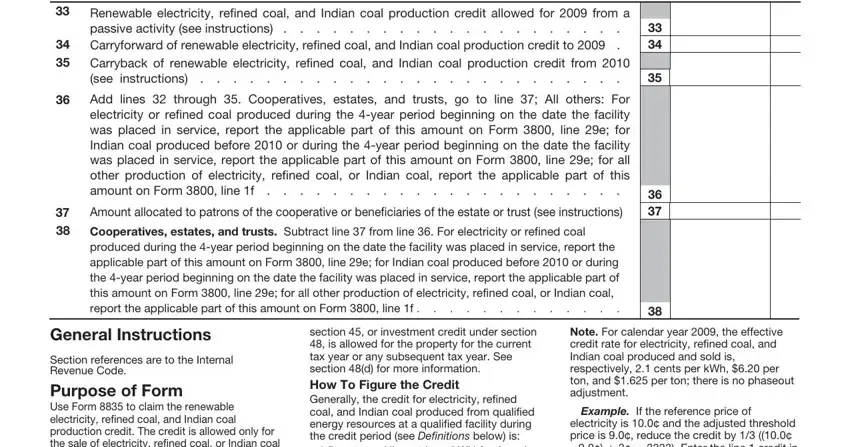

fly ash meeting the requirements of section 45 (c)(7), or (2) steel industry fuel (defined below).

Steel industry fuel is a fuel that is produced through a process of liquifying coal waste sludge (as defined by section 45(c)(7) (C)(ii)) and distributing it on coal and is used as a feedstock for the manufacture of coke.

Hydropower production means the incremental hydropower production for the tax year from any hydroelectric dam placed in service on or before 8/8/2005 and the hydropower production from any nonhydroelectric dam described in section 45 (c)(8)(C).

Marine and hydrokinetic renewable

energy means energy derived from waves, tides, and currents in oceans, estuaries, and tidal areas; free flowing water in rivers, lakes, and streams; free flowing water in an irrigation system, canal, or other man-made channel, including projects that utilize nonmechanical structures to accelerate the flow of water for electric power production purposes; or differentials in ocean temperature (ocean thermal energy conversion). See section 45(c) (10)(B) for exceptions.

Indian coal means coal which is produced from coal reserves which on 6/14/05 were owned by an Indian tribe or held in trust by the United States for the benefit of an Indian tribe or its members.

Qualified facility is any of the following

facilities owned by the taxpayer and used to produce electricity or, in the case of coal production facilities, refined and Indian coal. The facilities are shown by form section.

Part I

●Poultry waste facility placed in service after 12/31/99 and before 1/1/05.

●Wind facility placed in service after 12/31/93 and before 10/23/04.

●Closed-loop biomass facility placed in service after 12/31/92 and before 10/23/04.

Part II

●Wind facility placed in service after 10/22/04 and before 1/1/13. This does not include any facility for which any qualified small wind energy property expenditure (as defined in section 25D(d)(4)) is used in determining the residential energy efficient property credit.

●Closed-loop biomass facility placed in service after 10/22/04 and before 1/1/14.

●Closed-loop biomass facility modified to

co-fire with coal or other biomass (or both), placed in service before 1/1/14. See section 45 (d)(2).

●Closed-loop biomass facility that is a new unit placed in service after 10/3/08 in connection with a facility described in section 45(d)(2)(A)(i), but only to the extent of the increased amount of electricity produced at the facility by reason of the new unit.

●Open-loop biomass facility using cellulosic waste placed in service before 1/1/14.

●Open-loop biomass facility using agricultural livestock waste placed in service after 10/22/04 and before 1/1/14, and the nameplate capacity rating is not less than 150 kilowatts.

●Open-loop biomass facility that is a new unit placed in service after 10/3/08 in connection with a facility described in section 45(d)(3)(A),

but only to the extent of the increased amount of electricity produced at the facility by reason of the new unit.

●Geothermal energy facility placed in service after 10/22/04 and before 1/1/14.

●Solar energy facility placed in service after 10/22/04 and before 1/1/06.

●Small irrigation power facility placed in service after 10/22/04 and before 10/3/08.

●Landfill gas or trash facility using municipal solid waste placed in service after 10/22/04 and before 1/1/14.

●A refined coal production facility originally placed in service after 10/22/04 and before 1/1/10, or a facility producing steel industry fuel (or any modification to such a facility) placed in service before 1/1/10.

●Hydropower facility producing incremental hydroelectric production attributable to efficiency improvements or additions to capacity described in section 45(c)(8)(B) placed in service after 8/8/05 and before 1/1/14, and any other facility producing qualified hydroelectric production described in section 45(c)(8) placed in service after 8/8/05 and before 1/1/14.

●Indian coal production facility placed in service before 1/1/09.

●Marine and hydrokinetic renewable energy facility placed in service after 10/2/08 and before 1/1/14.

A qualified facility does not include a refined coal production facility or landfill gas facility using municipal solid waste to produce electricity, if the production from that facility is allowed as a credit under section 45K. This does not apply to a refined coal facility producing steel industry fuel.

