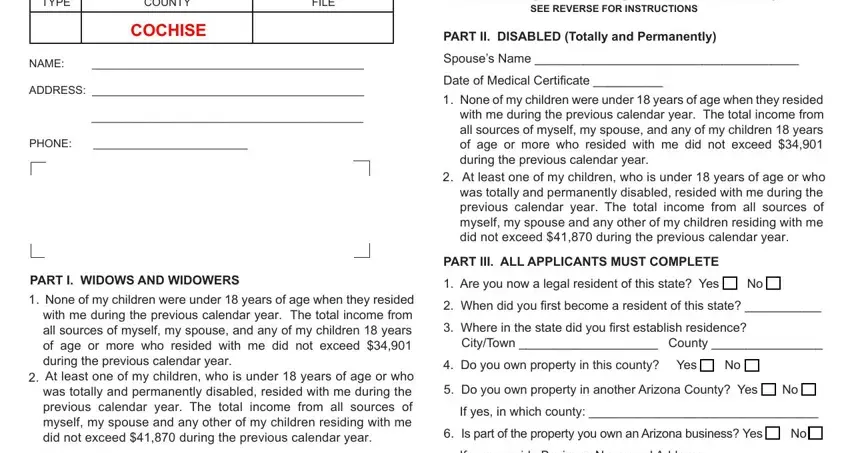

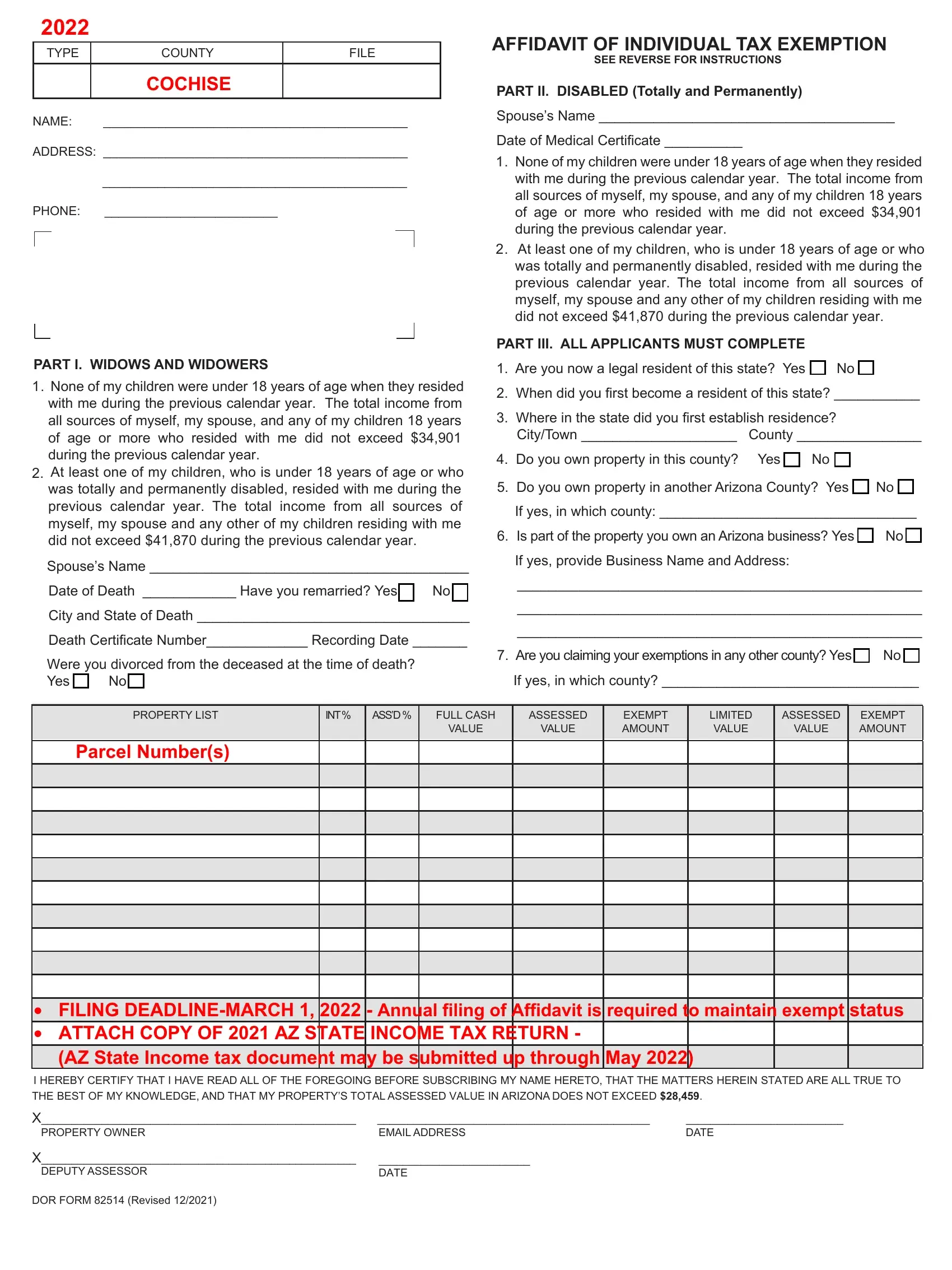

2022

TYPE |

COUNTY |

FILE |

|

|

|

|

|

|

|

|

|

COCHISE |

|

|

|

NAME: |

____________________________________________ |

|

ADDRESS: ____________________________________________ |

|

|

|

____________________________________________ |

|

PHONE: |

_________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I. WIDOWS AND WIDOWERS

1.None of my children were under 18 years of age when they resided with me during the previous calendar year. The total income from

all sources of myself, my spouse, and any of my children 18 years of age or more who resided with me did not exceed $34,901 during the previous calendar year.

2.At least one of my children, who is under 18 years of age or who was totally and permanently disabled, resided with me during the previous calendar year. The total income from all sources of

myself, my spouse and any other of my children residing with me did not exceed $41,870 during the previous calendar year.

Spouse’s Name _________________________________________

Date of Death ____________ Have you remarried? Yes |

No |

City and State of Death ___________________________________

Death Certificate Number_____________ Recording Date _______

Were you divorced from the deceased at the time of death?

