(A)If your principal place of business as completed in Section 1 of the form is AK, AL, AR, CA, CO, CT, DE, GA, IA, ID, IL, IN, KS, KY, LA, MA, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NM, NY, OH, OK, PA, RI, SC, SD, TN, TX, UT, VA, WA, WI or, WV, you must use that state as your base state. If your principal place of business is not in one of these states, go to (B).

(B)If your principal place of business is not one of the states listed in (A) above but you have an office or operating facility located in one of the states listed in (A) above, you must use that state as your base state.

(C)If you cannot select a base state using (A) or (B) above, you must select your base state from (A) above that is nearest to the location of your principal place of business; or

(D)Select your base state as follows:

a.If your principal place of business is in DC, MD, NJ, or VT or the Canadian Province of ON, NB, NL, NS, PE or QC, you may select one of the following states: CT, DE, MA, ME, NH, NY, PA, RI, VA or WV.

b.If your principal place of business is in FL or a state of Mexico, you may select one of the following states: AL, AR, GA, KY, LA, MS, NC, OK, SC, TN or TX.

c.If your principal place of business is in the Canadian Province of ON, MB or NU, you may select one of the following states: IA, IL, IN, KS, MI, MN, MO, NE, OH or WI.

d.If your principal place of business is in AZ, HI, NV, OR or WY or the Canadian Province of AB, BC, MB, NT, NU, SK or YT or a state of Mexico, you may select one of the following states: AK, CA, CO, ID, MT, ND, NM, SD, UT or WA.

Change of Base State

§If you selected your base state using (C) or (D) above and your principal place of business has moved to a qualified state in (A) or (B) above, you

may, at the next registration year, change your base state to a state listed in (A) or (B).

