Navigating the complexities of tax refunds for undyed diesel used in off-road or exempt purposes can be daunting, yet the DR-309639 form offers a structured avenue for taxpayers to reclaim their dues. Crafted by the Florida Department of Revenue, this form addresses the specific needs of individuals or entities that have paid taxes on undyed diesel fuel, subsequently used for off-road tasks or other exempted operations. Applicants are required to meticulously complete the form, providing information ranging from personal identification to intricate details of diesel usage, ensuring every red-fielded section is filled to avoid rejection. Alongside the primary application, supporting schedules guide the calculation of the refund amount, demanding an accurate account of diesel purchases, usage, and the tax implications thereof. The form not only caters to direct off-road applications but extends its benefit to activities like operating concrete mixers, compacting solid waste, or powering off-road equipment, provided these tasks comply with the stipulated conditions. Moreover, the DR-309639 form serves as a testament to the state's commitment to acknowledging the diverse utilizations of diesel fuel beyond propulsion, thereby offering a financial reprieve to taxpayers who adhere to the guidelines while contributing towards a more administratively efficient tax system.

| Question | Answer |

|---|---|

| Form Name | Dr 309639 Form |

| Form Length | 10 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 30 sec |

| Other names | form dr 309639 florida, dr 309639, fl dr 309639, dr 309639 refund |

Application for Refund of Tax Paid

on Undyed Diesel Used for

Mail to : Florida Department of Revenue

Refunds

PO Box 6490

Tallahassee FL

Fax:

Handwritten Example

0 1 2 3 4 5 6 7

R. 01/13

Rule

Florida Administrative Code

Effective 01/13

|

|

Typed Example |

8 |

9 |

0123456789 |

Use black ink.

NOTE: Your refund application will be rejected if ields in red are not completed in full.

Name of applicant/payee: Mailing street address:

Mailing city, state, ZIP:

Location street address:

Location city, state, ZIP:

Email address:

Sales & Use Tax number:

FEIN:

Business Partner Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

For invoices covering: |

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|||

month |

|

|

|

year through month |

|

|

|

year |

||||||||||||||||||||

Business telephone number (include area code): |

|

|

|

|

|

|

Fax number (include area code): |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

– |

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. Total Net Refund Requested (From Page 2, Part II, Line 13) |

$ |

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalty of perjury, I declare that I have read this application and the facts stated in it are true. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Applicant |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Person |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Include area code): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Who May Apply for Refunds?

Any person who purchases undyed,

On this application, you may take a credit for the fuel tax paid against the use tax due on the gallons consumed by a power

Tax Rates: The applicable tax rates are entered by the Department. The state tax rates on fuel, the county fuel tax rates, and the county discretionary sales surtax rates, as provided in sections 206.41, 206.87, 206.9825, 212.05, and 212.055, Florida Statutes (F.S.), are published annually in Taxpayer Information Publications on the Department’s website at www.mylorida.com/dor. The tax rates used to determine the amount of refund due are entered on this application by the Department. When computing use tax due, include the applicable surtax rate where the fuel is delivered.