Yes No

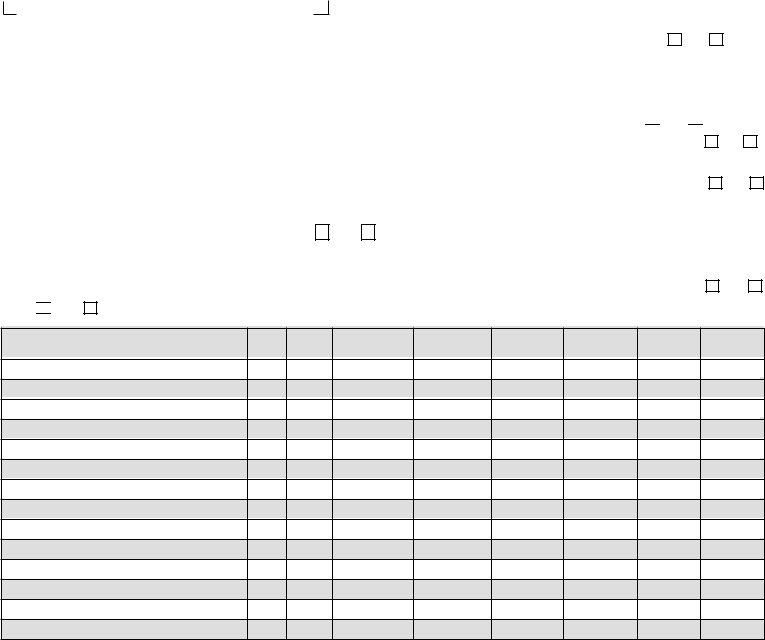

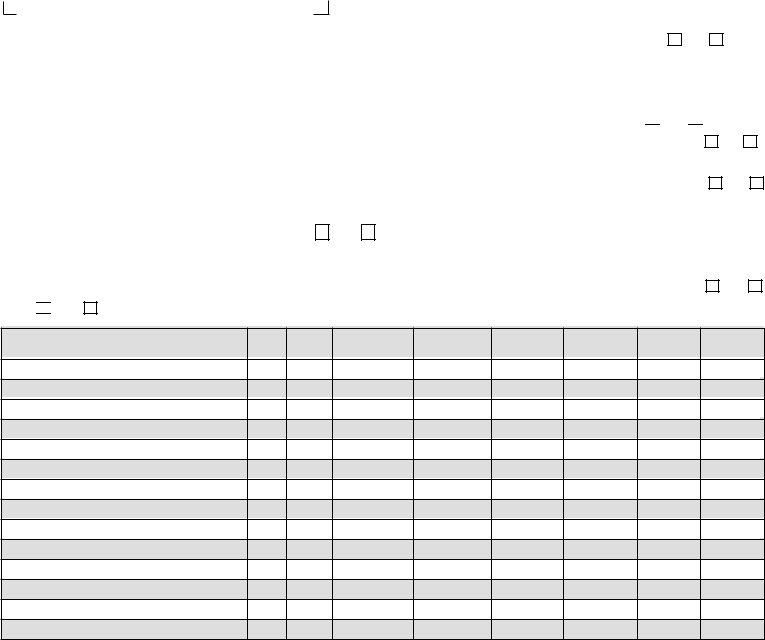

AFFIDAVIT OF INDIVIDUAL TAX EXEMPTION

SEE REVERSE FOR INSTRUCTIONS

PART II. DISABLED (Totally and Permanently)

Spouse’s Name ______________________________________

Date of Medical Certificate __________

1. None of my children were under 18 years of age when they resided with me during the previous calendar year. The total income from all sources of myself, my spouse, and any of my children 18 years of age or more who resided with me did not exceed $34,901 during the previous calendar year.

2. At least one of my children, who is under 18 years of age or who was totally and permanently disabled, resided with me during the previous calendar year. The total income from all sources of myself, my spouse and any other of my children residing with me did not exceed $41,870 during the previous calendar year.

PART III. ALL APPLICANTS MUST COMPLETE

1. Are you now a legal resident of this state? Yes |

No |

2.When did you first become a resident of this state? ___________

3.Where in the state did you first establish residence?

City/Town ____________________ County ________________

