The idea supporting our PDF editor was to make certain it is as simple as it can be. You will find the general procedure of filling up st4 form simple once you keep to all of these steps.

Step 1: You can click the orange "Get Form Now" button at the top of the following website page.

Step 2: After you've entered the st4 form editing page you may find each of the actions you may conduct concerning your file from the upper menu.

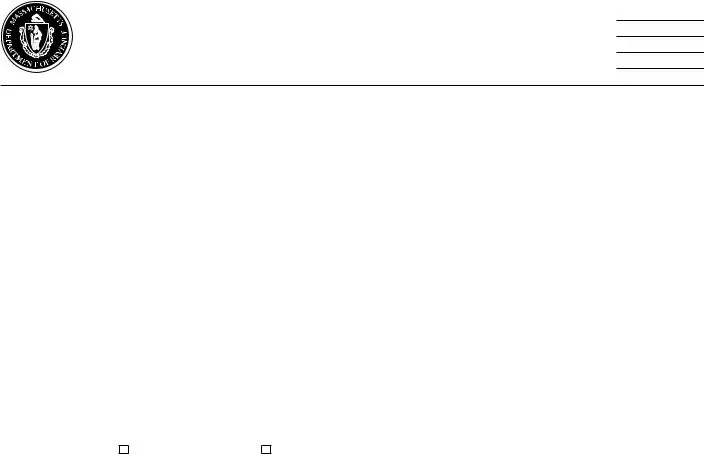

Type in the content requested by the software to prepare the document.

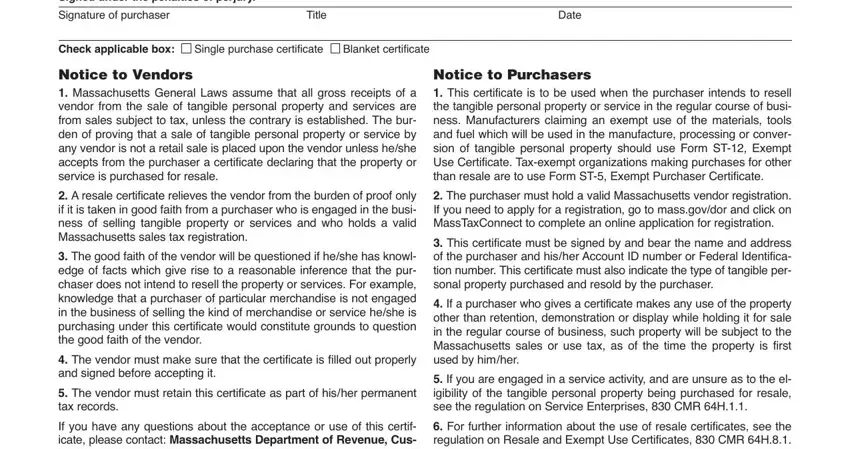

Make sure you fill up the Signed under the penalties of, Signature of purchaser, Title, Date, Check applicable box, Single purchase certificate, Blanket certificate, Notice to Vendors Massachusetts, Notice to Purchasers This, A resale certificate relieves the, The good faith of the vendor will, The vendor must make sure that, The vendor must retain this, If you have any questions about, and The purchaser must hold a valid field with the required details.

Step 3: As you hit the Done button, your ready file may be transferred to each of your gadgets or to electronic mail provided by you.

Step 4: Generate a minimum of a few copies of your document to avoid any specific potential challenges.