Working with PDF forms online is actually a piece of cake with this PDF tool. You can fill out cara form dgt here painlessly. FormsPal is focused on providing you with the best possible experience with our editor by constantly introducing new capabilities and upgrades. With these improvements, using our editor gets easier than ever! Getting underway is simple! All that you should do is adhere to the following basic steps directly below:

Step 1: Access the form in our tool by hitting the "Get Form Button" at the top of this page.

Step 2: The editor will let you work with your PDF form in various ways. Enhance it by writing your own text, correct original content, and add a signature - all within several clicks!

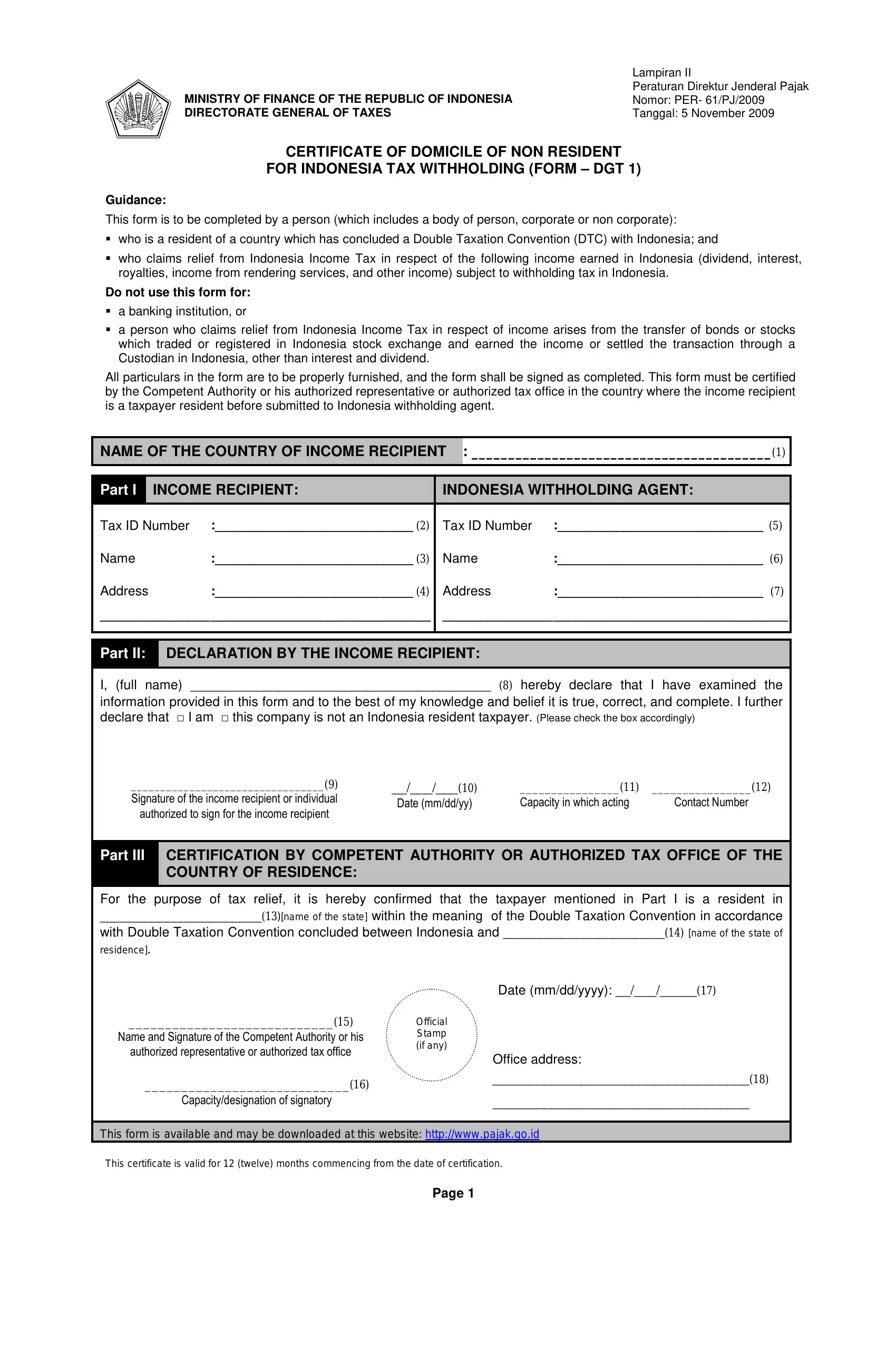

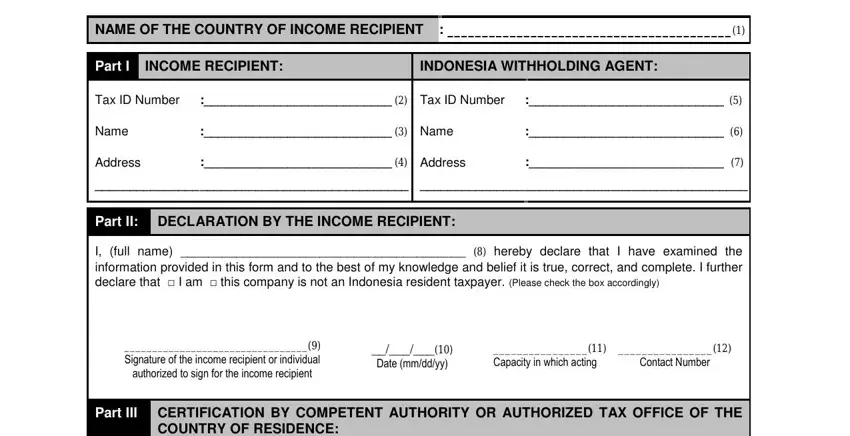

This PDF requires specific info to be filled in, thus ensure that you take some time to provide what is expected:

1. The cara form dgt needs certain information to be entered. Ensure that the following blanks are filled out:

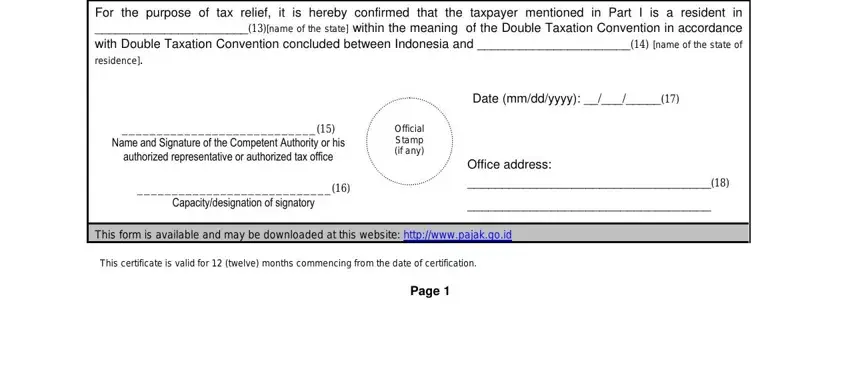

2. Just after the prior section is done, go to enter the suitable information in all these: For the purpose of tax relief it, cid, Official Stamp if any, Date mmddyyyy, Office address, This form is available and may be, and Page.

