The CT-636 form, crafted by the Department of Taxation and Finance, stands as a pivotal document for entities engaged in the production of alcoholic beverages within New York State, offering a pathway to claim the Alcoholic Beverage Production Credit. Tailored to cater to the diverse facets of the alcoholic beverage industry, this form encompasses specific sections addressing the production of beer, cider, wine, and liquor, respectively. Entities must provide their legal name, Employer Identification Number (EIN), and detail their tax period at the outset. It discerns between corporations claiming the credit directly and those obtaining a share of the credit through a partnership. The eligibility to claim this credit hinges on several factors, including production volume thresholds and the requisite registration as a distributor under Tax Law Article 18. With schedules dedicated to each beverage type, the form meticulously calculates the credit, offering detailed guidance for both C corporations and New York S corporations. Entities must navigate through eligibility criteria, perform computations across diverse schedules based on their specific produce, and ultimately consolidate these figures to ascertain the total credit claimable. This form not only delineates the procedural aspects but also intricately links to other requisite forms and schedules, underscoring the comprehensive approach employed by New York State to facilitate this tax incentive for alcoholic beverage producers.

| Question | Answer |

|---|---|

| Form Name | Ct636 Form |

| Form Length | 6 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 30 sec |

| Other names | MILLER BREWING COMPANY v. DEPARTMENT OF ALCOHOLIC BEVERAGE ... |

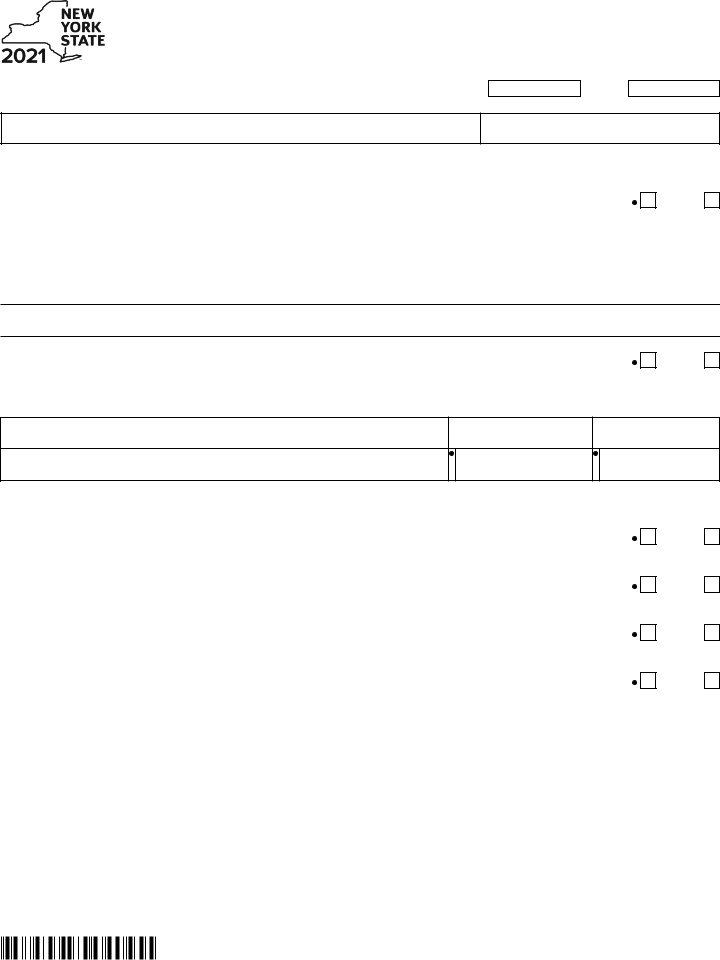

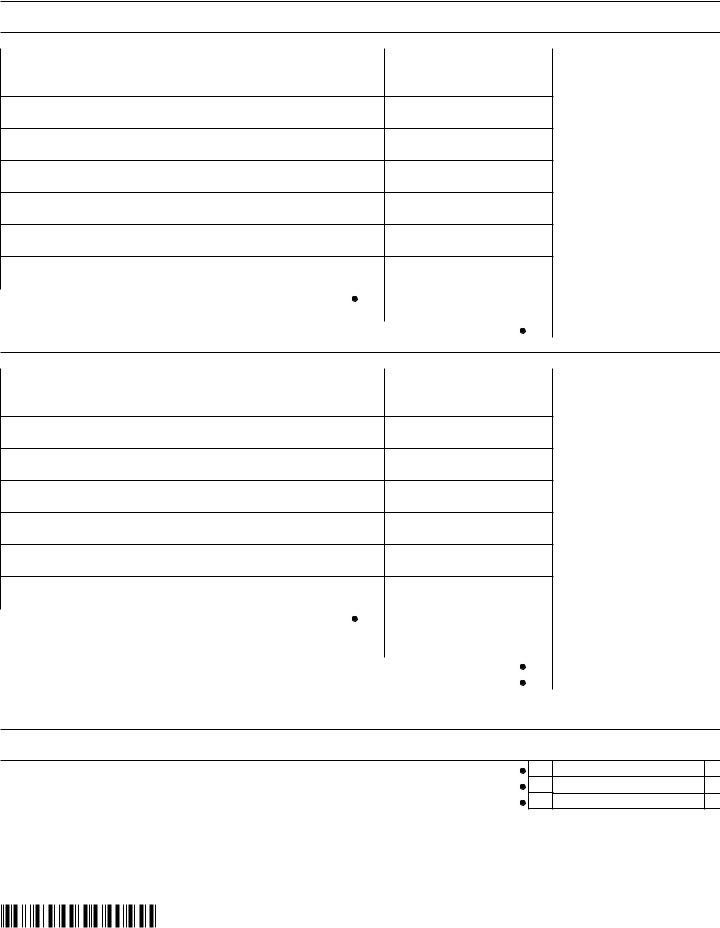

