Working with PDF forms online is always super easy with our PDF editor. You can fill out 14966J here without trouble. FormsPal is devoted to making sure you have the perfect experience with our editor by continuously introducing new capabilities and improvements. With all of these improvements, using our editor becomes easier than ever before! To get the ball rolling, go through these easy steps:

Step 1: Simply click the "Get Form Button" above on this webpage to see our form editor. There you will find all that is needed to fill out your file.

Step 2: This tool will give you the opportunity to work with your PDF document in various ways. Improve it by writing any text, adjust what is originally in the file, and place in a signature - all manageable in no time!

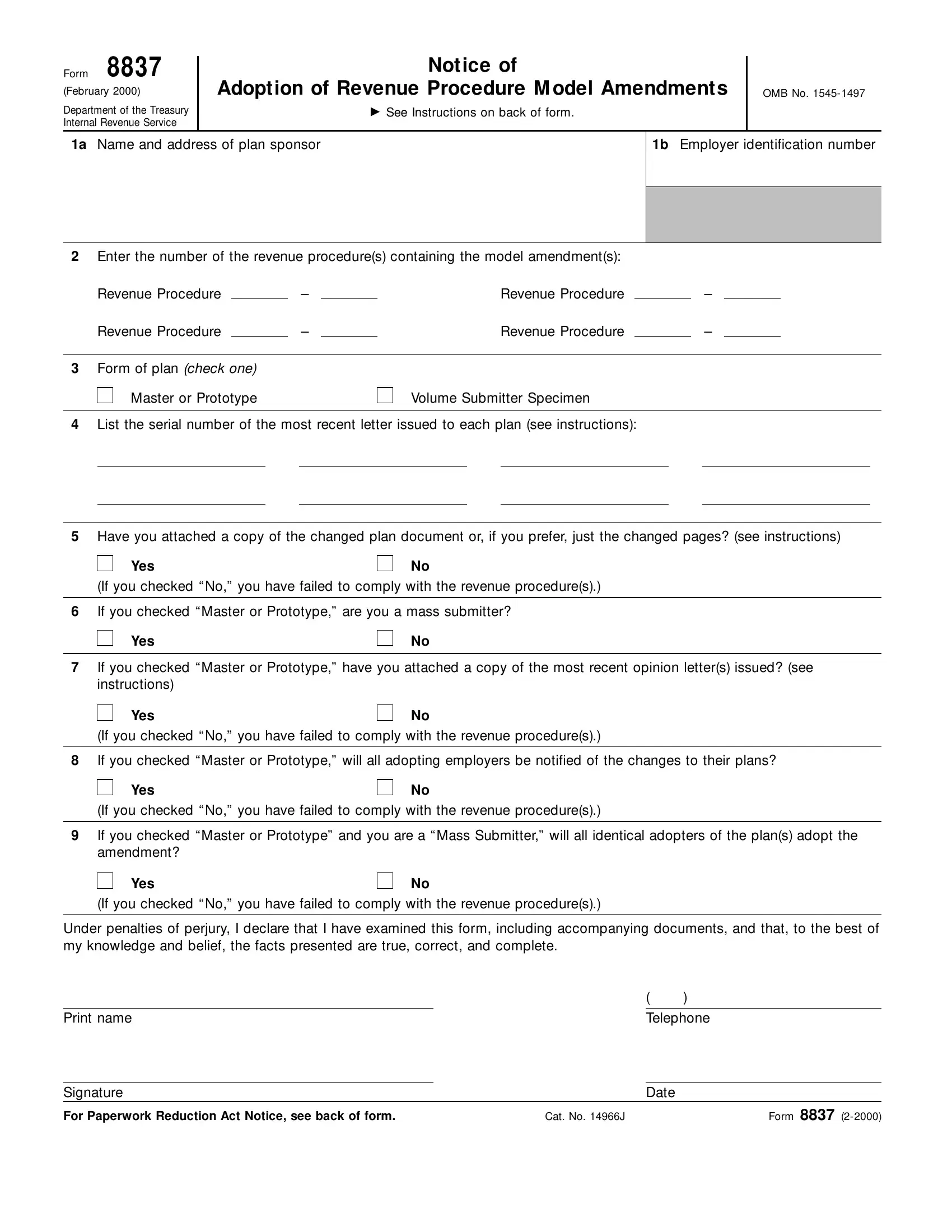

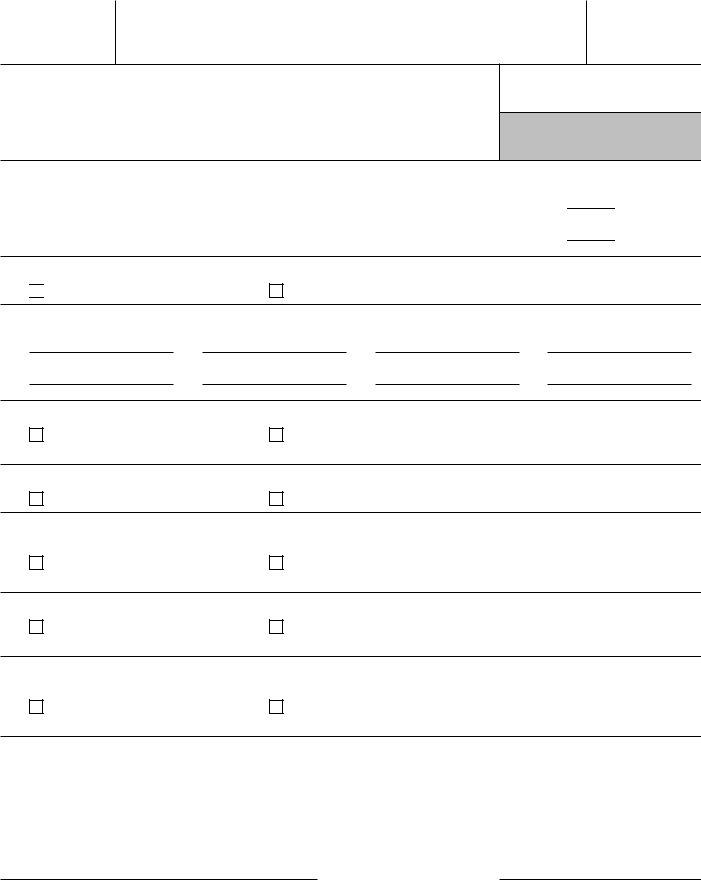

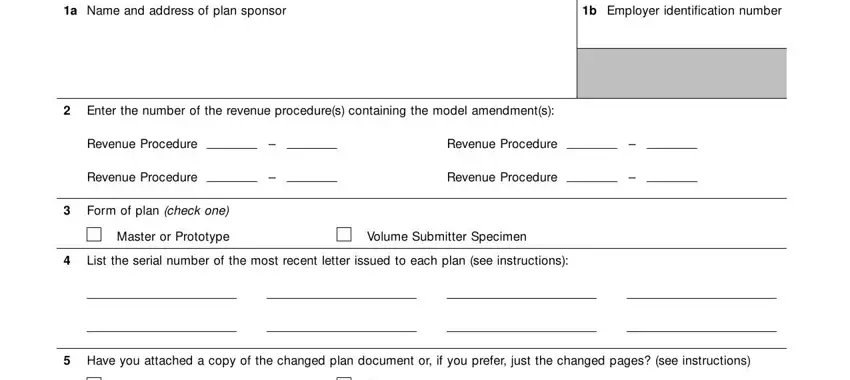

As for the blank fields of this precise document, here is what you want to do:

1. Complete the 14966J with a selection of major blank fields. Get all of the necessary information and make sure there's nothing forgotten!

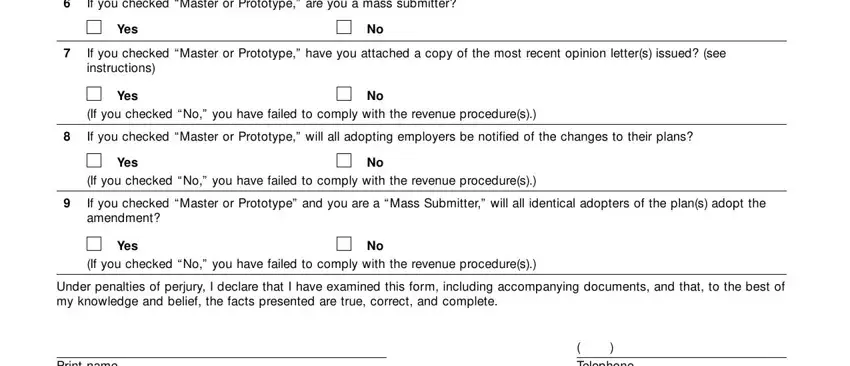

2. Just after the previous array of blanks is completed, go to enter the suitable details in these: If you checked Master or Prototype, Yes, If you checked Master or Prototype, Yes, If you checked No you have failed, If you checked Master or Prototype, Yes, If you checked No you have failed, If you checked Master or Prototype, Yes, If you checked No you have failed, Under penalties of perjury I, Print name, and Telephone.

Those who use this document frequently make mistakes when completing If you checked No you have failed in this part. Ensure you re-examine what you enter here.

Step 3: Go through everything you've entered into the blank fields and then click on the "Done" button. Right after registering afree trial account with us, it will be possible to download 14966J or send it via email immediately. The PDF will also be easily accessible from your personal account page with your each and every change. When you use FormsPal, you can certainly fill out forms without needing to be concerned about database breaches or records being shared. Our secure software helps to ensure that your private data is maintained safely.