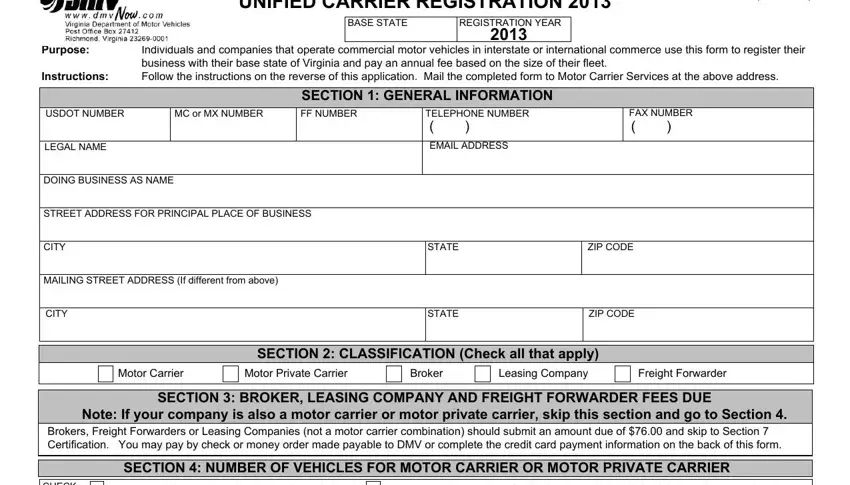

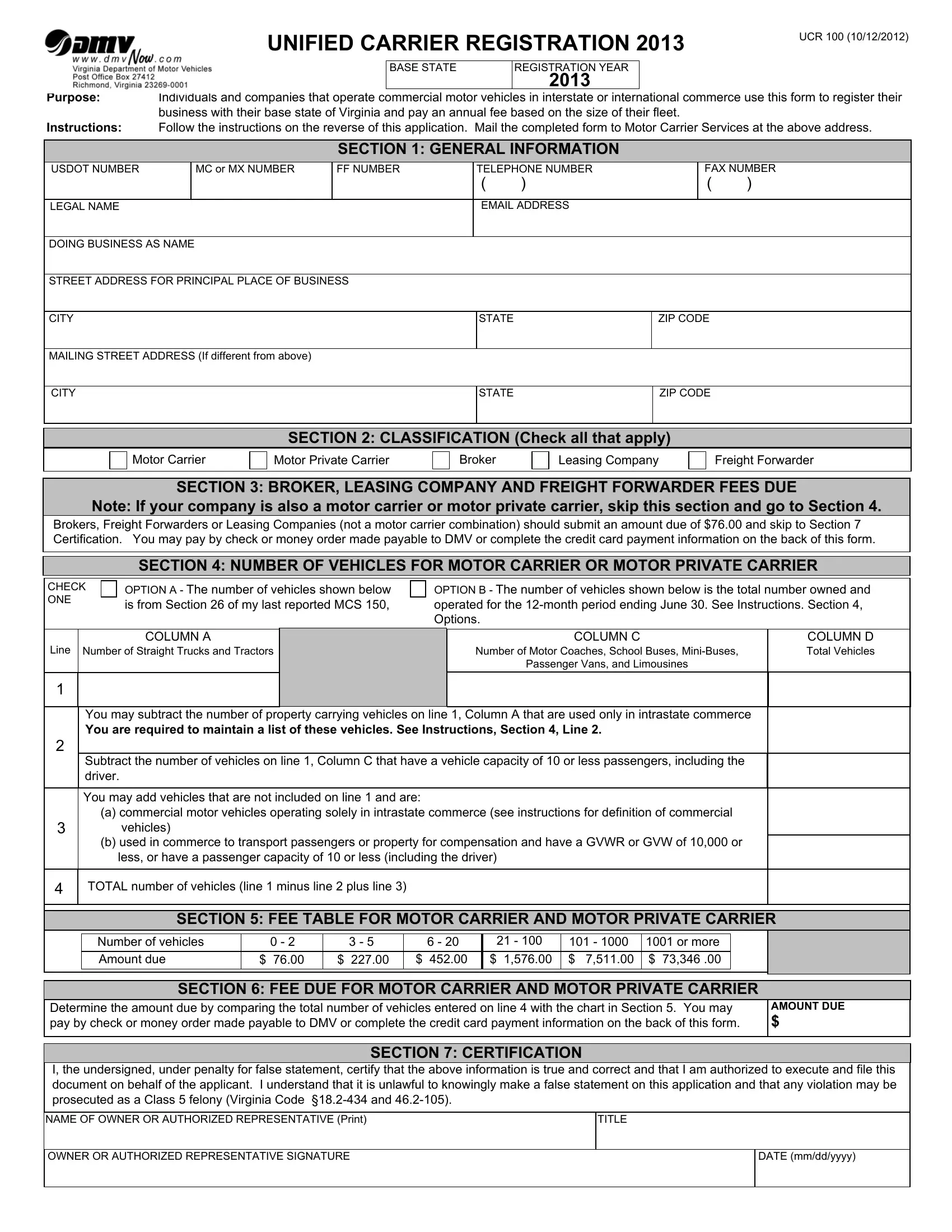

Section 1. - General Information

§Enter all identifying information for your company. The owner and DBA name should be identical to what is on file for your USDOT number

(See http://safer.fmcsa.dot.gov/CompanySnapshot.aspx). Enter the principal place of business address that serves as your headquarters and where your operational records are maintained or can be made available.

Section 2. - Classification

§“Motor Carrier” means a person providing commercial motor vehicle (as defined in section 31132 of 49 USC) transportation for compensation.

§“Motor Private Carrier” means a person, other than a motor carrier, transporting property by commercial motor vehicle (as defined in section 31132 of 49 USC) when - (A) the transportation is as provided in section 13501 of 49 USC; (B) the person is the owner, lessee, or bailee of the property being transported; and (C) the property is being transported for sale, lease, rent or bailment or to further a commercial enterprise.

§“Broker” means a person, other than a motor carrier, who sells or arranges for transportation by a motor carrier for compensation.

§“Freight Forwarder” means a person that arranges for truck transportation of cargo belonging to others, utilizing for-hire carriers to provide the actual truck transportation, and also performs or provides for assembling, consolidating, break-bulk and distribution of shipments and assumes responsibility for transportation from place of receipt to destination.

§“Leasing Company” means a person or company engaged in the business of leasing or renting for compensation motor vehicles they own without drivers to a

motor carrier, motor private carrier, or freight forwarder.

Section 3. - Fees Due-Brokers, Freight Forwarders and Leasing Companies

§Brokers, freight forwarders and leasing companies pay the lowest fee tier. If your company is also a motor carrier or a motor private carrier you will skip this

section of the application.

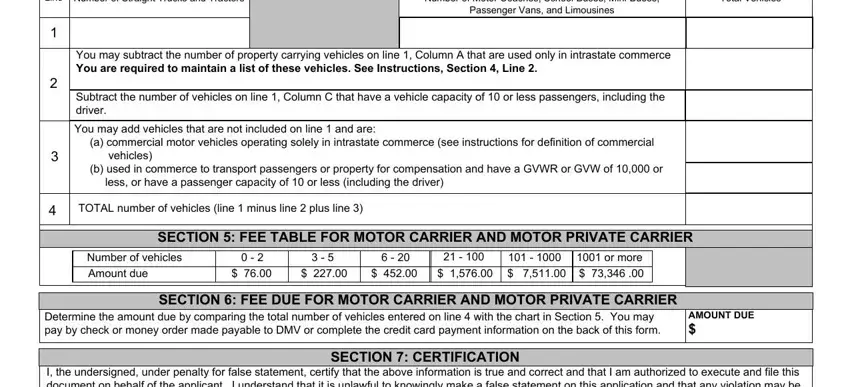

Section 4. - Number Of Motor Vehicles - Motor Carrier & Motor Private Carrier - Do not include any trailer counts in Columns A, C or D in this section.

