bfa form 756 can be filled out online easily. Just use FormsPal PDF editing tool to perform the job fast. FormsPal development team is ceaselessly working to develop the editor and insure that it is much better for people with its cutting-edge features. Bring your experience to the next level with constantly growing and exceptional possibilities available today! With a few basic steps, you may begin your PDF journey:

Step 1: Click the orange "Get Form" button above. It's going to open up our editor so that you can start completing your form.

Step 2: After you open the online editor, you will notice the form prepared to be completed. In addition to filling in various fields, you might also perform many other things with the PDF, including putting on your own words, changing the initial text, adding graphics, placing your signature to the document, and a lot more.

It really is simple to finish the pdf with this detailed guide! Here is what you must do:

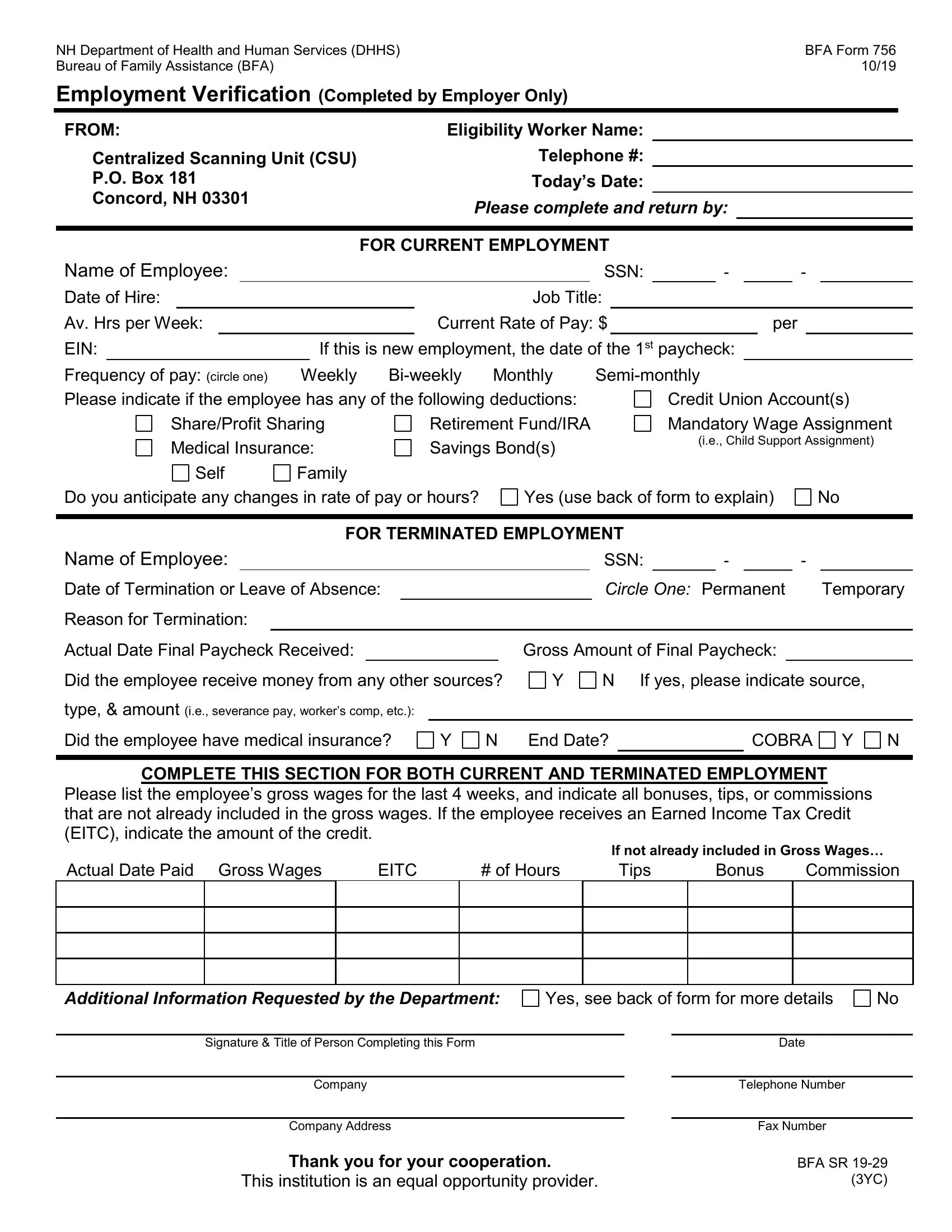

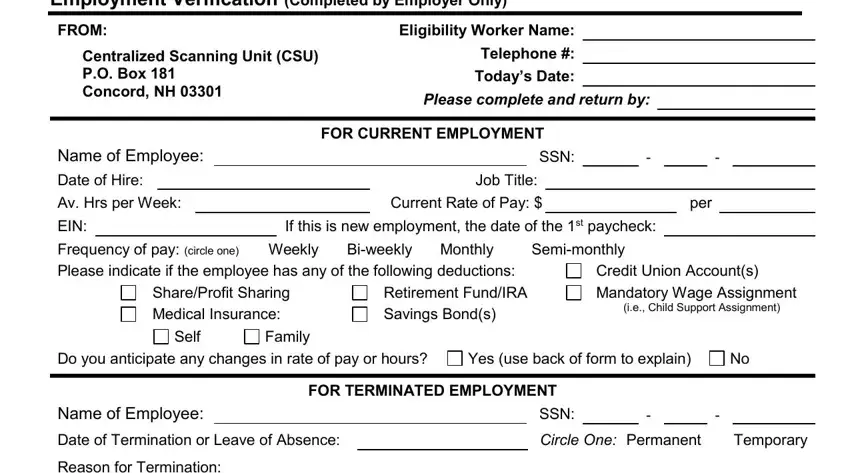