4.Do you own property in this county? Yes No

5. |

Do you own property in another Arizona County? Yes |

No |

|

If yes, in which county: _________________________________ |

6. |

Is part of the property you own an Arizona business? Yes |

No |

|

If yes, provide Business Name and Address: |

|

|

____________________________________________________ |

|

____________________________________________________ |

|

____________________________________________________ |

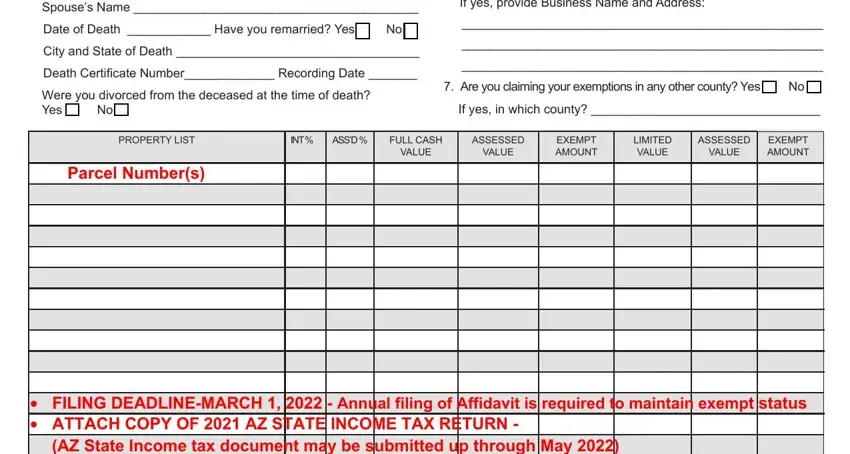

7. |

Are you claiming your exemptions in any other county? Yes |

No |

|

If yes, in which county? _________________________________ |

PROPERTY LIST

Parcel Number(s)

ASSESSED EXEMPT

VALUE AMOUNT

•FILING DEADLINE-MARCH 1, 2022 - Annual filing of Affidavit is required to maintain exempt status

•ATTACH COPY OF 2021 AZ STATE INCOME TAX RETURN -

(AZ State Income tax document may be submitted up through May 2022)

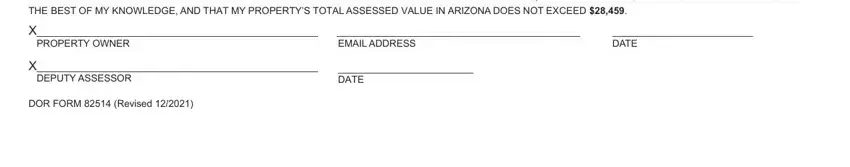

I HEREBY CERTIFY THAT I HAVE READ ALL OF THE FOREGOING BEFORE SUBSCRIBING MY NAME HERETO, THAT THE MATTERS HEREIN STATED ARE ALL TRUE TO THE BEST OF MY KNOWLEDGE, AND THAT MY PROPERTY’S TOTAL ASSESSED VALUE IN ARIZONA DOES NOT EXCEED $28,459.

