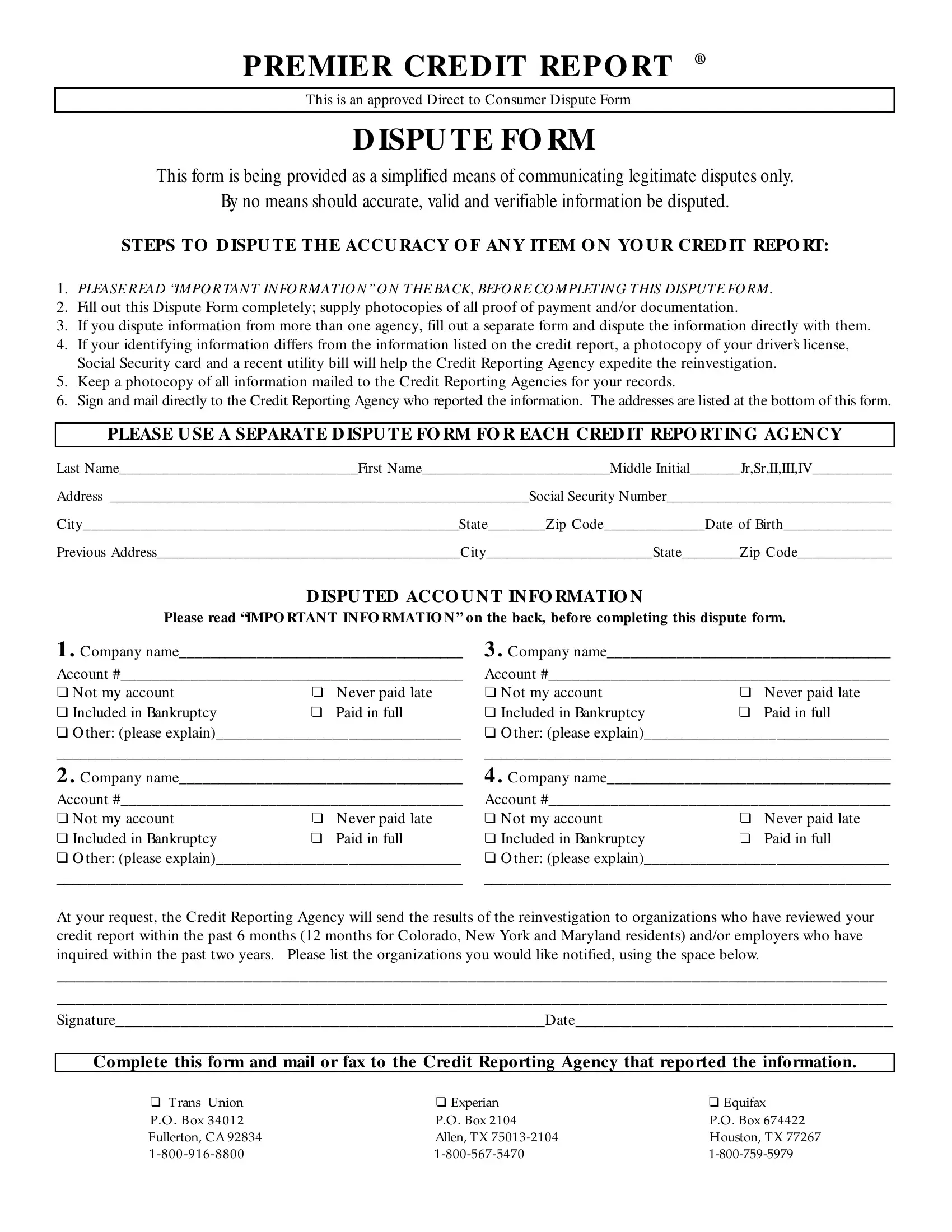

PREMIER CREDIT REPO RT ®

This is an approved Direct to Consumer Dispute Form

D ISPU TE FO RM

This form is being provided as a simplified means of communicating legitimate disputes only.

By no means should accurate, valid and verifiable information be disputed.

STEPS TO D ISPU TE THE ACCU RACY O F AN Y ITEM O N YO U R CRED IT REPO RT:

1.PLEASE R EAD “IM PO R TAN T IN FO R M AT IO N ”O N T HE BACK, BEFO R E CO M PLET IN G T HIS DISPUT E FO R M .

2.Fill out this Dispute Form completely; supply photocopies of all proof of payment and/or documentation.

3.If you dispute information from more than one agency, fill out a separate form and dispute the information directly with them.