For help in completing this form, please contact: |

Florida Department of Revenue |

||

|

|

|

Refunds |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

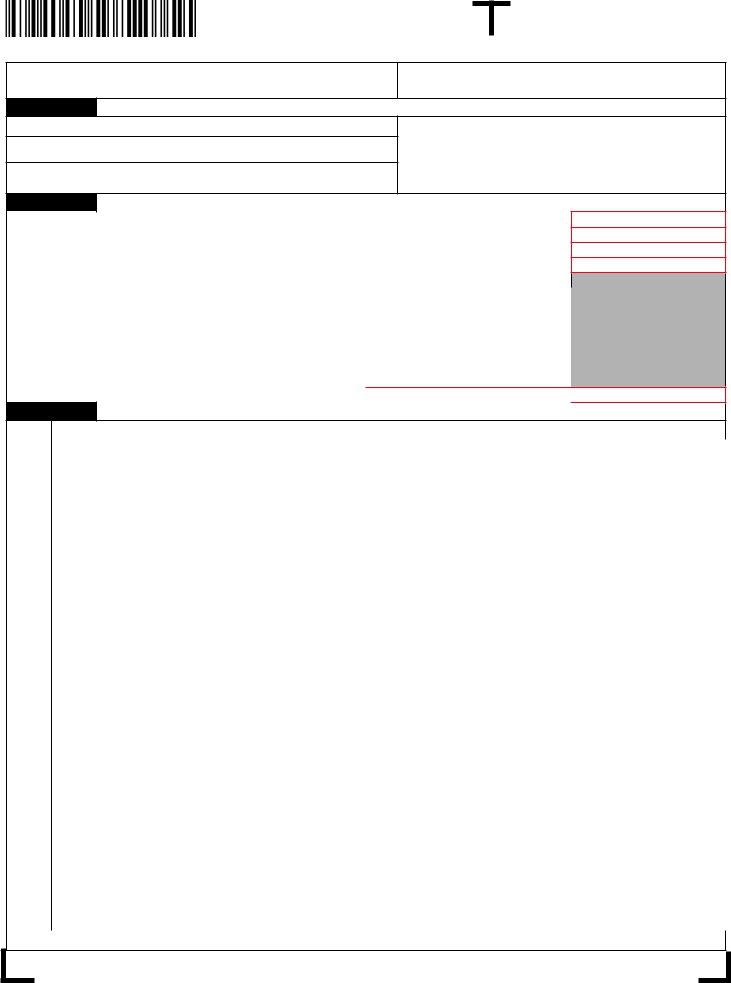

Name

R. 01/13

Page 2

FEIN

Category:

Please Check All Applicable Boxes: Note: This application can be used for more than one category of refund.

❑A Fuel used to turn a concrete mixer drum or to compact solid waste.

❑B Fuel used for unloading bulk cargo by pumping.

❑C Fuel used to propel

❑D Fuel used in

Part I:

1) |

Beginning Inventory (Measured on the irst day of the refund period) |

1. |

|||

2) |

Gallons Purchased (From completed Schedule |

2. |

|||

3) |

Ending Inventory (Measured on the last day of the refund period) |

3. |

|||

4) |

Gallons to be Accounted for (Lines 1 plus 2 minus 3) |

4. |

|||

5) |

Gallons Consumed in Trucks (For A and B users only) |

|

|||

|

a. |

Concrete Mixers/Solid Waste Compactors 5a. |

|

gals. |

|

|

|

|

|

|

|

|

b. |

Unloading by Pumping |

|

|

gals. |

|

(From completed Schedule ID, Part II) |

5b. |

|

|

|

6) |

Gallons Consumed for Other Exempt |

|

|||

|

c. |

To Propel |

6c. |

|

gals. |

|

|

|

|

|

|

|

d. |

6d. |

|

gals. |

|

|

|

|

|

|

|

7) |

Gallons Consumed for Highway Use (Line 4 minus Lines 5a, 5b, 6c, and 6d) |

7. |

|||

gals.

gals.

gals.

gals.

gals.

Part II:

Calculation of Refund Due Based on Categories Above:

A. Refund on Undyed Diesel Fuel Consumed by Concrete Mixers/Solid Waste Compactors:

8) |

Gallons Eligible for Refund (35% of Part 1, Line 5a) |

8. |

gals. |

|

|

|

|

9) |

Line 8 multiplied by Average Cost per Gallon (From Schedule 1B, see instructions) |

9. |

$ |

10) |

Fuel Tax Eligible for Refund (Line 8 multiplied by $.316) |

10. |

$ |

11) |

Sales Tax Due [Line 9 multiplied by (6% plus applicable surtax – see Schedule 1C)] 11. |

$ |

|

12) |

Net Refund Due (Line 10 minus Line 11) |

12. |

$ |

B. Refund on Undyed Diesel Fuel Consumed for Unloading Bulk Cargo by Pumping: |

|

|

|

8) |

Gallons Eligible for Refund (Part I, Line 5b) |

8. |

gals. |

|

|

|

|

9) |

Line 8 multiplied by the Average Cost per Gallon (From Schedule 1B, see instructions) 9. |

|

|

|

|

|

|

10) |

Fuel Tax Eligible for Refund (Line 8 multiplied by $.316) |

10. |

$ |

11) |

Sales Tax Due [Line 9 multiplied by (6% plus applicable surtax – see Schedule 1C) |

11. |

$ |

12) |

Net Refund Due (Line 10 minus Line 11) |

12. |

$ |

C. Refund on Undyed Diesel Fuel Used to Propel |

|

|

|

8) |

Gallons Eligible for Refund (Part I, Line 6c) |

8. |

gals. |

|

|

|

|

9) |

Line 8 multiplied by the Average Cost per Gallon (From Schedule 1B, see instructions) 9. |

$ |

|

10) |

Fuel Tax Eligible for Refund (Line 8 multiplied by $.316) |

10. |

$ |

11) |

Sales Tax Due [Line 9 multiplied by (6% plus applicable surtax – see Schedule 1C)] 11. |

$ |

|

12) |

Net Refund Due (Line 10 minus Line 11) |

12. |

$ |

D. Refund on Undyed Diesel Fuel Used in |

|||

8) |

Gallons Eligible for Refund (Part I, Line 6d) |

8. |

gals. |

|

|

|

|

9) |

Line 8 multiplied by the Average Cost per Gallon (From Schedule 1B, see instructions) 9. |

