Few things can be quicker than creating documents making use of this PDF editor. There isn't much you have to do to manage the wage adjustment file - simply follow these steps in the following order:

Step 1: The initial step will be to choose the orange "Get Form Now" button.

Step 2: After you get into the wage adjustment editing page, you will notice lots of the functions you may undertake about your document at the top menu.

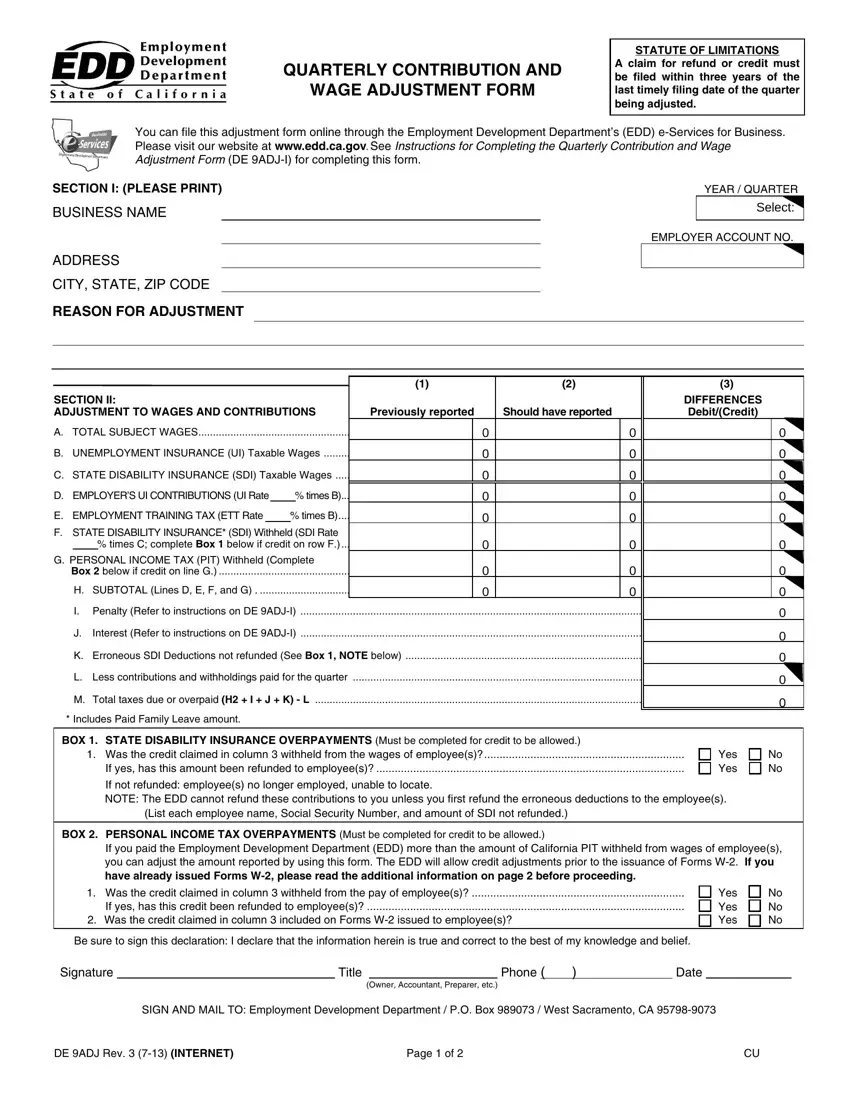

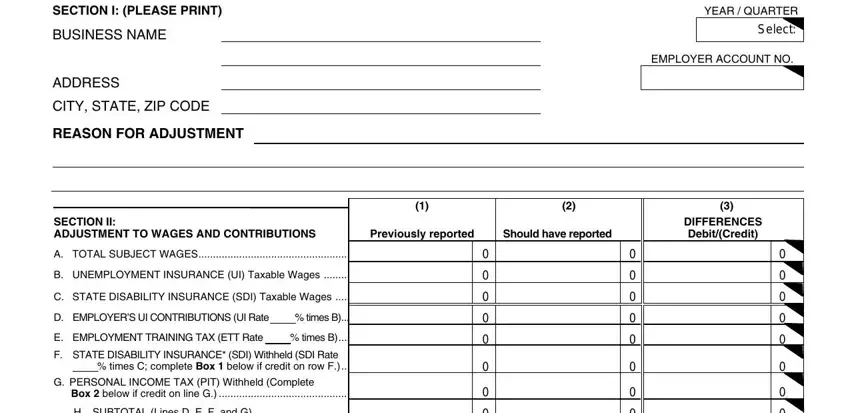

Feel free to provide the following information to fill out the wage adjustment PDF:

