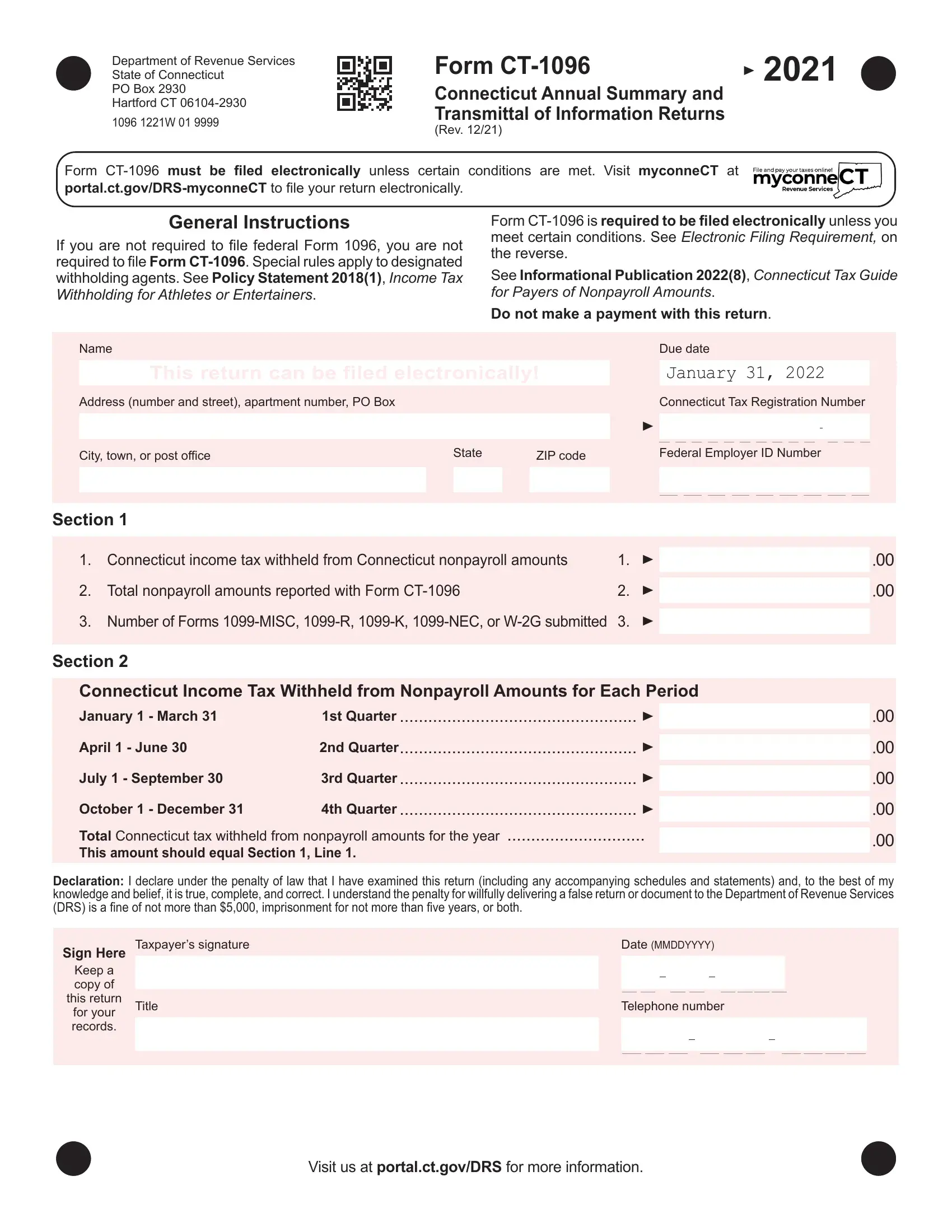

General Instructions

Form CT-1096 must be filed electronically unless certain conditions are met.

File this return electronically using myconneCT at

portal.ct.gov/DRS-myconneCT.

Electronic Filing Waiver

To request a waiver from the information return electronic filing

requirement complete Form CT-8508, Request for Waiver from Filing Information Returns Electronically, at least 30 days before the due date.

