With the objective of making it as quick to apply as possible, we developed the PDF editor. The whole process of creating the os 114 will be hassle-free in case you check out the next actions.

Step 1: Choose the orange button "Get Form Here" on the following webpage.

Step 2: As soon as you have accessed the os 114 edit page, you will notice all options you can take regarding your file at the top menu.

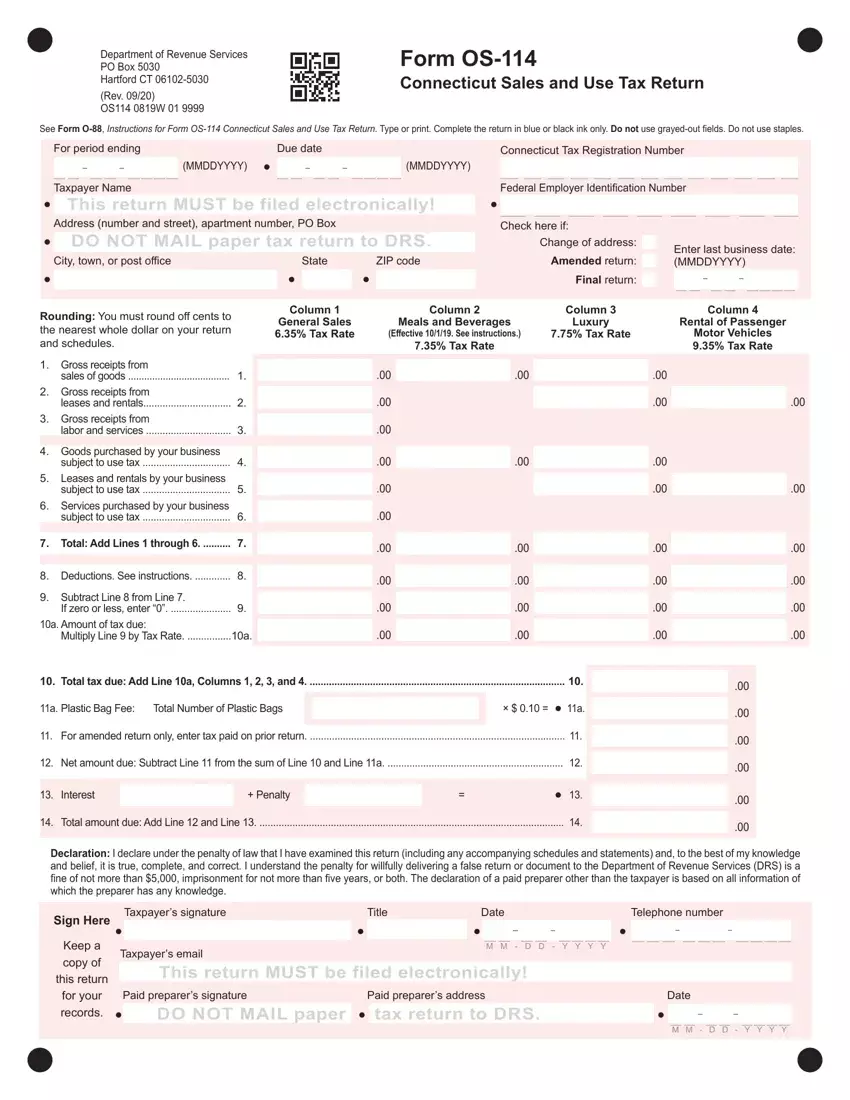

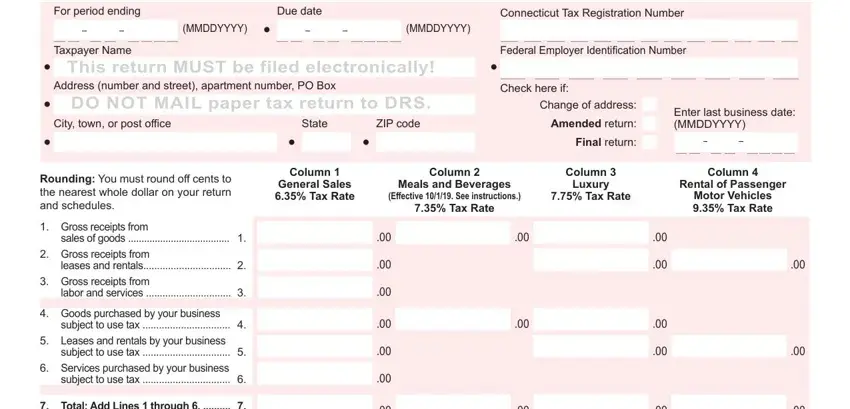

The next sections will compose the PDF document that you will be filling in:

