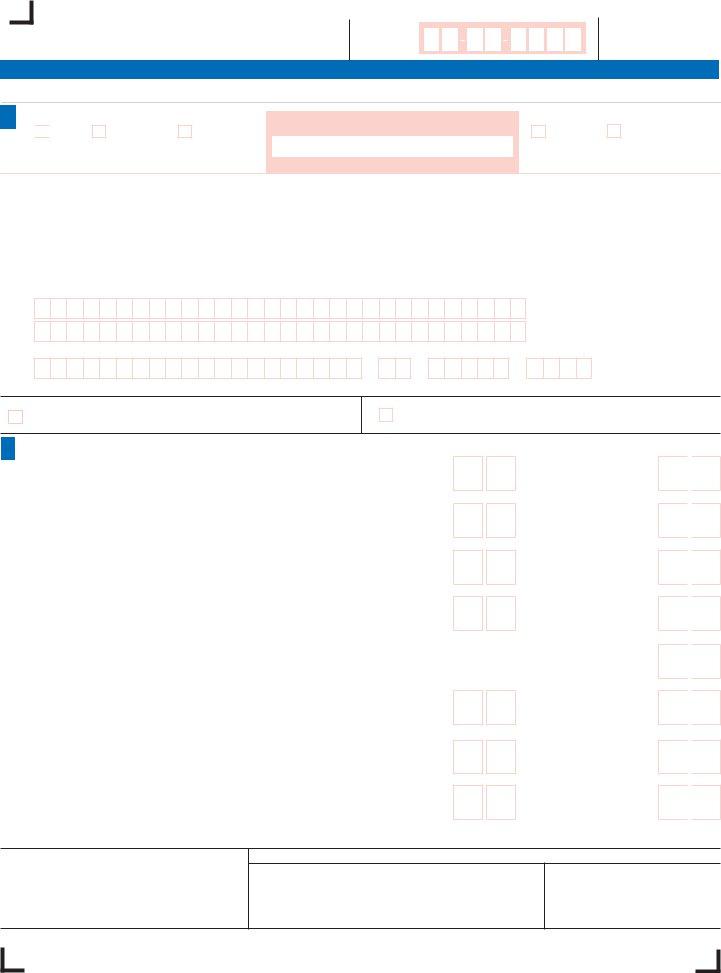

Filing tax returns is an annual responsibility that residents of Connecticut navigate using various forms, including the simplified CT-1040EZ. Designed specifically for certain Connecticut residents, the CT-1040EZ form caters to those with straightforward financial situations requiring less documentation and fewer calculations than the full CT-1040 form. This form allows eligible taxpayers to report their income, calculate their Connecticut adjusted gross income, and determine any taxes owed or refunds due for the tax year 2008. Important aspects include indicating one's filing status, accurately reporting federal adjusted gross income, and detailing any Connecticut income tax withheld. Additionally, the form facilitates claims for credits such as those for property taxes paid on a primary residence or motor vehicle, and it offers a way to contribute to designated charities. Taxpayers must diligently complete and sign the form, adhering to specific instructions on the reverse side, ensuring accuracy and completeness to avoid penalties. Completing the CT-1040EZ is made easier with clear instructions regarding necessary attachments, like the Schedule 1EZ for property tax credit and Schedule 2EZ if claiming an individual use tax, highlighting the form's aim to streamline the tax filing process for qualified Connecticut residents.

| Question | Answer |

|---|---|

| Form Name | Ct 1040 Ez Form |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | DRS, 1EZ, ct 1040ez, 2011 |

Form

Connecticut Resident EZ Income Tax Return

For DRS |

2 0 |

Use Only |

2008

Complete return in blue or black ink only. Taxpayers must sign declaration on reverse side.

For the year January 1 - December 31, 2008, or other taxable year beginning: _________________ , 2008 and ending: __________________, ______ .

1Filing Status

Single

Filing jointly for federal and Connecticut

Filing jointly for |

|

Filing separately for |

|

Filing separately for |

|

|

|||

|

federal and Connecticut |

|

Connecticut only |

|

|

|

|

||

|

|

Connecticut only

Enter spouse’s name here and SSN below.

