9 direct download can be filled out online in no time. Simply open FormsPal PDF tool to perform the job in a timely fashion. Our team is focused on providing you with the absolute best experience with our tool by consistently adding new features and upgrades. Our tool has become a lot more useful with the latest updates! Now, filling out PDF forms is a lot easier and faster than before. Starting is effortless! What you need to do is stick to these easy steps down below:

Step 1: First, access the pdf tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: With this advanced PDF editing tool, you'll be able to accomplish more than merely complete blanks. Express yourself and make your documents seem great with custom textual content added in, or tweak the file's original input to excellence - all that backed up by the capability to add any images and sign the file off.

Be mindful when filling out this pdf. Make sure that every blank is filled out properly.

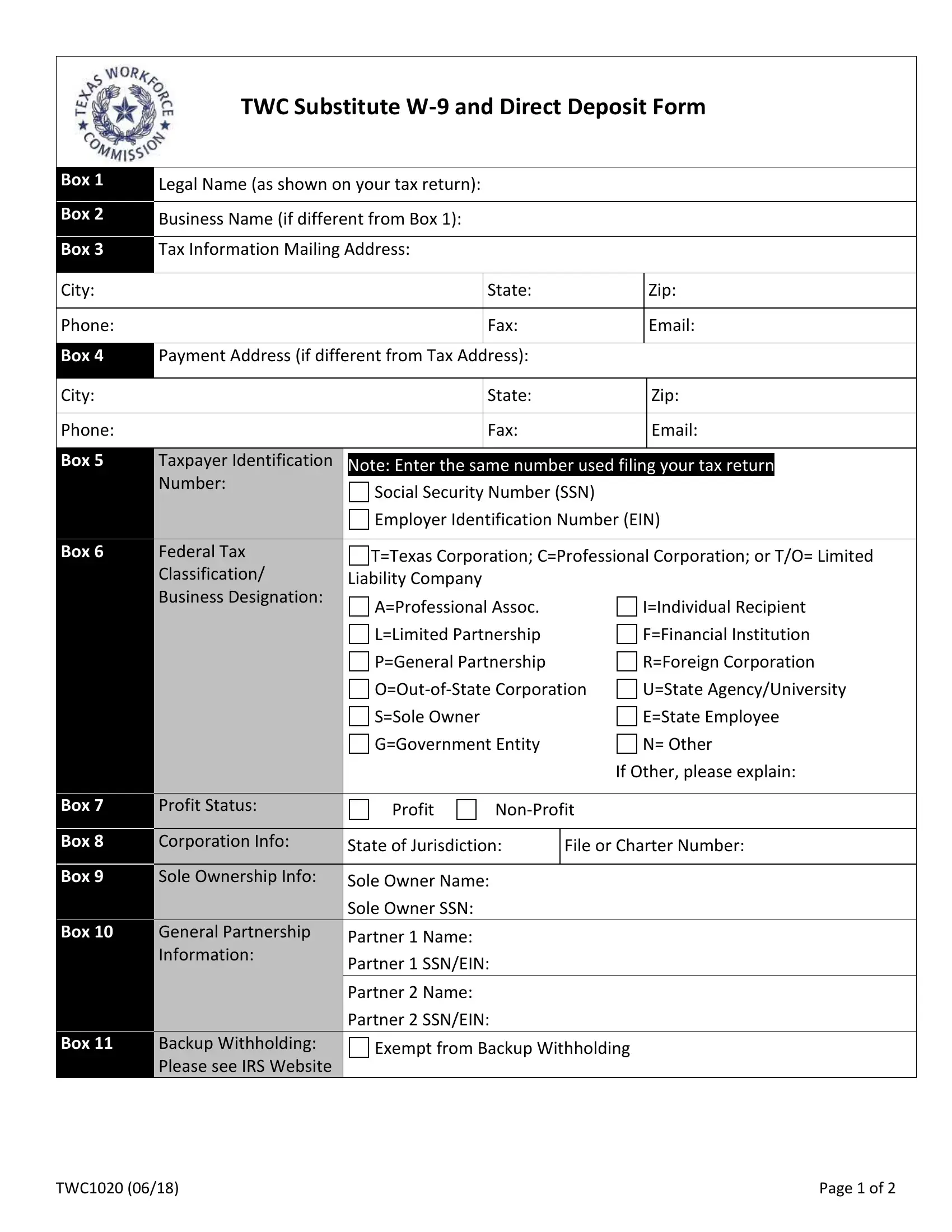

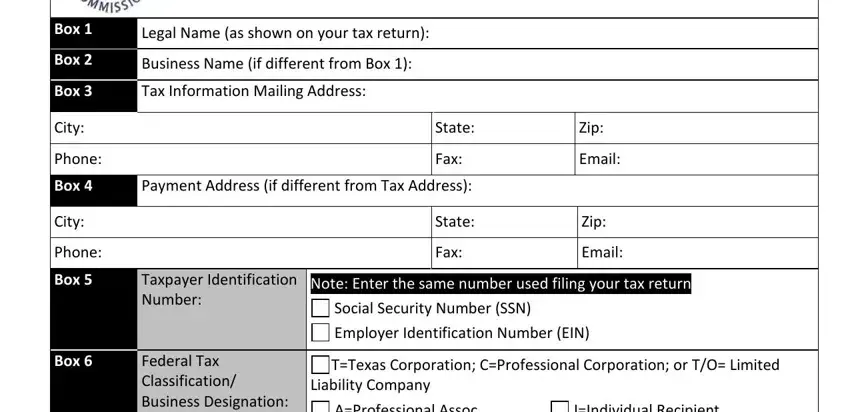

1. The 9 direct download involves particular details to be inserted. Ensure that the following blank fields are finalized:

