When using the online PDF editor by FormsPal, you can easily complete or change Missouri Form Mo 1040 here. Our team is focused on making sure you have the absolute best experience with our tool by continuously presenting new capabilities and improvements. Our editor is now a lot more user-friendly as the result of the newest updates! Now, editing PDF documents is simpler and faster than before. To get the ball rolling, consider these easy steps:

Step 1: Hit the "Get Form" button above on this page to open our tool.

Step 2: With the help of this handy PDF editor, you may accomplish more than just fill in blank form fields. Express yourself and make your documents seem perfect with customized text added, or modify the original input to excellence - all that backed up by an ability to add any kind of graphics and sign the file off.

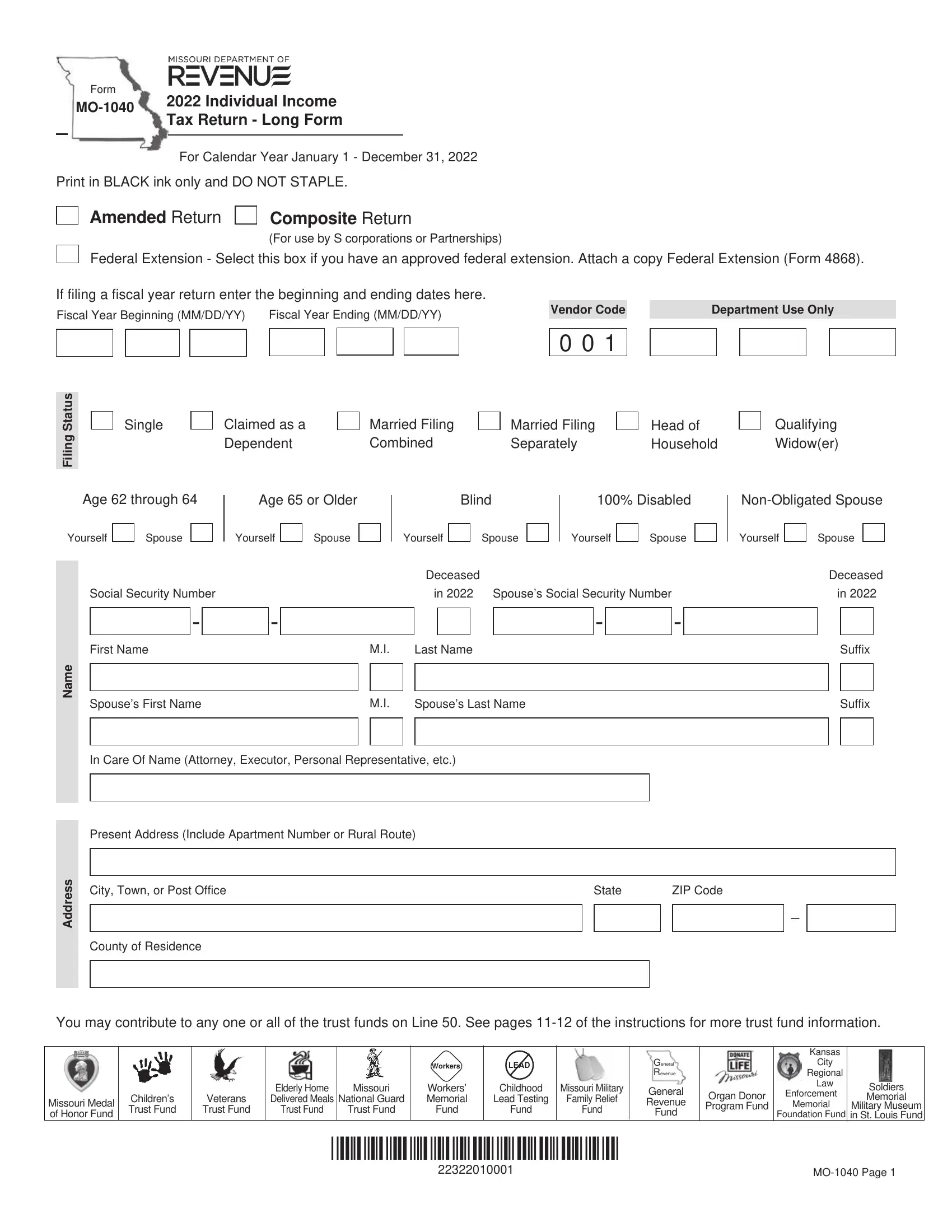

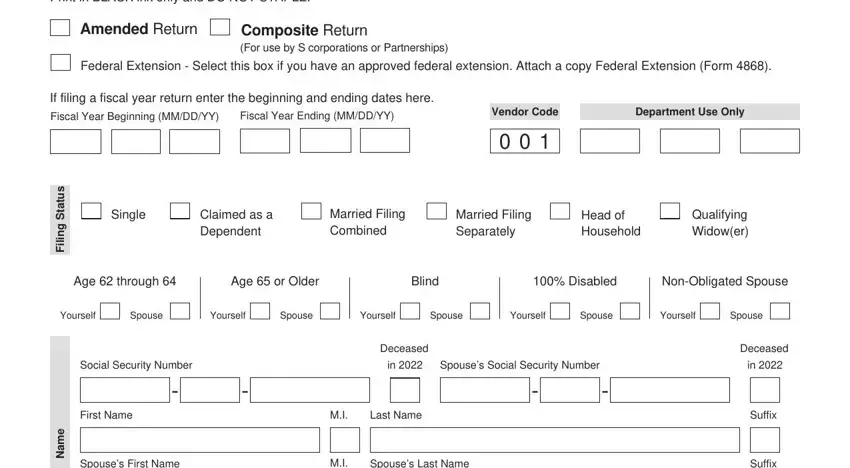

For you to complete this document, make certain you provide the required details in every single blank:

1. You will want to fill out the Missouri Form Mo 1040 correctly, hence be attentive when filling in the sections containing all of these fields:

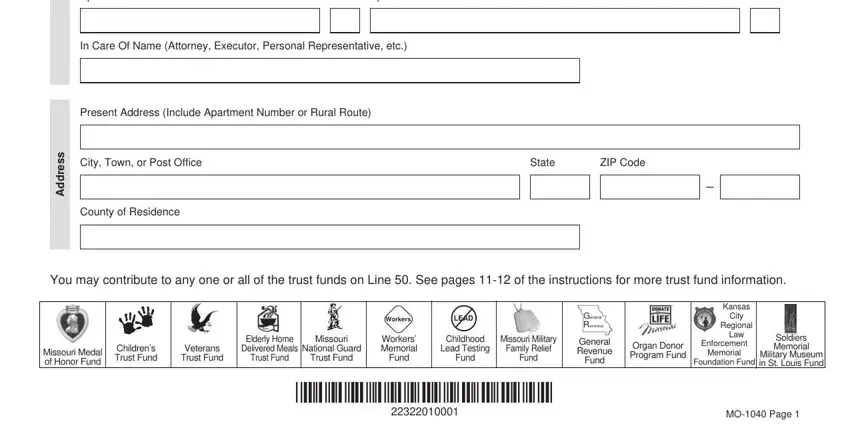

2. Once this selection of fields is done, go on to enter the applicable details in these - Spouses First Name, Spouses Last Name, In Care Of Name Attorney Executor, Present Address Include Apartment, Suffix, City Town or Post Office, State, ZIP Code, County of Residence, s s e r d d A, You may contribute to any one or, Missouri Medal of Honor Fund, Childrens Trust Fund, Veterans Trust Fund, and Elderly Home Delivered Meals.

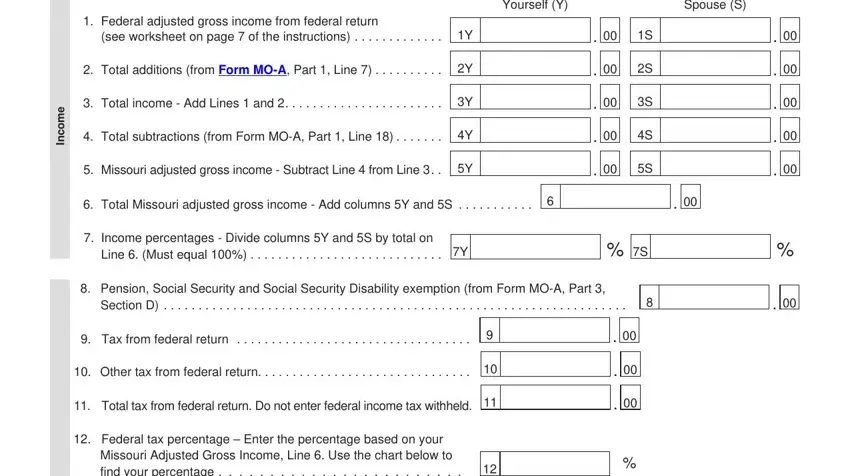

3. In this part, examine e m o c n, Yourself Y, Spouse S, Federal adjusted gross income, see worksheet on page of the, Total additions from Form MOA, Total income Add Lines and, Total subtractions from Form MOA, Missouri adjusted gross income, Total Missouri adjusted gross, Income percentages Divide, Line Must equal, Pension Social Security and, Section D, and Tax from federal return. Each one of these will need to be taken care of with highest attention to detail.