Head of household

Qualifying widow(er) with dependent child

name, |

SSN here. |

Print your |

address, and |

Your Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

Spouse Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Check if |

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if |

|

|

|

|

||||||||||||

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

deceased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

deceased |

|

|

|

|

||||||||

Your first name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MI |

|

Last name (If two last names, insert a space between names.) |

Suffix (Jr./Sr.) |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint return, spouse’s first name |

|

|

|

|

|

|

|

|

|

|

MI |

|

Last name (If two last names, insert a space between names.) |

Suffix (Jr./Sr.) |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (number and street, apartment number, suite number, PO Box)

City, town, or post office (If town is two words, leave a space between the words.) State |

ZIP code |

-

Check here if you do not want forms sent to you next year. This does not relieve you of your responsibility to file.

Form |

Check here if you are filing Form |

and attach the form to the front of the return. |

2

Do not staple. |

or 1099 forms. |

Clip check here. |

Do not send |

1. |

Federal adjusted gross income from federal Form 1040, |

|

|

Line 37; Form 1040A, Line 21; or Form 1040EZ, Line 4 |

1. |

2. |

Refunds of state and local income taxes from federal |

|

|

Form 1040, Line 10: See instructions, Page 10. |

2. |

3. |

Connecticut adjusted gross income: |

|

|

Subtract Line 2 from Line 1. |

3. |

4. |

Income tax from tax tables or Tax Calculation |

|

|

Schedule: See instructions, Page 10. |

4. |

5.Credit for property taxes paid on your primary residence, motor vehicle, or both: Complete and attach SCHEDULE 1EZ,

on Page 3 or your credit will be disallowed. |

5. |

6. Connecticut income tax: Subtract Line 5 from Line 4. |

|

If less than zero, enter “0.” |

6. |

7.Individual use tax from SCHEDULE 2EZ, Line 28, on Page 3: See instructions, Page 11. Complete and attach SCHEDULE 2EZ.

If no tax is due, enter “0.” |

7. |

8. Add Line 6 and Line 7. |

8. |

Whole Dollars Only

|

, |

|

|

|

|

|

. |

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

||

|

|

|

|

|

|

||

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

||

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

||

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

||

|

, |

|

|

|

|

|

. |

|

|

|

|

|

|

||

|

, |

|

|

|

|

|

. |

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

To complete your return, continue on Page 2, Form

Make your check payable to:

Commissioner of Revenue Services

To ensure proper posting, write your

SSN(s) (optional) and

“2008 Form

Use envelope provided, with correct mailing label, or mail to:

For refunds and all other tax forms without payment: For all tax forms with payment:

Department of Revenue Services |

Department of Revenue Services |

PO Box 150420 |

PO Box 150440 |

Hartford CT |

Hartford CT |

Due date: April 15, 2009 - Attach a copy of all applicable schedules and forms to this return.

For a faster refund, see Page 2 of the booklet for electronic filing options.