X____________________________________________________ |

_____________________________________________ |

__________________________ |

PROPERTY OWNER |

EMAIL ADDRESS |

DATE |

X____________________________________________________ |

_________________________ |

|

DEPUTY ASSESSOR |

DATE |

|

DOR FORM 82514 (Revised 12/2021) |

|

|

INSTRUCTIONS for completing the DOR 82514 AFFIDAVIT

for INDIVIDUAL PROPERTY TAX EXEMPTION

Read the information below, the instructions for the DOR 82514 affidavit (following), and the information

on the DOR 82514 carefully before completing the DOR 82514 affidavit form.

A:A person who is initially applying for the property tax exemption allowed by A.R.S. § 42-11111, exemption for property of widows, widowers and disabled persons, and who the County Assessor has approved for the exemption, is no longer required to file an annual affidavit with the County Assessor in any subsequent year(s).

Note: Some Assessors still require the filing of an annual affidavit in order to monitor continued exemption eligibility. Please contact your local County Assessor to verify requirements.

B:Pursuant to A.R.S. § 42-11111(H), the applicant (or that person’s representative) shall annually calculate

total household income from the previous Tax Year to ensure that the widow, widower or disabled person still qualifies for the tax exemption. The applicant (or the applicant’s representative) is also required by law to notify the County Assessor, in writing, of any event that disqualifies the widow, widower or disabled person from further property tax exemption. Disqualifying events include the applicant’s death, the remarriage of a widow or widower, the applicant’s or household’s total income exceeding the limits

prescribed by law, or the conveyance of the property to another owner. Other disqualifying events may also apply. The applicant’s property becomes subject to taxation from the date of disqualification, including interest, penalties and (the cost of) proceedings for tax delinquencies.

C:The specified total household income limits, assessed valuation limits and tax exemption amounts are adjusted annually for inflation, based on a “GDP price deflator” factor that is calculated by the Department of Revenue no later than December 31 of each year. The increased total household income limitations become the next Tax Year’s limits, in accordance with A.R.S. § 42-11111(B) (C) & (E).

INSTRUCTIONS for ALL APPLICANTS:

•On an initial affidavit form, list all taxable property the applicant owns. Attach additional identifying or descriptive information, if necessary. If subsequent year affidavits are required by the Assessor, correct any of the preprinted information listed on the DOR 82514 by crossing out any real or personal property which the applicant no longer owns, and by adding any property the applicant now owns not shown on the list.

•If an initial affidavit is being submitted (i.e., the applicant is filing for the first time), a copy of the applicant’s most recent State Income Tax Return MUST accompany the filed DOR 82514 affidavit for the County Assessor’s use in determining the applicant’s initial eligibility.

•Pursuant to A.R.S. § 42-11152, the County Assessor may require additional proof of the facts stated on the affidavit by the applicant before approving an exemption. A false statement that is made or sworn to in the affidavit constitutes perjury.

•Sign the completed affidavit. The affidavit must be notarized if it is not signed in the presence of an Assessor’s representative. Be sure that the copy of the affidavit form that is filed with the County Assessor has the

applicant’s original signature on it. To assure that the property tax exemption application is processed for the current Tax Year, if the affidavit is hand-delivered, file the DOR 82514 with the County Assessor’s Office no later than the last (business) day of February. If the affidavit is mailed to the County Assessor, be sure that it is postmarked on or before the last day of February.

Note: Check with the local County Assessor’s Office for their hours and days of operation if the last business day in February of the current calendar year is a Friday. Some County Assessor’s Offices may now be closed on Fridays.

For DISABLED PERSONS:

A “Certificate of Disability for Property Tax Exemption” form (DOR 82514B), with the original signature of the applicant’s physician on it, and which is dated, MUST accompany the applicant’s filed DOR 82514 affidavit.

The applicant should retain a copy of the signed affidavit, any attachments that are submitted with it, and the Certificate of Disability, if applicable, as a permanent record.

For questions regarding this form, please contact your local County Assessor at the number listed on the front of this form.