If a waiver is granted, your information returns must be submitted to DRS on compact disk by January 31, 2021. See Form CT-4804, Transmittal of Information Returns Reported on Compact Disc (CD) for Forms W‑2G, 1099‑R, 1099‑K, 1099‑NEC, and 1099‑MISC.

Complete this return in blue or black ink only. Do not use staples.

Electronic Filing Requirement

If you file 25 or more Forms 1099-MISC, 1099-R, 1099-K,

1099-NEC, or W-2G you are required to file electronically unless you have been granted a waiver from electronic filing of information

returns. See Waiver of Electronic Filing Requirement, on this page.

If you file 24 or fewer Forms 1099-MISC, 1099-R, 1099-K, 1099-NEC, or W‑2G you are encouraged to file electronically but may file paper

forms without requesting a waiver. Please note that each form is year

specific. To prevent any delay in processing your return, the correct year’s form must be submitted to DRS. Do not use staples.

Electronic reporting requirements are available at portal.ct.gov/DRS and in Informational Publication 2021(12), Forms 1099‑R, 1099‑MISC, 1099‑K, 1099‑NEC, and W‑2G Electronic Filing Requirements for Tax Year 2020.

When to File

Form CT-1096 is due January 31, 2021.

If the due date falls on a Saturday, Sunday, or legal holiday, the return will be considered timely if filed by the next business day.

Who Must File Form CT-1096

If you are required to file federal Form 1096, you must file Form CT-1096 with DRS even if you are not required to be registered with DRS, and submit every state copy of:

•Federal Form W-2G for (1) Connecticut Lottery winnings paid to resident and nonresident individuals even if no Connecticut income tax was withheld; and (2) other gambling winnings paid to resident individuals even if no Connecticut income tax was withheld;

•Federal Form 1099-MISC for payments made to resident individuals or to nonresident individuals if the payments relate to services performed wholly or partly in Connecticut even if no Connecticut income tax was withheld;

•Federal Form 1099-R reporting distributions paid to resident individuals even if no Connecticut income tax was withheld. For all other recipients, only if Connecticut income tax was withheld;

•Federal Form 1099-K reporting payments to payees located or with locations in Connecticut; and

•Federal Form 1099-NEC reporting non-employee compensation for payments made to resident individuals or to nonresident individuals if the payments relate to services performed wholly or partly in Connecticut even if no Connecticut income tax was withheld.

Rounding Off to Whole Dollars

You must round off cents to the nearest whole dollar on your returns and schedules. If you do not round, DRS will disregard the cents.

Round down to the next lowest dollar all amounts that include 1 through 49 cents. Round up to the next highest dollar all amounts

that include 50 through 99 cents. However, if you need to add two

or more amounts to compute the amount to enter on a line, include cents and round off only the total.

Example: Add two amounts ($1.29 + $3.21) to compute the total ($4.50) to enter on a line. $4.50 is rounded to $5.00 and

entered on the line.

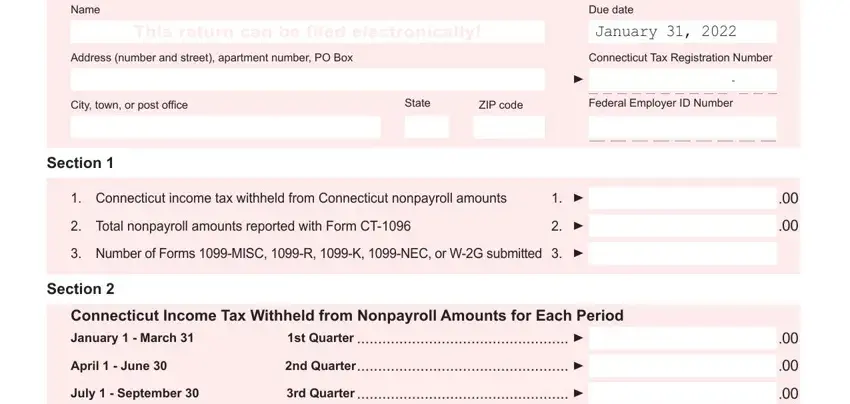

Line Instructions

Group the forms by form number and submit each group with a separate Form CT-1096.

