Connecticut Form Ct-399 is a document that is used to request the release of tax information. The form can be used to request information for both individual and business taxpayers. The form must be completed and submitted to the Department of Revenue Services (DRS) in order to requests the release of tax information. Taxpayers should use caution when submitting this form, as incorrect or incomplete submissions may result in delays or refusal of the release of requested information. It is important to note that there are specific criteria that must be met in order to qualify for tax information release, so taxpayers should ensure that they meet all requirements before submitting their request.

| Question | Answer |

|---|---|

| Form Name | Form Ct 399 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | Fillable Online tax ny CT-399 Staple forms here New York ... |

|

Department of Taxation and Finance |

||

|

Depreciation Adjustment Schedule |

||

|

Tax Law – Articles |

|

|

|

|

|

|

Legal name of corporation |

|

Employer identification number |

|

|

|

|

|

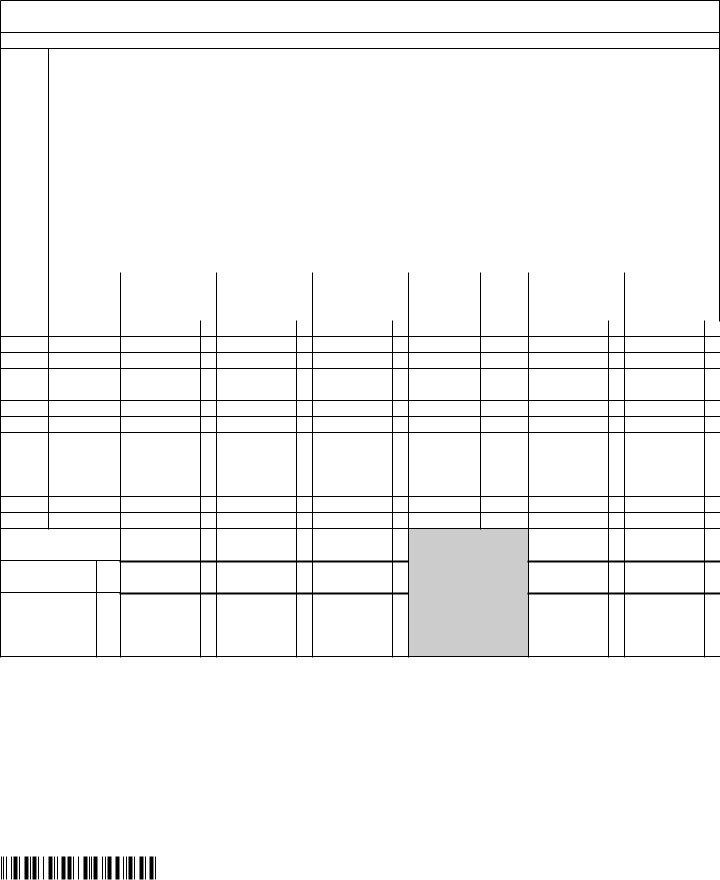

Part 1 – Computation of New York State depreciation modifications when computing entire net income (ENI) List only depreciable property that requires or is entitled to a depreciation modification when computing ENI (see Form

Section A – ACRS/MACRS property (attach separate sheets if necessary, displaying this information formatted as below; see instructions)

A – Description of property (identify each item of property here; for each item of property complete columns B through I on the corresponding lines below)

Item |

|

|

|

|

|

|

|

Property |

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

J |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

K |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

B |

|

|

C |

D |

E |

F |

G |

H |

I |

|||||

Item |

Date placed |

Cost or |

Accumulated federal |

Federal |

Method of |

Life |

Accumulated |

Allowable |

|||||||

|

in service |

other |

ACRS/MACRS |

ACRS/MACRS |

figuring NYS |

or |

NYS |

NYS |

|||||||

|

basis |

depreciation |

depreciation deduction |

depreciation |

rate |

depreciation |

depreciation |

||||||||

|

|

|

|

(see instructions) |

(see instructions) |

(see instructions) |

(see instructions) |

(see instr.) |

(see instructions) |

(see instructions) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

F |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

G |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

H |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

J |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

K |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

N |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

P |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Q |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts from |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

attached list, if any .... |

|

|

|

|

|

|

|

|

|

|

|

|

|||

1 Totals of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Section A |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

482001210094

Page 2 of 3

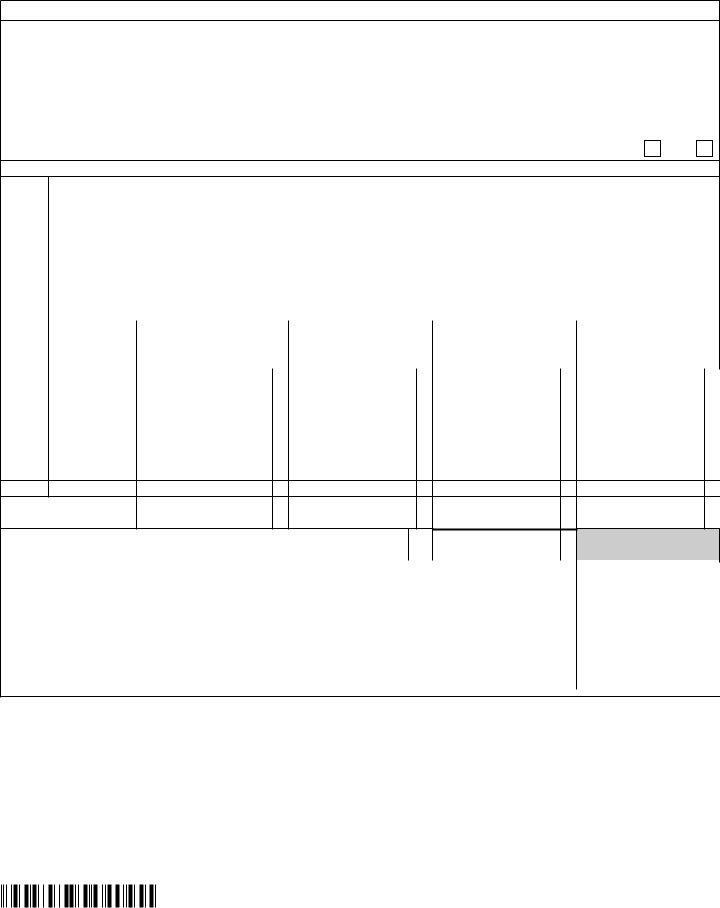

Section B – Property qualified under IRC section 168(k)(2) for federal special depreciation (attach separate sheets if necessary,

displaying this information formatted as below; see instructions)