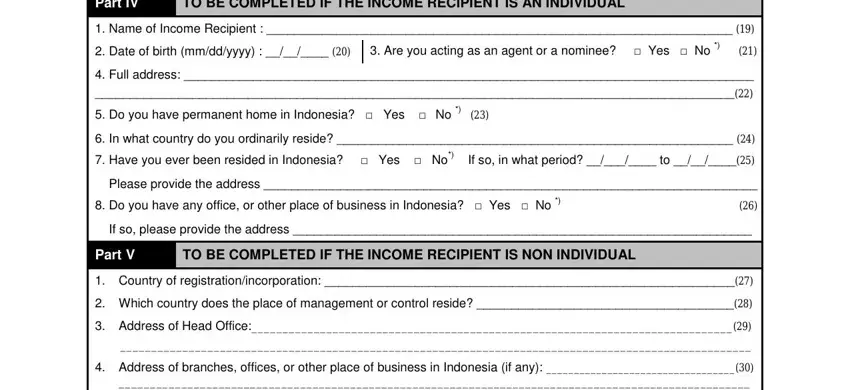

3. The next stage is usually easy - complete every one of the empty fields in Part IV, TO BE COMPLETED IF THE INCOME, Name of Income Recipient Are, Date of birth mmddyyyy, Full address Do you have, In what country do you ordinarily, Please provide the address Do, If so please provide the address, Part V, TO BE COMPLETED IF THE INCOME, Country of, Which country does the place of, Address of Head Office, and Address of branches offices or in order to complete this segment.

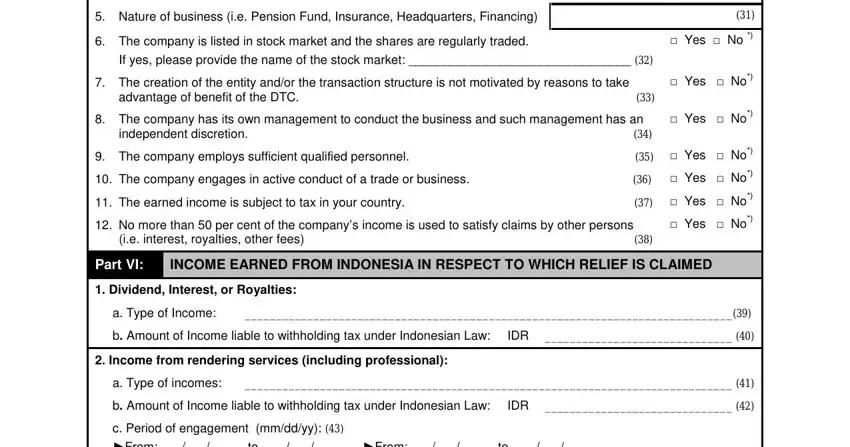

4. This next section requires some additional information. Ensure you complete all the necessary fields - Nature of business ie Pension, The company is listed in stock, If yes please provide the name of, The creation of the entity andor, advantage of benefit of the DTC, The company has its own, independent discretion, Yes No, Yes No, Yes No, The company employs sufficient, No more than per cent of the, ie interest royalties other fees, Part VI, and INCOME EARNED FROM INDONESIA IN - to proceed further in your process!

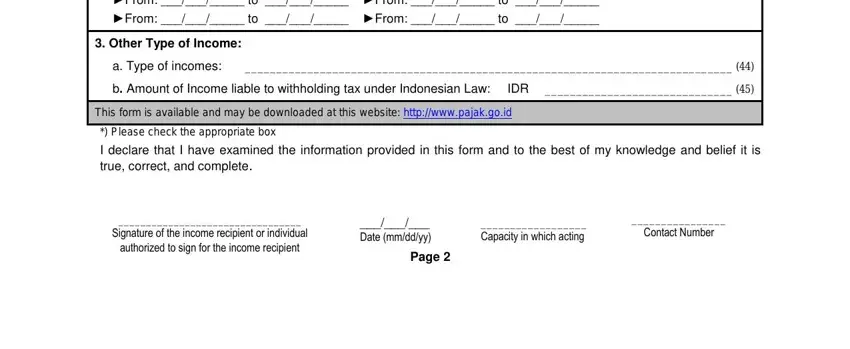

5. As a final point, the following final portion is what you'll have to wrap up before closing the form. The blanks at this point are the next: From to From to From to From, Other Type of Income, a Type of incomes, b Amount of Income liable to, IDR, This form is available and may be, I declare that I have examined the, cid, and Page.

Be very attentive while completing From to From to From to From and a Type of incomes, as this is the section in which many people make some mistakes.

Step 3: Right after looking through your entries, hit "Done" and you are done and dusted! Make a free trial account with us and obtain immediate access to cara form dgt - downloadable, emailable, and editable inside your personal cabinet. FormsPal ensures your data confidentiality by using a protected system that never saves or shares any private data typed in. Feel safe knowing your paperwork are kept safe any time you use our editor!