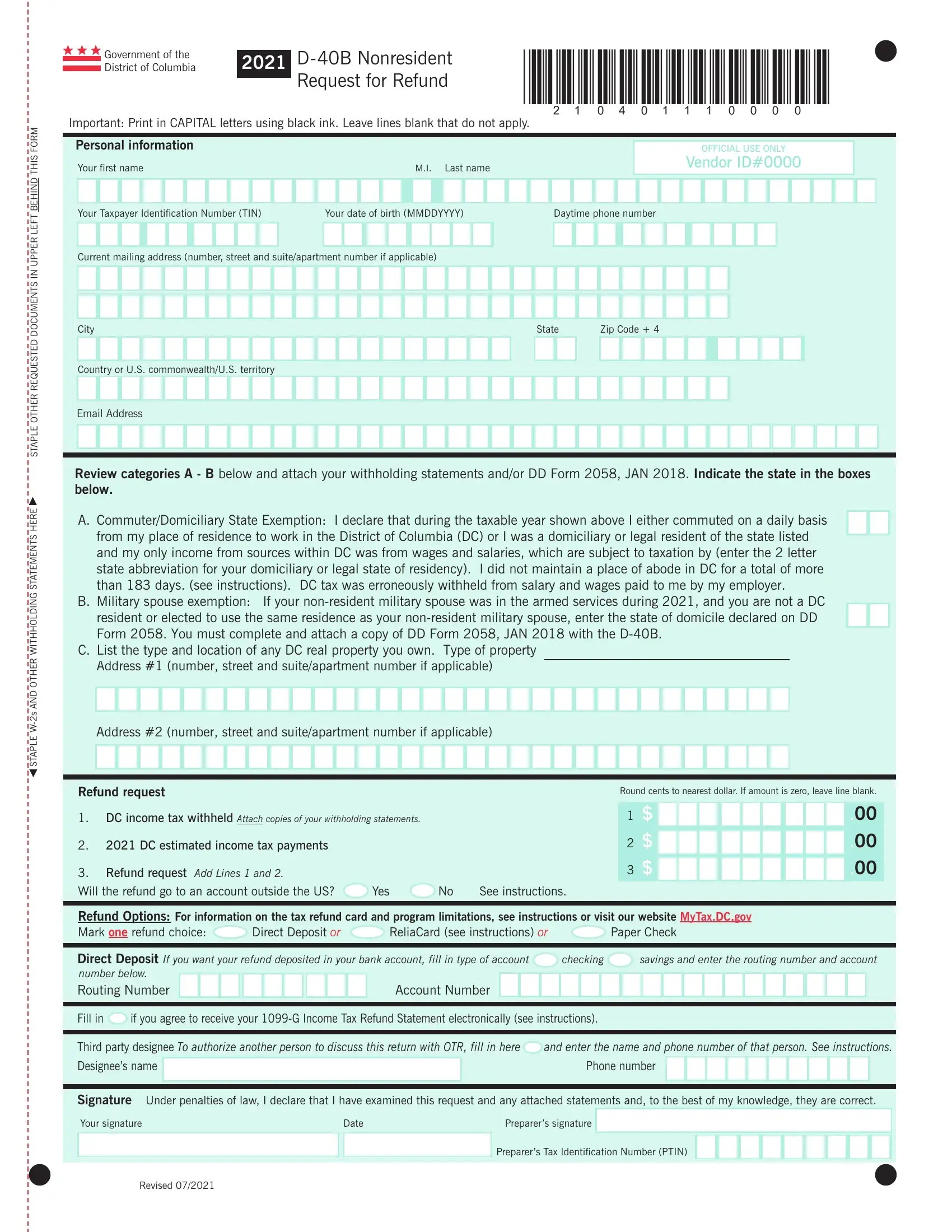

Using PDF forms online is actually surprisingly easy using our PDF editor. You can fill out taxable here painlessly. To make our editor better and more convenient to work with, we constantly work on new features, with our users' feedback in mind. To get the process started, take these basic steps:

Step 1: First of all, access the pdf editor by pressing the "Get Form Button" above on this webpage.

Step 2: As you open the editor, there'll be the form made ready to be filled in. In addition to filling in various fields, you can also do various other actions with the file, such as adding your own words, editing the initial text, inserting graphics, placing your signature to the form, and a lot more.

