With the help of the online PDF editor by FormsPal, you may fill out or modify cra01 here and now. To keep our tool on the forefront of efficiency, we work to put into practice user-driven capabilities and enhancements regularly. We're always looking for feedback - play a pivotal role in remolding PDF editing. For anyone who is looking to get started, here's what it will take:

Step 1: Access the PDF file inside our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: With our state-of-the-art PDF tool, you're able to do more than simply fill in forms. Express yourself and make your documents look professional with custom textual content incorporated, or modify the file's original content to perfection - all that comes along with an ability to insert any type of pictures and sign it off.

It really is an easy task to fill out the pdf with our practical guide! Here's what you must do:

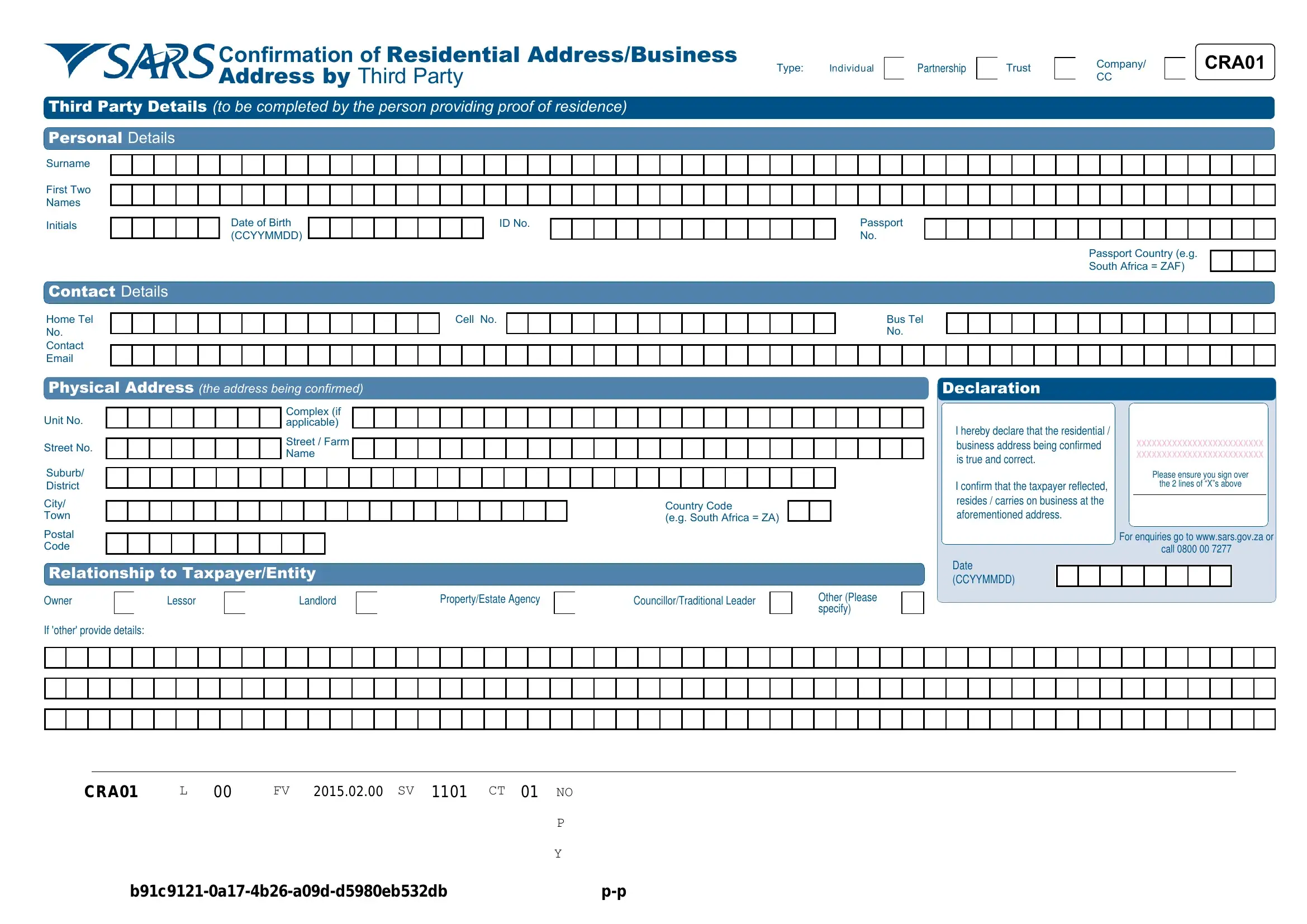

1. The cra01 involves specific details to be typed in. Be sure the subsequent blanks are completed:

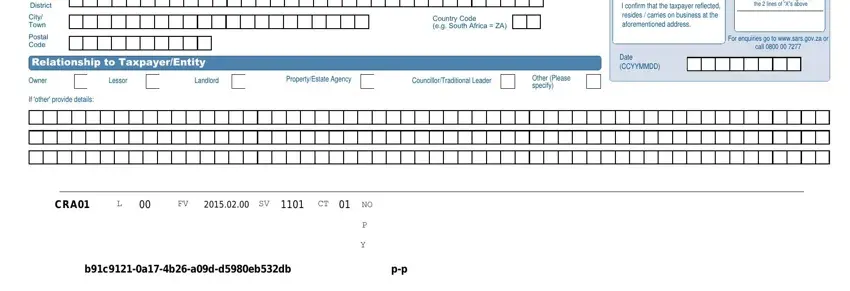

2. Once your current task is complete, take the next step – fill out all of these fields - Suburb District, City Town, Postal Code, business address being confirmed, I confirm that the taxpayer, Please ensure you sign over, the lines of Xs above, For enquiries go to wwwsarsgovza or, call, Country Code eg South Africa ZA, Relationship to TaxpayerEntity, Owner, Lessor, Landlord, and PropertyEstate Agency with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

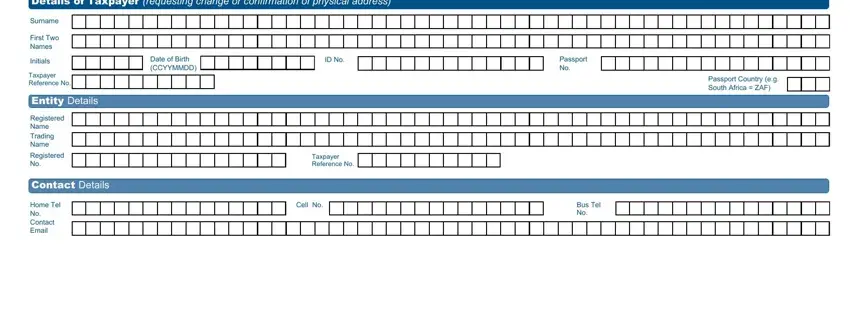

3. Completing Details of Taxpayer requesting, Surname, First Two Names, Initials, Taxpayer Reference No, Entity Details, Registered Name Trading Name, Registered No, Contact Details, Home Tel No Contact Email, Date of Birth CCYYMMDD, ID No, Passport No, Passport Country eg South Africa, and Taxpayer Reference No is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

4. You're ready to proceed to this fourth part! In this case you have all of these empty form fields to fill in.

As for this field and next field, be sure you get them right in this current part. Those two are viewed as the key ones in the PDF.

Step 3: Check that your information is correct and then click on "Done" to finish the process. After setting up a7-day free trial account with us, you will be able to download cra01 or email it right off. The document will also be accessible through your personal account with your every edit. We do not share or sell any details you enter while working with documents at our website.