1. When filling out the bfa form 756, make certain to complete all of the important blanks within its associated section. This will help to hasten the work, allowing for your information to be processed without delay and properly.

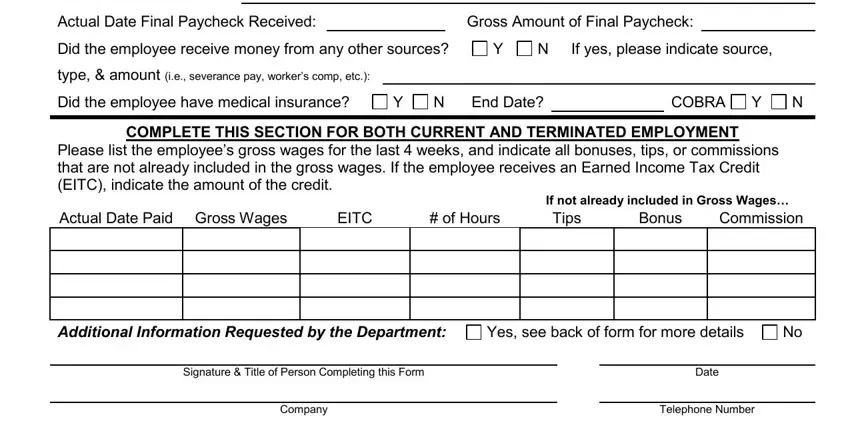

2. The subsequent part is to submit the following blanks: Reason for Termination, Actual Date Final Paycheck Received, Gross Amount of Final Paycheck, Did the employee receive money, If yes please indicate source, type amount ie severance pay, Did the employee have medical, End Date, COBRA, COMPLETE THIS SECTION FOR BOTH, Please list the employees gross, Actual Date Paid Gross Wages, EITC, of Hours, and Additional Information Requested.

It is easy to make errors while filling in your End Date, therefore be sure to go through it again prior to when you send it in.

Step 3: Make certain the information is accurate and press "Done" to progress further. Acquire your bfa form 756 when you join for a 7-day free trial. Readily view the pdf file inside your personal account page, along with any modifications and adjustments being all preserved! Here at FormsPal, we endeavor to make certain that your details are stored protected.