$ |

|

10) |

Fuel Tax Eligible for Refund (Line 8 multiplied by $.316) |

10. |

$ |

11) |

Sales Tax Due [Line 9 multiplied by (6% plus applicable surtax – see Schedule 1C)] 11. |

$ |

|

12) |

Net Refund Due (Line 10 minus Line 11) |

12. |

$ |

13) |

Total Net Refund Requested (Sum of applicable Line 12 totals |

|

|

for Sections A, B, C, D. Carry forward to Page 1, Line 13) |

13. |

$ |

|

Note: Total gallons eligible for refund cannot exceed Part I, Line 4 (Gallons to be Accounted for).

R.01/13 Page 3

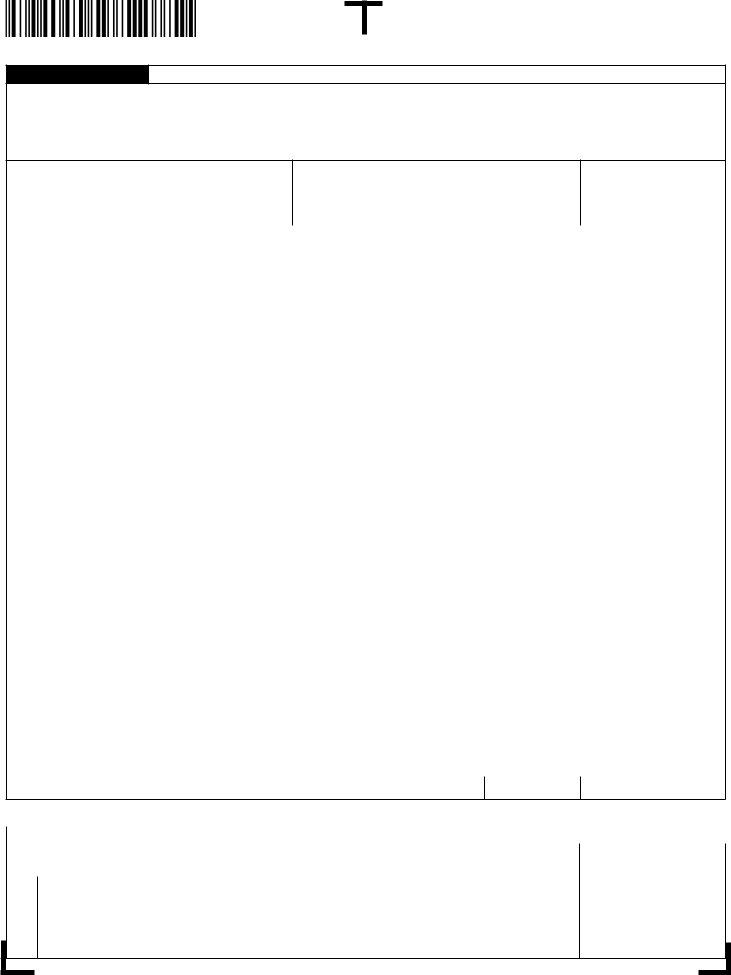

Schedule 1A

Schedule of Purchase of

You must complete and include this schedule with your application to qualify for the refund. In addition, the following information must be made available upon request to validate proof of purchase and taxes paid.

•Invoice from retail station where undyed diesel was purchased and placed directly into the supply tank of a qualifying motor vehicle.

•Invoice from bulk fuel provider. If fuel is placed into qualifying vehicles from bulk storage, you must maintain the original proof of purchase and you must include a daily withdrawal summary of

Applicant Name |

FEIN |

Invoiced Through Date |

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

Name of Supplier |

Supplier FEIN/DEP Number |

Date Received |

Invoice Number |

Gallons Invoiced |

Invoiced Price Including Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS

|

Schedule 1B |

Average Cost per Gallon Computation |

|

|

|

|

|

|

|

1 |

|

Total State and Local Option Fuel Tax Paid on Fuel Purchases: |

$ |

|

|

|

(Total of Column 5 from Schedule 1A multiplied by $.316) |

|

|

|

|

|

|

|

2. |

|

Total Cost of Purchased Fuel Less State and Local Option Tax: |

$ |

|

|

|

(Total of Column 6 from Schedule 1A minus Line 1 from Schedule 1B) |

|

|

|

|

|

|

|

3. |

|

Average Cost per Gallon: |

$ |

|

(Total of Line 2 from Schedule 1B divided by Column 5 from Schedule 1A), carried out four decimal