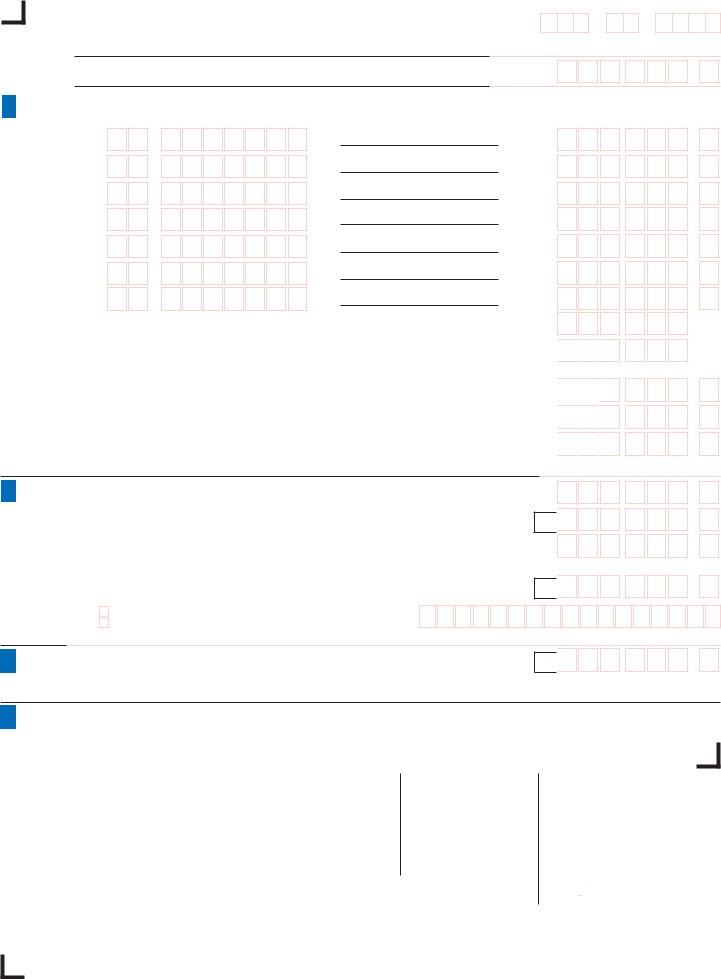

Form |

Your Social |

|

Security Number |

-

-

9. Enter amount from Line 8. |

9. |

,

.00

Column A |

Column B |

Column C |

3Employer’s federal ID No. from Box b of

or payer’s federal ID No. from Form 1099 |

Connecticut wages, tips, etc. |

Connecticut income tax withheld |

Only enter information from your

–

–

–

–

–

–

–

.00

.00

.00

.00

.00

.00

.00

10a.

10b.

10c.

10d.

10e.

10f.

10g.

,

,

,

,

,

,

,

. 00 |

. 00 |

. 00 |

. 00 |

. 00 |

. 00 |

. 00 |

Enter amount from Supplemental Schedule

10.Total Connecticut income tax withheld: Add amounts in Column C and enter here. You must complete Columns A, B, and C or your withholding will be disallowed.

11.All 2008 estimated tax payments and any overpayments applied from a prior year

12.Payments made with Form

13.Total payments: Add Lines 10, 11, and 12.

10h.

10.

11.

12.

13.

,

,

,

,

,

. |

00 |

. |

|

00 |

.00

.00

.00

414. Overpayment: If Line 13 is more than Line 9, subtract Line 9 from Line 13.

15.Amount of Line 14 you want applied to your 2009 estimated tax

16.Total contributions of refund to designated charities from SCHEDULE 3EZ, Line 29

17.Refund: Subtract Lines 15 and 16 from Line 14.

For faster refund, use Direct Deposit by completing Lines 17a, 17b, and 17c.

17a. Type: Checking |

|

17b. Routing |

|

|

|

|

|

|

|

|

|

17c. Account |

Savings |

|

Number |

|

|

|

|

|

|

|

|

|

Number |

|

14.

15.

16.

17.

,

,

,

,

.00

.00

.00

.00

518. Total amount due: If Line 9 is more than Line 13, subtract Line 13 from Line 9.

18.

,

.00

6Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Keep a copy for your records.

Sign Here.

Your signature |

Date |

Daytime telephone number |

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Spouse’s signature (if joint return) |

|

Date |

|

Daytime telephone number |

||||||||||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Paid preparer’s signature |

Date |

Telephone number |

Preparer’s SSN or PTIN |

|||||||||||

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

Firm’s name, address, and ZIP code |

|

|

|

Federal Employer Identification Number |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Party Designee - Complete the following to authorize DRS to contact another person about this return.

Designee’s name |

Telephone number |

Personal identification number (PIN) |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete applicable schedules on Form

