The Canada Revenue Agency's T5 Statement of Investment Income form plays a crucial role in the financial reporting landscape for Canadian taxpayers, specifically targeting the realm of investment income. This document is designed to provide a detailed account of an individual's investment income over the fiscal year, encompassing dividends from Canadian corporations, interest from Canadian sources, and capital gains dividends. It intricately breaks down the actual amount of dividends, distinguishing between eligible and other than eligible dividends, as well as their taxable amounts and associated federal credits. Furthermore, the T5 form includes sections dedicated to recipient and payer information, foreign currency details, along with instructions for completion, whether filing is done electronically or on paper. The ease of filing, combined with the necessity for accuracy in reporting investment income, underscores the importance of the T5 form in adhering to Canada's tax regulations. The form's comprehensive layout ensures taxpayers can report their investment income correctly, facilitating the process of determining tax obligations with accuracy.

| Question | Answer |

|---|---|

| Form Name | CRA T5 Summary Form |

| Form Length | 9 pages |

| Fillable? | Yes |

| Fillable fields | 20 |

| Avg. time to fill out | 6 min 15 sec |

| Other names | t5 summary fillable, t5 fillable, canada tax t5 summary fillable pdf, t5 fillable 2018 |

Canada Revenue |

Agence du revenu |

Agency |

du Canada |

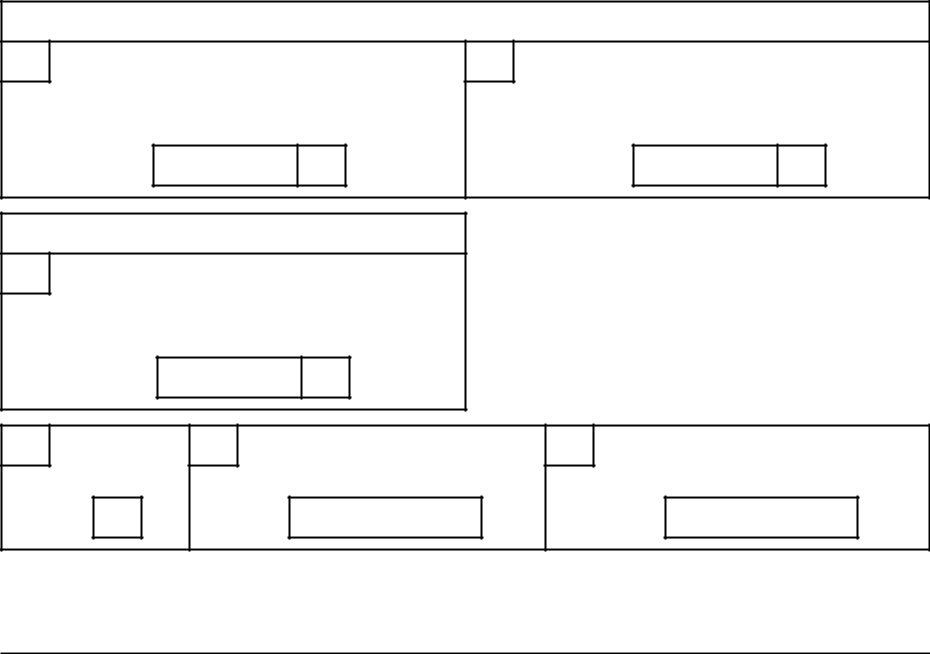

T5

STATEMENT OF INVESTMENT INCOME

T5 (12)

Year

|

|

Dividends from Canadian corporations |

|

Federal credit |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

Actual amount |

25 |

|

Taxable amount |

26 |

|

Dividend tax |

||||||

|

|

of eligible |

|

|

of eligible |

|

credit for eligible |

|||||||

|

|

dividends |

|

|

dividends |

|

|

dividends |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

Interest from

Canadian sources

18

Capital gains

dividends

continue on next page

T5 – 1

Dividends from Canadian corporations

10

Actual amount of dividends other

than eligible dividends

11

Taxable amount

of dividends other

than eligible dividends

Federal credit

12

Dividend tax credit for

dividends other than eligible

dividends

21

Report

Code

22

Recipient

identification number

23

Recipient type

T5 – 2

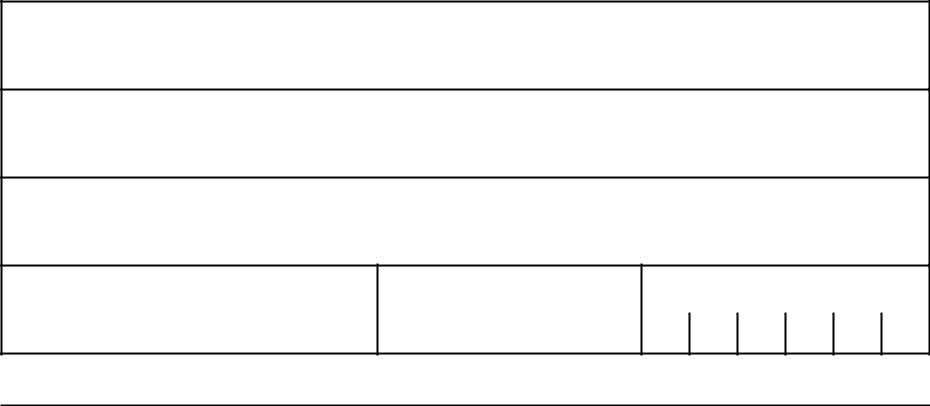

Other information (see the back)

