Understanding the intricacies of the DE 2503F form is crucial for anyone looking to navigate the complexities of receiving benefits related to sickness or caregiving in the United States. This form serves as a critical tool in the process, allowing individuals to document and submit various types of wage samples they might have received. These can include paid sick leave, vacation pay, personal time off, holiday bonuses, commissions, and other forms of compensation. The DE 2503F is comprehensive and requires careful attention to detail, especially when responding to sections like Question 6, which asks for a clear representation of wages received in different categories. By correctly completing this form, individuals ensure they accurately report their earnings, which is essential for the evaluation of their benefit claims. This not only speeds up the process but also maximizes the chances of a favorable outcome, making an understanding of the DE 2503F form's requirements and nuances an invaluable asset.

| Question | Answer |

|---|---|

| Form Name | DE 2503F Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | de 2503 pdf, de 2503f, de 2503 rev 6 3 12, de2503 |

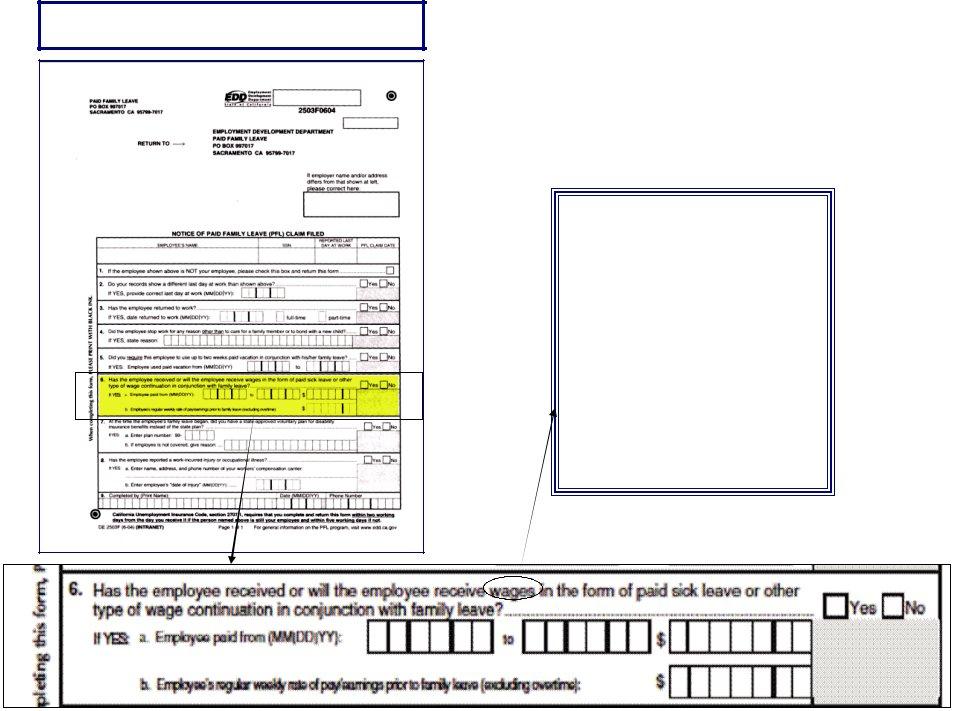

Sample DE 2503F, Question 6

NOTE FOR QUESTION 6: Samples of wages received can be in the following form:

Paid Sick Leave

Vacation

Personal time off

Holiday

Bonus

Commission

Other