§Definition - “Commercial motor vehicle” (as defined under 49 USC Section 31101) means a self-propelled vehicle used on the highways in commerce principally to transport passengers or cargo, if the vehicle: (1) Has a gross vehicle weight rating (GVWR) or gross vehicle weight (GVW) of at least 10,001 pounds, whichever is greater; (2) Is designed to transport more than 10 passengers, including the driver; or (3) Is used in transporting material found by the Secretary of Transportation to be hazardous under section 5103 of this title and transported in a quantity requiring placarding under regulations prescribed by the Secretary under section 5103.

§OPTIONS - Check box to indicate the source of the vehicle counts used in this section. If using Option B puts you in a lower fee bracket, you must maintain a list of vehicles on form UCR 102, available on www.dmvNOW.com, Forms and Publications.

§Line 1 - In the table, enter the number of commercial motor vehicles you reported on your last MCS-150 form or the total number of commercial motor vehicles owned and operated for the 12-month period ending June 30 of the year immediately prior to the year for which the UCR registration is made. This table includes owned and leased vehicles (term of lease for more than 30 days)

§Line 2 - Subtract the number of vehicles designed to transport 10 passengers or less (including the driver) that are included in Column C of Line 1. You may also subtract the number of property-carrying vehicles used solely in intrastate commerce (never used to carry interstate freight) that you included in Section 4, Column A. You may not enter on this line the number of passenger-carrying vehicles included in Column C that were used solely in intrastate commerce. You must maintain a list of vehicles you subtracted under this option using form UCR 101 available on www.dmvNOW.com, Forms and Publications. Information on these forms may be requested by your base state. DO NOT RETURN THESE FORMS WITH YOUR REGISTRATION RENEWAL.

§Line 3 - You may add the number of owned commercial motor vehicles (straight trucks, tractors, motor coaches, school buses, mini-buses, passenger vans or limousines) that were used only in intrastate commerce if they were not included in Column A or C above. You may also include on this line the number of other self-propelled vehicles used in interstate or intrastate commerce to transport passengers or property for compensation that are not defined as a commercial motor vehicle that have a gross vehicle weight rating or gross vehicle weight of 10,000 pounds or less or a passenger capacity of 10 or less (including the driver).

§Line 4 - Total Number of Vehicles. Total the number of vehicles shown in Column D. Use this total and the fee table in Section 5 to determine the amount due. Enter the amount in Section 6.

Section 5. - Fee Table for Motor Carrier & Motor Private Carrier

§This table is the approved UCR fees you will pay dependent upon the number of vehicles reported in Section 4. This fee may change from year to year. Contact

your base state if you do not have the fee table for the correct registration period.

Section 6. - Fee Due for Motor Carrier & Motor Private Carrier

§Enter the amount due for the total number of vehicles calculated in Section 4. Pay this amount.

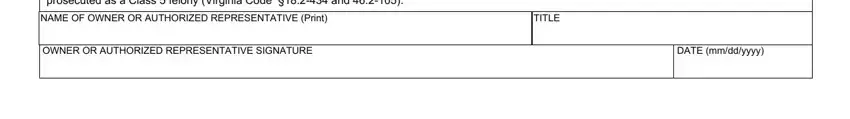

Section 7. - Certification

§The owner or an individual who has a power of attorney to sign on behalf of the owner or owners must sign this form. This certification indicates that the information is correct under penalty of perjury.

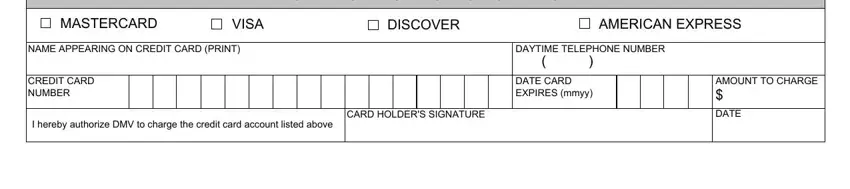

CREDIT CARD CHARGE AUTHORIZATION