places |

R. 01/13

Page 4

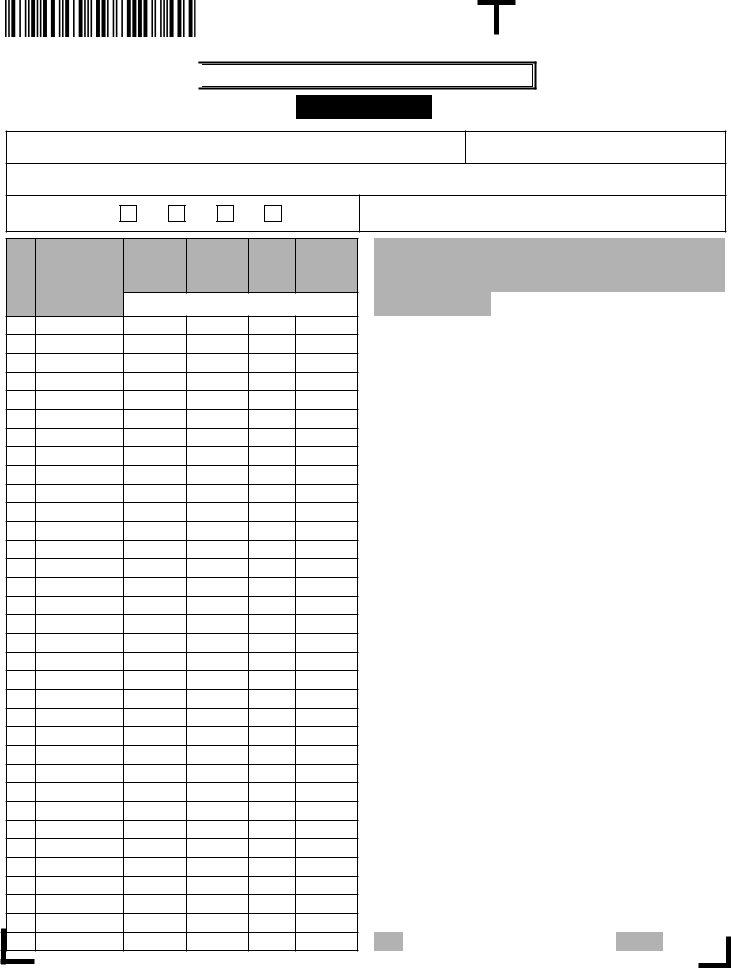

Computation of Sales Tax Due by County

Schedule 1C

License No.: |

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

|

Category: |

A |

B |

|

C |

|

D |

|

|

|

|

|

|

GALLONS |

|

*ACPG |

|

|

|

|

CODE |

|

|

SUBJECT |

|

FROM |

|

RATE |

|

SALES TAX |

|

|

TAX |

|

1B |

|

|

DUE |

||

|

COUNTY |

|

TO SALES |

|

SCHEDULE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GALLONS |

X |

ACPG |

X |

RATE |

= |

SALES TAX |

|

|

|

|

|

|

|

|

|

DUE |

11 |

ALACHUA |

|

|

|

|

|

0.06 |

|

|

12 |

BAKER |

|

|

|

|

|

0.07 |

|

|

13 |

BAY |

|

|

|

|

|

0.065 |

|

|

14 |

BRADFORD |

|

|

|

|

|

0.07 |

|

|

15 |

BREVARD |

|

|

|

|

|

0.065 |

|

|

16 |

BROWARD |

|

|

|

|

|

0.06 |

|

|

17 |

CALHOUN |

|

|

|

|

|

0.075 |

|

|

18 |

CHARLOTTE |

|

|

|

|

|

0.07 |

|

|

19 |

CITRUS |

|

|

|

|

|

0.06 |

|

|

20 |

CLAY |

|

|

|

|

|

0.07 |

|

|

21 |

COLLIER |

|

|

|

|

|

0.06 |

|

|

22 |

COLUMBIA |

|

|

|

|

|

0.07 |

|

|

23 |

DADE |

|

|

|

|

0.07 |

|

|

|

24 |

DESOTO |

|

|

|

|

|

0.075 |

|

|

25 |

DIXIE |

|

|

|

|

|

0.07 |

|

|

26 |

DUVAL |

|

|

|

|

|

0.07 |

|

|

27 |

ESCAMBIA |

|

|

|

|

|

0.075 |

|

|

28 |

FLAGLER |

|

|

|

|

|

0.07 |

|

|

29 |

FRANKLIN |

|

|

|

|

|

0.07 |

|

|

30 |

GADSDEN |

|

|

|

|

|

0.075 |

|

|

31 |

GILCHRIST |

|

|

|

|

|

0.07 |

|

|

32 |

GLADES |

|

|

|

|

|

0.07 |

|

|

33 |

GULF |

|

|

|

|

|

0.07 |

|

|

34 |

HAMILTON |

|

|

|

|

|

0.07 |

|

|

35 |

HARDEE |

|

|

|

|

|

0.07 |

|

|

36 |

HENDRY |

|

|

|

|

|

0.07 |

|

|

37 |

HERNANDO |

|

|

|

|

|

0.06 |

|

|

38 |

HIGHLANDS |

|

|

|

|

|

0.07 |

|

|

39 |

HILLSBOROUGH |

|

|

|

|

0.07 |

|

|

|

40 |

HOLMES |

|

|

|

|

|

0.07 |

|

|

41 |

INDIAN RIVER |

|

|

|

|

|

0.07 |

|

|

42 |

JACKSON |

|

|

|

|

|

0.075 |

|

|

43 |

JEFFERSON |

|

|

|

|

|

0.07 |

|

|

44 |

LAFAYETTE |

|

|

|

|

|

0.07 |

|

|

Period: / / to / /

(Choose one. Use a separate schedule for each applicable category. See Page 2 for explanation of categories.)

|

|

GALLONS |

|

*ACPG |

|

|

|

|

|

CODE |

|

SUBJECT |

|

FROM |

|

|

RATE |

SALES TAX |

|

|

TAX |

|

1B |

|

|

DUE |

|

||

|

COUNTY |

TO SALES |

|

SCHEDULE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GALLONS |

X |

ACPG |

X |

RATE = SALES TAX |

|

||

|

|

|

|

|

|

|

|

DUE |

|

|

|

|

|

|

|

|

|

|

|

45 |

LAKE |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

46 |

LEE |

|

|

|

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

47 |

LEON |

|

|

|

|

|

0.075 |

|

|

|

|

|

|

|

|

|

|

|

|

48 |

LEVY |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

49 |

LIBERTY |

|

|

|

|

|

