The PDF editor you will benefit from was developed by our main web developers. You may get the colorado retail sales tax return form 2020 document fast and without problems applying our software. Just stick to this specific guide to begin with.

Step 1: Click the orange button "Get Form Here" on the page.

Step 2: Now you are on the form editing page. You can enhance and add text to the file, highlight specified content, cross or check particular words, include images, insert a signature on it, get rid of unneeded fields, or remove them completely.

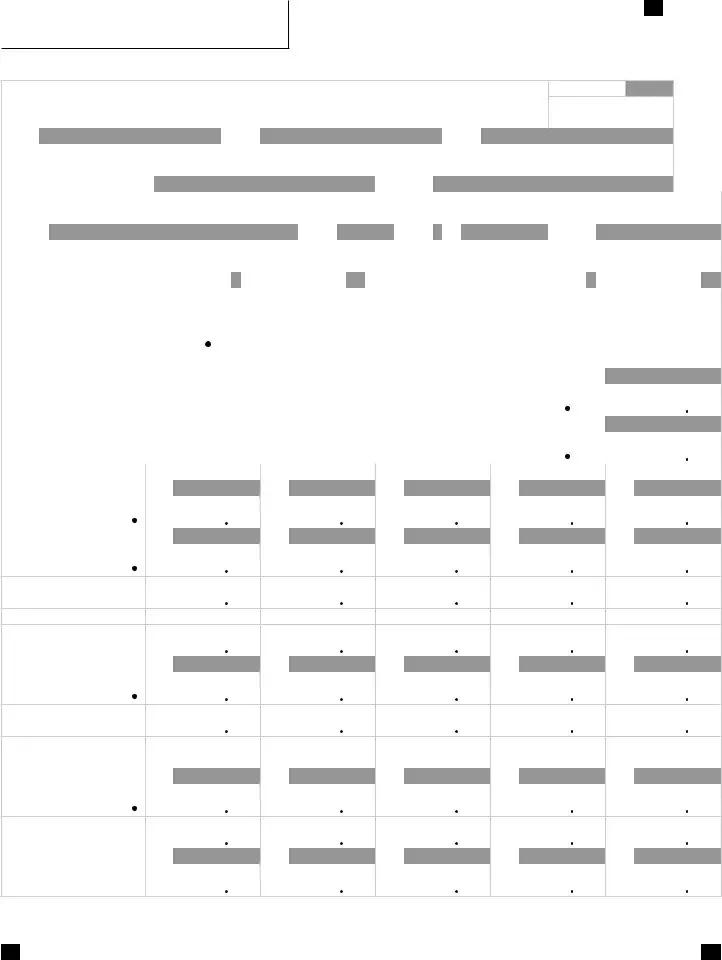

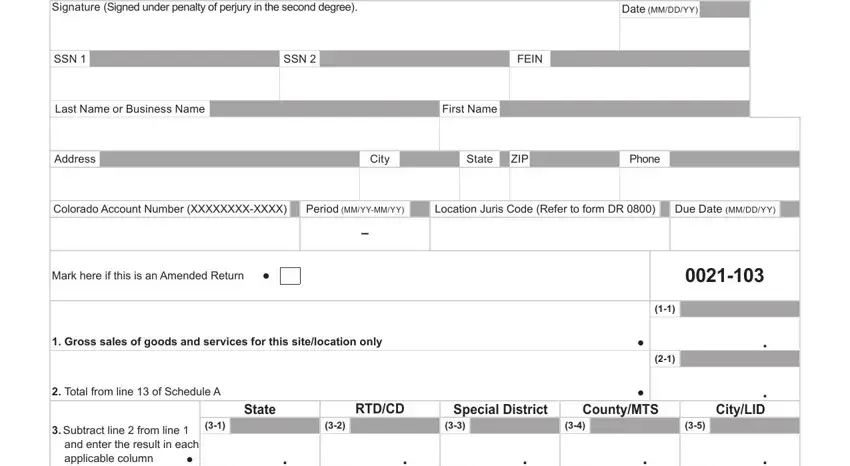

You will have to type in the following details to fill out the file:

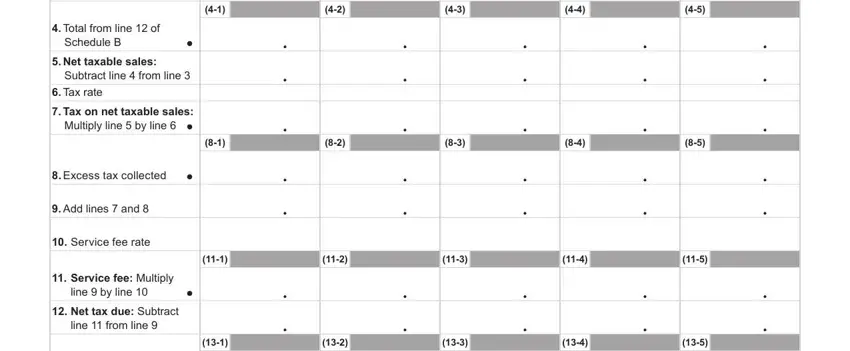

Write the essential details in the Total from line of, Schedule B, Net taxable sales, Subtract line from line, Tax rate, Tax on net taxable sales Multiply, Excess tax collected, Add lines and, Service fee rate, Service fee Multiply, line by line, Net tax due Subtract, and line from line area.

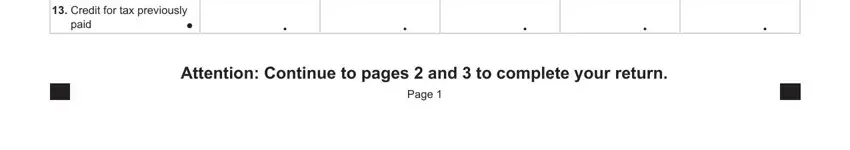

Note any data you are required in the segment Credit for tax previously, paid, and Attention Continue to pages and.

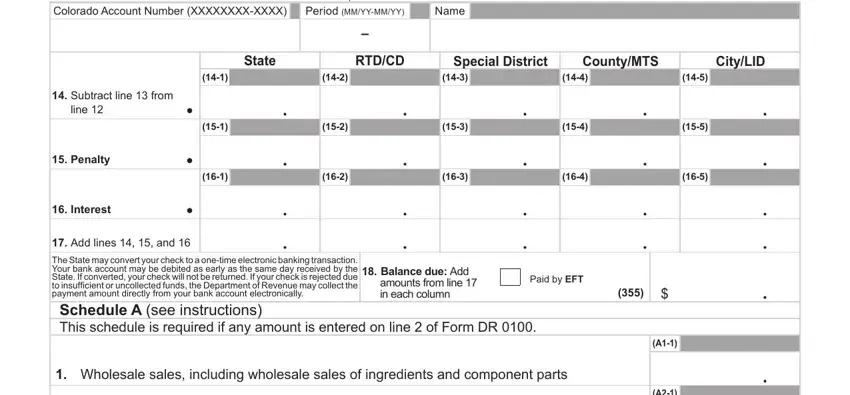

The Colorado Account Number, Period MMYYMMYY, Name, State, RTDCD, Special District, CountyMTS, CityLID, Subtract line from, line, Penalty, Interest, Add lines and, The State may convert your check, and amounts from line in each column segment needs to be applied to write down the rights or responsibilities of both parties.

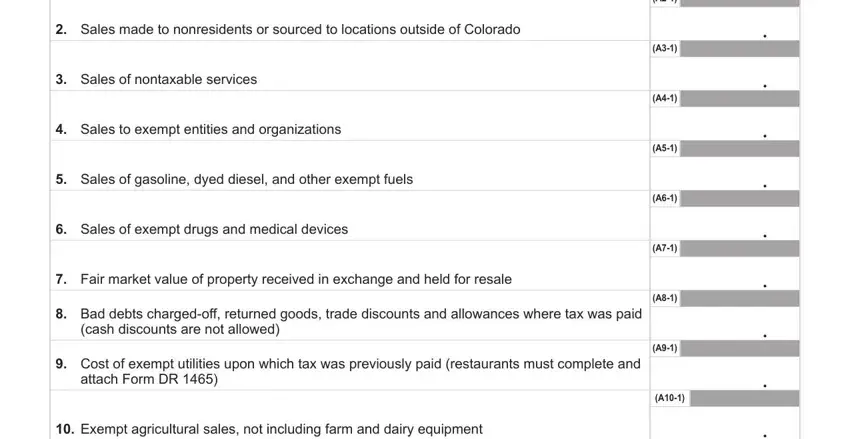

End up by analyzing all these fields and filling them in accordingly: Sales made to nonresidents or, Sales of nontaxable services, Sales to exempt entities and, Sales of gasoline dyed diesel and, Sales of exempt drugs and medical, Fair market value of property, Bad debts chargedoff returned, cash discounts are not allowed, Cost of exempt utilities upon, attach Form DR, and Exempt agricultural sales not.

Step 3: Hit the button "Done". The PDF form can be transferred. You can easily download it to your pc or send it by email.

Step 4: Prepare duplicates of your file. This is going to protect you from forthcoming problems. We cannot look at or reveal your details, hence be assured it's going to be protected.