Department of Taxation and Finance |

|

Alcoholic Beverage Production Credit |

Tax Law – Sections 37 and

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

File this form with Form

All filers must complete line A.

AAre you claiming this credit as a corporation that earned the credit (not as a corporate partner that received

a share of the credit from a partnership)? (mark an X in the appropriate box; see instructions) |

Yes |

No

C corporations

If Yes, complete Schedule A, Schedules B, C, D, and/or E, as applicable, and Schedules F and G.

If No, and you are claiming this credit as a corporate partner, complete Schedules H, F and G.

New York S corporations

If Yes, complete Schedule A, Schedules B, C, D, and/or E, as

applicable.

If No, and you are claiming this credit as a corporate partner, complete Schedule H.

Schedule A – Eligibility

B Are you registered as a distributor under Tax Law Article 18 (Taxes on Alcoholic Beverages)? |

Yes |

No

If Yes, enter the name, the EIN, and the State Liquor Authority (SLA) license number of the registered distributor below. If No, stop. You do not qualify for this credit.

Name of registered distributor

EIN of registered

distributor

SLA license number

of registered distributor

CFor the tax year, did you produce in New York State (for each question, mark an X in the appropriate box; see Eligibility in the instructions):

60 million gallons or less of beer? |

Yes |

If Yes, complete Schedule B. |

|

60 million gallons or less of cider? |

Yes |

If Yes, complete Schedule C. |

|

20 million gallons or less of wine? |

Yes |

If Yes, complete Schedule D. |

|

800,000 gallons or less of liquor? |

Yes |

If Yes, complete Schedule E. |

|

If you answered No to all questions, stop. You do not qualify for this credit for this tax year. |