0.075 |

|

|

|

|

|

|

|

|

|

|

|

|

50 |

MADISON |

|

|

|

|

|

0.075 |

|

|

|

|

|

|

|

|

|

|

|

|

51 |

MANATEE |

|

|

|

|

|

0.065 |

|

|

|

|

|

|

|

|

|

|

|

|

52 |

MARION |

|

|

|

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

53 |

MARTIN |

|

|

|

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

54 |

MONROE |

|

|

|

|

|

0.075 |

|

|

|

|

|

|

|

|

|

|

|

|

55 |

NASSAU |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

56 |

OKALOOSA |

|

|

|

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

57 |

OKEECHOBEE |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

58 |

ORANGE |

|

|

|

|

|

0.065 |

|

|

|

|

|

|

|

|

|

|

|

|

59 |

OSCEOLA |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

60 |

PALM BEACH |

|

|

|

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

61 |

PASCO |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

62 |

PINELLAS |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

63 |

POLK |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

64 |

PUTNAM |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

65 |

ST. JOHNS |

|

|

|

|

|

0.06 |

|

|

|

|

|

|

|

|

|

|

|

|

66 |

ST. LUCIE |

|

|

|

|

|

0.065 |

|

|

|

|

|

|

|

|

|

|

|

|

67 |

SANTA ROSA |

|

|

|

|

|

0.065 |

|

|

|

|

|

|

|

|

|

|

|

|

68 |

SARASOTA |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

69 |

SEMINOLE |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

70 |

SUMTER |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

71 |

SUWANNEE |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

72 |

TAYLOR |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

73 |

UNION |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

74 |

VOLUSIA |

|

|

|

|

|

0.065 |

|

|

|

|

|

|

|

|

|

|

|

|

75 |

WAKULLA |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

76 |

WALTON |

|

|

|

|

|

0.075 |

|

|

|

|

|

|

|

|

|

|

|

|

77 |

WASHINGTON |

|

|

|

|

|

0.07 |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*AVERAGE COST PER GALLON

R.01/13 Page 5

Unit Type Identiication Worksheet

Schedule 1D, Part IA

(3) Serial Number (VIN)

(2) Year, Make and Model

(1) Unit Type

R. 01/13

Page 6

Schedule 1D, Part IB |

Unit Type Categories Deined |

|

|

|

|

Percentage |

Unit Types |

Deinition |

|

|

|

10% |

Asphalt Truck |

A truck used to distrubute asphalt concrete utilizing a power |

|

|

unload the product. |

|

|

|

15% |

Boom Truck |

A truck that has a hydraulically driven boom mounted on a turret afixed to the truck which |

|

|

utilizes a power |

|

|

|

20% |

Bulk Feed Truck |

A truck used to deliver feed utilizing a power |

|

|

product. |

|

|

|

10% |

Car Carrier w/Hydraulic Winch |

A truck that transports vehicles from one location to another using a hydraulic lift to unload |