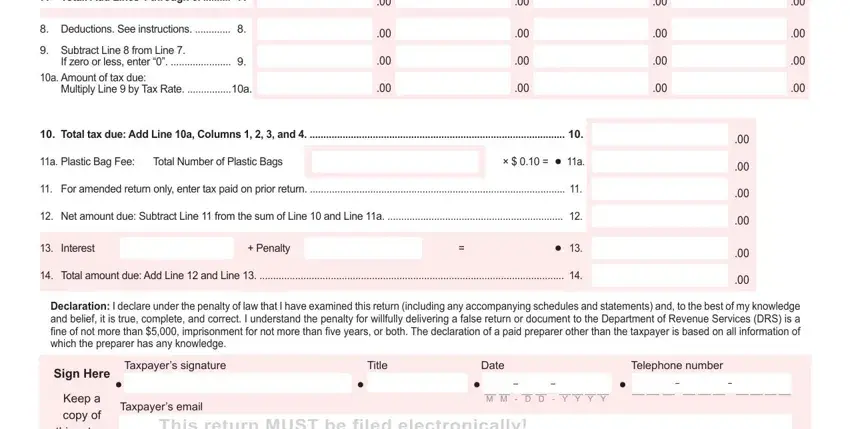

Complete the Total Add Lines through, Deductions See instructions, Subtract Line from Line, If zero or less enter, a Amount of tax due, Multiply Line by Tax Rate a, Total tax due Add Line a Columns, a Plastic Bag Fee, Total Number of Plastic Bags, For amended return only enter tax, Net amount due Subtract Line, Interest, Penalty, Total amount due Add Line and, and Declaration I declare under the field with all the data demanded by the program.

Jot down the appropriate details when you are on the Keep a copy of this return for, This return MUST be filed, Paid preparers signature, DO NOT MAIL paper, Paid preparers address tax return, Date, and M M D D Y Y Y Y segment.

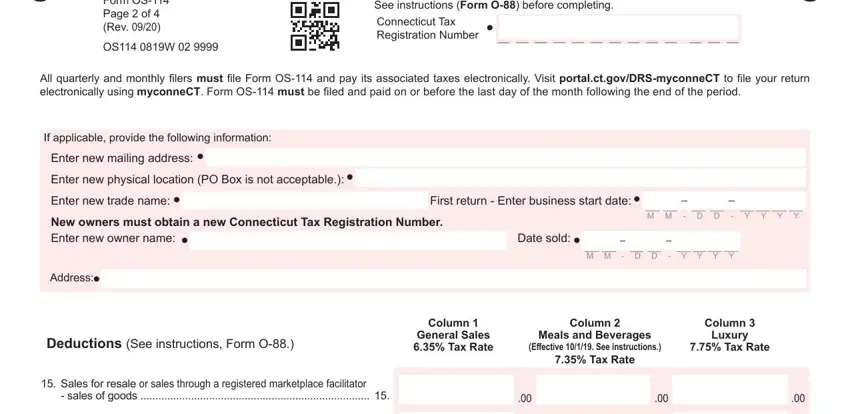

The Form OS Page of Rev, OS W, See instructions Form O before, All quarterly and monthly filers, If applicable provide the, Enter new mailing address, Enter new physical location PO, Enter new trade name, First return Enter business, New owners must obtain a new, Address, D D, Y Y Y Y, M M, and Date sold area should be applied to note the rights or responsibilities of both sides.

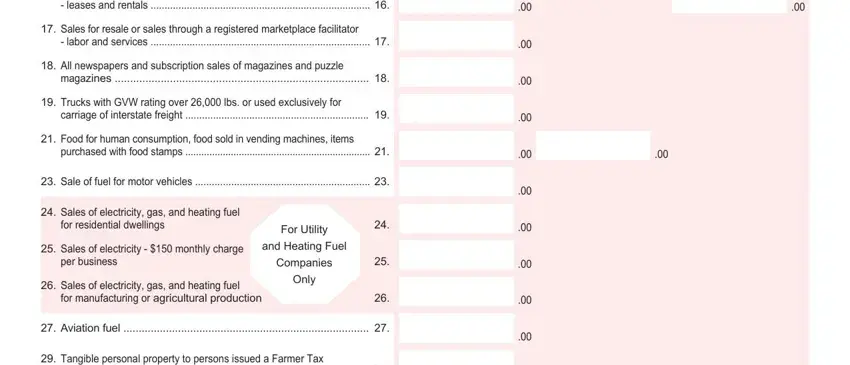

Finalize by reviewing the next fields and filling them in accordingly: Sales for resale or sales through, leases and rentals, Sales for resale or sales through, labor and services, All newspapers and subscription, magazines, Trucks with GVW rating over lbs, carriage of interstate freight, Food for human consumption food, purchased with food stamps, Sale of fuel for motor vehicles, Sales of electricity gas and, for residential dwellings, Sales of electricity monthly, and per business.

Step 3: Press "Done". It's now possible to upload your PDF form.

Step 4: Generate copies of the form - it can help you stay clear of potential future troubles. And don't be concerned - we do not share or check your details.