|

No

No

No

No

544001210094

Page 2 of 6

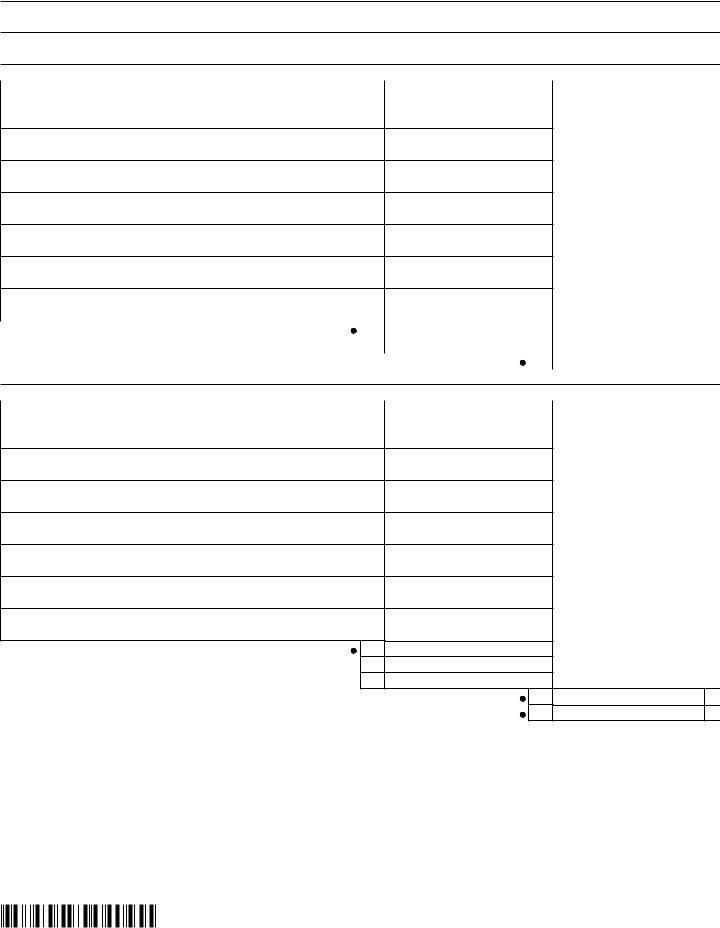

Schedules B through F – Computation of credit

Schedule B – Credit for beer produced in New York State in this tax year (see instructions)

Part 1 – Credit for the first 500,000 gallons (attach additional sheets if necessary)

A |

B |

Beer production facility’s physical address |

Total gallons of beer |

|

(from Form(s) |

|

see instructions) |

Total of column B amounts from additional sheets, if any |

|

|

|

|

|

|

1 |

..........................................................Add column B amounts |

1 |

|

|

|

|

2 |

Enter the lesser of line 1 or 500,000 |

2 |

|

|

|

|

3 |

Credit for the first 500,000 gallons (multiply line 2 by .14; see instructions) |

3 |

|

|

||

Part 2 – Credit for gallons in excess of 500,000 (attach additional sheets if necessary)

A |

B |

Beer production facility’s physical address |

Total gallons of beer |

|

(from Form(s) |

|

see instructions) |

Total of column B amounts from additional sheets, if any |

|||

4 |

Add column B amounts |

4 |

|

5 |

Subtract 500,000 from line 4 |

5 |

|

6 |

Enter the lesser of line 5 or 15,000,000 |

(see instructions) |

6 |

7 |

Credit for gallons in excess of 500,000 |

(multiply line 6 by .045) |

7 |

8 |

Total credit for beer produced in New York State (add lines 3 and 7) |

........................................... 8 |

|

New York S corporations: Include the amount from line 8 on the applicable line of Form

544002210094

Schedule C – Credit for cider produced in New York State in this tax year (see instructions)

Part 1 – Credit for the first 500,000 gallons (attach additional sheets if necessary)

A |

B |

Cider production facility’s physical address |

Total gallons of cider |

|

(from Form |

|

see instructions) |

Total of column B amounts from additional sheets, if any |

|

|

|

|

|

............................................................9 Add column B amounts |

9 |

|

|

|

|

..........................................10 Enter the lesser of line 9 or 500,000 |

10 |

|

|

|

|

11 Credit for the first 500,000 gallons (multiply line 10 by .14; see instructions) |

11 |

|

|

||

|

|

|

|

|

|

Part 2 – Credit for gallons in excess of 500,000 (attach additional sheets if necessary) |

|

|

|

||

A |

|

B |

|

|

|

Cider production facility’s physical address |

|

Total gallons of cider |

|

|

|

|

|

(from Form |

|

|

|

|

|

see instructions) |

|

|

|

Total of column B amounts from additional sheets, if any |

|

|

|

|

|

|

|

12 |

...........................................................Add column B amounts |