4.If your identifying information differs from the information listed on the credit report, a photocopy of your driver’s license, Social Security card and a recent utility bill will help the Credit Reporting Agency expedite the reinvestigation.

5.Keep a photocopy of all information mailed to the Credit Reporting Agencies for your records.

6.Sign and mail directly to the Credit Reporting Agency who reported the information. The addresses are listed at the bottom of this form.

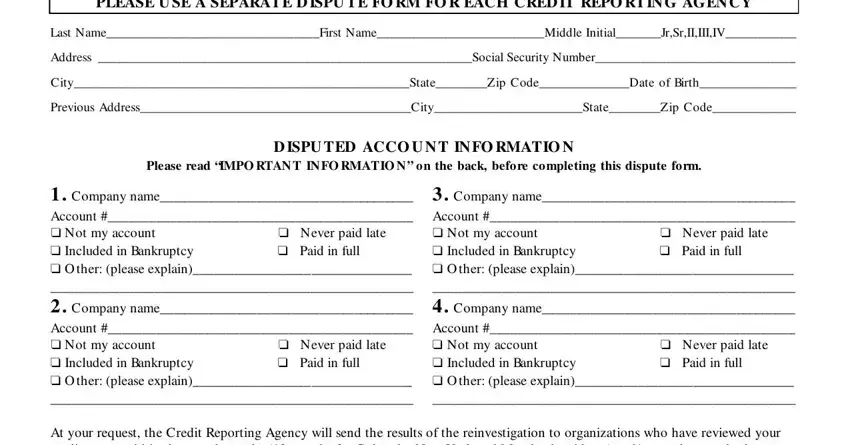

PLEASE U SE A SEPARATE D ISPU TE FO RM FO R EACH CRED IT REPO RTIN G AGEN CY

Last Name_________________________________First Name__________________________Middle Initial_______Jr,Sr,II,III,IV___________

Address __________________________________________________________Social Security Number_______________________________

City____________________________________________________State________Zip Code______________Date of Birth_______________

Previous Address__________________________________________City_______________________State________Zip Code_____________

D ISPU TED ACCO U N T IN FO RMATIO N

Please read “IMPO RTAN T IN FO RMATIO N ” on the back, before completing this dispute form.

1 . Company name_____________________________________ |

3 . Company name_____________________________________ |

Account #____________________________________________ |

Account #____________________________________________ |

❏ Not my account |

❏ Never paid late |

❏ Not my account |

❏ Never paid late |

❏ Included in Bankruptcy |

❏ Paid in full |

❏ Included in Bankruptcy |

❏ Paid in full |

❏O ther: (please explain)________________________________ ❏ O ther: (please explain)________________________________

_____________________________________________________ _____________________________________________________

2 . Company name_____________________________________ |

4 . Company name_____________________________________ |

Account #____________________________________________ |

Account #____________________________________________ |

❏ Not my account |

❏ Never paid late |

❏ Not my account |

❏ Never paid late |

❏ Included in Bankruptcy |

❏ Paid in full |

❏ Included in Bankruptcy |

❏ Paid in full |

❏O ther: (please explain)________________________________ ❏ O ther: (please explain)________________________________

_____________________________________________________ _____________________________________________________

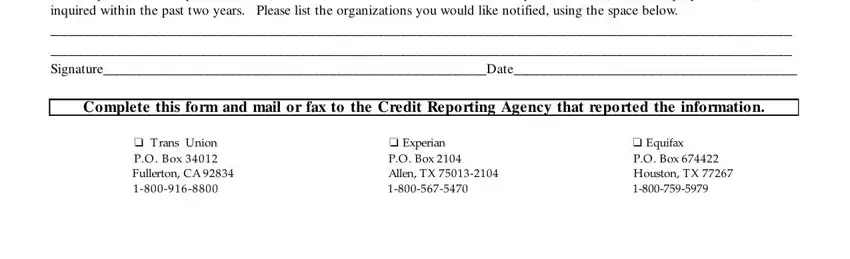

At your request, the Credit Reporting Agency will send the results of the reinvestigation to organizations who have reviewed your credit report within the past 6 months (12 months for Colorado, New York and Maryland residents) and/or employers who have inquired within the past two years. Please list the organizations you would like notified, using the space below.

_________________________________________________________________________________________

_________________________________________________________________________________________

Signature______________________________________________Date__________________________________

Complete this form and mail or fax to the Credit Reporting Agency that reported the information.

