With the help of the online editor for PDFs by FormsPal, you'll be able to fill in or alter california charitable s right here. The tool is continually maintained by our staff, acquiring useful features and growing to be better. This is what you'd need to do to start:

Step 1: Access the PDF form in our tool by clicking the "Get Form Button" above on this page.

Step 2: The editor helps you modify most PDF documents in a variety of ways. Change it by including customized text, correct existing content, and place in a signature - all readily available!

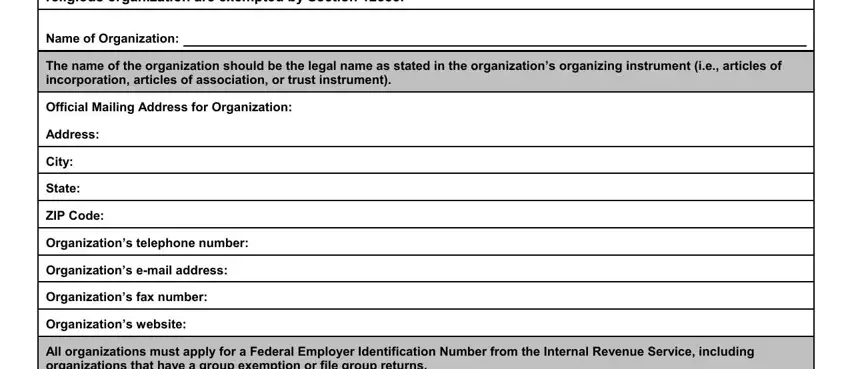

If you want to fill out this PDF form, ensure you enter the right details in every single field:

1. For starters, while completing the california charitable s, start in the area that features the next blank fields:

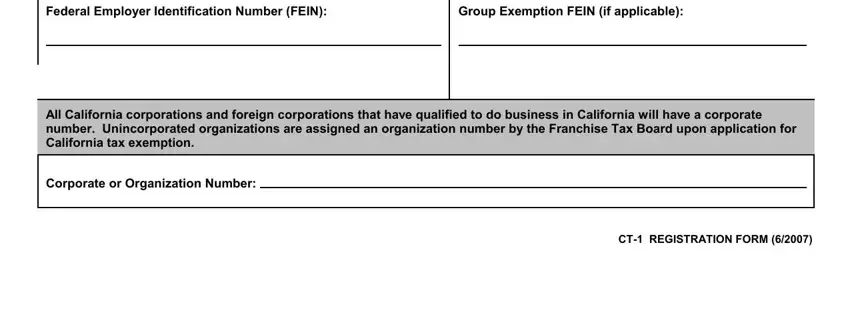

2. Right after filling in this part, go on to the next part and enter all required particulars in all these fields - Federal Employer Identification, Group Exemption FEIN if applicable, All California corporations and, Corporate or Organization Number, and CT REGISTRATION FORM.

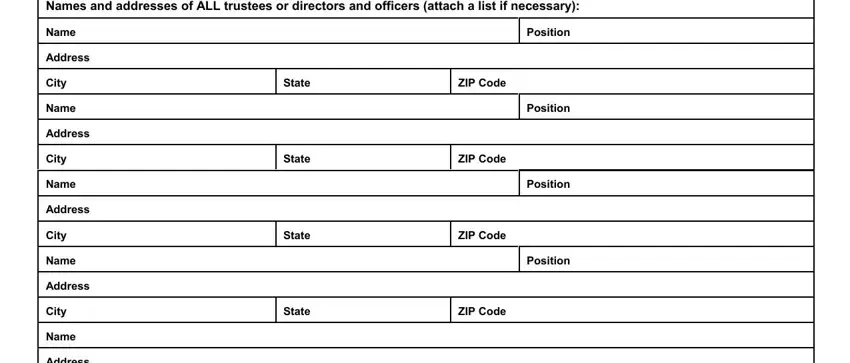

3. Completing Names and addresses of ALL, Name, Address, City, Name, Address, City, Name, Address, City, Name, Address, City, Name, and Address is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

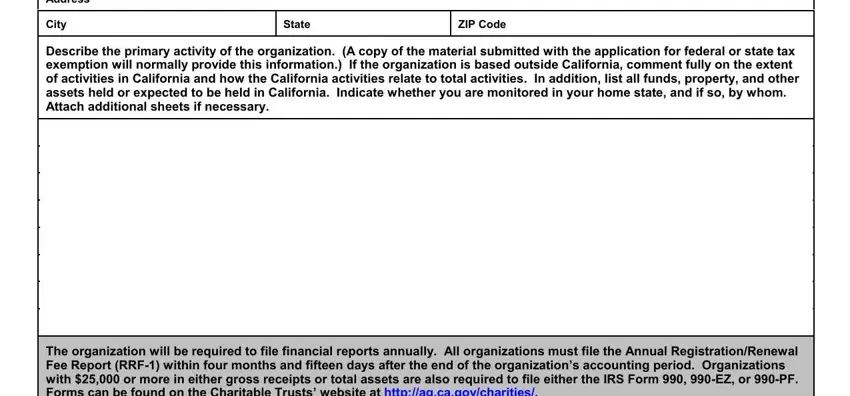

4. Filling out Address, City, State, ZIP Code, Describe the primary activity of, and The organization will be required is vital in this next section - always spend some time and take a close look at every single empty field!

People who use this document often get some things wrong while filling in Address in this section. Make sure you revise whatever you type in here.

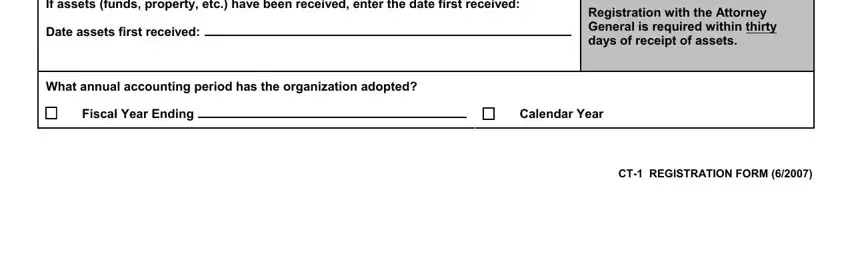

5. Because you approach the finalization of this form, you'll find several extra requirements that should be satisfied. Specifically, If assets funds property etc have, Date assets first received, Registration with the Attorney, What annual accounting period has, Fiscal Year Ending, Calendar Year, and CT REGISTRATION FORM must all be filled out.

Step 3: Always make sure that your details are accurate and click "Done" to complete the process. After starting a7-day free trial account at FormsPal, it will be possible to download california charitable s or email it immediately. The document will also be readily available through your personal cabinet with your each and every change. We do not share the details that you type in whenever filling out forms at our website.