You'll be able to fill in colorado occupational privilege tax effectively with the help of our online PDF tool. To maintain our editor on the forefront of convenience, we work to adopt user-driven features and enhancements on a regular basis. We are at all times grateful for any suggestions - join us in remolding the way you work with PDF docs. If you are seeking to start, here's what it's going to take:

Step 1: Click the "Get Form" button in the top area of this webpage to access our editor.

Step 2: This tool provides the opportunity to modify almost all PDF forms in various ways. Modify it by writing your own text, correct original content, and add a signature - all when it's needed!

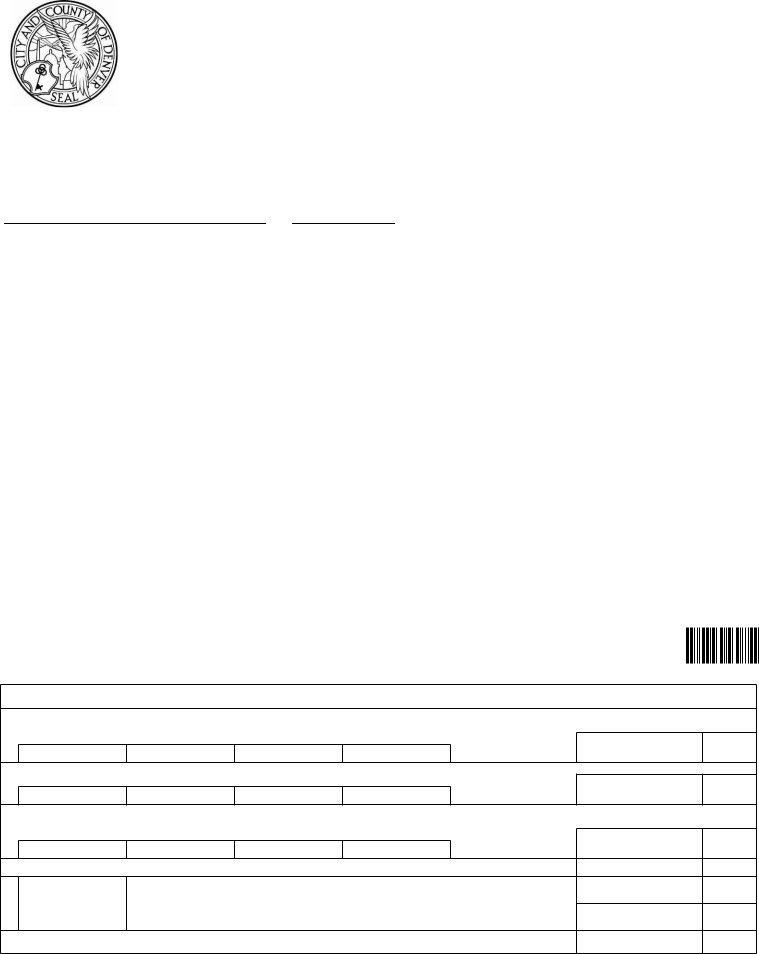

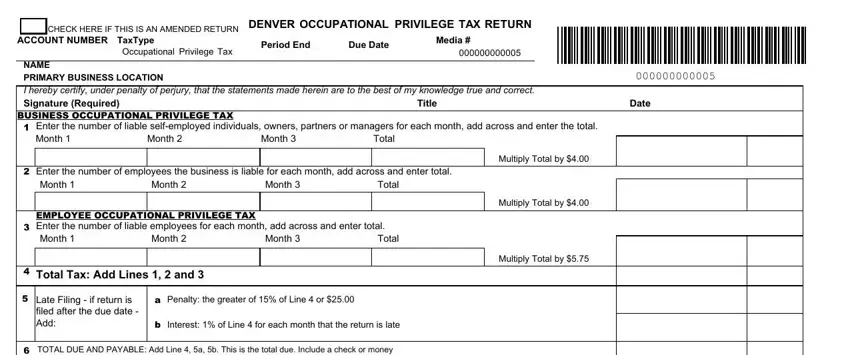

As for the blank fields of this particular PDF, here is what you should do:

1. The colorado occupational privilege tax necessitates certain information to be inserted. Be sure that the following blank fields are finalized:

2. Immediately after this section is done, proceed to enter the suitable information in all these - CHECK HERE IF THIS IS AN AMENDED, ACCOUNT NUMBER TaxType, Occupational Privilege Tax, RETURN LOWER PORTION DETACH HERE, DENVER OCCUPATIONAL PRIVILEGE TAX, Period End, Due Date, Media, NAME PRIMARY BUSINESS LOCATION I, Title, Month, Month, Month, To tal, and Date.

It is possible to get it wrong when completing your To tal, so make sure that you look again before you send it in.

Step 3: Once you have looked once more at the details you given, press "Done" to finalize your document generation. Sign up with us today and instantly gain access to colorado occupational privilege tax, ready for download. All adjustments you make are kept , so that you can customize the file further when required. FormsPal offers risk-free form tools with no personal data record-keeping or any type of sharing. Feel at ease knowing that your details are in good hands here!