Handling PDF forms online is simple with this PDF tool. Anyone can fill out dfas form dd 2656 7 here in a matter of minutes. To have our editor on the leading edge of efficiency, we work to adopt user-oriented features and enhancements on a regular basis. We're at all times looking for suggestions - play a vital role in remolding how you work with PDF documents. Here is what you would want to do to begin:

Step 1: Access the form inside our editor by clicking the "Get Form Button" above on this webpage.

Step 2: As you open the file editor, you'll notice the document prepared to be filled out. Besides filling out various blanks, you may also perform some other things with the form, including putting on your own words, editing the original textual content, inserting images, signing the PDF, and more.

This form will involve specific information; in order to guarantee accuracy and reliability, you should take note of the recommendations just below:

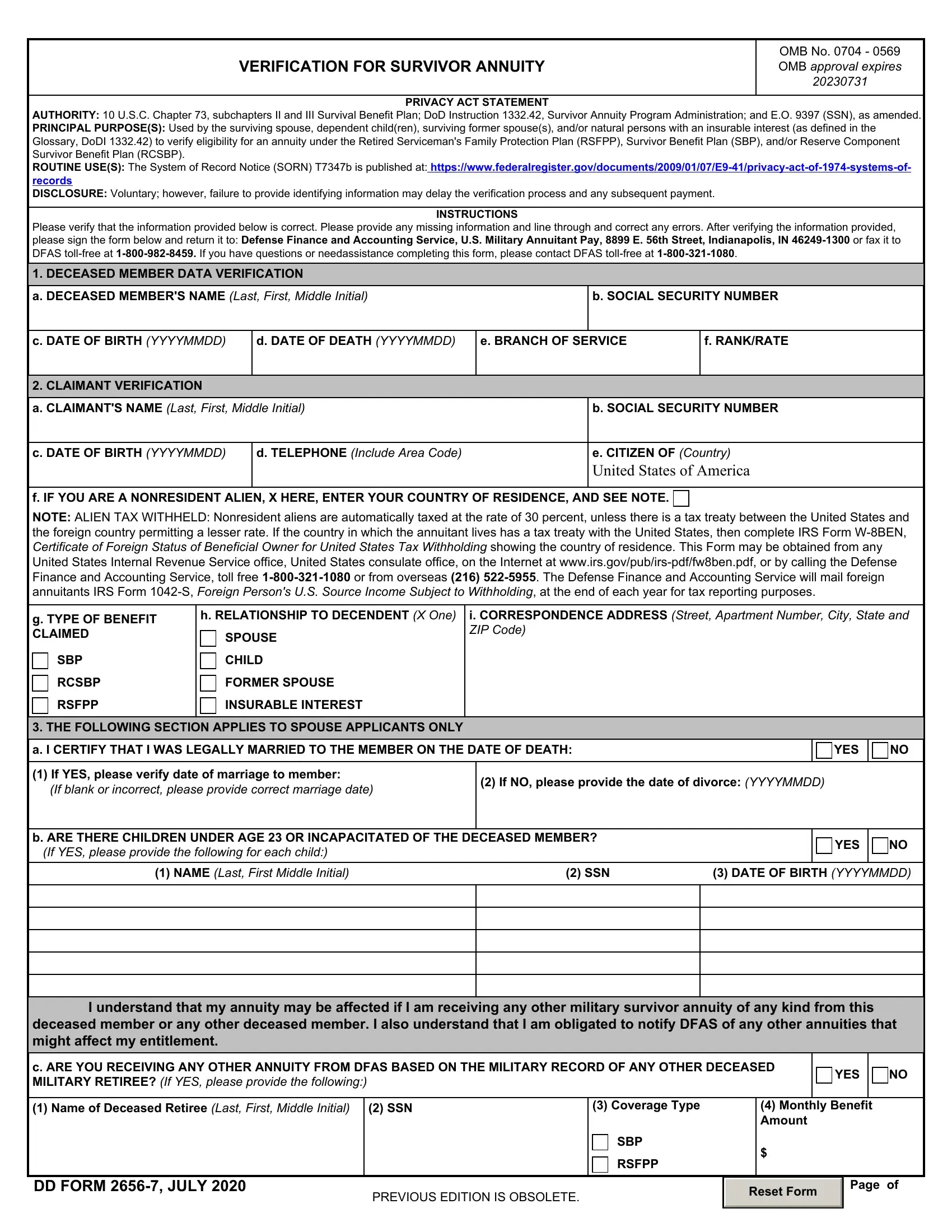

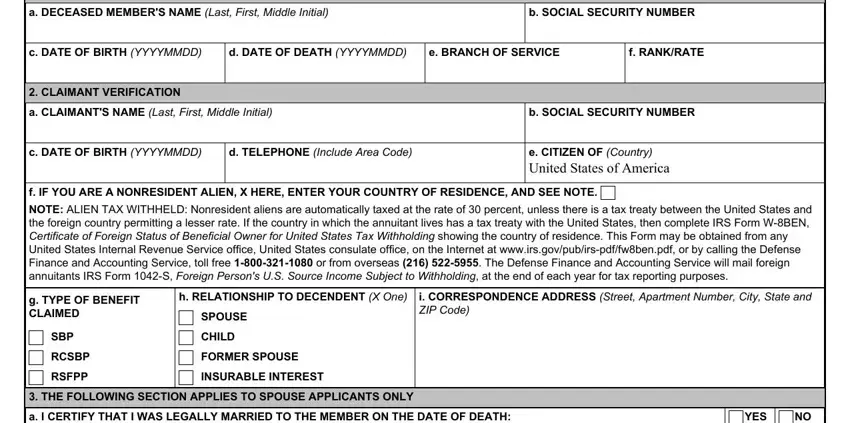

1. It's important to complete the dfas form dd 2656 7 properly, therefore be careful when filling out the segments comprising these blanks:

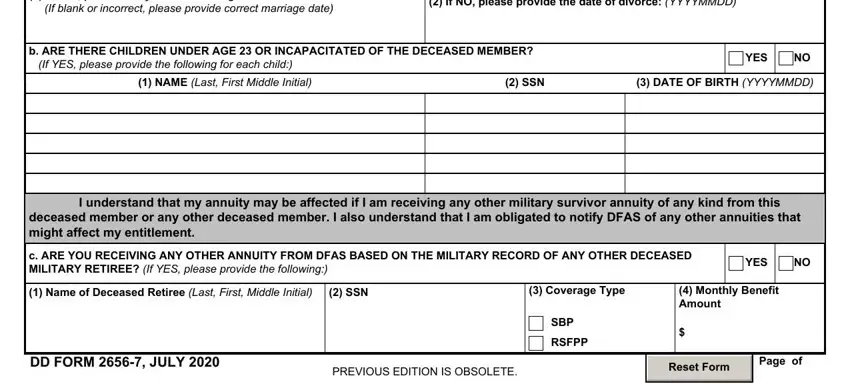

2. Once your current task is complete, take the next step – fill out all of these fields - If YES please verify date of, If NO please provide the date of, b ARE THERE CHILDREN UNDER AGE OR, YES, NAME Last First Middle Initial, SSN, DATE OF BIRTH YYYYMMDD, I understand that my annuity may, deceased member or any other, c ARE YOU RECEIVING ANY OTHER, YES, Name of Deceased Retiree Last, SSN, DD FORM JULY, and PREVIOUS EDITION IS OBSOLETE with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

