One of the most important forms that you will ever fill out in your life is the Dssr 130 form. This form is used to apply for social security benefits, and if you fill it out incorrectly, you could end up with a lot of headaches down the road. Make sure to take your time filling out this form, and consult with a lawyer or accountant if you have any questions. The last thing you want to do is mess up your application and miss out on valuable social security benefits.

| Question | Answer |

|---|---|

| Form Name | Dssr 130 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | ds 0120 worksheet, dssr 130 pdf fillable, ds 0120 03 2015 tqsa worksheet worksheet for employee to process tqsa claim, dssr 120 |

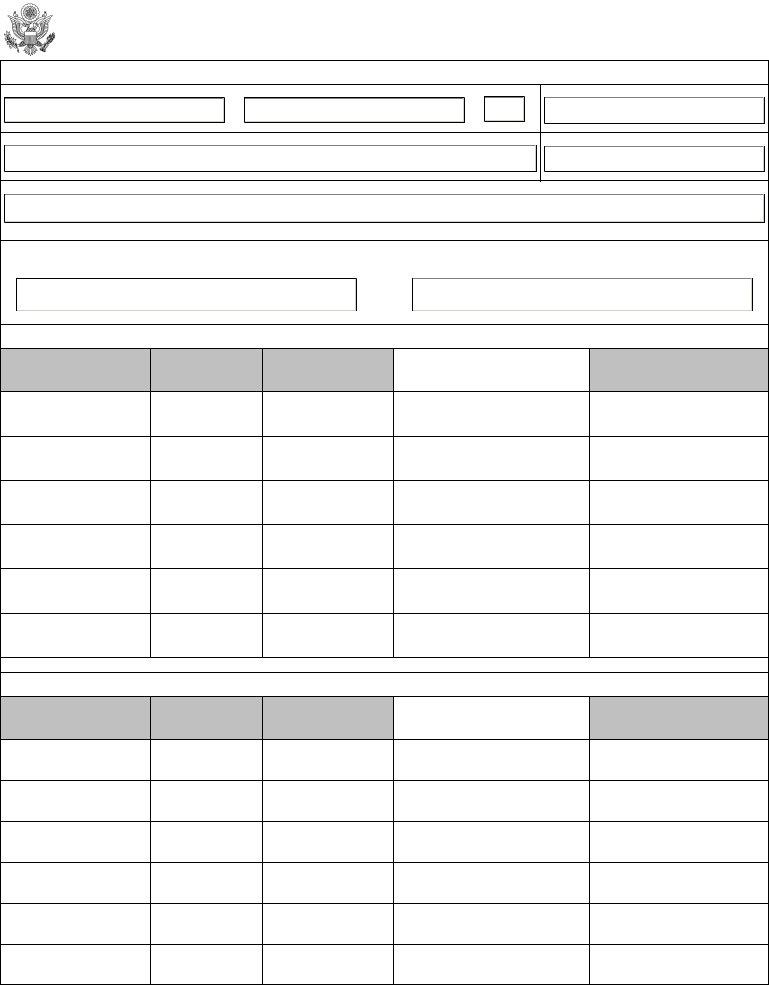

U.S. Department of State

LQA - LIVING QUARTERS ALLOWANCE ANNUAL/INTERIM EXPENDITURES

WORK SHEET (DSSR 130)

Allowable expenses under the Living Quarters Allowance are reported here to process a claim on the

1. Employee Name (Last, First, MI) |

2. Agency |

3. Pay Plan/Series/Grade/Annual Salary

4. Date of Arrival

5.Current Post/Country of Assignment/Locality Code

6.If Spouse or Domestic Partner is Employed by the U.S. Government:

Spouse's or Domestic Partner's Name |

Quarters Allowance Received |

7. Family Domiciled at Post

Name of Family Member

Relationship

DOB Except Spouse or Domestic Partner

Percentage of |

Date of Arrival at |

Support |

Post |

|

|

|

|

Residence

Address

8. Family Domiciled Away From Post

Name of Family Member

Relationship

DOB Except Spouse or Domestic Partner

Percentage of |

Date of Arrival at |

Support |

Post |

|

|

|

|

Residence

Address

Page 1 of 4 |

|

|

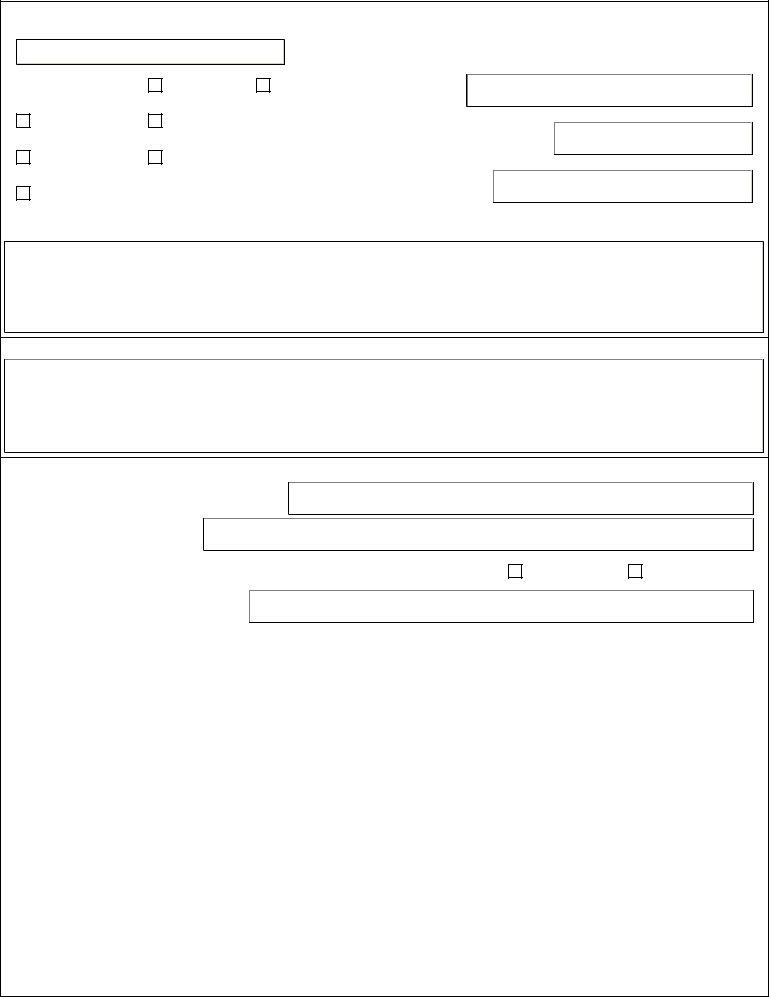

9. Description of Quarters Occupied by the Employee

|

|

|

Date of Quarters Occupied |

|

|

Quarters Size: Total rooms should include dining room, living room, kitchen, |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

bedrooms, den, and bathrooms. |

|

|

|

|

|

|

|

|

|

|

Type of Quarters |

|

House |

|

Apartment |

|||

|

|

|

||||||

|

|

|

Furnished |

|

Unfurnished |

|

|

Total Rooms |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Total Useable Square Footage |

|

|

|

Privately Leased |

|

Government Owned or Leased |

|||

|

|

|

|

|||||

|

|

|

Personally Owned |

|

|

|

|

or Square Meters |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

10. If employee shares quarters, give name of person(s) with whom sharing and the employing firm or agency. |

||||||||

11. If employee rents quarters from another U.S. government employee, give name of that employee and employing agency.

12.If employee lets or sublets portion of his owned or leased quarters:

(a)Name of sublessee and employing agency or firm

(b)Amount received from sublessee

(c) Has amount received from sublessee been deducted from expenses claimed under Block 16? |

|

Yes |

|

No |

(d)Date let or sublet

Page 2 of 4

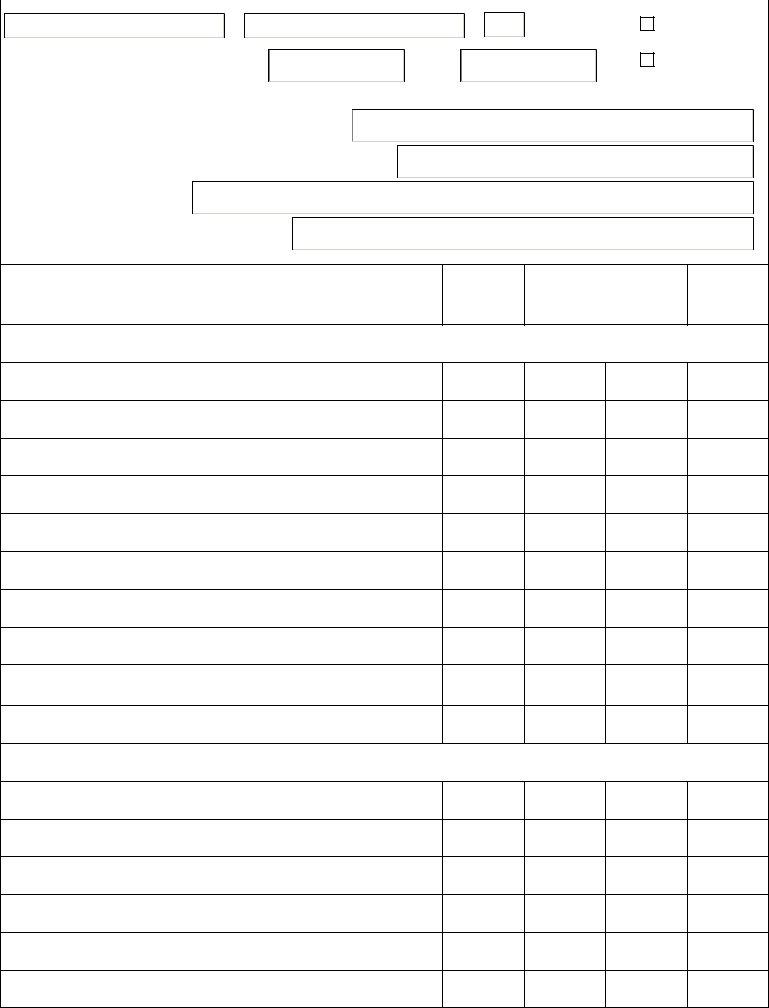

13. Employee Name (Last, First, MI) |

|

|

14. Check One: |

||

|

|

|

|

|

Estimated or |

|

|

|

|

|

|

LQA Expenses for the Period |

From |

To |

|

|

Actual |

|

|

||||

|

|

|

|||

|

|

|

|

|

|

15. FOR OFFICIAL USE ONLY

Foreign currency rate used to compute expenses listed under item 16

For personally owned quarters (POQ), date of original purchase

Exchange rate at time of purchase

Number of years already claimed for rent portion of LQA

16.The following expenses were actually incurred or are estimated for the period claimed in Block 14. Expenses should be supported by lease or rental agreement, receipts or canceled checks. If unobtainable, explain why under Block 17, Remarks.

(A)

Foreign

Currency

Expenses

(B) |

(C) |

U.S. Dollar |

For Official |

Expenses |

Use Only |

|

|

(D)

For Official

Use Only

Items (a) through (j) are rent and

(a)Rent, if leased; or 10% of original purchase price, if owned (Claim limit: 10 years)

(b)Garage rental (Not to exceed 25% of maximum LQA rate)

(c)Furniture rental (Not to exceed 25% of maximum LQA rate)

(d)Insurance on rented property and/or furnishings required by local law to be paid by lessee

(e)Taxes levied by the local government and required by law or custom to be paid by lessee

(f)Land rent, if required by local law or custom (Applies only to POQ)

(g)Agent's fee if mandatory by law or custom and is condition of obtaining lease

(h)Apartment/Condominium fees (Excluding single family dwelling and POQ)