|

|

vehicles. |

|

|

|

40% |

Concrete Pumper |

A vehicle with a mounted boom used to transfer liquid concrete by pumping. |

|

|

|

15% |

Dump Trailer |

A trailer used for transporting loose material (such as sand, gravel, or dirt) for construction. |

|

|

A typical dump trailer is equipped with a hydraulically operated |

|

|

the rear, the front of which can be lifted up to allow the contents to be deposited on the |

|

|

ground behind the triler at the site of delivery. The trailor must operate using the fuel in the |

|

|

fuel supply tank of the motor vehicle. |

|

|

|

20% |

Dump Truck |

A truck used for transporting loose material (such as sand, gravel, or dirt) for construction. |

|

|

A typical dump truck is equipped with a hydraulically operated |

|

|

rear, the front of which can be lifted up to allow the contents to be deposited on the ground |

|

|

behind the truck at the site of delivery. |

|

|

|

35% |

Fertilizer Spreader Truck |

A truck mounted spreader that uses a pump or power |

|

|

|

15% |

Hot Asphalt Distribution Truck |

A truck having an insulated tank, heating system and distribution system used to spray a |

|

|

base layer of diesel, kerosene, or vegetable oil at a uniformed rate on the surface before |

|

|

laying asphalt concrete. |

|

|

|

25% |

Lime Spreader |

A truck mounted spreader that uses a pump or power |

|

|

|

10% |

Motor Fuel Delivery Vehicle |

A truck used to deliver fuel utlizing a power |

|

|

product. |

|

|

|

30% |

Milk Tank Truck |

A motor vehicle designed to carry milk and discharges the milk using a power |

|

|

engine exhaust. |

|

|

|

35% |

Mobile Crane |

A motor vehicle that consist of an attached rotating superstructure for lifting and lowering a |

|

|

load and moving it horizontally by means of a pump. |

|

|

|

15% |

Pneumatic Tank Truck |

A truck with a pneumatic tank that uses a power |

|

|

tank to unload product. |

|

|

|

15% |

Seeder Truck |

A truck with a seeder unit mounted on the chassis. |

|

|

|

15% |

Spray Truck |

A truck mounted with a spray device for the purpose of spraying seeds, fertilizer or other |

|

|

solids or liquids utilizing a power |

|

|

|

20% |

Tank Truck |

A motor vehicle designed to carry liquid commodities and discharges such commidities |

|

|

using a power |

|

|

|

10% |

All Others |

Any other qualifying motor vehicle that uses |

|

|

power |

|

|

|

R.01/13 Page 7

Schedule 1D, Part II

Computation of Eligible Gallons Consumed for Unloading Bulk Cargo by Pumping Worksheet

You must complete and include this schedule with your application to qualify for refund.

(A) |

(B) |

(C) |

(D) |

(E) |

Number of Unit Type |

Unit Type |

Total Gallons Consumed by |

Percentage Allowed |

Refundable Gallons = (C) x (D) |

|

|

Qualifying Vehicle |

for |

|

|

|

|

|

|

|

Asphalt Truck |

|

10% |

|

|

|

|

|

|

|

Boom Truck |

|

15% |

|

|

|

|

|

|

|

Bulk Feed Truck |

|

20% |

|

|

|

|

|

|

|

Car Carrier with |

|

10% |

|

|

Hydraulic Winch |

|

|

|

|

|

|

|

|

|

Concrete Pumper |

|

40% |

|

|

|

|

|

|

|

Dump Trailer |

|

15% |

|

|

|

|

|

|

|

Dump Truck |

|

20% |

|

|

|

|

|

|

|

Fertilizer Spreader |

|

35% |

|

|

Truck |

|

|

|

|

|

|

|

|

|

Hot Asphalt |

|

15% |

|

|

Distribution Truck |

|

|

|

|

|

|

|

|

|

Lime Spreader |

|

25% |

|

|

|

|

|

|

|

Motor Fuel Delivery |

|

10% |

|

|

Vehicle |

|

|

|

|

|

|

|

|

|

Milk Tank Truck |

|

30% |

|

|

|

|

|

|

|

Mobil Crane |

|

35% |

|

|

|

|

|

|

|

Pneumatic Tank Truck |

|

15% |

|

|

|

|

|

|

|

Seeder Truck |

|

15% |

|

|

|

|

|

|

|

Spray Truck |

|

15% |

|

|

|

|

|

|

|

Tank Truck |

|

20% |

|

|

|

|

|

|

|

All Others |

|

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total gallons consumed

Total gallons of undyed diesel fuel consumed unloading bulk cargo by pumping. Carry this amount to

Page 2, Part 1 Line 5B and Part ll Section B, Line 8 of this return.

