Working with PDF forms online is easy with our PDF editor. You can fill out delaware form 1902b information return here painlessly. The editor is continually improved by our staff, getting awesome functions and becoming better. For anyone who is seeking to get going, here is what it's going to take:

Step 1: Access the PDF form inside our tool by clicking the "Get Form Button" in the top part of this page.

Step 2: Using our handy PDF file editor, you can accomplish more than merely fill out blank fields. Try each of the features and make your documents seem faultless with customized textual content incorporated, or fine-tune the original input to perfection - all that accompanied by the capability to incorporate almost any images and sign the PDF off.

Completing this PDF calls for focus on details. Ensure all required areas are done correctly.

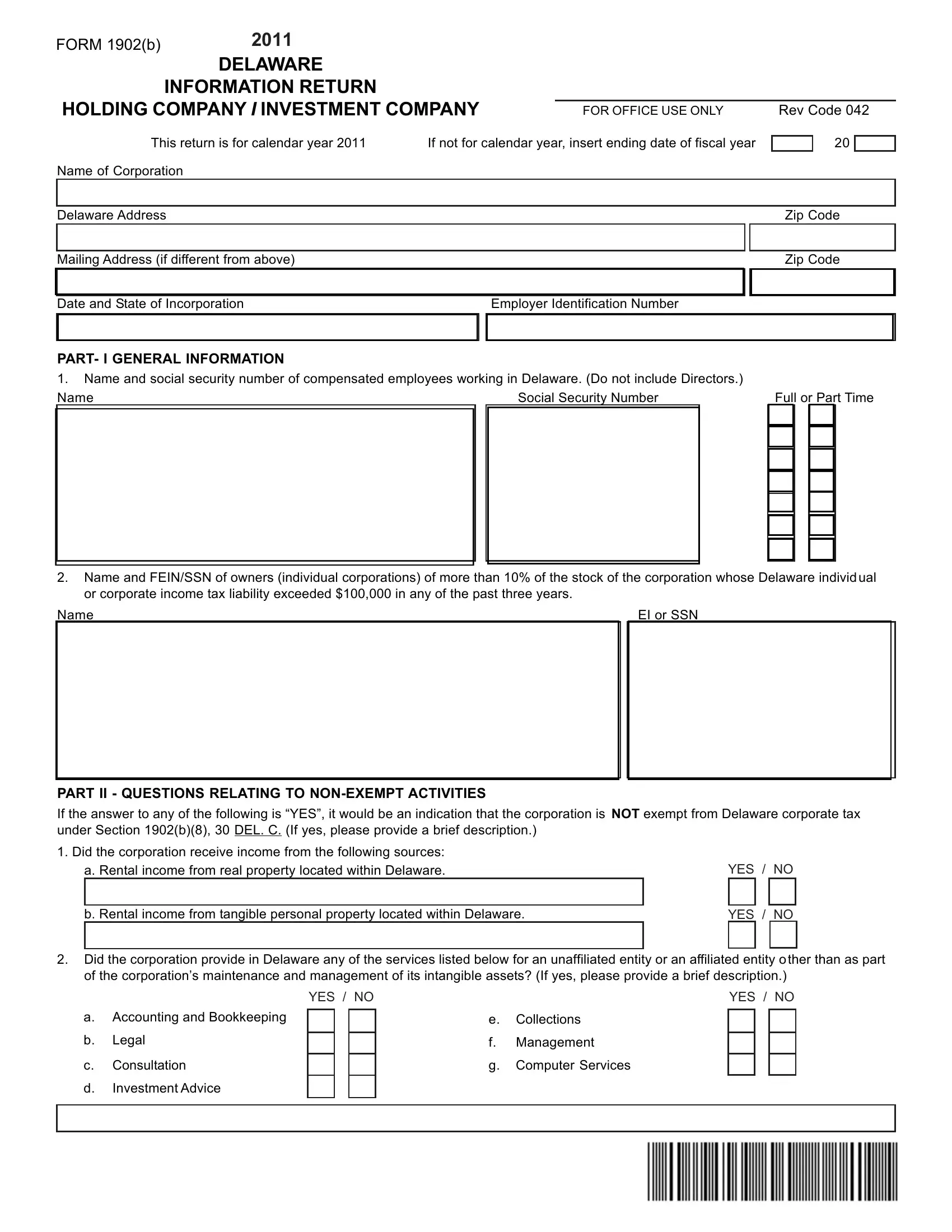

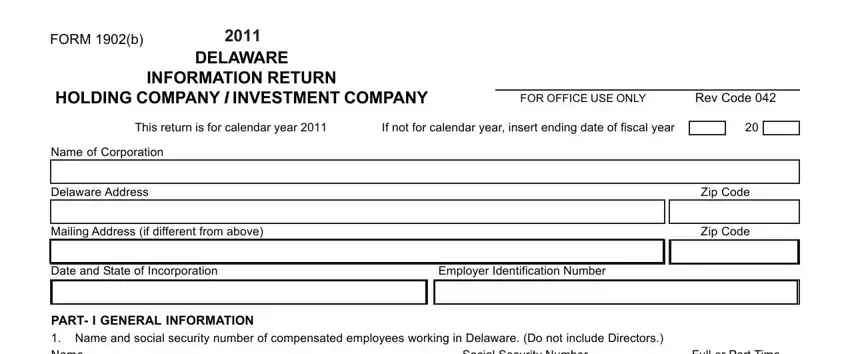

1. To start with, when filling out the delaware form 1902b information return, start out with the section that has the subsequent fields:

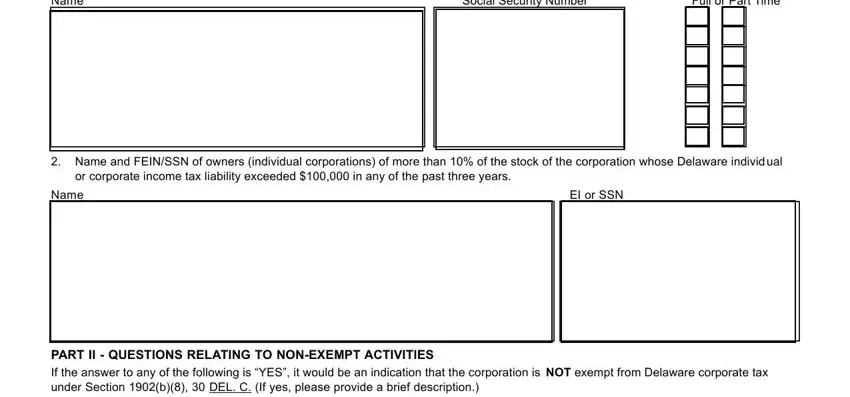

2. Now that the last section is finished, you're ready put in the necessary details in Name and social security number, Social Security Number, Full or Part Time, Name and FEINSSN of owners, or corporate income tax liability, Name, EI or SSN, PART II QUESTIONS RELATING TO, and If the answer to any of the so you're able to move forward further.

Be really careful when filling in Full or Part Time and Name and social security number, as this is the part in which many people make mistakes.

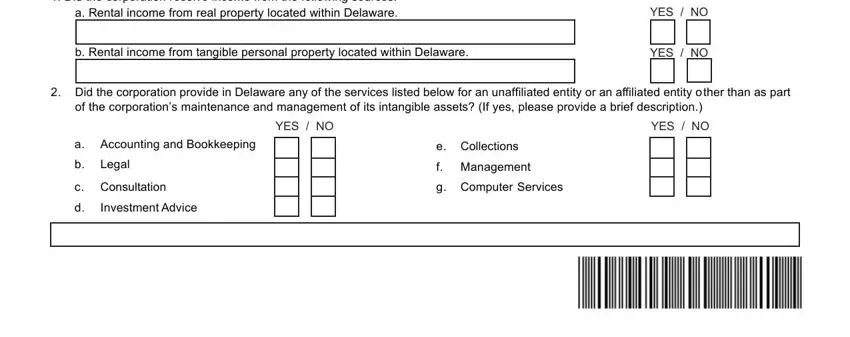

3. This 3rd segment is generally rather simple, Did the corporation receive, b Rental income from tangible, YES NO, YES NO, Did the corporation provide in, of the corporations maintenance, YES NO, YES NO, a Accounting and Bookkeeping, Legal, c Consultation, Investment Advice, e Collections, f Management, and g Computer Services - all these blanks must be completed here.