12 |

|

|

|

|

|

13 |

Subtract 500,000 from line 12 |

13 |

|

|

|

|

|

14 |

Enter the lesser of line 13 or 15,000,000 (see instructions) |

14 |

|

|

|

|

|

15 |

Credit for gallons in excess of 500,000 (multiply line 14 by .045) |

|

|

|

|

|

|

|

|

15 |

|

|

|

||

16 |

Total credit for cider produced in New York State (add lines 11 and 15) |

....................................... |

16 |

|

|

|

|

New York S corporations: Include the amount from line 16 on the applicable line of Form

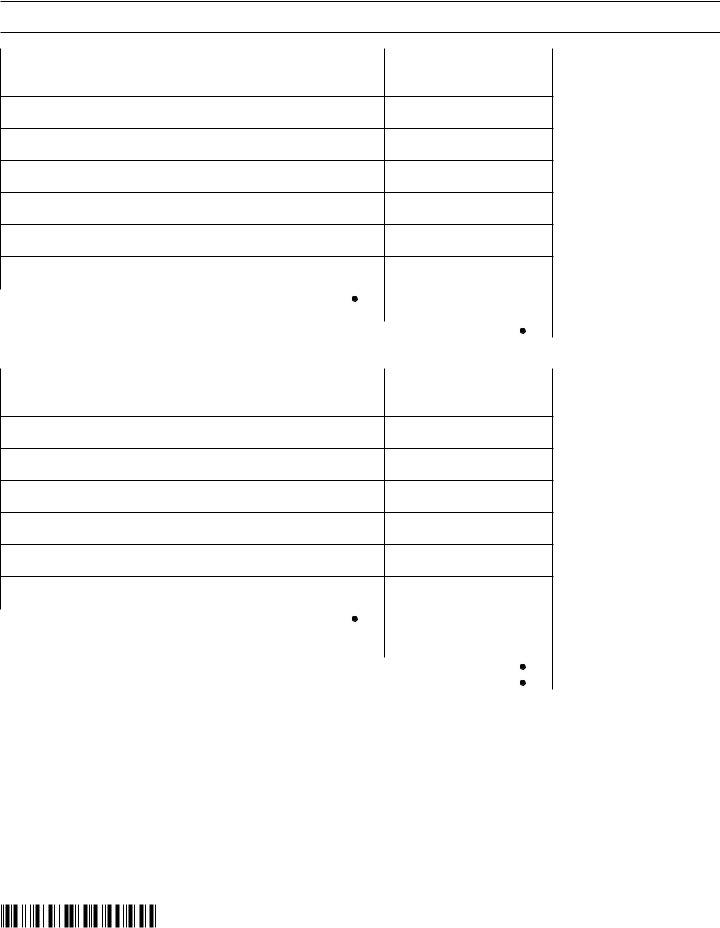

544003210094

Page 4 of 6

Schedule D – Credit for wine produced in New York State in this tax year (see instructions)

Part 1 – Credit for the first 500,000 gallons (attach additional sheets if necessary)

A |

B |

Wine production facility’s physical address |

Total gallons of wine |

|

(from Form(s) |

|

see instructions) |

Total of column B amounts from additional sheets, if any |

|

|

|

|

|

|

17 |

...........................................................Add column B amounts |

17 |

|

|

|

|

18 |

Enter the lesser of line 17 or 500,000 |

18 |

|

|

|

|

19 |

Credit for the first 500,000 gallons (multiply line 18 by .14; see instructions) |

19 |

|

|

||

Part 2 – Credit for gallons in excess of 500,000 (attach additional sheets if necessary)

A |

B |

Wine production facility’s physical address |

Total gallons of wine |

|

(from Form(s) |

|

see instructions) |

Total of column B amounts from additional sheets, if any |

|

|

|

|

|

|

|

20 |

...........................................................Add column B amounts |

20 |

|

|

|

|

|

21 |

Subtract 500,000 from line 20 |

21 |

|

|

|

|

|

22 |

Enter the lesser of line 21 or 15,000,000 (see instructions) |

22 |

|

|

|

|

|

23 |

Credit for gallons in excess of 500,000 (multiply line 22 by .045) |

|

|

|

|

|

|

|

|

23 |

|

|

|

||

24 |

Total credit for wine produced in New York State (add lines 19 and 23) |

....................................... |

24 |

|

|

|

|

New York S corporations: Include the amount from line 24 on the applicable line of Form

