Dealing with PDF documents online is always simple using our PDF tool. You can fill out Delaware Form Lq9 here painlessly. FormsPal is dedicated to providing you the best possible experience with our editor by regularly releasing new capabilities and enhancements. With these improvements, using our editor gets better than ever before! Here is what you will need to do to start:

Step 1: Simply press the "Get Form Button" in the top section of this page to launch our pdf editor. There you will find all that is required to fill out your file.

Step 2: This editor lets you modify your PDF form in various ways. Improve it by writing your own text, correct what's already in the PDF, and put in a signature - all at your fingertips!

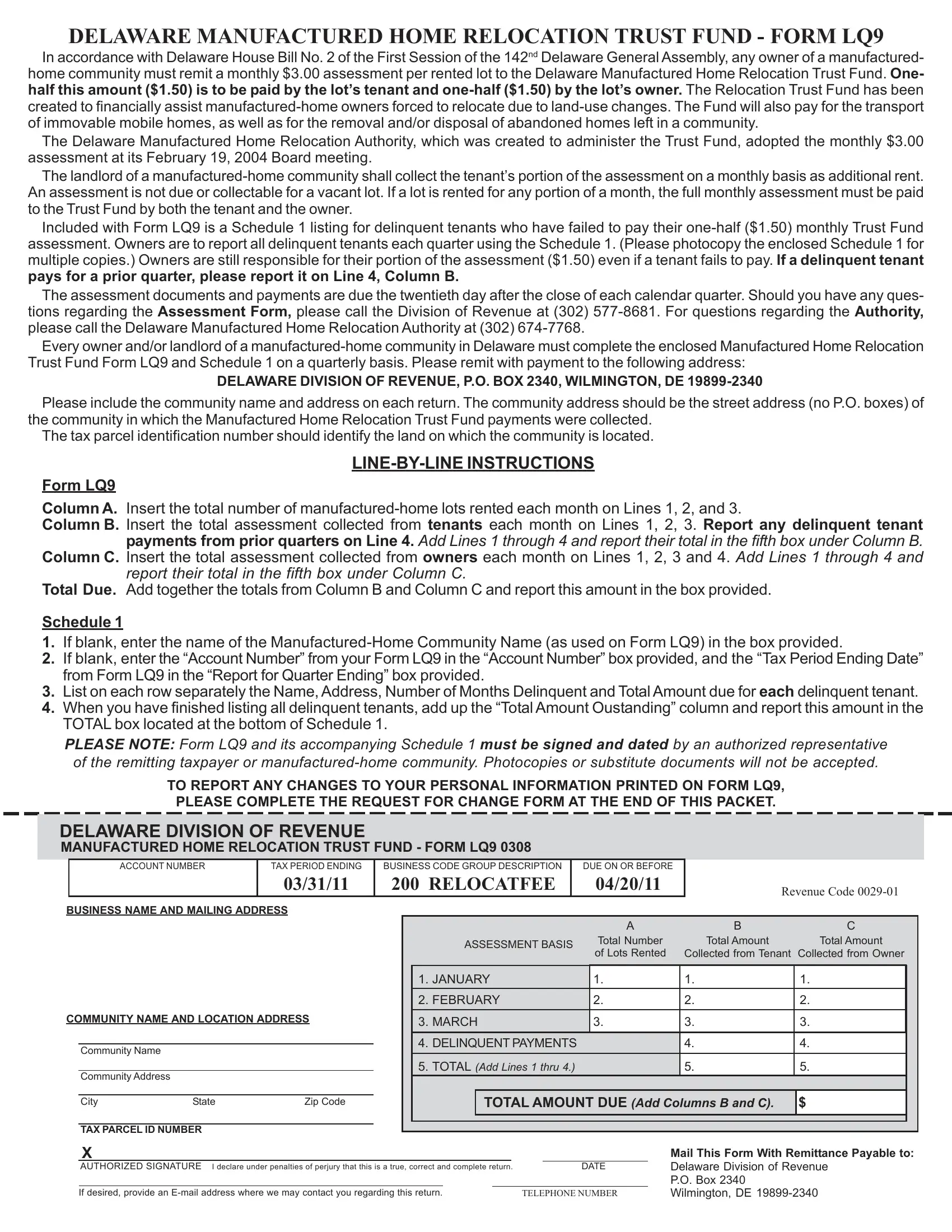

So as to fill out this PDF form, be sure to enter the required information in every field:

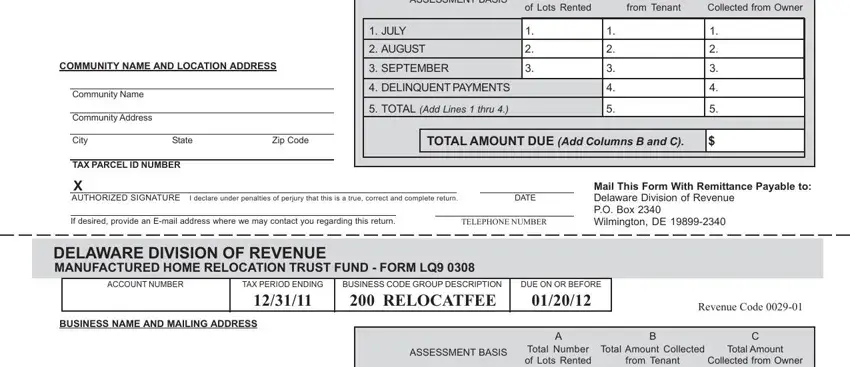

1. Start filling out your Delaware Form Lq9 with a selection of essential blanks. Note all of the required information and ensure there's nothing neglected!

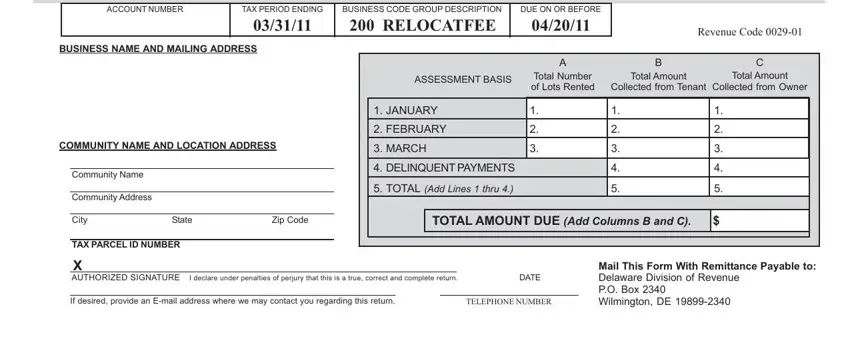

2. Once your current task is complete, take the next step – fill out all of these fields - DELAWARE DIVISION OF REVENUE, ACCOUNT NUMBER, TAX PERIOD ENDING, BUSINESS CODE GROUP DESCRIPTION, DUE ON OR BEFORE, Revenue Code, BUSINESS NAME AND MAILING ADDRESS, COMMUNITY NAME AND LOCATION ADDRESS, Community Name, Community Address, ASSESSMENT BASIS, Total Number of Lots Rented, Total Amount Collected, Total Amount, and from Tenant with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