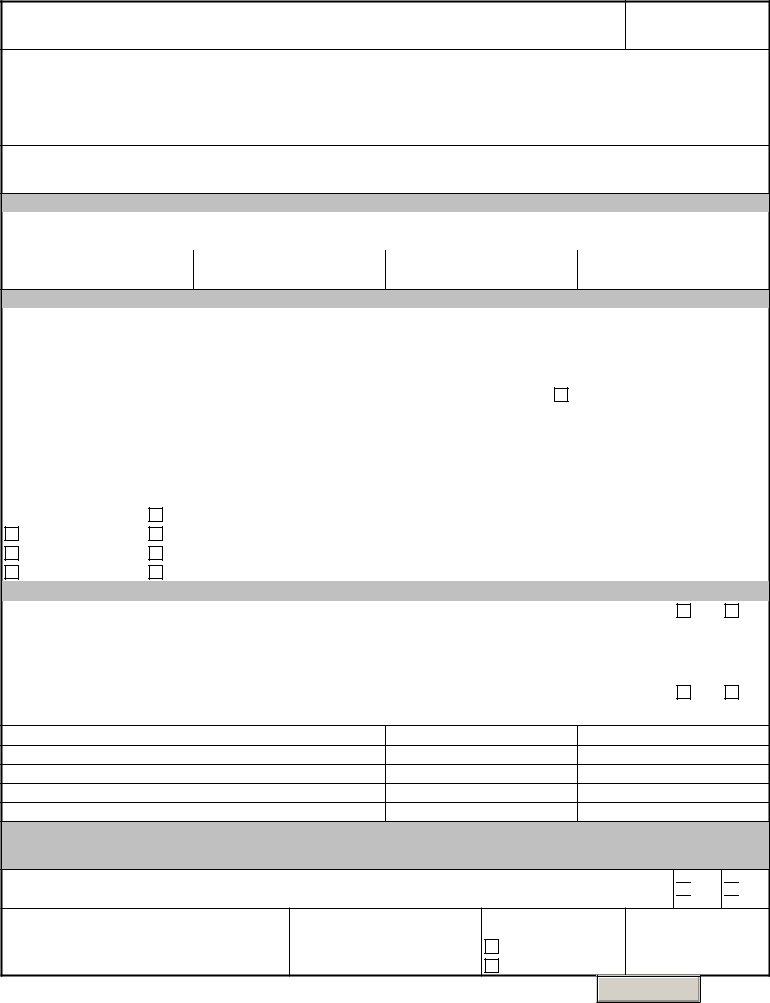

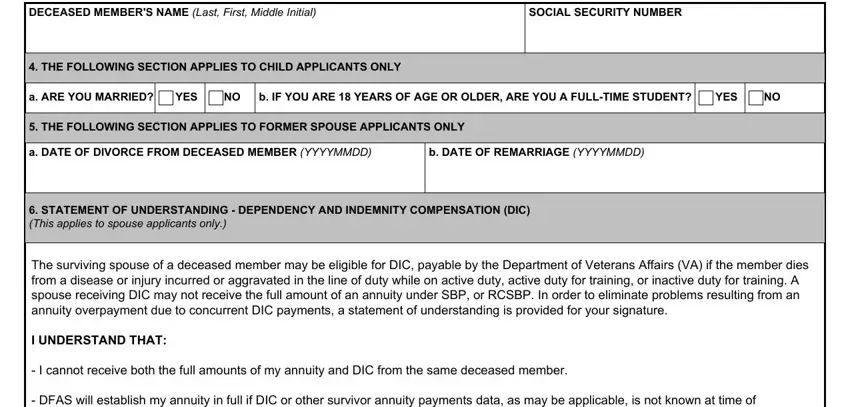

3. This third step is usually fairly simple, DECEASED MEMBERS NAME Last First, SOCIAL SECURITY NUMBER, THE FOLLOWING SECTION APPLIES TO, a ARE YOU MARRIED, YES, b IF YOU ARE YEARS OF AGE OR, YES, THE FOLLOWING SECTION APPLIES TO, a DATE OF DIVORCE FROM DECEASED, b DATE OF REMARRIAGE YYYYMMDD, STATEMENT OF UNDERSTANDING, and The surviving spouse of a deceased - these blanks has to be filled in here.

It is easy to make errors while filling out the SOCIAL SECURITY NUMBER, therefore make sure that you reread it before you decide to send it in.