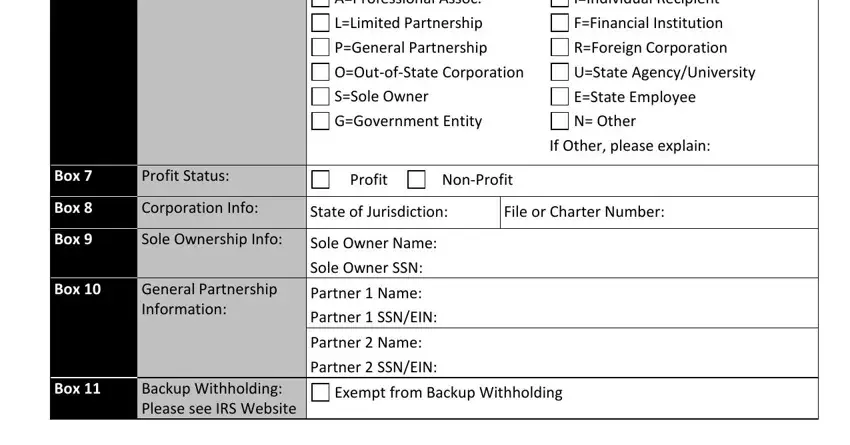

2. Once your current task is complete, take the next step – fill out all of these fields - AProfessional Assoc, IIndividual Recipient, LLimited Partnership, FFinancial Institution, PGeneral Partnership, RForeign Corporation, OOutofState Corporation, UState AgencyUniversity, SSole Owner, GGovernment Entity, EState Employee N Other, If Other please explain, Box Box Box, Box, and Box with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

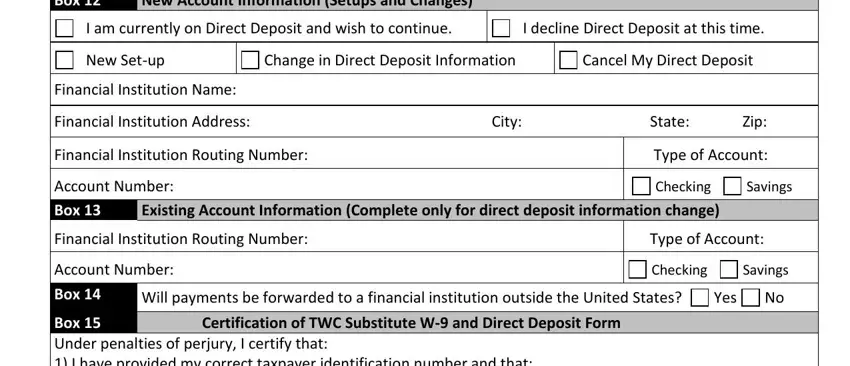

3. This third step should also be quite straightforward, Box, New Account Information Setups and, I am currently on Direct Deposit, I decline Direct Deposit a t this, New Setup, Change in Direct Deposit, Cancel My Direct Deposit, Financial Institution Name, Financial Institution Address, City, State, Zip, Financial Institution Routing, Type of Account, and Account Number Box Financial - all of these form fields will need to be filled in here.

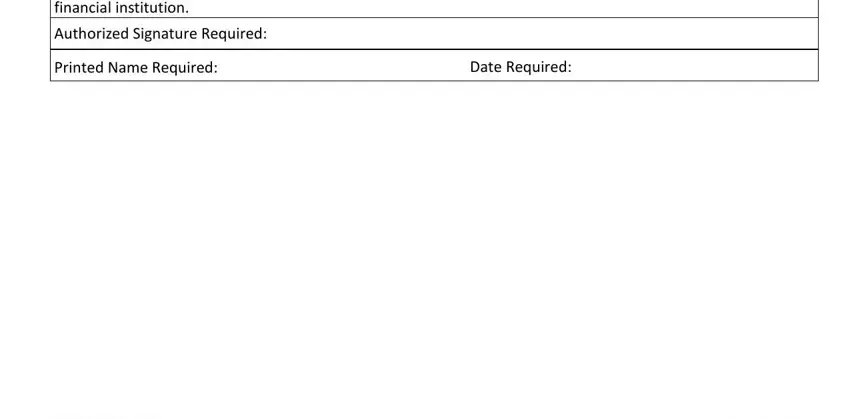

4. Your next subsection will require your input in the following areas: I further understand that the, Authorized Signature Required, Printed Name Required, and Date R e qui r ed. Make certain you give all needed details to move onward.

Always be very attentive when filling out Date R e qui r ed and Authorized Signature Required, since this is the section in which many people make a few mistakes.

Step 3: Once you have reread the information in the file's blank fields, press "Done" to conclude your form at FormsPal. Create a 7-day free trial option at FormsPal and acquire immediate access to 9 direct download - downloadable, emailable, and editable inside your FormsPal account. We do not share the details that you type in when filling out documents at FormsPal.