Credit period is:

●10 years for a wind, poultry waste,

closed-loop biomass (not modified for co-fire purposes), or refined coal production facility, beginning on the date the facility was placed in service.

●10 years for a closed-loop biomass facility modified to co-fire with coal, other biomass, or both, beginning on the date the facility was placed in service, but not earlier than 10/22/04.

●10 years for a hydropower facility, beginning on the date the efficiency improvements or additions to capacity are placed in service.

●7 years for an Indian coal production facility, beginning on the date the facility was placed in service, but not before 1/1/06.

●5 years for an open-loop biomass facility using agricultural livestock waste, geothermal, solar energy, small irrigation power, landfill gas, or trash facility, beginning on the date the facility was placed in service, if placed in service during the period after 10/22/04 and before 8/9/05. The credit period is 10 years if placed in service after 8/8/05.

●5 years for an open-loop biomass facility using cellulosic waste, beginning on the date the facility was placed in service, but not earlier than 1/1/05.

●The period beginning on the later of the date the facility was placed in service, the date the modifications (described in section 45(e)(8)(D)(iii)) were placed in service, or 10/1/08, and ending on the later of 12/31/09, or 1 year after the date the facility or modifications (described in section 45(e)(8)(D)(iii)) were placed in service for steel industry fuel.

United States and U.S. possessions include the seabed and subsoil of those submarine areas that are adjacent to the territorial waters over which the United States has exclusive rights according to international law.

Who Can Take the Credit

Generally, the owner of the facility is allowed the credit. In the case of closed-loop biomass facilities modified to co-fire with coal, other biomass, or both, and open-loop biomass facilities, if the owner is not the producer of the electricity, the lessee or the operator of the facility is eligible for the credit.

