de1np form form can be filled in online without any problem. Just try FormsPal PDF editing tool to complete the job in a timely fashion. The editor is constantly improved by our team, receiving new awesome functions and becoming better. This is what you'll need to do to get started:

Step 1: First, open the pdf tool by clicking the "Get Form Button" above on this site.

Step 2: This editor enables you to work with your PDF in a range of ways. Change it by writing your own text, correct what is originally in the document, and put in a signature - all within a few mouse clicks!

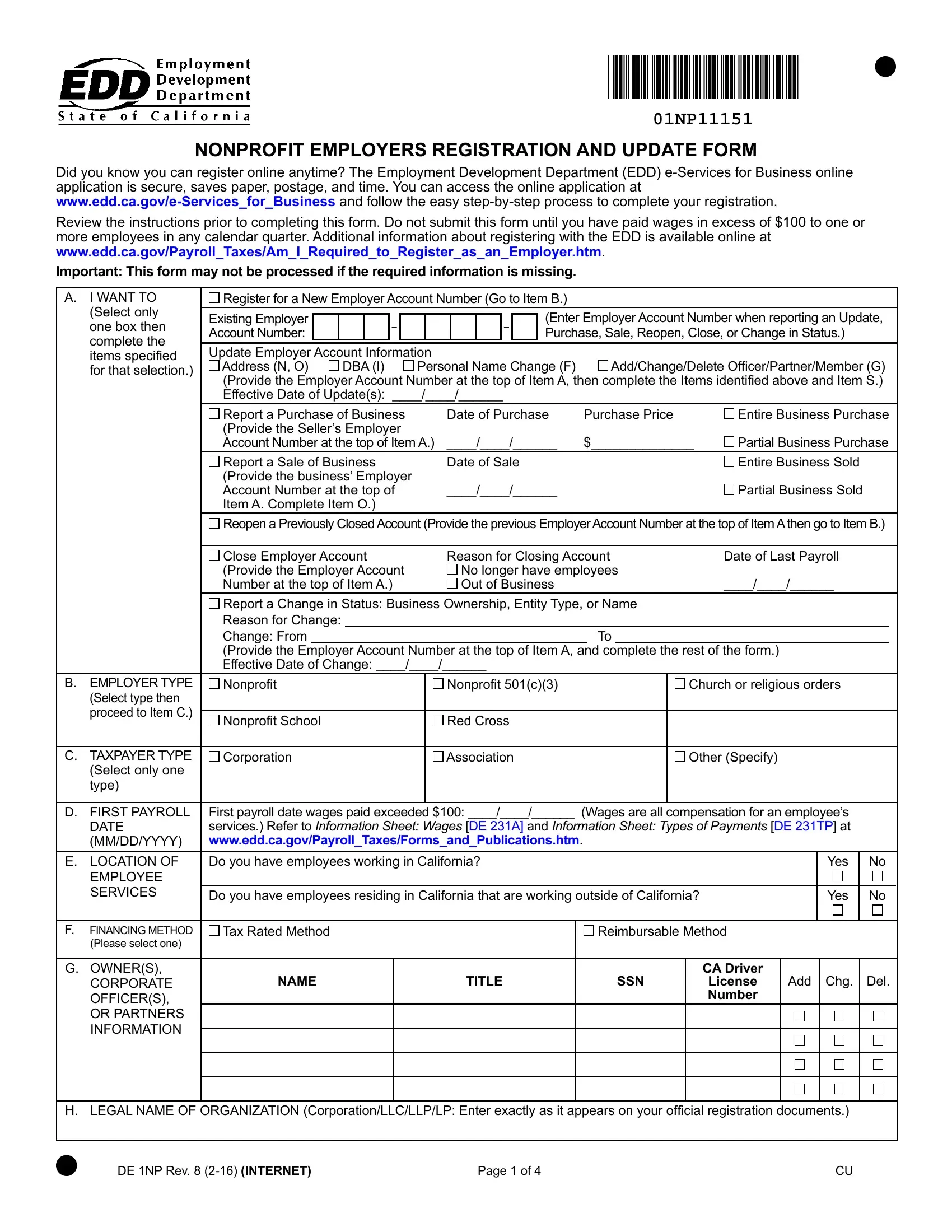

This document will need particular details to be filled in, therefore be sure you take whatever time to provide exactly what is required:

1. The de1np form form involves certain details to be inserted. Ensure the subsequent fields are filled out:

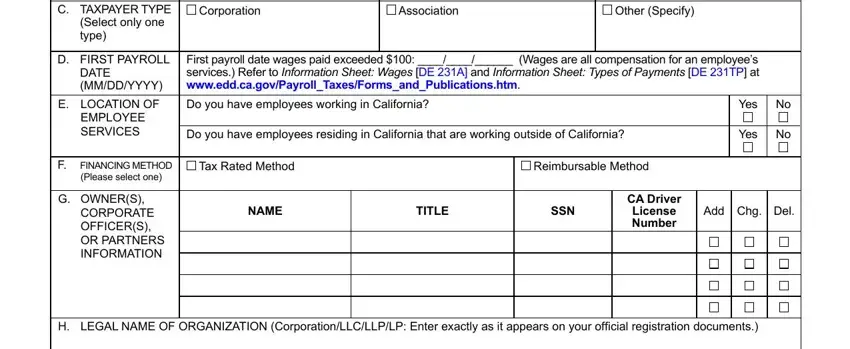

2. Soon after performing the last step, go to the next step and fill in the necessary details in these blanks - C TAXPAYER TYPE Select only one, D FIRST PAYROLL, DATE MMDDYYYY E LOCATION OF, EMPLOYEE SERVICES, Corporation, Association, Other Specify, First payroll date wages paid, Do you have employees working in, Do you have employees residing in, Yes, Yes, F FINANCING METHOD, Please select one, and Tax Rated Method.