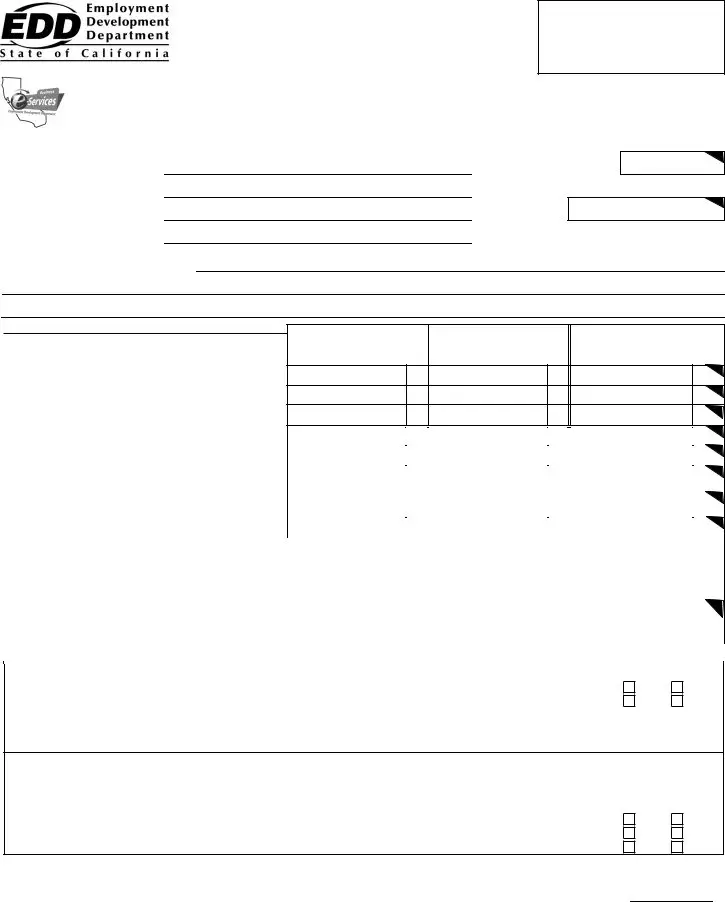

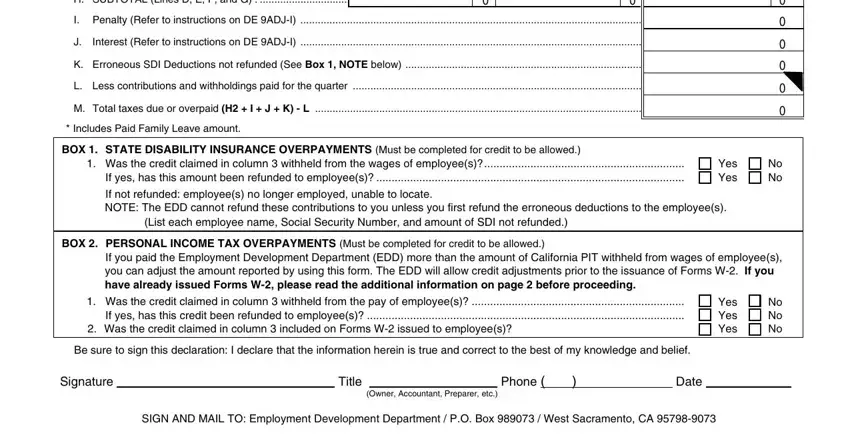

The program will expect you to fill in the H SUBTOTAL Lines D E F and G, I Penalty Refer to instructions on, Interest Refer to instructions on, K Erroneous SDI Deductions not, L Less contributions and, M Total taxes due or overpaid H I, Includes Paid Family Leave amount, BOX STATE DISABILITY INSURANCE, Was the credit claimed in column, Yes Yes, No No, If not refunded employees no, NOTE The EDD cannot refund these, List each employee name Social, and BOX PERSONAL INCOME TAX segment.