Line 1: Enter Connecticut income tax withheld from nonpayroll amounts during the calendar year. This should equal the Total Line from Section 2.

Line 2: Enter total:

•Connecticut Lottery winnings paid to resident and nonresident individuals, as reported on federal Form W-2G, whether or not Connecticut income tax was withheld;

•Other gambling winnings paid to resident individuals, as reported on federal Form W-2G, whether or not Connecticut income tax was withheld;

•Miscellaneous payments reported on federal Form 1099-MISC to resident individuals or to nonresident individuals if the payments relate to services performed wholly or partly in Connecticut even if no Connecticut income tax was withheld;

•Distributions paid to resident individuals as reported on federal Form 1099-R, even if no Connecticut income tax was withheld. For all other recipients, only if Connecticut income tax was withheld; and

•Payments to payees located or with locations in Connecticut as reported on federal Form 1099-K.

Line 3: Enter the number of 1099-MISC, 1099-R, 1099-K, 1099-NEC, or W-2G forms submitted with this return.

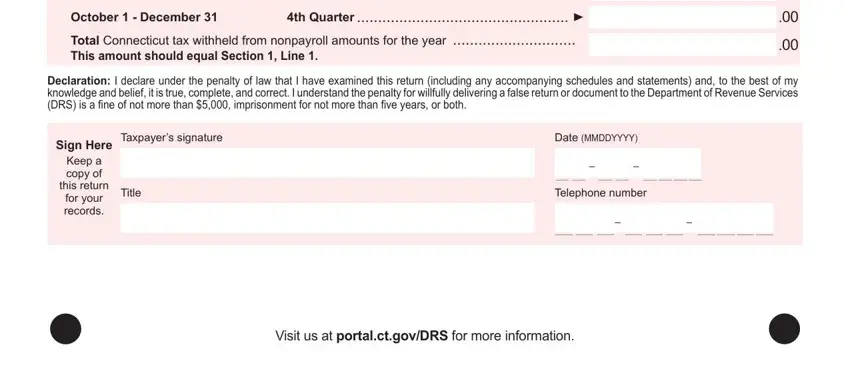

Amended Returns

If you previously filed 25 or more Forms 1099‑MISC, 1099‑R, 1099‑K,

1099-NEC or W-2G electronically you must amend Form CT-1096 electronically, even if you are correcting 24 or fewer Forms 1099-MISC, 1099-R, 1099-K, 1099-NEC, or W-2G. See IP 2021(12).

If you previously filed 24 or fewer Forms 1099‑MISC, 1099‑R, 1099‑K,

1099-NEC or W-2G electronically you are encouraged to amend electronically but may file paper forms without requesting a waiver.

If you previously filed 24 or fewer paper Forms 1099‑MISC, 1099‑R, 1099-K, 1099-NEC or W-2G you may amend Form CT-1096 and submit corrected Forms 1099-MISC, 1099-R, 1099-K, 1099-NEC or W-2G using paper. To amend Form CT-1096 by paper submit a revised Form

CT-1096 clearly labeled “Amended.” The total Connecticut tax withheld on Form CT‑945 or Form CT‑941X, Line 3, must agree with the total

reported on Form CT-1096, Line 1. The gross Connecticut nonpayroll amounts reported on Form CT‑945 or Form CT‑941X, Line 2, must

agree with total nonpayroll amounts reported on Form CT-1096, Line 2.

Forms and Publications

Visit the DRS website at portal.ct.gov/DRS to download and print Connecticut tax forms and publications.

For More Information

Call DRS Monday through Friday, 8:30 a.m. to 4:30 p.m. at:

•800-382-9463 (Connecticut calls from outside the Greater Hartford calling area only); or

•860-297-5962 (from anywhere).

TTY, TDD, and Text Telephone users only may transmit inquiries anytime by calling 860-297-4911.Taxpayers may also call 711 for relay services. A taxpayer must tell the 711 operator the number he or she wishes to call. The relay operator will dial it and then communicate using a TTY with the taxpayer.