|

|

|

|

Form |

|

Your Social |

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

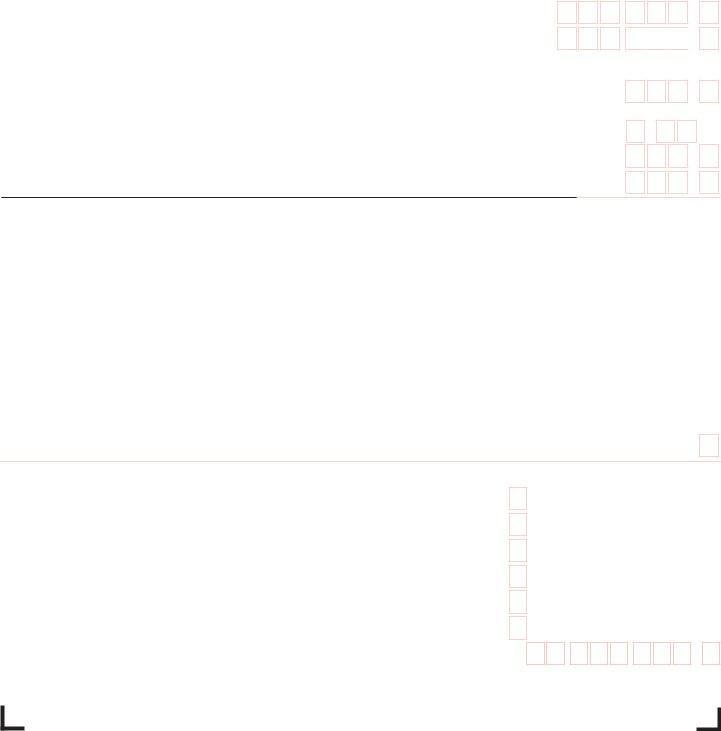

Schedule 1EZ - Property Tax Credit See instructions, Page 13. |

|

|

|

|

|

|

|

Auto 2 |

|

|||||||||||||

|

Qualifying Property |

|

Primary Residence |

|

Auto 1 |

|

|

(joint returns or qualifying widow(er) only) |

|

|||||||||||||||

|

Name of Connecticut Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Town or District |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

If primary residence, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

street address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

If motor vehicle, enter year, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

make, and model. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date(s) Paid |

_ _ /_ _ / 2008 |

|

_ _ /_ _ / 2008 |

|

_ _ /_ _ / 2008 |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

_ _ /_ _ / 2008 |

|

_ _ /_ _ / 2008 |

|

_ _ /_ _ / 2008 |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount Paid 19. |

|

|

|

, |

|

|

|

. |

00 |

20. |

|

|

|

, |

|

|

|

. |

00 |

21. |

22. Total property tax paid: Add Lines 19, 20, and 21. |

|

|

|

|

|

|

|

|

|

22. |

||||||||||

23.Maximum property tax credit allowed

24.Enter the lesser of Line 22 or Line 23.

25.Enter the decimal amount for your fi ling status and Connecticut AGI from the Property Tax Credit Table located in the instruction booklet. If zero, enter the amount from Line 24 on Line 27.

26.Multiply Line 24 by Line 25.

27.Subtract Line 26 from Line 24. Enter here and on Line 5. Attach SCHEDULE 1EZ to your return or your credit will be disallowed.

,

,

23.

24.

25.

26.

27.

. 00

. 00 500. 00

. 00

.

. 00

. 00

Schedule 2EZ - Individual Use Tax

Complete this worksheet to calculate your Connecticut individual use tax liability and attach Page 3 to your return.

Column A |

Column B |

Column C |

Column D |

Column E |

Column F |

Column G |

|

|

|

|

|

Tax, if any, |

Balance due |

Date of |

Description of |

Retailer or |

Purchase |

CT tax due |

paid to |

(Column E minus |

purchase |

goods or services |

service provider |

price |

(.06 X Column D) |

another |

Column F but not |

|

|

|

|

|

jurisdiction |

less than zero) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total of individual purchases under $300 not listed above |

|

|

|

|

||

|

|

|

|

|

|

|

28. Individual use tax: Add all amounts for Column G. Enter here and on Line 7. |

28. |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 3EZ - Contributions to Designated Charities

.00

29a. |

AIDS Research |

29a. |

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

29b. |

Organ Transplant |

29b. |

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

29c. |

Endangered Species/Wildlife |

29c. |

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

29d. |

Breast Cancer Research |

29d. |

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

29e. |

Safety Net Services |

29e. |

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

29f. |

Military Family Relief Fund |

29f. |

|

|

|

|

|

|

||||

|

|

, |

|

|

|

, |

|

|

|

|||

29. Total contributions: Add Lines 29a through 29f; enter amount here and on Line 16.

.00

.00

.00

.00

.00

.00

29.

,

,

.00

Complete applicable schedules on this page and send all three pages of the return to DRS.