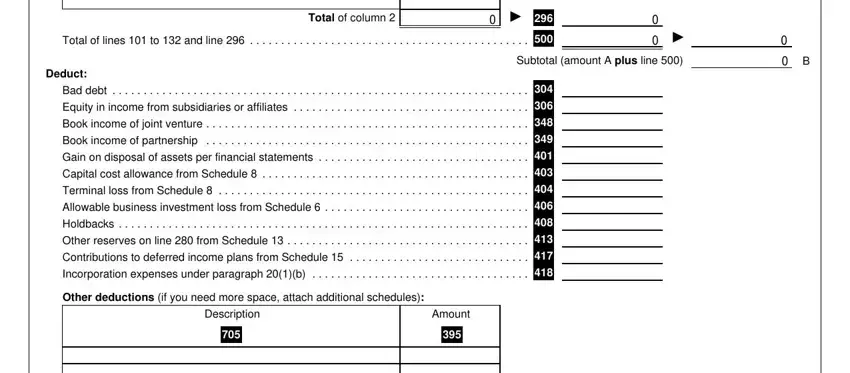

3. Completing cid Total of lines to and line, cid Net income loss for income tax, Total of column, Enter amount C on line on page, and T SCH S E is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

4. To move forward, your next step will require typing in a handful of blank fields. These include Identification, Business number BN, Corporations name, R C, Address of head office Has this, Yes, City, Province territory or state, Country other than Canada, Postal or ZIP code, To which tax year does this return, Tax year start, Year Month Day, Tax yearend, and Year Month Day, which you'll find crucial to carrying on with this form.

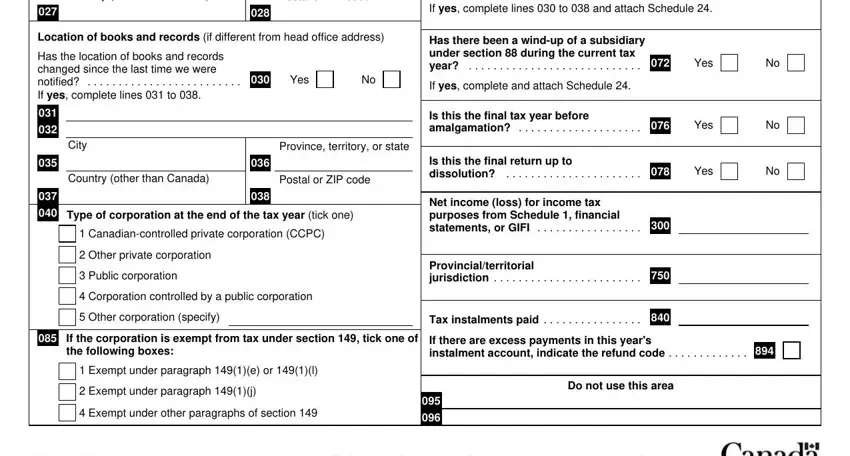

5. When you draw near to the completion of this file, there are just a few extra requirements that need to be met. In particular, If yes complete lines to and, Country other than Canada, Postal or ZIP code, Location of books and records if, Has the location of books and, Yes, City, Province territory or state, Country other than Canada, Postal or ZIP code, Type of corporation at the end, Canadiancontrolled private, Other private corporation, Public corporation, and Corporation controlled by a must all be done.

Be very mindful while filling in Has the location of books and and Public corporation, because this is where most users make some mistakes.

Step 3: Make certain your details are accurate and click "Done" to progress further. Join FormsPal right now and easily access how to file t2 short return online, available for downloading. All changes made by you are kept , enabling you to change the file at a later time if needed. FormsPal is dedicated to the confidentiality of our users; we make sure that all information entered into our editor continues to be confidential.