❏ T rans Union |

❏ Experian |

❏ Equifax |

P.O . B ox 3 4 0 1 2 |

P.O . Box 2104 |

P.O . Box 674422 |

Fullerton, CA 92834 |

Allen, T X 75013-2104 |

Houston, T X 77267 |

1 -8 0 0 -9 1 6 -8 8 0 0 |

1-800-567-5470 |

1-800-759-5979 |

IMPO RTAN T IN F O RMATIO N

✒ACCURATE INFO RMATIO N CANNO T BE CH ANGED O R REMO VED.

✒H O W INFO RMATIO N GETS O N YO U R CREDIT REPO RT - O rganizations with wh om you have submitted an application or an existing credit account may furnish your identifying information, employment and/or payment history on open and closed accounts to Credit Reporting Agencies (C RA’s). Some organizations subscribe to one, two or all three major Credit Reporting Agencies. Court researchers obtain public record information from the courts and furnish the data to the three national Credit Reporting Agencies.

✒H O W LO NG INFO RMATIO N REMAINS O N YO UR FILE - As a general rule credit information remains on file for 7 years from the date of last activity. This includes open and closed accounts. There are exceptions; derogatory accounts remain on file for 7 years from the original date of delinquency. As Agreed/Closed accounts may remain on file for 10 years from the last reported date on the TransUnion file. Bankruptcy Chapter 13 remains on file for 7 years, Bankruptcy

Chapter 7, 11 and 12 remain on file for 10 years from the date filed. New York State residents only: satisfied judgments remain

on file for 5 years from the date filed and paid collections remain on file for 5 years from the date of last activity with the original creditor.

✒U PDAT IN G A BAN KRU PTC Y TO DISC H ARGED - If accounts included in a bankruptcy are not indicated as “Discharged” on your credit report, send a copy of your Schedule A which lists all debt s th at were included in the Bankruptcy along with your Bankruptcy Discharge, to the three 3 C RA’s. With this documentation, the C RA’s can properly update your credit file.

✒DUPLICATE ACCO UNTS - Some credit grantors issue both revolving and installment accounts using the same account number. Also, a new account number may be assigned due to a change of address, this would display as the same account with two different account numbers.

✒STU DENT LO AN S - St udent loans may be a collection of several small loans that were accepted each semester or school year. The same lender may report each small loan. The total should equal the loan amount you pay.

✒BALANCE INFO RMATIO N - Since credit grantors supply information on a periodic basis, the balance shown may not be the balance it is today. If the balance reported was correct as of the status date, it is not necessary to dispute th e balance on that account.

✒DIVO RCE DECREE - A divorce decree does not supersede the original contract with the creditor and does not release you from legal responsibility on any accounts. You must contact each creditor individually and seek their legal binding release of your obligation. O nly after that release can your credit history be updated accordingly.

✒UNUSED CREDIT CARDS - The best way to cancel credit card accounts that are no longer used is to call the lender and ask that the account be closed. Ask the customer service representative to note the account was closed at your request. You may want to send a letter to the lender making the same request.

✒PRE-APPRO VED CREDIT O FFERS - Many companies and lenders utilize national credit reporting databases to obtain lists to offer pre-approved credit. If you prefer NO T to receive pre-approved offers, please notify the National O pt O ut Request Line at (888) 567-8688. An automated attendant will explain the procedure and ask for your identifying information to remove your name from these lists.

✒DIRECT MARKETING MAILINGS - Many companies market consumer products and services by mail. If you prefer

N O T to receive direct marketing mailings, you can write to: Direct Marketing Association, Mail Preference Service, P. O . Box 9008, Farmingdale, New York, 11735-9008; Direct Marketing Association, Telephone Preference Service, P.O . Box 9014, Farmington, NY 11735; and Experian, 901 W. Bond, Lincoln, NE 68521, Attn. Consumer Services Department. Include your complete name, full address, Social Security number and signature. The Direct Marketing Association will have your name removed from these lists.

✒“CREDIT CLINICS” O R “CREDIT REPAIR CLINICS” - If an organization claims it can remove negative – but accurate – credit information from your credit report, it is either lying or committing fraud. Their fees range from hundreds to thousands of dollars. Consumers can dispute inaccurate information directly with the Credit Reporting Agency for free or at minimal cost.

✒NEW SO CIAL SECURITY NUMBER - You must submit evidence that misuse of your old number has caused you recent or ongoing disadvantage. O btaining a new number is not easy even if you’ve been victimized and truly need a new number.

It’s a crime to apply for credit using a new or altered Social Security number if your intent is to change your identity and leave behind bad credit. If convicted you could face fines and even jail time.