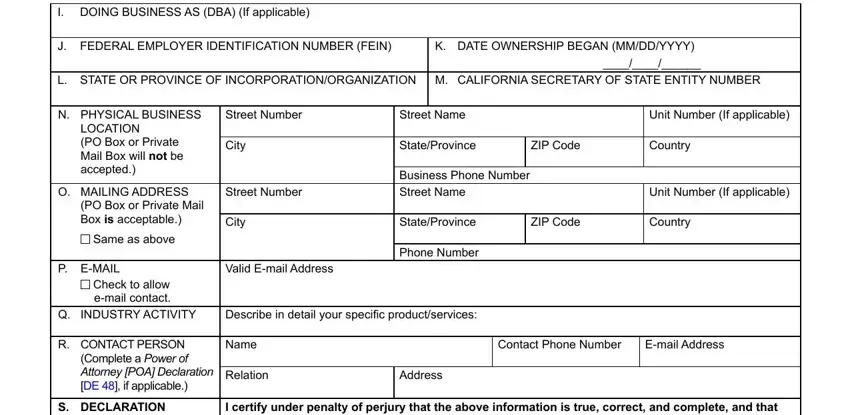

3. In this specific part, take a look at I DOING BUSINESS AS DBA If, J FEDERAL EMPLOYER IDENTIFICATION, K DATE OWNERSHIP BEGAN MMDDYYYY, L STATE OR PROVINCE OF, N PHYSICAL BUSINESS, Street Number, Street Name, Unit Number If applicable, City, StateProvince, ZIP Code, Country, LOCATION PO Box or Private Mail, O MAILING ADDRESS, and PO Box or Private Mail Box is. Every one of these will have to be completed with utmost awareness of detail.

Regarding Unit Number If applicable and StateProvince, make certain you get them right in this current part. The two of these are the most important ones in this PDF.

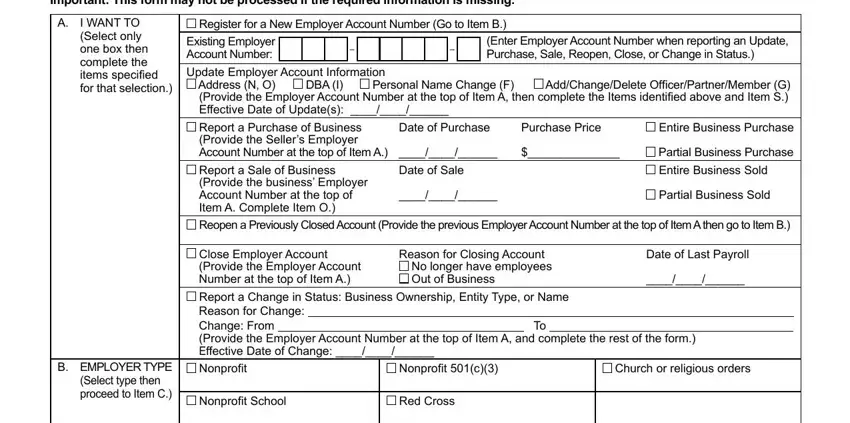

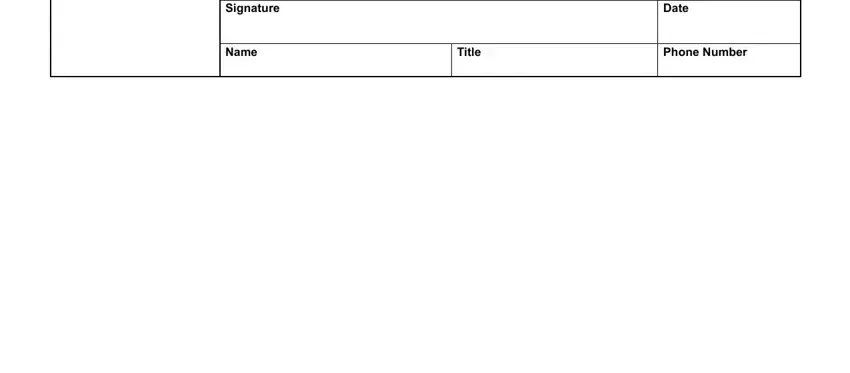

4. This specific subsection comes next with these particular blanks to complete: I certify under penalty of perjury, Date, Name, Title, and Phone Number.

Step 3: Prior to submitting the file, you should make sure that all blanks have been filled in properly. The moment you think it is all good, press “Done." Try a free trial subscription at FormsPal and gain direct access to de1np form form - downloadable, emailable, and editable inside your FormsPal cabinet. FormsPal provides protected form editing with no personal data record-keeping or any kind of sharing. Be assured that your information is in good hands with us!