Once you open the online editor for PDFs by FormsPal, you'll be able to complete or modify form 1870 right here and now. In order to make our tool better and less complicated to work with, we consistently work on new features, taking into consideration feedback from our users. Here is what you will need to do to begin:

Step 1: Open the form in our editor by hitting the "Get Form Button" in the top area of this page.

Step 2: This editor offers you the opportunity to modify your PDF document in many different ways. Enhance it by writing your own text, adjust existing content, and place in a signature - all readily available!

This PDF form requires some specific details; in order to ensure consistency, take the time to take into account the recommendations further on:

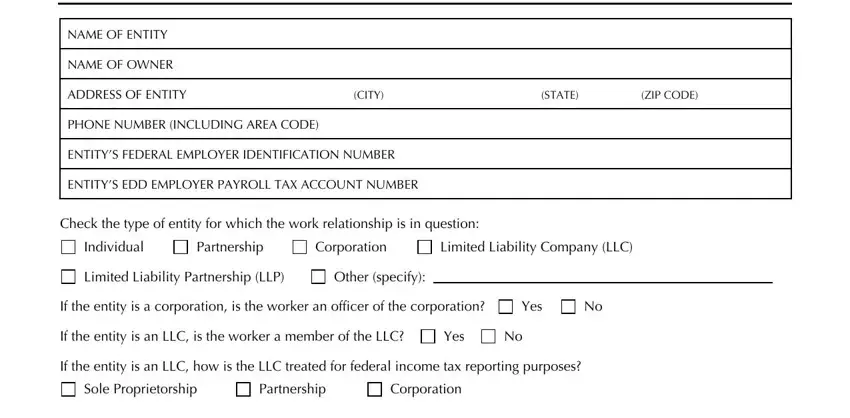

1. It's essential to complete the form 1870 properly, hence be careful while working with the sections including these blanks:

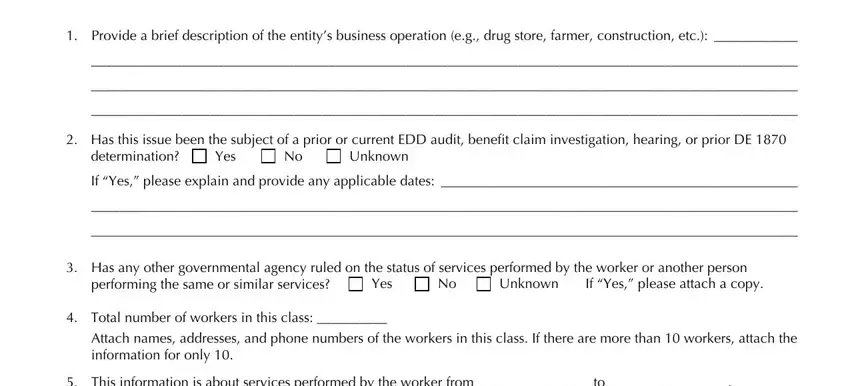

2. Right after the first section is done, go on to type in the applicable details in these: Provide a brief description of, Has this issue been the subject, determination, Yes, Unknown, If Yes please explain and provide, Has any other governmental agency, performing the same or similar, Yes, Unknown If Yes please attach a copy, Total number of workers in this, Attach names addresses and phone, and This information is about.

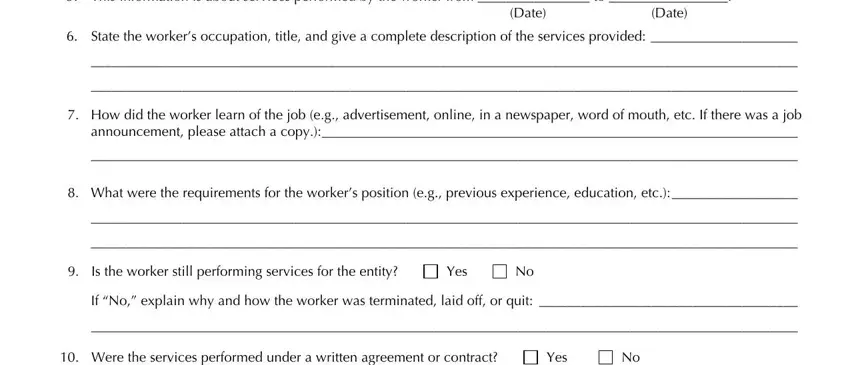

3. Completing This information is about, Date, Date, State the workers occupation, How did the worker learn of the, What were the requirements for, Is the worker still performing, Yes, Were the services performed under, and Yes is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

When it comes to How did the worker learn of the and This information is about, ensure you review things here. The two of these are the key fields in this document.

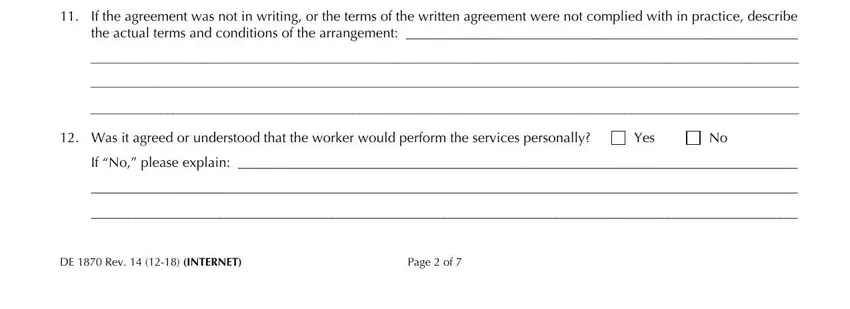

4. It's time to begin working on this fourth segment! Here you will get all of these If the agreement was not in, Was it agreed or understood that, If No please explain, Yes, DE Rev INTERNET, and Page of blanks to do.

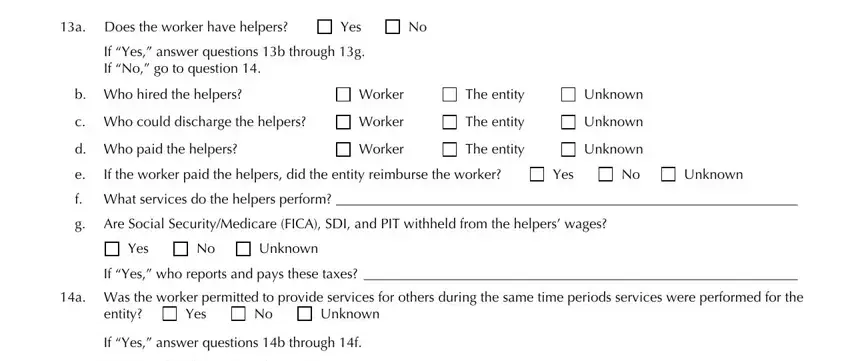

5. The final step to finalize this form is essential. You'll want to fill in the appropriate blanks, like f What services do the helpers, Unknown, Yes, Worker, If Yes answer questions b through, a Does the worker have helpers b, If the worker paid the helpers did, The entity, The entity, The entity, Unknown, Worker, Worker, Yes, and Yes, prior to finalizing. Failing to accomplish that may lead to an unfinished and potentially unacceptable document!

Step 3: Make certain your information is correct and then click "Done" to complete the task. Join us right now and easily obtain form 1870, all set for download. Each change you make is handily saved , making it possible to customize the form later on when required. FormsPal is dedicated to the personal privacy of our users; we always make sure that all personal information handled by our editor is kept protected.