We've used the endeavours of our best computer programmers to create the PDF editor you can apply. The app allows you to create the ct tax document with no trouble and don’t waste valuable time. Everything you should do is comply with these easy-to-follow tips.

Step 1: To begin with, pick the orange "Get form now" button.

Step 2: So you are going to be on your file edit page. You can include, customize, highlight, check, cross, add or remove areas or text.

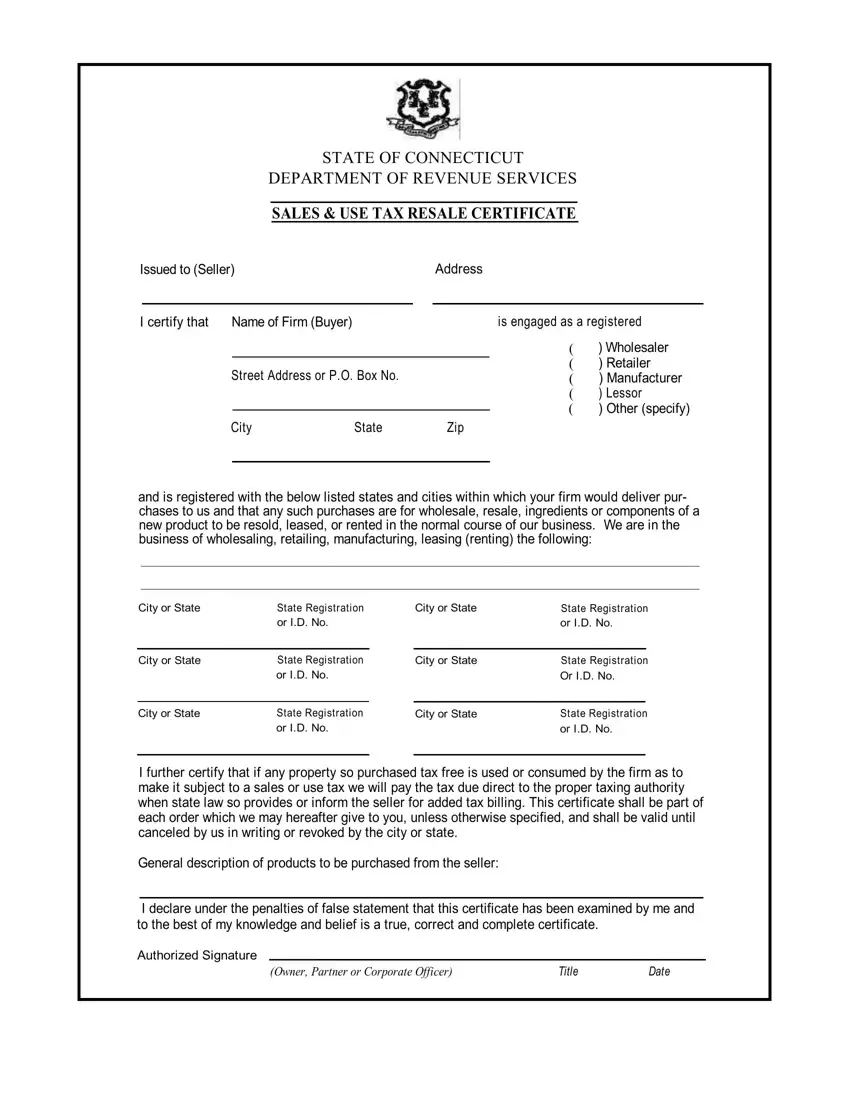

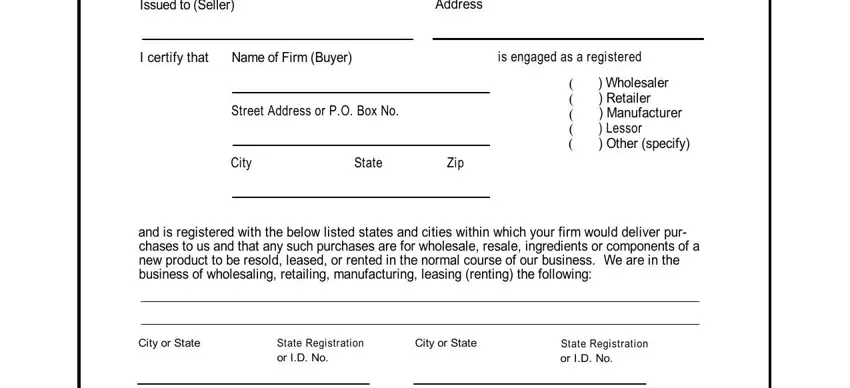

Type in the essential content in each one section to fill in the PDF ct tax

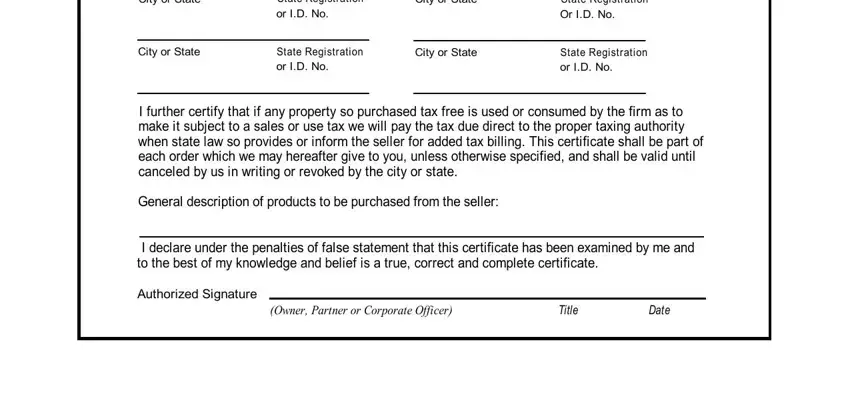

Type in the requested details in the area City or State, City or State, State Registration or ID No, City or State, State Registration or ID No, City or State, State Registration Or ID No, State Registration or ID No, I further certify that if any, General description of products to, I declare under the penalties of, Authorized Signature, Owner Partner or Corporate Officer, Title, and Date.

Step 3: Choose the button "Done". The PDF form may be transferred. You can upload it to your device or send it by email.

Step 4: Come up with a duplicate of each file. It may save you some time and make it easier to avoid misunderstandings as time goes on. Keep in mind, your details isn't revealed or viewed by us.