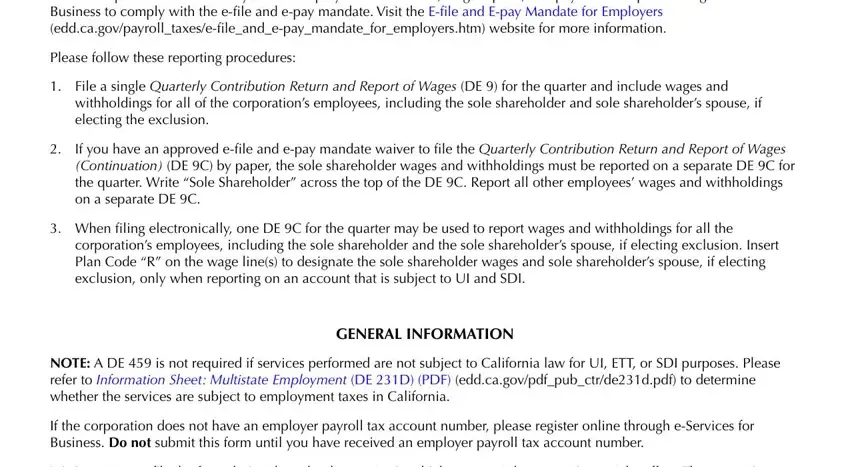

REPORTING INSTRUCTIONS

You are required to electronically submit employment tax returns, wage reports, and payroll tax deposits using e-Services for Business to comply with the e-file and e-pay mandate. Visit the E-file and E-pay Mandate for Employers (edd.ca.gov/payroll_taxes/e-file_and_e-pay_mandate_for_employers.htm) website for more information.

Please follow these reporting procedures:

1.File a single Quarterly Contribution Return and Report of Wages (DE 9) for the quarter and include wages and withholdings for all of the corporation’s employees, including the sole shareholder and sole shareholder’s spouse, if electing the exclusion.

2.If you have an approved e-file and e-pay mandate waiver to file the Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) by paper, the sole shareholder wages and withholdings must be reported on a separate DE 9C for the quarter. Write “Sole Shareholder” across the top of the DE 9C. Report all other employees’ wages and withholdings on a separate DE 9C.

3.When filing electronically, one DE 9C for the quarter may be used to report wages and withholdings for all the corporation’s employees, including the sole shareholder and the sole shareholder’s spouse, if electing exclusion. Insert Plan Code “R” on the wage line(s) to designate the sole shareholder wages and sole shareholder’s spouse, if electing exclusion, only when reporting on an account that is subject to UI and SDI.

GENERAL INFORMATION

NOTE: A DE 459 is not required if services performed are not subject to California law for UI, ETT, or SDI purposes. Please

refer to Information Sheet: Multistate Employment (DE 231D) (PDF) (edd.ca.gov/pdf_pub_ctr/de231d.pdf) to determine whether the services are subject to employment taxes in California.

If the corporation does not have an employer payroll tax account number, please register online through e-Services for Business. Do not submit this form until you have received an employer payroll tax account number.

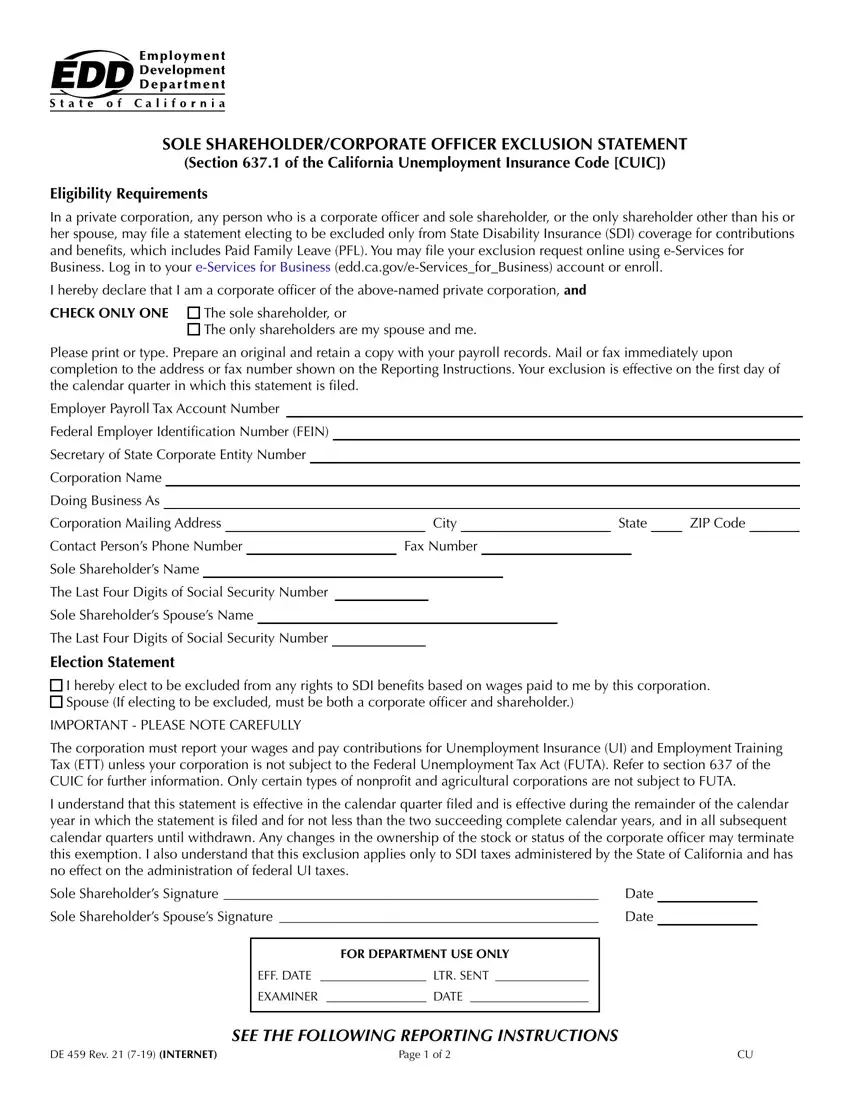

It is important to file the form during the calendar quarter in which you want the exemption to take effect. The exemption becomes effective the first day of the calendar quarter in which it is filed. A delay in filing this form may cause your exemption to take effect in the next calendar quarter. Do not file this form as an attachment to your DE 9, DE 9C, or any other Employment Development Department (EDD) form.

The EDD reserves the right to request additional information pertaining to this form.

The exemption may be terminated at any time by a change in stock ownership or status of the corporate officer as described in section 637.1 of the CUIC.

The exemption may be voluntarily terminated after two succeeding complete calendar years have passed. The corporate officer/sole shareholder must submit a written request to the EDD for termination.

If you have any questions concerning the exemption or reporting requirements, please contact the EDD at the address below.

Attention: Specialized Coverage Desk

Employment Development Department

Taxpayer Assistance Center

PO Box 2068

Rancho Cordova, CA 95741-2068

Phone: 1-888-745-3886

Fax: 1-916-319-1179

The EDD is an equal opportunity employer/program. Auxiliary aids and services are available upon request to individuals with disabilities. Requests for services, aids, and/or alternate formats need to be made by calling 1-888-745-3886 (voice) or TTY 1-800-547-9565.