The DR-225 form is a vital document for registered taxpayers in Florida, essential for accurately reporting and paying documentary stamp taxes on unrecorded documents. This specialized return form must be submitted to the Florida Department of Revenue and is required from every person who executes or issues certain financial instruments within the state. Among these instruments are notes and other written obligations to pay money, including retail installment sale contracts and title loans, as well as bonds and transfers of interest in Florida real property. The taxes, calculated based on the money involved or property value, differ depending on the document type and, for real property, the location within Florida. The form outlines specific deadlines for submission and payment, emphasizing that returns are due by the 20th day following each reporting period. Late submissions incur penalties and interest, calculated as specified within the form. Designed for ease of completion, it requests details such as the tax due, surtaxes, penalties, interest, and total amount due, including a section for declaration and signature. Alongside these procedural aspects, the DR-225 form provides instructions for ensuring forms are machine-readable and how to handle changes in business information or ownership, reinforcing its role as a comprehensive tool for taxpayers navigating Florida's tax requirements.

| Question | Answer |

|---|---|

| Form Name | Dr 225 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | form documentary stamp, dr 225 tax form, form documentary tax, dr225 |

Mail to:

FLORIDA DEPARTMENT OF REVENUE 5050 W TENNESSEE ST TALLAHASSEE FL

Name and address if not preprinted:

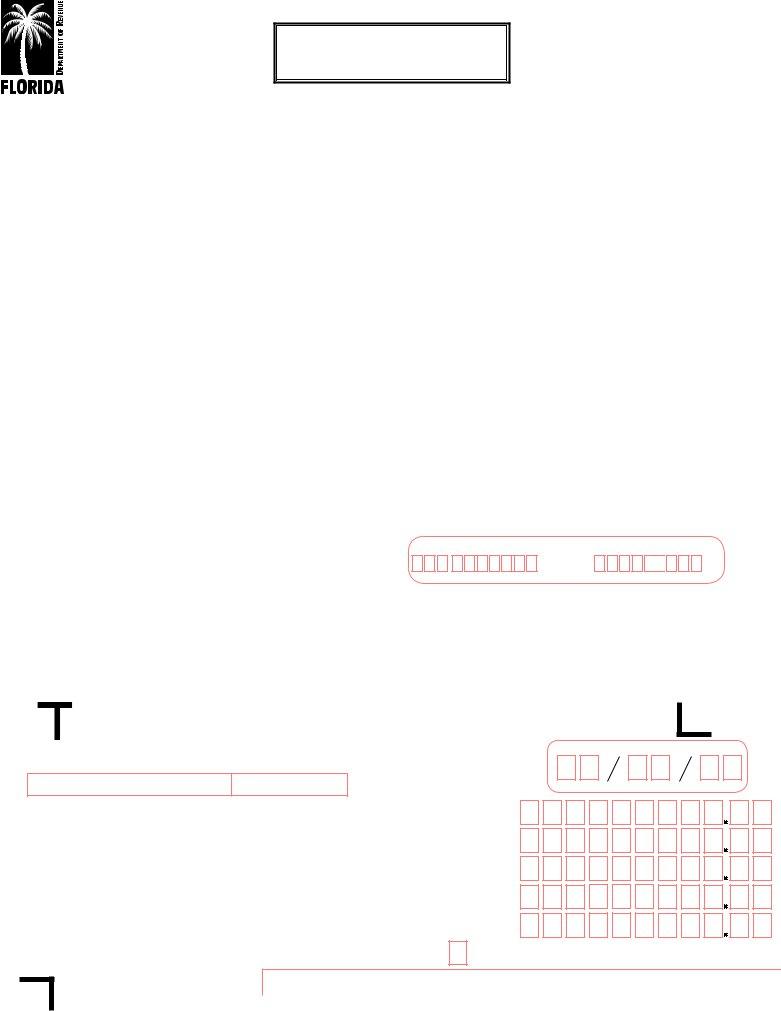

Documentary Stamp Tax Return

For Registered Taxpayers’

Unrecorded Documents

Certiicate #:

Business Partner #:

Contract Object #:

FEIN:

Reporting Period:

Location Address:

R. 01/16

Rule

Florida Administrative Code

Effective 01/16

Return due date: |

A return must be iled even if no tax is due or EFT payment sent. |

Who must ile a tax return? Every person who executes or issues instruments as described below, and is registered with the Department of Revenue, must report documentary stamp tax collected on unrecorded documents.

When are tax returns and payments due? Tax returns and payments are due by the 20th day of the month following each reporting period. If the 20th falls on a Saturday, Sunday, or state or federal holiday, your tax return must be postmarked or

20th. You must ile a tax return for each reporting period, even if no tax is due.

Taxpayers who make payments electronically can go to www.mylorida.com/dor/eservices to ind payment due date calendars and other

Notes and Other Written Obligations to Pay Money: Tax is calculated at $.35 per $100 or portion thereof. Florida law limits the maximum tax due on notes and other written obligations to $2,450. However, there is no limit on the tax due for a mortgage or other lien iled or recorded in Florida. Tax is due on documents that contain a promise to pay, a sum certain in money, and are executed or delivered in Florida. Examples include:

•Notes and other written obligations to pay

•Retail installment sale contracts

•Title loans

•Certain renewal notes

Bonds: Tax is calculated at $.35 per $100 or portion thereof. Tax is due on the original issuance of bonds in Florida, based on the face value of the bond.

