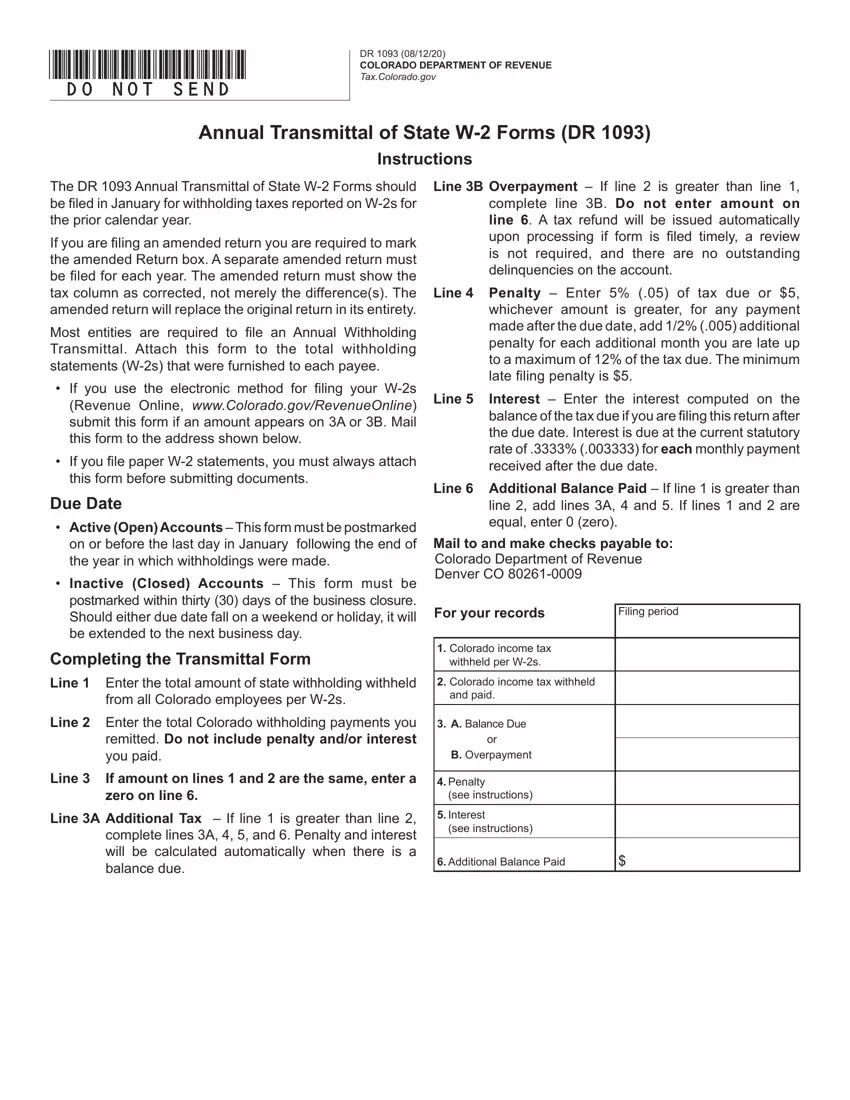

Couple of things are simpler than filling in forms taking advantage of this PDF editor. There is not much for you to do to enhance the form dr 1093 file - simply adopt these measures in the next order:

Step 1: Click on the button "Get Form Here".

Step 2: When you've accessed the form dr 1093 editing page you may notice all of the options you'll be able to undertake regarding your file within the top menu.