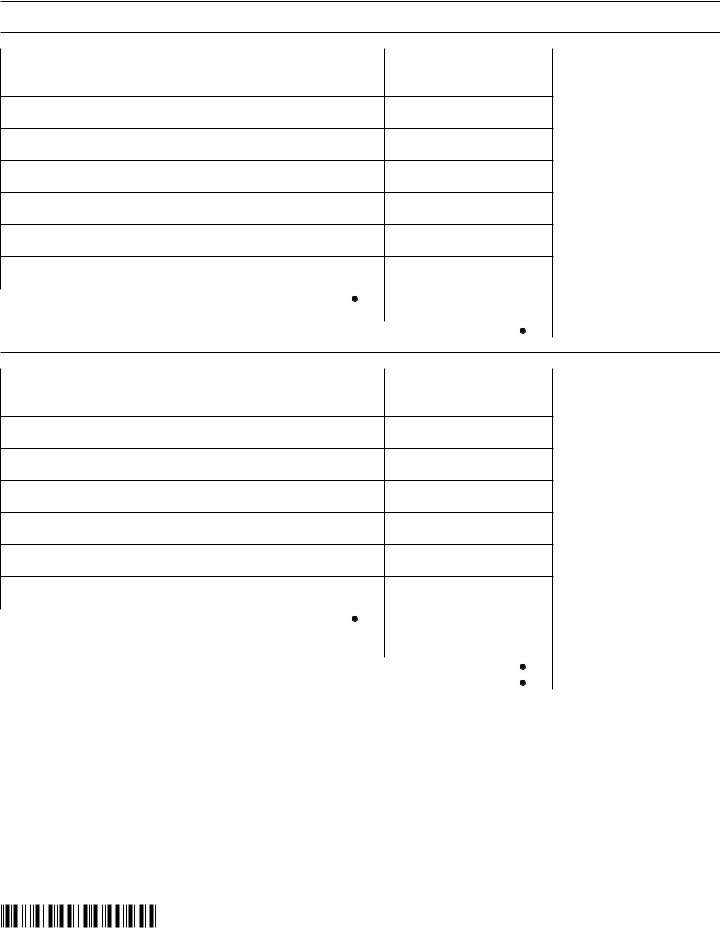

544004210094

Schedule E – Credit for liquor produced in New York State in this tax year (see instructions)

Part 1 – Credit for the first 500,000 gallons (attach additional sheets if necessary)

A |

B |

Liquor production facility’s physical address |

Total gallons of liquor |

|

(from Form(s) |

|

see instructions) |

Total of column B amounts from additional sheets, if any |

|

|

|

|

|

|

25 |

...........................................................Add column B amounts |

25 |

|

|

|

|

26 |

Enter the lesser of line 25 or 500,000 |

26 |

|

|

|

|

27 |

Credit for the first 500,000 gallons (multiply line 26 by .14; see instructions) |

27 |

|

|

||

Part 2 – Credit for gallons in excess of 500,000 (attach additional sheets if necessary)

A |

B |

Liquor production facility’s physical address |

Total gallons of liquor |

|

(from Form(s) |

|

see instructions) |

Total of column B amounts from additional sheets, if any |

|

|

|

|

|

|

|

28 |

...........................................................Add column B amounts |

28 |

|

|

|

|

|

29 |

Subtract 500,000 from line 28 |

29 |

|

|

|

|

|

30 |

Enter the lesser of line 29 or 300,000 (see instructions) |

30 |

|

|

|

|

|

31 |

Credit for gallons in excess of 500,000 (multiply line 30 by .045) |

|

|

|

|

|

|

|

|

31 |

|

|

|

||

32 |

....................................Total credit for liquor produced in New York State (add lines 27 and 31) |

32 |

|

|

|

||

New York S corporations: Include the amount from line 32 on the applicable line of Form