Box |

Amount |

Box |

|

Amount |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recipient's name (last name first) and address

Last name (in capital letters)

First name

Address

City

Province/Territory

Postal code

continue on next page

T5 – 3

Payer's name and address

Payer's name

First name

Address

City

Province/Territory

Postal code

Currency and identification codes |

27 |

|

|

|

|

Foreign currency

28 |

|

|

29 |

|

|

|

|

|

|

|

Transit |

|

Recipient account |

|

For information, see pages 5 to 9 [the back].

T5 – 4

HOW TO COMPLETE THIS FORM

You can use this form whether you file electronically or on paper.

Before completing any T5 slip, see Guide T4015, T5 Guide – "Return of Investment Income". You can get a copy by going to www.cra.gc.ca/forms or by calling

For more information about filing electronically, go to

www.cra.gc.ca/iref.

If you file your T5 slips on paper:

Use one sheet for three different recipients for the copy you are sending to the CRA. Do not separate the slips when you send them with your T5 Summary.

Use a separate sheet for the two copies you are giving to the recipient and the copy you are keeping in your records.

Send a copy with the T5 Summary to: |

|

Ottawa Technology Centre |

|

Canada Revenue Agency |

|

P.O. Box 9633, Station T |

|

Ottawa ON K1G 6H3 |

continue on next page |

|

T5 – 5

Report these amounts on your income tax and benefit return

For information on how to report your income, see your tax guide.

10

11

12

13

Dividends from Canadian corporations other than eligible dividends – The amount an individual has to report as income is the amount shown in box 11. The dividend tax credit to which an individual is entitled is shown in box 12. For more information, see lines 120 and 425 in your tax guide.

Interest from Canadian sources – For information on how to report this amount on your return, see line 121 in your tax guide.

Box 14 – Box 15 –

Other income from Canadian sources

Foreign income

For information on how to report box 14 or 15 amounts on your return, see line 121 in your tax guide.

Box 16 – Foreign tax paid

We use this amount to calculate your foreign tax credit. For more information, see line 405 of your tax guide.

T5 – 6

Box 17 – Royalties from Canadian sources

If royalties are from a work or invention of yours, enter the amount on line 104 of your return. Otherwise, enter the amount on line 121 of your return.

18

Capital gains dividends – Enter this amount on line 174 of Schedule 3, "Capital Gains (or Losses)."

Box 19 – Accrued income: Annuities

This amount is the earnings part of a general annuity. If you were 65 or older at the end of the year, or if you received the annuity payments because of the death of your spouse or

21

22

Report code – The code in this box indicates that this slip is the original ("O"), an amended ("A"), or a cancelled slip ("C").

Recipient identification number – If you are an individual (other than a trust), the number in this box is your social insurance number. In all other cases, the number is your 9 characters business number.

continue on next page

T5 – 7

23

24

25

26

27

28

29

Recipient type – The code in this box indicates if the amount was paid to an individual ("1"), a joint account ("2"), a corporation ("3"), an association, trust, club, or partnership ("4"), or a government ("5").

Eligible dividends from Canadian corporations – The amount an individual has to report as income is the amount shown in box 25. The dividend tax credit to which an individual is entitled is shown in box 26. For more information, see lines 120 and 425 in your tax guide.

Foreign currency – Leave this area blank if you are reporting amounts in Canadian dollars. For more information, see box 27 in the Guide T4015, T5 "Guide – Return of Investment Income."

Transit – If you are reporting for a financial institution or any similar business, enter the recipient’s transit code or branch identification code (up to eight characters) in this area.

Recipient account – If you can identify the recipient by an account number or policy number, enter the appropriate characters

(up to 12) in this area.

T5 – 8

You may have to pay your taxes by instalments. For more information, go to www.cra.gc.ca/instalments or call

Under the "Income Tax Act", you have to give your social insurance number (SIN) on request to any person who prepares an information slip for you. If your SIN is not shown on this slip, please contact the payer and provide it. If you do not have a SIN, you should apply for one at any Service Canada Centre.

For more information on "Other Information," consult the section "Other information" in Guide T4015, T5 Guide – "Return of Investment Income".

"Privacy Act", Personal Information Bank number CRA PPU 150 and CRA PPU 005

T5 – 9