This PDF form needs some specific details; in order to ensure accuracy and reliability, you need to pay attention to the following recommendations:

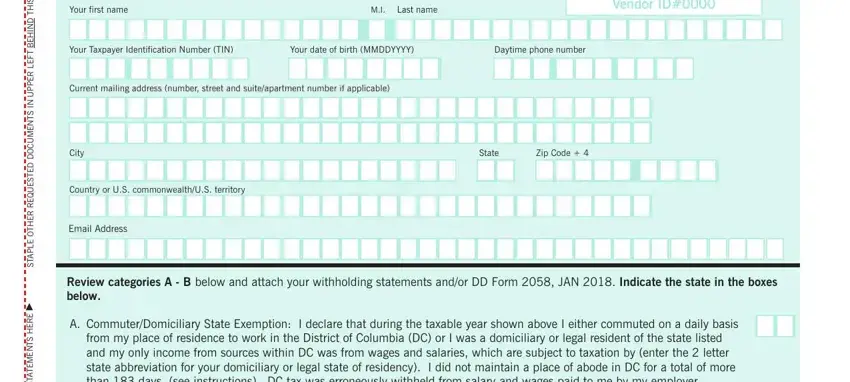

1. Before anything else, when completing the taxable, beging with the page that includes the subsequent blanks:

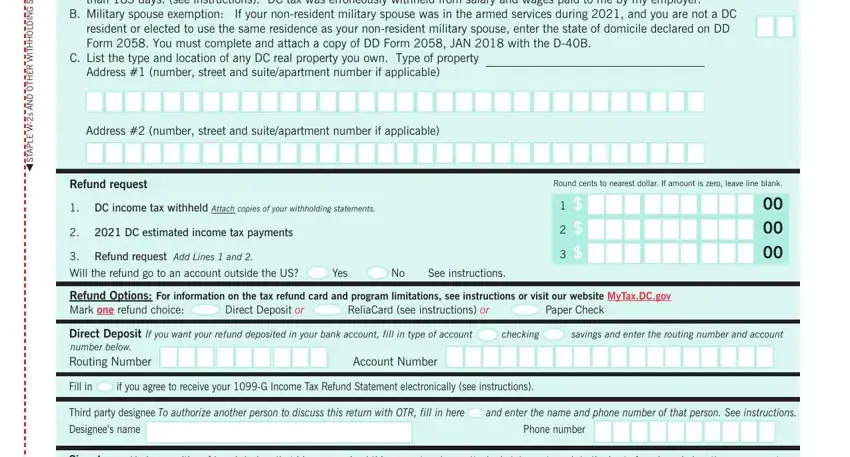

2. When the last part is finished, you need to include the needed details in E R E H S T N E M E T A T S G N D, from my place of residence to work, B Military spouse exemption If, C List the type and location of, Address number street and, Address number street and, Refund request, DC income tax withheld Attach, DC estimated income tax payments, Refund request Add Lines and, Will the refund go to an account, Yes, See instructions, Round cents to nearest dollar If, and Refund Options For information on so you can go further.

It is possible to get it wrong when filling out your Will the refund go to an account, hence make sure that you go through it again before you'll send it in.

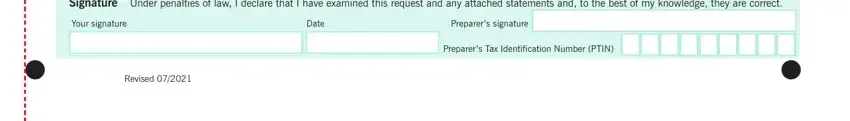

3. Through this part, examine Signature Under penalties of law I, Your signature, Date, Preparers signature, Revised, and Preparers Tax Identification. Each one of these are required to be completed with utmost precision.

Step 3: Prior to finalizing this form, ensure that all blanks are filled in properly. As soon as you establish that it is good, click on “Done." Get hold of the taxable once you register at FormsPal for a free trial. Immediately access the pdf file inside your personal account, together with any edits and adjustments being automatically synced! If you use FormsPal, you can certainly complete forms without the need to be concerned about personal data incidents or records being shared. Our secure software helps to ensure that your private data is maintained safely.