Instructions for Completing Application for Refund of Tax Paid on Undyed Diesel Fuel Used for

R.01/13 Page 8

APower of Attorney, Florida Department of Revenue Form

Instructions for Page 2

Category:

Check the appropriate boxes based on use of diesel fuel. If the fuel is used for more than one purpose, please check all boxes that apply. This application must be iled within 3 years after the date the tax was paid.

Part I:

Line 1: Beginning Inventory – Enter the physical inventory of gallons measured on the irst day of the refund period before you include any purchases. Your beginning inventory must be the same as your ending inventory from the previous iling period.

Line 2: Gallons Purchased – Enter the number of diesel fuel gallons purchased during the refund period stated on Page 2, Part I, Line 2 of this Application for Refund. Schedule 1A of this application should be used for purchases made in the year stated on the front page of the application. You must use an application for the year in which the tax was paid. Prior year applications may be obtained from the Department’s Internet site at www.mylorida.com/dor/forms or by calling Refunds at

Line 3: Ending Inventory – Enter the physical inventory of gallons measured on the last day of the refund period.

Line 4: Gallons to be Accounted For – Add Line 1 plus Line 2. Subtract Line 3 from the result and enter here.

Line 5: Gallons Consumed in Trucks –

5(a) – Enter the gallons used to turn concrete mixer drums or to compact solid waste. 5(b) – Enter the gallons used to unload bulk cargo by pumping.

Line 6: Gallons Consumed for Other Exempt

6(c) – Enter the gallons used to propel

6(d) – Enter the gallons used in

Line 7: Gallons Consumed for Highway Use – Enter the amount on Line 4 (Gallons to be Accounted For) minus the total of Lines 5(a) and 5(b) (gallons consumed in trucks) minus the total of Lines 6(a) and 6(b) (gallons consumed for other purposes).

Part II:

The gallons eligible for a refund are subject to use tax under s. 212.0501, F.S., based on the average cost per gallon. The average cost per gallon is calculated on the cost of the fuel less the state and local option taxes.

A.A refund will be granted on 35% of the diesel fuel gallons consumed by vehicles using the fuel to turn concrete mixer drums or to compact solid waste as follows:

Gallons Eligible for Refund = .35 multiplied by Line 5(a) from Part I

Sales Tax Due = (.06 plus surtax) multiplied by (Average Cost per Gallon from Schedule 1B) multiplied by eligible gallons*

Net Refund Due = Tax on Eligible Gallons minus Sales Tax Due

B.A refund will be granted for undyed diesel fuel used by a power

Gallons Eligible for Refund = Part I, Line 5(b)

Sales Tax Due = (.06 plus surtax) multiplied by (Average Cost per Gallon From Schedule 1B) multiplied by eligible gallons*

Net Refund Due = Tax on Eligible Gallons minus Sales Tax Due

Tax paid on undyed diesel fuel consumed for unloading bulk cargo by pumping is subject to refund if the fuel is from the same supply tank that fuels the highway vehicle. The refund is only for the fuel consumed for unloading bulk cargo by pumping and not for fuel used to power the vehicle over the highway.

R. 01/13

Page 9

Carry the total gallons of undyed diesel fuel consumed for unloading bulk cargo by pumping to Page 2, Part I, Line 5b, and Part II, Section B, Line 8 of the return.

You must complete Schedule 1D, Part IA using Schedule 1D, Part IB and Schedule 1D, Part II. Include Schedule 1D, Part IA and Schedule 1D Part II when you ile your Application for Refund of Tax Paid on Undyed Diesel Used for

C.A refund will be granted for

Gallons Eligible for Refund = Part I, Line 6(c)

Sales Tax Due = (.06 plus surtax) multiplied by (Average Cost per Gallon from Schedule 1B) multiplied by eligible gallons*. The rate for each county is entered by the Department.

Net Refund Due = Tax on Eligible Gallons minus Sales Tax Due

D.A refund will be granted for

Gallons Eligible for Refund = Part I, Line 6(d)

Sales Tax Due = (.06 plus surtax) multiplied by (Average Cost per Gallon from Schedule 1B) multiplied by eligible gallons*.

Net Refund Due = Tax on Eligible Gallons minus Sales Tax Due

*Since the refund of fuel tax is offset against the liability of sales and use tax, DO NOT report sales and use tax for these same gallons on the Sales Tax Return

First time ilers must complete this application and submit the following documentation for the refund to be considered complete. First time iling requirements also apply to any taxpayer adding a new category or a category not claimed on prior refund applications.

1.Copy of tax paid invoices or fuel management reports. For subsequent ilings, the taxpayer is allowed to submit a schedule in lieu of tax paid invoices or fuel management reports. The schedule must include the same information as required on invoices.

