purchasers can be filled in without any problem. Just make use of FormsPal PDF editor to do the job right away. To keep our tool on the forefront of efficiency, we aim to put into action user-oriented features and improvements on a regular basis. We are at all times glad to get suggestions - assist us with reshaping PDF editing. To get the ball rolling, consider these easy steps:

Step 1: Simply click on the "Get Form Button" in the top section of this site to launch our pdf form editing tool. This way, you'll find everything that is needed to fill out your document.

Step 2: With our handy PDF editor, it's possible to do more than merely complete forms. Edit away and make your docs seem high-quality with customized text incorporated, or tweak the original input to excellence - all that comes with an ability to incorporate just about any pictures and sign the file off.

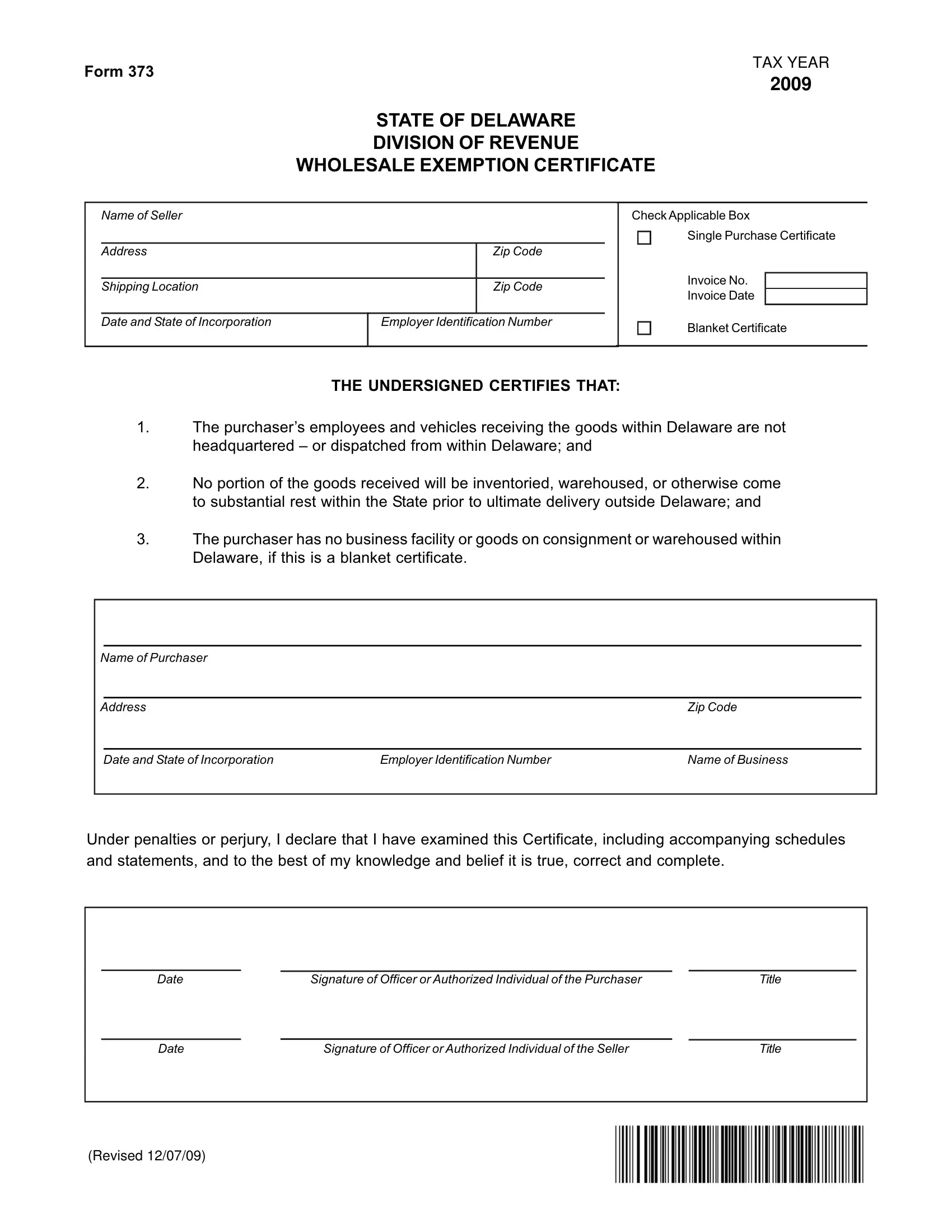

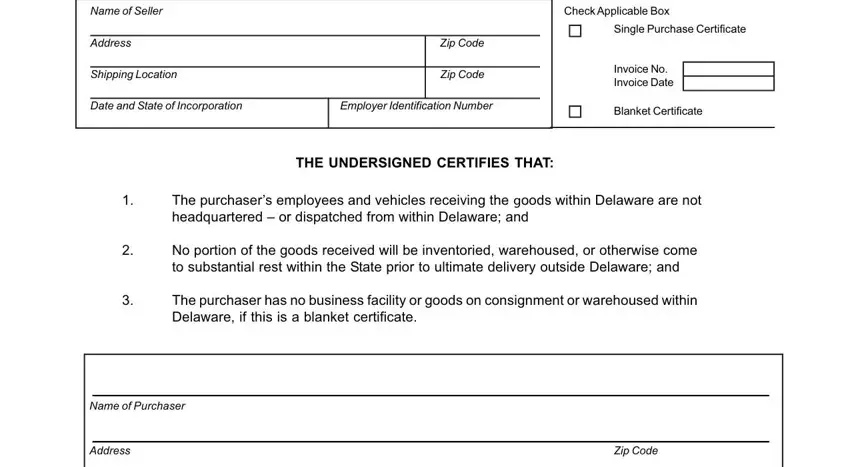

This form will need particular data to be entered, so you should take the time to provide precisely what is expected:

1. When filling out the purchasers, be sure to complete all necessary blanks in their corresponding part. This will help to speed up the process, enabling your details to be processed promptly and properly.

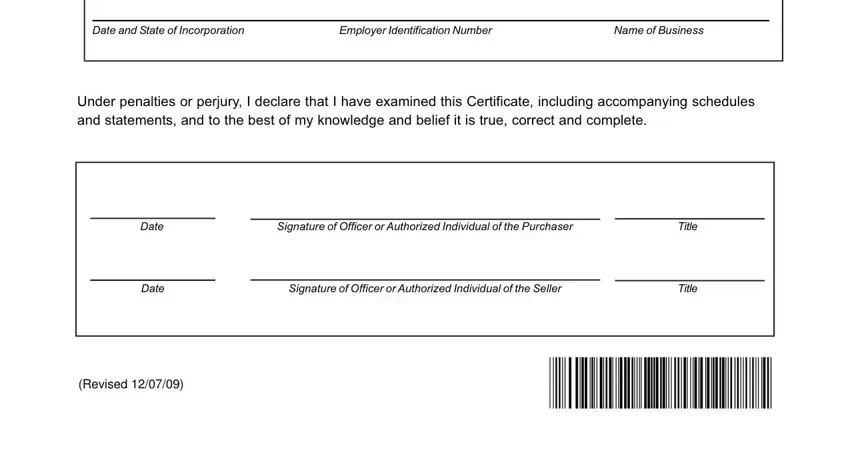

2. The third step is to complete all of the following blank fields: Date and State of Incorporation, Employer Identification Number, Name of Business, Under penalties or perjury I, Date, Signature of Officer or Authorized, Date, Signature of Officer or Authorized, Title, Title, and Revised.

Be extremely mindful when filling out Revised and Signature of Officer or Authorized, since this is the part where a lot of people make a few mistakes.

Step 3: Immediately after proofreading your filled in blanks, press "Done" and you're all set! Right after starting a7-day free trial account here, it will be possible to download purchasers or email it immediately. The PDF form will also be at your disposal in your personal account page with your each and every modification. FormsPal guarantees protected document completion with no personal data recording or distributing. Rest assured that your details are safe here!