Instruments Transferring Interest in Florida Real Property: For real property situated in any county in Florida, except

Instructions for Completing a

Use black ink. Do not make any stray marks in boxed ield areas.

|

Handwritten Example |

|

Typed Example |

||||||||

0 |

1 |

2 |

3 4 |

5 |

6 |

7 |

8 |

9 |

0 1 2 3 4 |

|

6 7 8 9 |

5 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Use black ink

**Detach coupon and return with payment.**

Florida Department of Revenue

Documentary Stamp Tax Return For Registered Taxpayers’ Unrecorded Documents

Be sure to sign and date reverse side.

DOR USE ONLY

Certiicate Number |

Reporting Period |

Location Address

Due:

Late After:

postmark or hand delivery date

|

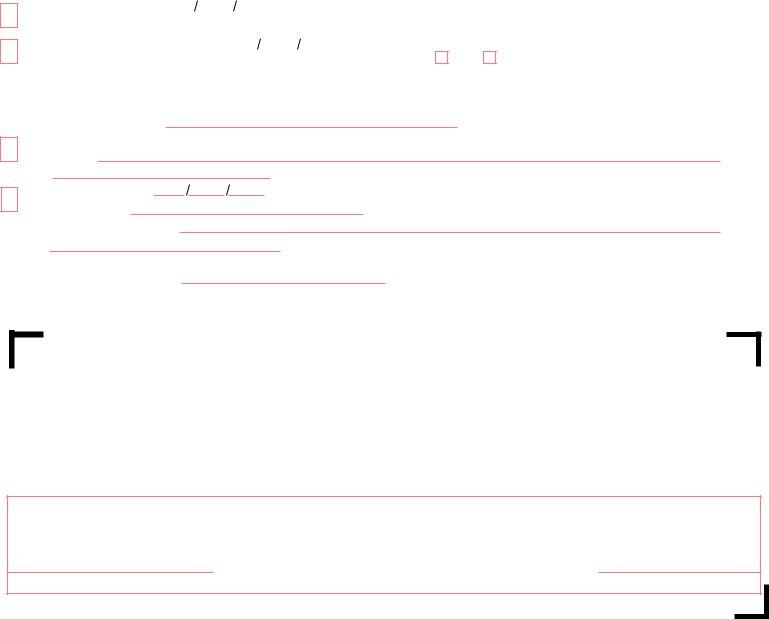

1. |

Documentary |

, |

, |

|

|

|

|

|||

|

|

Stamp Tax Due |

, |

, |

|

2. |

Surtax Due |

||||

|

|

||||

3. |

Penalty |

, |

, |

||

|

|

|

|||

|

4. |

Interest |

, |

, |

|

|

5. |

Amount Due With |

, |

, |

|

|

|

|

|||

|

|

Return |

|

|

|

|

|

Check here if payment was made electronically. |

|||

Do Not Write in the Space Below

9100 0 99999999 0019025033 9 400009999 9999 2

Instructions for Filing Documentary Stamp Tax Return

Line 1. Documentary Stamp Tax Due. Enter the total amount of documentary stamp tax collected.

Line 2. Surtax Due. Enter the total amount of surtax collected.

Line 3. Penalty. The penalty for a late tax payment is 10 percent for each month (or fraction of a month) the payment is late, not to exceed 50 percent of the tax due. The minimum penalty for a

Line 4. Interest. Interest is due from the date tax is due until paid. Florida law provides for a loating rate of interest for late payments of taxes due. The loating rate of interest is calculated based on a formula in section 213.235, Florida Statutes, and is updated on January 1 and July 1 of each year. To obtain interest rates go to the Department’s Internet site at www.mylorida.com/dor.

Line 5. Amount Due with Return. Add the amounts on Lines 1 – 4 and enter the total. Pay this amount with your return. Make your check payable to the Florida Department of Revenue. Check the box if you electronically transmitted your payment.

Sign and Date the Return. The person authorized to ile the

Resources: Visit the Department’s website at www.mylorida.com/dor or call Taxpayer Services, 8 a.m. to 7 p.m., ET, Monday through Friday, excluding holidays, at

Mail your return and payment to:

Florida Department of Revenue

5050 W Tennessee St

Tallahassee FL

Electronic Funds Transfer (EFT): Florida law requires certain taxpayers to pay taxes and ile tax returns electronically. Go to the Department’s Internet site to enroll or get information about electronic payment and iling requirements and procedures.

Change of Information

The legal entity changed on |

|

|

|

|

|

|

|

|

|

|

|

|

|

. If you change your legal entity and are continuing to do business in Florida, you must register |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

The business was closed permanently on |

|

|

|

|

|

|

|

|

|

|

|

|

|

. (The Department will cancel your documentary stamp tax certiicate number as of this date.) |

||||||||||||||||||||||||||||||||||||||

Are you a corporation/partnership required to ile corporate income tax returns? |

Yes |

No |

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax Certiicate |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

FEIN |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Business Partner Number

The business address has changed. New Address:

City:

The business was sold on

Name of New Owner:

Mailing Address of New Owner:

City:

t Signature of Taxpayer (Required):

State: |

|

|

ZIP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. The new owner information is: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

Telephone Number of New Owner: ( |

) |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

County: |

|

|

|

|

State: |

|

|

ZIP: |

|

|

|

|

|

|||||

|

|

|

Date: |

|

|

Telephone Number: ( |

) |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

**Detach coupon and return with payment**

Has Your Address or Business Information Changed?

oCheck here and complete the Change of Information form above.

Change of Ownership?

oIf you sell your business or ownership changes, check here and complete the Change of Information form above. You will also need to ile a inal return.

Final Return?

oCheck here if you are discontinuing your business and this is your inal return. Closing date: ______/______/______.

Under penalties of perjury, I declare that I have examined this tax return and the facts stated in it are true.

|

|

|

|

|

|

|

Signature of Authorized Taxpayer |

|

Title |

|

( ) Phone Number |

|

Date |

|

|

|

||||

|

|

|||||

|