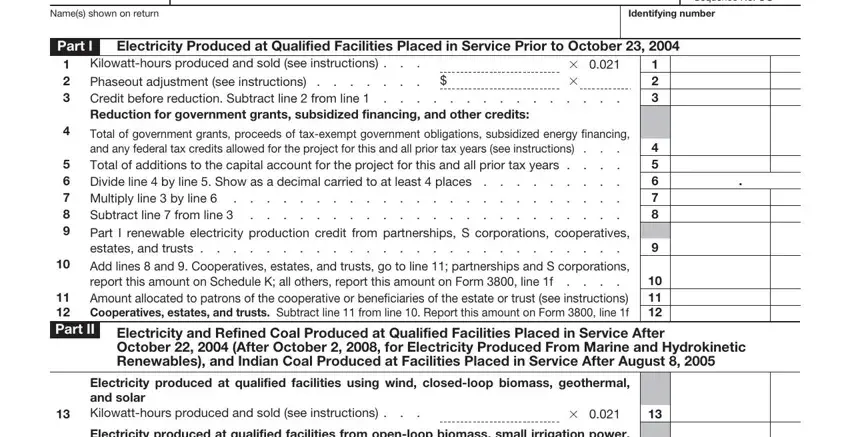

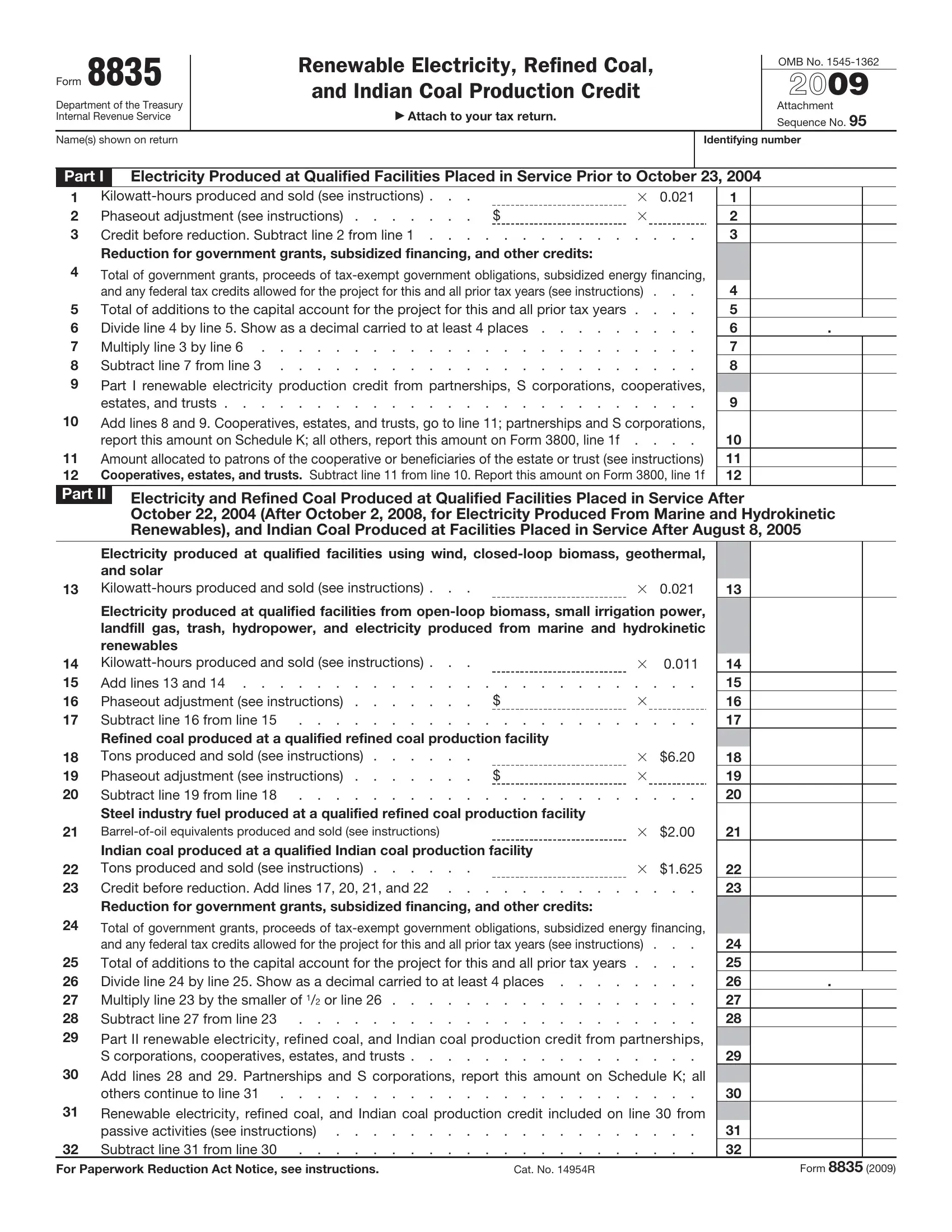

Specific Instructions for Part I and Part II

Figure any renewable electricity, refined coal, and Indian coal production credit from your trade or business on lines 1 through 8 or lines 13 through 28. Skip lines 1 through 8 or lines 13 through 28 if you are only claiming a credit that was allocated to you from an S corporation, partnership, cooperative, estate, or trust.

Fiscal year taxpayers. If you have sales in 2009 and 2010 and the credit rate on lines 1, 13, 14, 18, 21, or 22 (or the phaseout adjustment on lines 2, 16, or 19) is different for 2010, make separate computations for each line. Use the respective sales, credit rate, and phaseout adjustment for each calendar year. Enter the total of the two computations on the credit rate line(s) (lines 1, 13, 14, 18, 21, or 22) or the phaseout adjustment line(s) (lines 2, 16, or 19). Attach the computations to Form 8835 and write “FY” in the margin.

Line 1 and Line 13

Enter the kilowatt-hours of electricity produced at qualified facilities and multiply by $.021. Fiscal year filers with 2010 sales may have to refigure lines 1 and 13 as explained under Fiscal year taxpayers above.

If you claimed the credit for a closed-loop biomass facility modified to co-fire with coal, other biomass, or both, after 10/21/04, and before tax year 2007, you should file an amended return to refigure your credit. Use Form 8835 for the applicable tax year to refigure your credit. The additional limitation, based on the thermal content of closed-loop biomass used in the facility and the thermal content of all fuels used in the facility, that applied to these facilities no longer applies. As a result, the credit related to these facilities is figured on line 13.

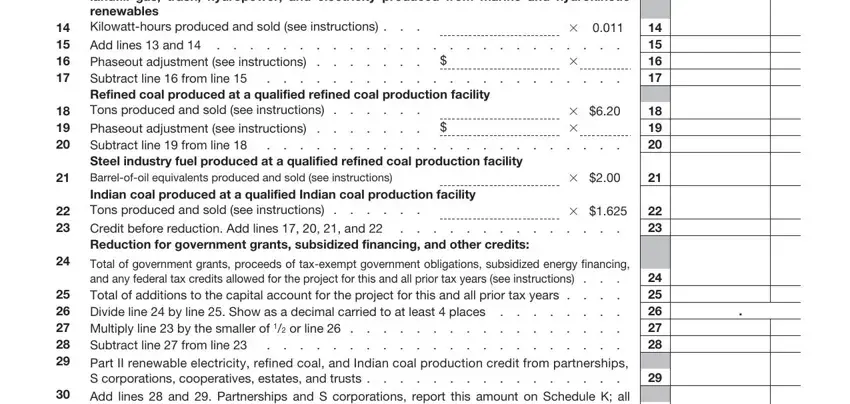

Line 14

Enter the kilowatt-hours of electricity produced and sold at qualified facilities and multiply by $.011. Fiscal filers with 2010 sales must figure line 14 as explained under Fiscal year taxpayers above.

Line 2 and Line 16

Calendar year filers enter zero on line 2 or line

16.Fiscal year filers with sales in 2010 also enter zero if the published 2010 reference price is equal to or less than the 2010 adjusted threshold price. See How To Figure the Credit on page 2 to figure the adjustment.

Line 18

Enter the tons of refined coal (other than steel industry fuel) produced and sold during 2009 from a qualified refined coal production facility