A – Description of property (identify each item of property here; for each item of property complete columns B through I on the corresponding lines below)

Item |

|

|

|

|

Property |

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

E |

|

|

|

|

|

|

|

|

|

F |

|

|

|

|

|

|

|

|

|

G |

|

|

|

|

|

|

|

|

|

H |

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

J |

|

|

|

|

|

|

|

|

|

K |

|

|

|

|

|

|

|

|

|

L |

|

|

|

|

|

|

|

|

|

M |

|

|

|

|

|

|

|

|

|

A |

|

B |

C |

D |

E |

F |

G |

H |

I |

Item |

Date placed |

Cost or |

Accumulated |

Federal depreciation Method of figuring |

Life or |

Accumulated NYS |

Allowable NYS |

||

|

in service |

other basis |

federal depreciation |

deduction |

NYS depreciation |

rate |

depreciation |

depreciation |

|

|

(see instructions) |

(see instructions) |

(see instructions) |

(see instructions) |

(see instr.) |

(see instructions) |

|

||

|

|

|

|

|

|

|

|

|

|

A |

- |

- |

|

|

|

|

|

|

|

B- -

C- -

D |

- |

- |

E |

- |

- |

F- -

G- -

H |

- |

- |

I |

- |

- |

J |

- |

- |

K |

- |

- |

L- -

M- -

Amounts from

attached list, if any ....

2Totals of

Section B 2

3Add lines 1 and 2 in columns C, D, E, H, and I

(see instr) ....... 3

If you have not disposed of any ACRS/MACRS property placed in service in tax years beginning before 1994, and you have not disposed of qualified property for which you claimed a federal special depreciation deduction (in a tax year beginning after December 31, 2002, for property placed in service on or after June 1, 2003), enter the total of column E as an addback to federal taxable income (FTI) and the total of column I as a deduction from FTI on the appropriate lines of the applicable form (see line 3

instructions).

If you have disposed of any property listed on this form in a prior year, complete Parts 2 and 3.

482002210094

Part 2 – Disposition adjustments (attach separate sheets if necessary, displaying this information formatted as below; see instructions)

•For each item of property listed below, determine the difference between the total federal depreciation deduction, including a federal special depreciation deduction allowed under IRC section 168(k) for qualified property under IRC section 168(k)(2), and the total New York State depreciation used in the computation of federal and New York State taxable income in prior and current years.

•If the federal depreciation deduction is larger than the New York State depreciation deduction, subtract column D from column C and enter the result in column E.

•If the New York State depreciation deduction is larger than the federal depreciation deduction, subtract column C from column D and enter the result in column F.

Disposition of property for certain tax credits – In this tax period, did you dispose of property for which the |

Yes |

No |

investment tax credit was previously claimed? (mark an X in one box; see instructions) |

A – Description of property (identify each item of property here; for each item of property complete columns B through F on the corresponding lines below)

Item |

|

|

|

Property |

|

|

A |

|

|

|

|

|

|

B |

|

|

|

|

|

|

C |

|

|

|

|

|

|

D |

|

|

|

|

|

|

E |

|

|

|

|

|

|

F |

|

|

|

|

|

|

G |

|

|

|

|

|

|

H |

|

|

|

|

|

|

A |

B |

|

C |

D |

E |

F |

Item |

Date placed |

Total federal depreciation |

Total New York State |

Adjustment (if C is larger |

Adjustment (if D is larger |

|

|

in service |

deduction taken |

depreciation taken |

than D, column C - column D; |

than C, column D - column C; |

|

|

(see instructions) |

(see instructions) |

see instructions) |

see instructions) |

||

|

|

|

|

|

|

|

A |

- |

- |

|

|

|

|

B |

- |

- |

|

|

|

|

C |

- |

- |

|

|

|

|

D |

- |

- |

|

|

|

|

E |

- |

- |

|

|

|

|

F |

- |

- |

|

|

|

|

G |

- |

- |

|

|

|

|

H- -

Amounts from attached list, if any........

4 Total excess federal depreciation deductions over New York State

|

depreciation deductions (add column E amounts) |

4 |

|

|

|

|

|

5 |

Total excess New York State depreciation deductions over federal depreciation deductions (add column F amounts) |

5 |

|

|

|||

Part 3 – Summary of adjustments to ENI |

|

A |

|

|

B |

||

|

Federal |

|

|

New York State |

|||

6 |

Enter amount from line 3, column E |

6 |

|

|

|

|

|

7 |

Enter amount from line 3, column I |

7 |

|

|

|

|

|

8 |

Enter amount from line 4 |

8 |

|

|

|

|

|

9 |

Enter amount from line 5 |

9 |

|

|

|

|

|

10 |

..................................................Add amounts in column A and column B |

10 |

|

|

|

|

|

If you file Form: |

Enter the amount from line 10, column A, on Form: |

Enter the amount from line 10, column B, on Form: |

482003210094