payroll software no download needed microsoft can be completed without difficulty. Just try FormsPal PDF editing tool to complete the task promptly. To have our editor on the forefront of practicality, we strive to put into practice user-oriented capabilities and enhancements on a regular basis. We're always grateful for any feedback - play a pivotal part in revolutionizing the way you work with PDF forms. To get the process started, go through these basic steps:

Step 1: Press the "Get Form" button above. It will open our pdf editor so you can start filling in your form.

Step 2: As you access the editor, you will find the document made ready to be completed. Besides filling in various fields, you may as well perform several other actions with the Document, namely putting on your own text, changing the initial text, inserting graphics, putting your signature on the PDF, and more.

It will be an easy task to finish the pdf using this detailed guide! This is what you want to do:

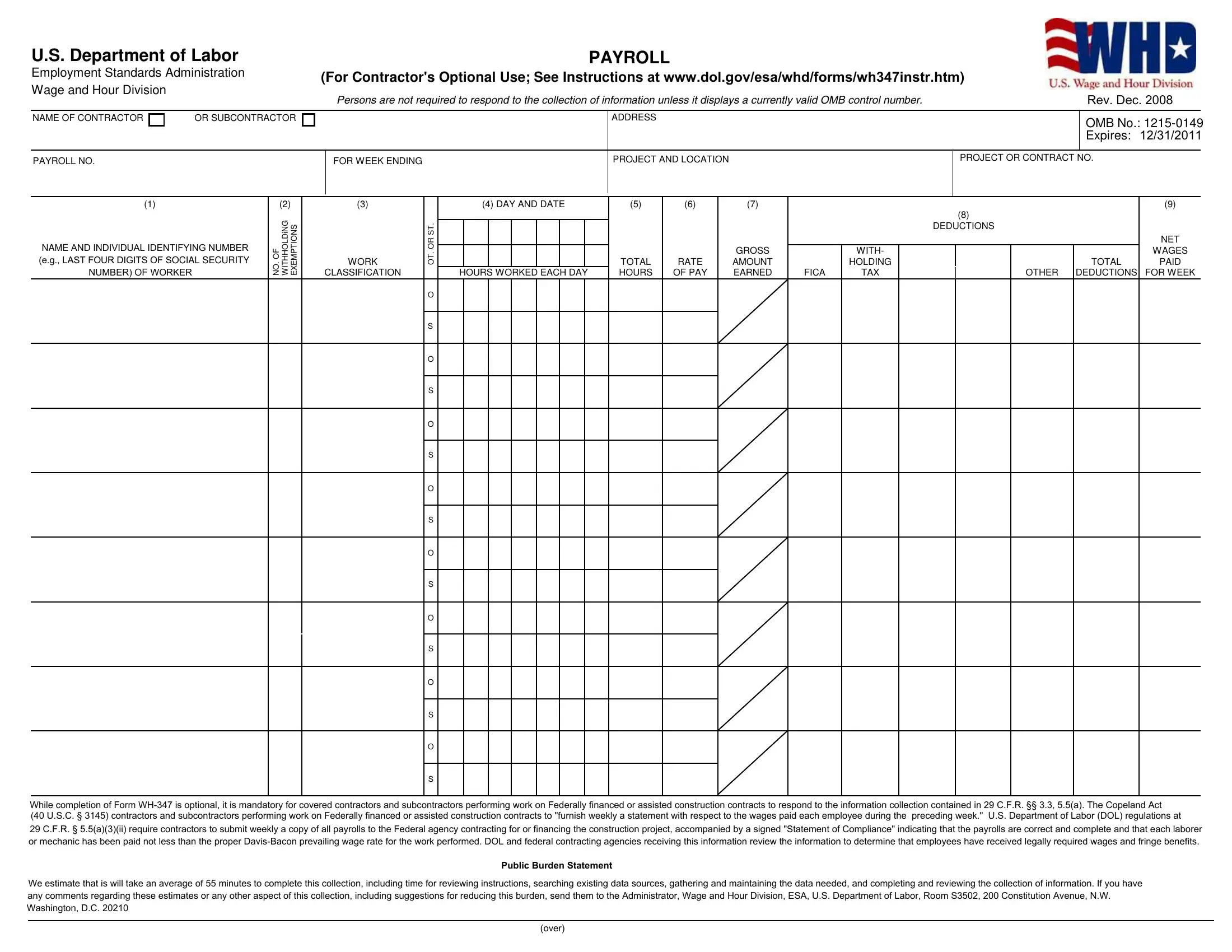

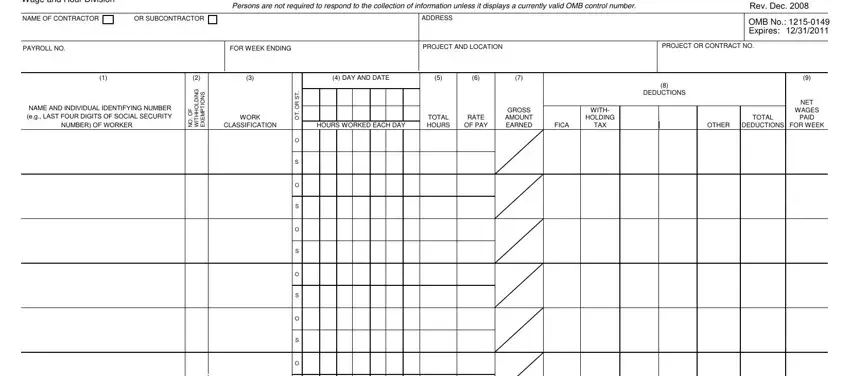

1. First, once filling in the payroll software no download needed microsoft, start in the part that has the next fields:

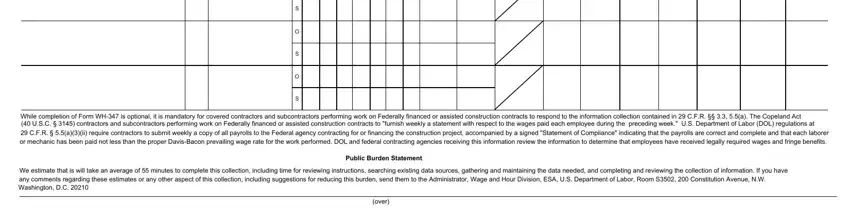

2. The subsequent part is to fill in the following blank fields: While completion of Form WH is, CFR aii require contractors to, We estimate that is will take an, Public Burden Statement, and over.

Lots of people frequently make errors while filling in CFR aii require contractors to in this section. You need to read twice what you type in here.

Step 3: Check that your information is accurate and simply click "Done" to complete the process. Create a 7-day free trial plan at FormsPal and obtain instant access to payroll software no download needed microsoft - download, email, or edit inside your FormsPal cabinet. At FormsPal, we endeavor to guarantee that your information is stored protected.