2.Explanation of how fuel was used. For subsequent ilings, the taxpayer need only provide this document when fuel usage changes.

3.Equipment list. The equipment list must be updated when eligible equipment is added or deleted.

4.Power of Attorney form (Form

All applications for refund must contain suficient information and documentation for the Department to determine the amount of the refund claim due. This information and documentation must also be maintained at your place of business. If your application does not contain the information and documentation required for the Department to determine the amount of refund due, the Department will issue a written request to you for the additional information or documentation required to determine the amount of refund due. The written request will be issued within 30 days of receipt of your application.

Schedule Instructions

Schedule 1A – Schedule of Purchases of

The Schedule of Purchases provides detail to support fuel purchases. If you do not provide all information required under Columns 1 through 6 of this schedule, your refund will be reduced or denied. If you need additional copies of schedules, photocopy as many copies as you need to provide the required information.

A fuel management report may substitute for the Schedule of Purchases (1A). However, the fuel management report must be in the same format and provide the same information as required on the Schedule of Purchases (1A), except for Column 2.

R. 01/13

Page 10

When reporting less than .50 gallons, round down to the nearest whole gallon. If reporting .50 gallons or greater, round up to the nearest whole gallon.

Schedule 1B – Average Cost per Gallon Computation

Schedule 1C – Computation Schedule of Sales Tax Due by County

Complete a separate Schedule 1C for each refund category (A, B, C, or D) listed on Page 2, Part II of your refund application.

Schedule 1D – To be completed by Category B ilers only

Schedule 1D, Part IA – Unit Type Identiication Worksheet

Tax paid on undyed diesel fuel consumed for unloading bulk cargo by pumping is subject to refund if the fuel is from the same supply tank that fuels the highway vehicle. The refund is only for the fuel consumed for unloading bulk cargo by pumping and not for fuel used to power the vehicle over the highway.

To claim a refund, you must complete Schedule 1D, Part IA, and Schedule 1D, Part II and include them when you ile your

Column Instructions for Schedule 1D, Part IA , Unit Type Identiication Worksheet:

Use this schedule to identify the units that qualify for the refund.

Column 1. Unit Type – Enter the type of vehicle from Schedule 1D, Part IB, Unit Type Categories Deined, that corresponds to your unit type.

Column 2. Year, Make, and Model – Enter the year of the vehicle, the manufacturer, and the model. (example, 2009, Ford

Column 3. Serial Number (VIN) – Enter the vehicle identiication number assigned by the manufacturer.

Schedule 1D, Part IB – Unit Type Categories Deined

Use this schedule to determine the total gallons of undyed diesel fuel consumed unloading bulk cargo by pumping. Carry this amount to Page 2, Part 1, Line 5B and Part II, Section B, Line 8.

Schedule 1D, Part II – Computation of Eligible Gallons Consumed for Unloading Bulk Cargo by Pumping Worksheet)

A refund of tax paid on undyed diesel fuel will be granted based on a percentage of gallons consumed by a qualifying vehicle. The term “consumed by a qualifying vehicle” means fuel consumed for unloading bulk cargo by pumping and fuel used to propel the vehicle. Applicants using the unit type “All Others” from Page 6, Schedule 1D, Part 1B, will be required to meet the same requirements for irst time ilers and must provide vehicle speciications to the Department.

Use this schedule to calculate the total gallons of undyed diesel used for unloading bulk cargo by pumping.

Column A. Number of Units – List the number of units for each category type.

Column B. Type of Unit – This column represents the unit categories that are subject to refund.

Column C. Total Gallons Consumed – List the total gallons consumed by each unit category type. The gallons reported in this column must include undyed diesel fuel consumed for unloading bulk cargo by pumping and fuel used to propel the vehicle.

Column D. Percentage Allowed for

Column E. Refundable Gallons – Calculate the number of gallons eligible for refund by multiplying Column (C) times Column (D).

Carry the total gallons of undyed diesel fuel consumed for unloading bulk cargo by pumping is Page 2, Part I, Line 5b, and Part II, Section B, Line 8 of the return.

Computation of Eligible Gallons Consumed for Unloading Bulk Cargo by Pumping (Schedule 1D, Part II Worksheet)

A refund of tax paid on undyed diesel fuel will be granted based on a percentage of gallons consumed by a qualifying vehicle. The term “consumed by a qualifying vehicle” means fuel consumed for unloading bulk cargo by pumping and fuel used to propel the vehicle. Applicants using the unit type “All Others” from Page 5, Schedule 1D, Part 1B, will be required to meet the same requirements for irst time ilers and must provide vehicle speciications to the Department.