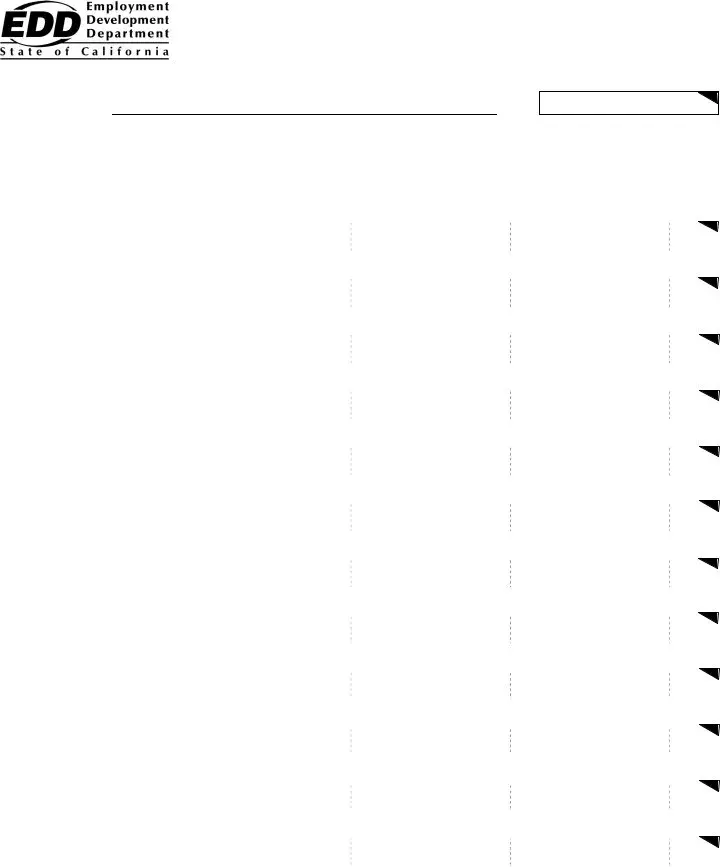

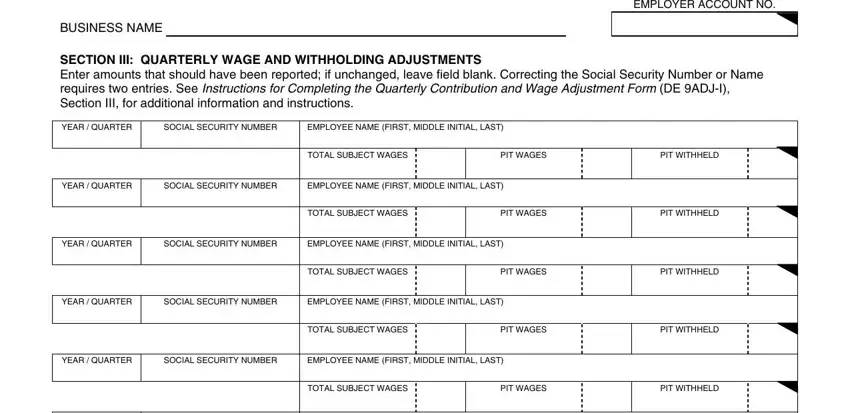

You should be required some crucial data to fill in the EMPLOYER ACCOUNT NO, BUSINESS NAME, SECTION III QUARTERLY WAGE AND, YEAR QUARTER, SOCIAL SECURITY NUMBER, EMPLOYEE NAME FIRST MIDDLE INITIAL, TOTAL SUBJECT WAGES, PIT WAGES, PIT WITHHELD, YEAR QUARTER, SOCIAL SECURITY NUMBER, EMPLOYEE NAME FIRST MIDDLE INITIAL, TOTAL SUBJECT WAGES, PIT WAGES, and PIT WITHHELD box.

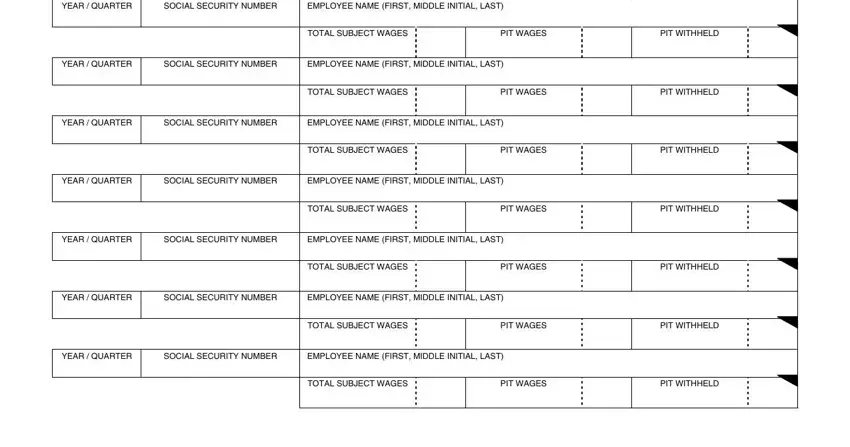

In part YEAR QUARTER, SOCIAL SECURITY NUMBER, EMPLOYEE NAME FIRST MIDDLE INITIAL, TOTAL SUBJECT WAGES, PIT WAGES, PIT WITHHELD, YEAR QUARTER, SOCIAL SECURITY NUMBER, EMPLOYEE NAME FIRST MIDDLE INITIAL, TOTAL SUBJECT WAGES, PIT WAGES, PIT WITHHELD, YEAR QUARTER, SOCIAL SECURITY NUMBER, and EMPLOYEE NAME FIRST MIDDLE INITIAL, indicate the rights and responsibilities.

Step 3: Press the Done button to confirm that your completed document can be exported to every device you prefer or delivered to an email you indicate.

Step 4: To stay away from probable forthcoming troubles, it is important to possess a minimum of a few copies of each separate form.