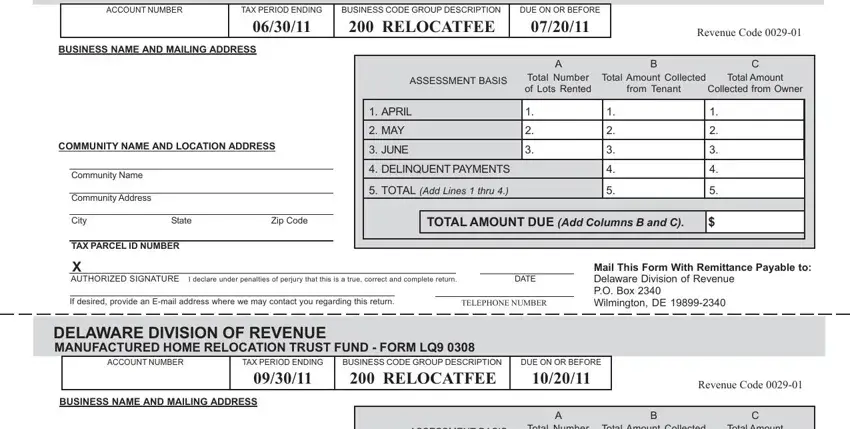

3. The following section should be rather uncomplicated, COMMUNITY NAME AND LOCATION ADDRESS, Community Name, Community Address, ASSESSMENT BASIS, Total Number of Lots Rented, Total Amount Collected, Total Amount, from Tenant, Collected from Owner, JULY, AUGUST, SEPTEMBER, DELINQUENT PAYMENTS, TOTAL Add Lines thru, and City - each one of these fields will have to be filled in here.

In terms of Total Amount and Community Address, be sure you review things in this section. These two are the most important fields in the file.

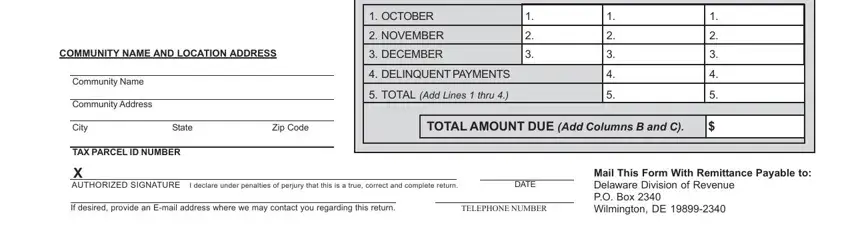

4. All set to fill out this next portion! In this case you have these COMMUNITY NAME AND LOCATION ADDRESS, Community Name, Community Address, OCTOBER, NOVEMBER, DECEMBER, DELINQUENT PAYMENTS, TOTAL Add Lines thru, City, State, Zip Code, TOTAL AMOUNT DUE Add Columns B and, TAX PARCEL ID NUMBER, X AUTHORIZED SIGNATURE I declare, and DATE fields to complete.

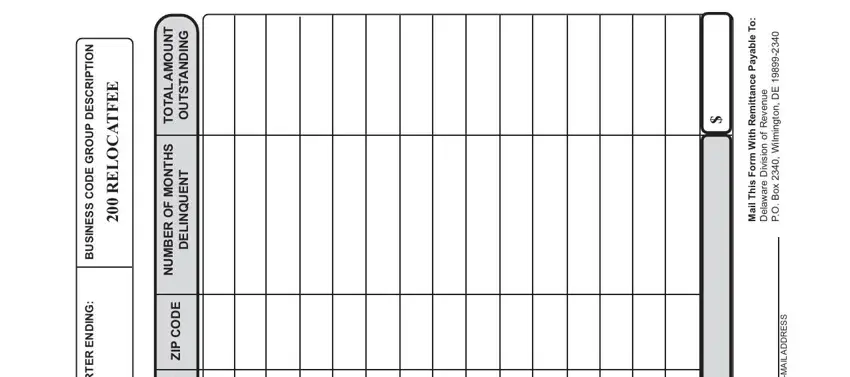

5. This form has to be concluded with this area. Further you will notice a comprehensive set of blanks that require correct details for your form submission to be complete: N O T P R C S E D P U O R G E D O, G N D N E R E T R A U Q R O F T R, E E F T A C O L E R, T N U O M A L A T O T, G N D N A T S T U O, S H T N O M F O R E B M U N, T N E U Q N L E D, E D O C P Z, o T e b a y a P e c n a t t i, m e R h t i, W m r o F s h T, l i, a M, e u n e v e R, and n o s v D e r a w a e D.

Step 3: Right after looking through your entries, press "Done" and you're done and dusted! Join FormsPal today and easily access Delaware Form Lq9, all set for download. All adjustments made by you are kept , meaning you can change the pdf later anytime. If you use FormsPal, it is simple to complete forms without being concerned about database leaks or entries being distributed. Our secure system ensures that your private details are stored safe.