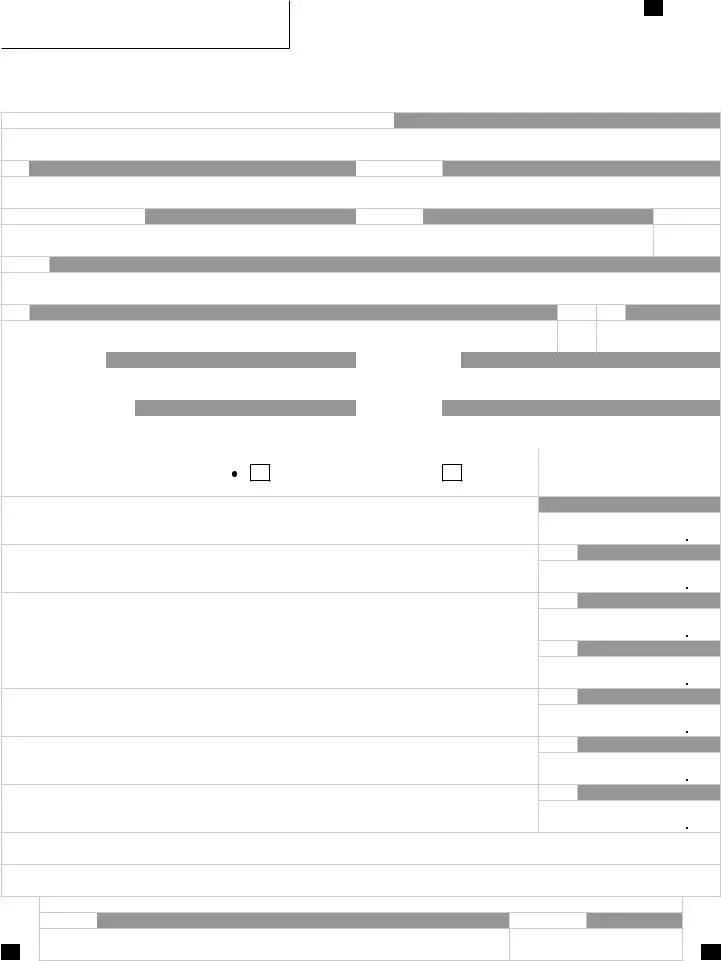

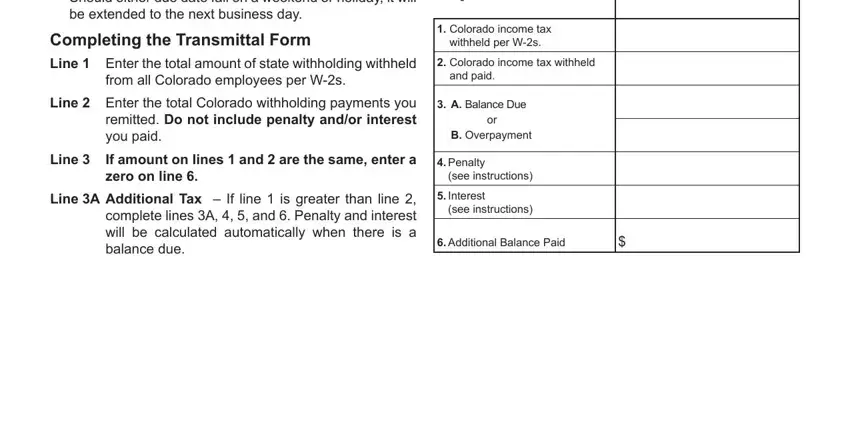

The particular sections will help make up the PDF document:

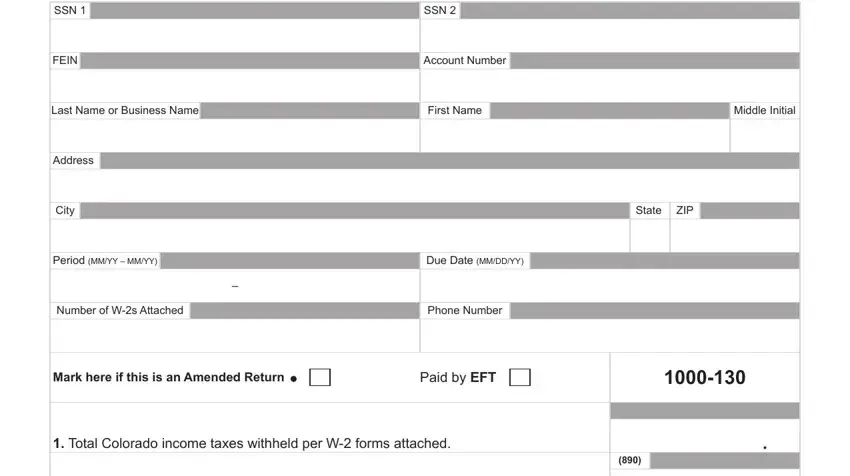

You should type in the data inside the section Colorado Department of Revenue, SSN, FEIN, SSN, Account Number, Last Name or Business Name, First Name, Middle Initial, Address, City, State, ZIP, Period MMYY MMYY, Due Date MMDDYY, and Number of Ws Attached.

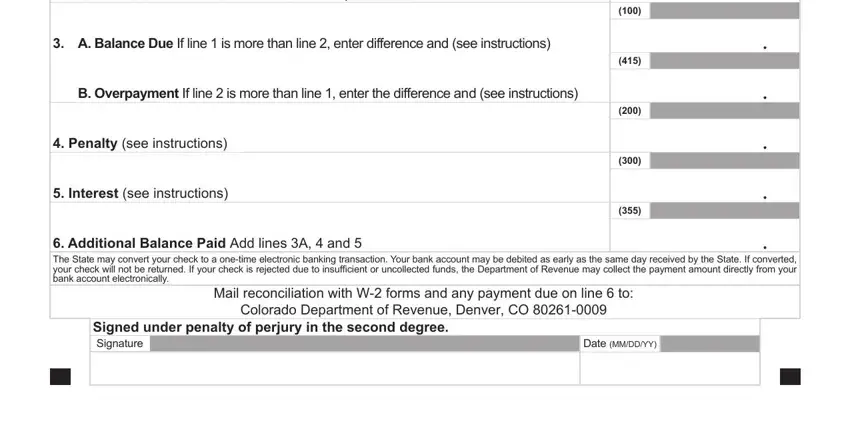

The system will demand you to present particular essential info to conveniently fill out the area Total Colorado income taxes, A Balance Due If line is more, B Overpayment If line is more, Penalty see instructions, Interest see instructions, Additional Balance Paid Add lines, Mail reconciliation with W forms, Signed under penalty of perjury in, and Date MMDDYY.

Step 3: As soon as you press the Done button, your finished file can be simply exported to each of your devices or to electronic mail stated by you.

Step 4: Have at least two or three copies of your file to prevent any specific upcoming challenges.