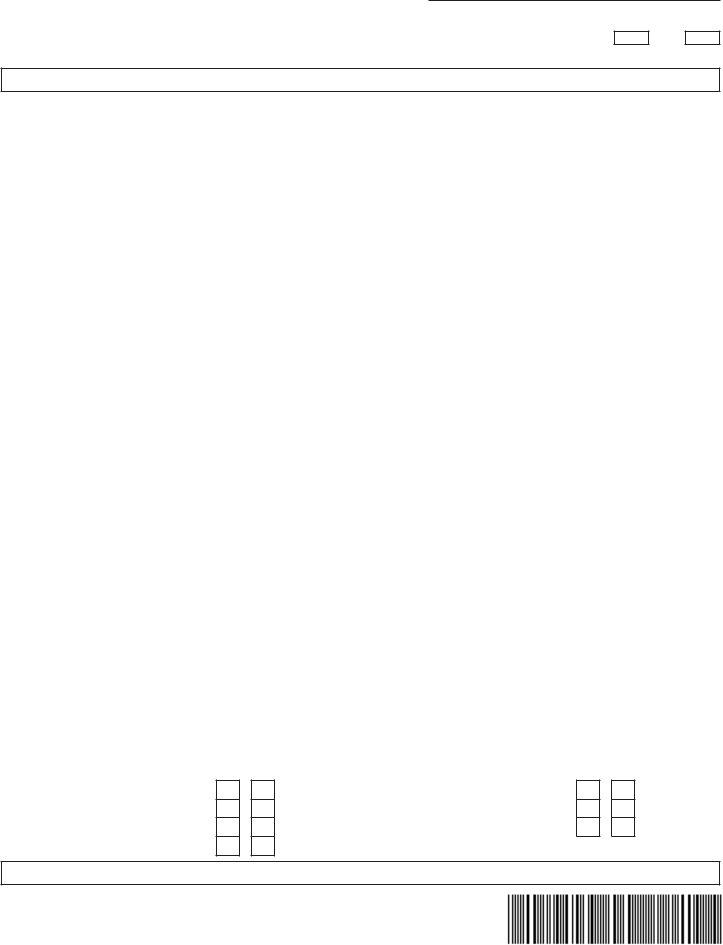

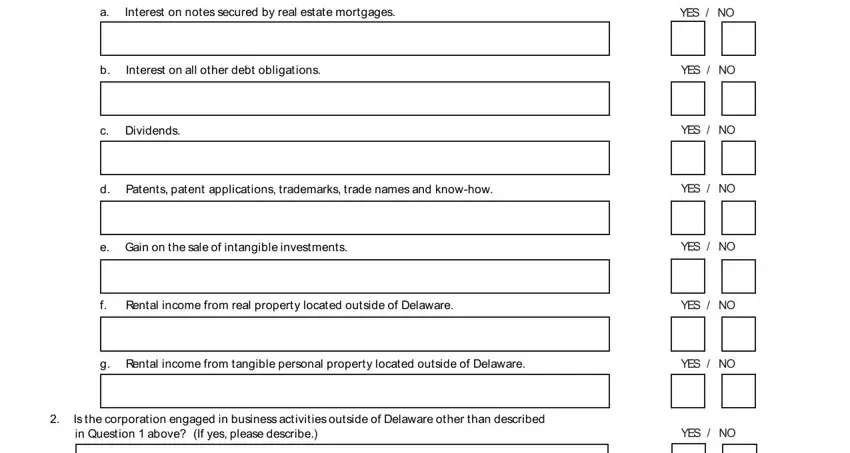

4. Completing Interest on notes secured by real, Interest on all other debt, c Dividends, YES NO, YES NO, YES NO, d Patents patent applications, YES NO, e Gain on the sale of intangible, Rental income from real property, YES NO, YES NO, g Rental income from tangible, YES NO, and Is the corporation engaged in is crucial in this next step - always don't rush and fill in every empty field!

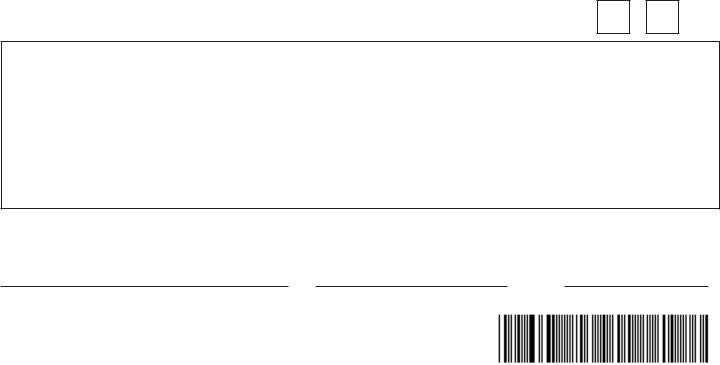

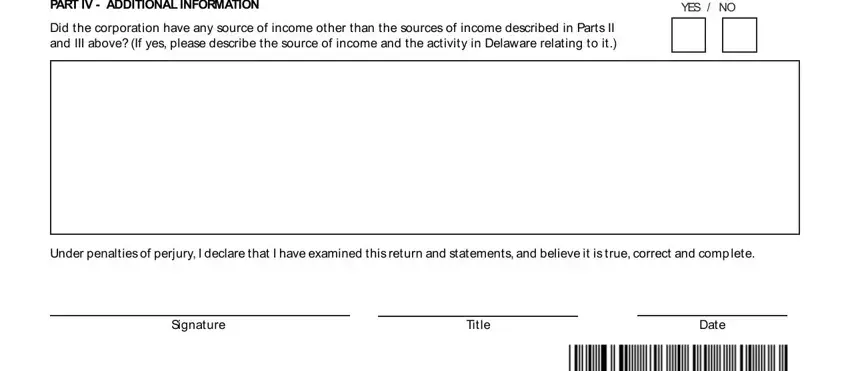

5. This document must be finalized by going through this part. Here there is a detailed list of blank fields that require appropriate details in order for your document submission to be faultless: PART IV ADDITIONAL INFORMATION, Did the corporation have any, YES NO, Under penalties of perjury I, Signature, Title, and Date.

Step 3: Just after double-checking your form fields, press "Done" and you're good to go! Download the delaware form 1902b information return once you register online for a 7-day free trial. Immediately gain access to the document in your FormsPal cabinet, along with any modifications and changes being automatically synced! We don't sell or share any details that you type in whenever dealing with forms at our website.