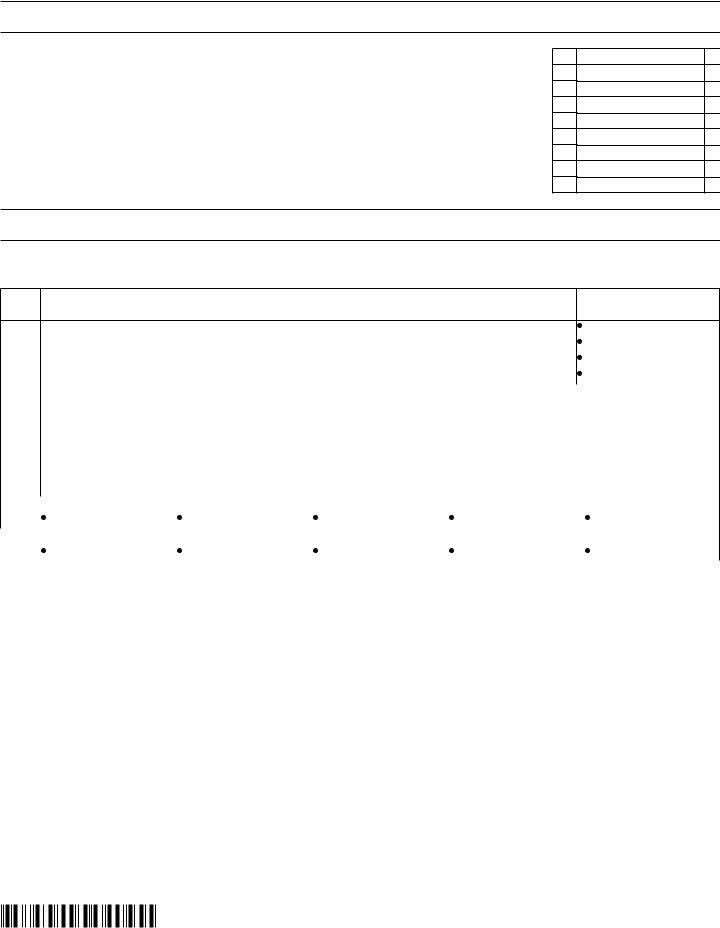

Schedule F – Total credit (New York S corporations do not complete this schedule) |

|

|

33 |

Alcoholic beverage production credit (add lines 8, 16, 24, and 32) |

33 |

34 |

Partner: Enter your share of credit from your partnership (from line 45, column G) |

34 |

35 |

Add lines 33 and 34 |

35 |

Continue with Schedule G. |

|

|

544005210094

Page 6 of 6

Schedule G – Computation of tax credit used, refunded, or credited as an overpayment to the next year

(see instructions; New York S corporations do not complete this schedule)

36Tax due before credits ........................................................................................................................

37Tax credits claimed before this credit ...............................................................................................

38Subtract line 37 from line 36 ...............................................................................................................

39Minimum tax ........................................................................................................................................

40Credit limitation (subtract line 39 from line 38; if zero or less, enter 0).......................................................

41Credit to be used this tax year...........................................................................................................

42Unused tax credit available as a refund or as an overpayment (subtract line 41 from line 35)

43Tax credit to be refunded (limited to the amount on line 42) ...................................................................

44Amount to be applied as an overpayment to next year’s tax (subtract line 43 from line 42) .................. ..............

36

37

38

39

40

41

42

43

44

Schedule H – Partnership information (attach additional sheets if necessary)

If you were a partner in a partnership and received a share of the credit from that partnership, complete the following information (list

the name of each partnership and the EIN here; for each partnership complete columns C through G on the corresponding lines below).

Item |

A |

B |

|

Name of partnership |

Partnership’s EIN |

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item |

|

C |

|

D |

|

E |

|

|

F |

|

G |

|||||

|

|

|

Share of credit |

|

Share of credit |

|

Share of credit |

|

|

Share of credit |

|

Total share of alcoholic |

||||

|

|

|

for beer production |

|

for cider production |

|

for wine production |

|

|

for liquor production |

beverage production credit |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(add columns C through F) |

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total from additional sheet(s) .... |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45 Totals of columns C through G and amounts from additional sheets (see instructions) |

|

|

|

|

|

|

|

|||||||||

|

45 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York S corporations: Include the amount from line 45, columns C through F on the applicable lines of Form

All others: Enter the amount from the line 45, column G on line 34.

544006210094