(i)Interest on a loan from American Institution To finance "Key Money" paid to landlord

(j)Appreciation fee paid directly to landlord. Must appear on lease or rental agreement

Items (k) through (o) are utilities and utility related expenses

(k)Heat - Gas, Fuel

(I) Electricity

(m)Other Heat, Fuel (specify)

(n)Water

(o)Garbage and Trash Disposal

Total Expenses Claimed For This Period

Page 3 of 4 |

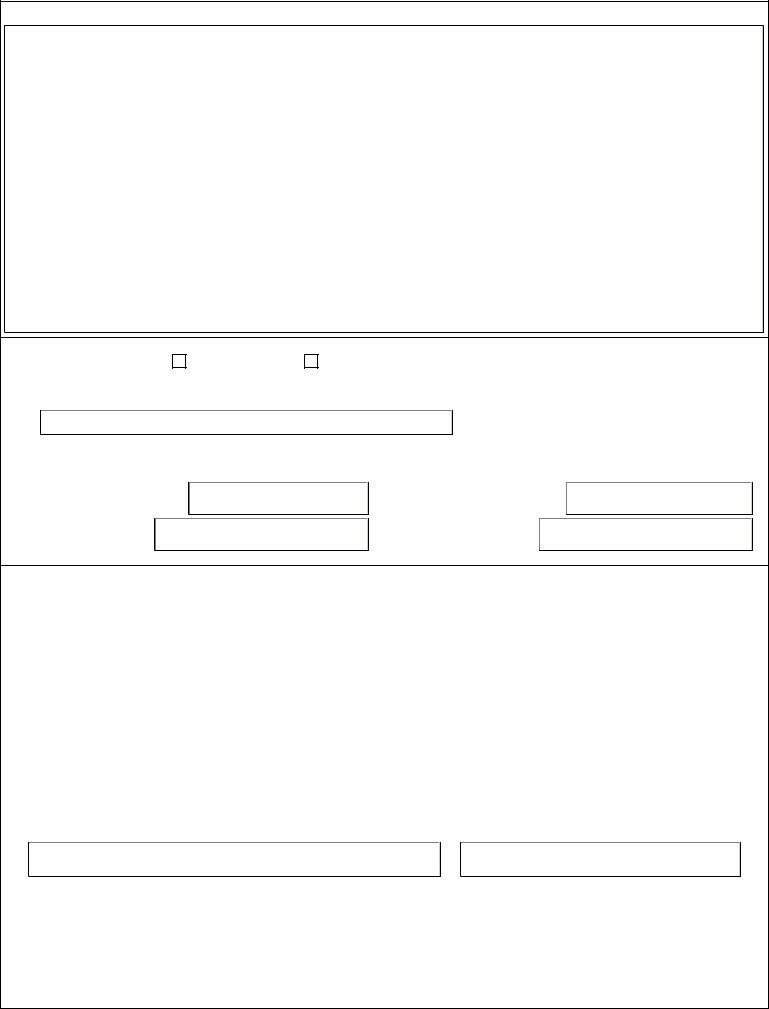

17. Remarks

18.For Official Use Only (DSSR 135 and 136)

Quarters Allowance Group |

|

WF ("With Family") |

|

WOF ("Without Family") |

Maximum Annual LQA Rate (DSSR 920, Plus 10%, 20%, or 30% For Additional Family Members) = |

||||

Daily LQA Rate = Annual LQA Rate Divided By Number Of Days In Calendar Year. Biweekly Rate = Daily Rate Times 14. Any Other Period = Daily Rate Times |

||||

Number Of Days Claimed. |

|

|

|

|

Begin Date Claimed |

|

|

End Date Claimed |

|

Number Of Days Claimed |

|

|

LQA This Period |

|

19.Employee Statement: I certify that the amounts claimed above were incurred for the period claimed or are estimated to the best of my knowledge for future costs.

Employee's Signature |

Date |

Page 4 of 4 |