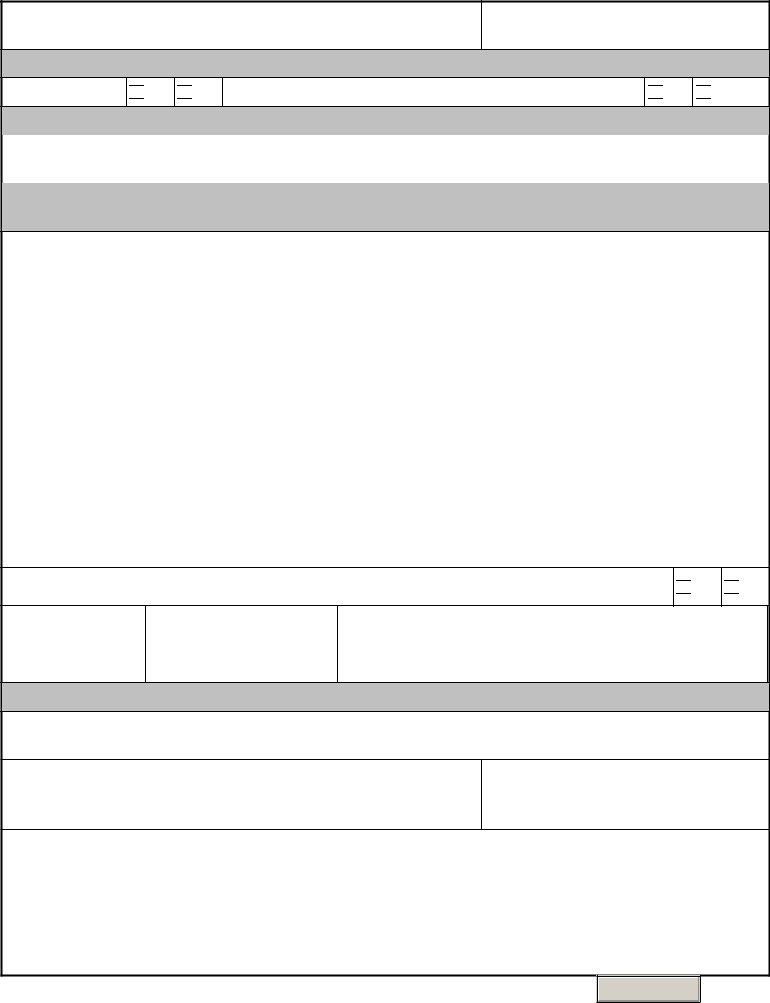

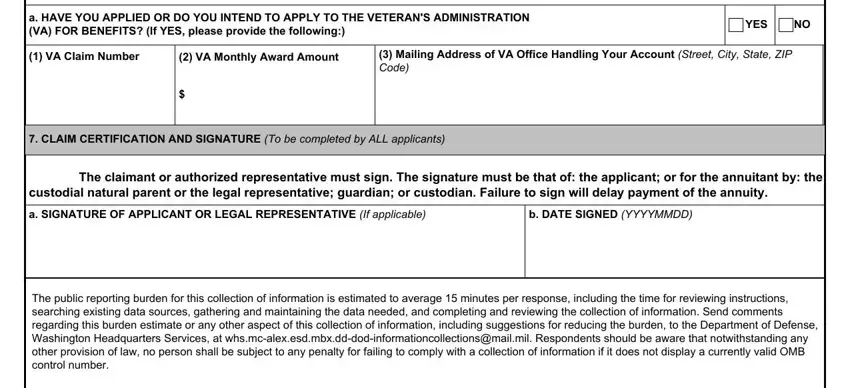

4. It is time to begin working on the next form section! Here you will get all these a HAVE YOU APPLIED OR DO YOU, YES, VA Claim Number, VA Monthly Award Amount, Mailing Address of VA Office, CLAIM CERTIFICATION AND SIGNATURE, custodial natural parent or the, The claimant or authorized, a SIGNATURE OF APPLICANT OR LEGAL, b DATE SIGNED YYYYMMDD, and The public reporting burden for blanks to do.

Step 3: Just after looking through your fields and details, press "Done" and you are done and dusted! Right after starting afree trial account with us, you will be able to download dfas form dd 2656 7 or send it through email without delay. The PDF file will also be at your disposal from your personal account with your every single modification. At FormsPal, we do everything we can to be sure that your details are maintained private.