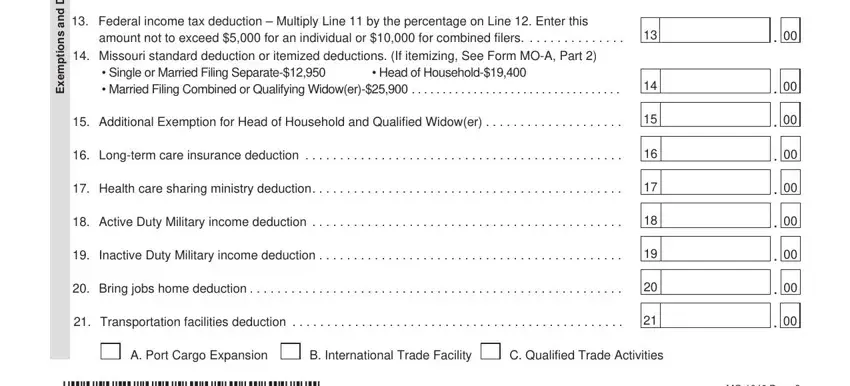

4. To move ahead, the following step requires filling out a few fields. Examples of these are s n o i t c u d e D d n a, s n o i t p m e x E, Federal income tax deduction, amount not to exceed for an, Missouri standard deduction or, Single or Married Filing Separate, Additional Exemption for Head of, Longterm care insurance deduction, Health care sharing ministry, Active Duty Military income, Inactive Duty Military income, Bring jobs home deduction, Transportation facilities, A Port Cargo Expansion, and B International Trade Facility, which are vital to going forward with this process.

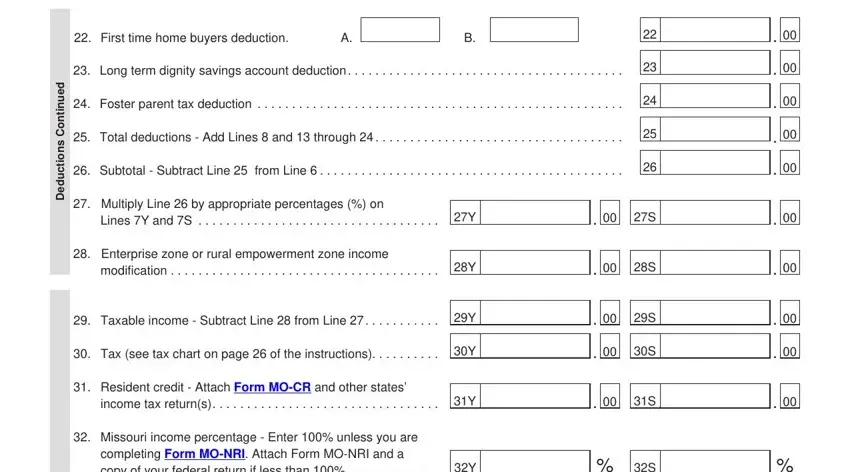

5. This very last point to submit this PDF form is crucial. Make sure you fill out the required fields, for example d e u n i t n o C s n o i t c u d, First time home buyers deduction, Long term dignity savings account, Foster parent tax deduction, Total deductions Add Lines and, Subtotal Subtract Line from, Multiply Line by appropriate, Lines Y and S, Enterprise zone or rural, modification, Taxable income Subtract Line, Tax see tax chart on page of the, Resident credit Attach Form MOCR, income tax returns, and Missouri income percentage Enter, prior to finalizing. If not, it might lead to an incomplete and potentially nonvalid form!

Lots of people generally make mistakes when completing Long term dignity savings account in this section. Don't forget to reread everything you type in right here.

Step 3: Proofread all the details you've inserted in the blank fields and then click on the "Done" button. Sign up with FormsPal today and easily get Missouri Form Mo 1040, available for downloading. All modifications you make are preserved , allowing you to modify the pdf at a later point as required. With FormsPal, you can complete forms without the need to worry about database breaches or entries being shared. Our protected software ensures that your private data is maintained safe.