Our best developers have worked collectively to set-up the PDF editor that you'll benefit from. The app makes it simple to complete dtf print documents shortly and efficiently. This is all you need to do.

Step 1: Find the button "Get Form Here" and click it.

Step 2: So you are going to be on your document edit page. You can add, modify, highlight, check, cross, add or delete fields or text.

For each part, fill out the data asked by the program.

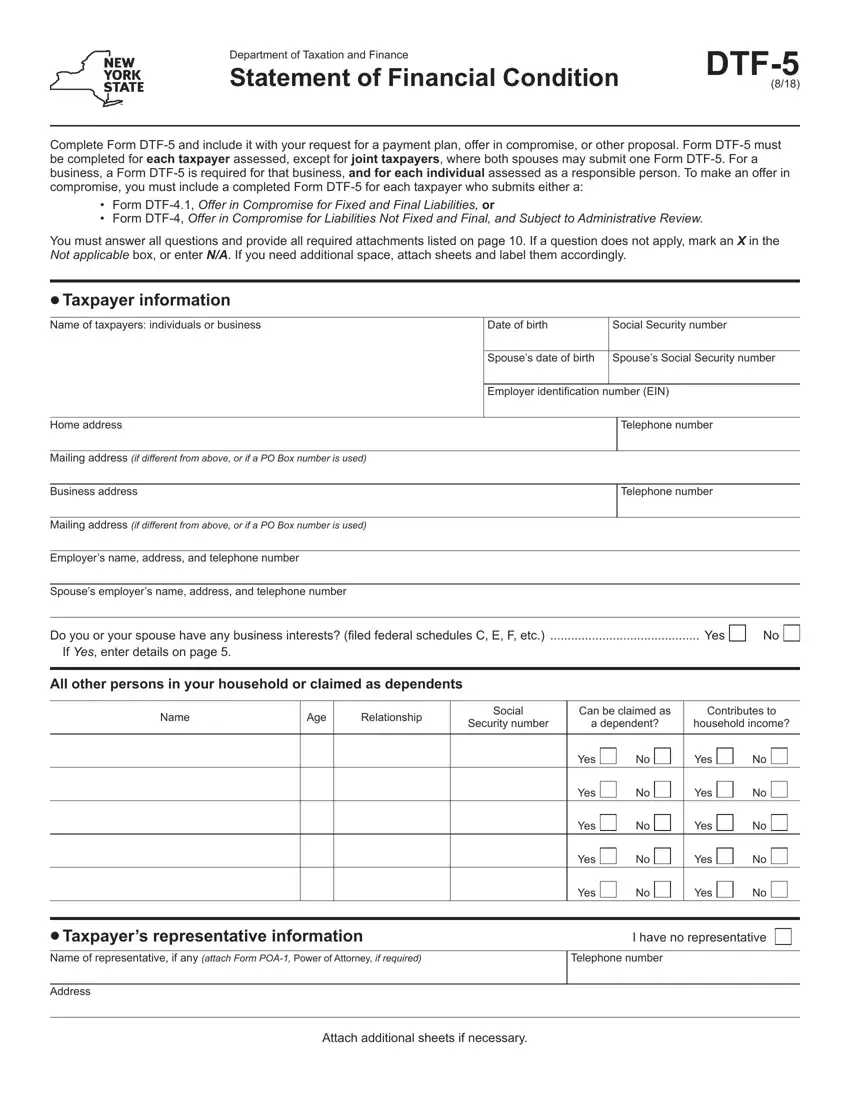

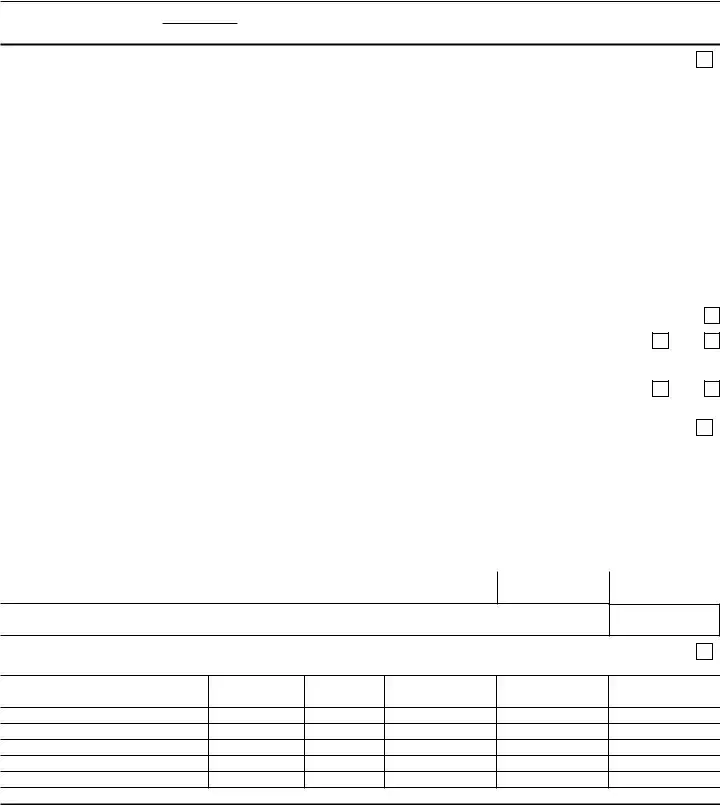

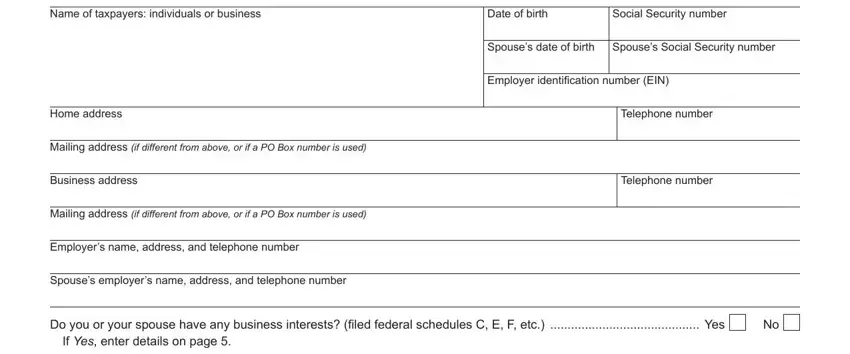

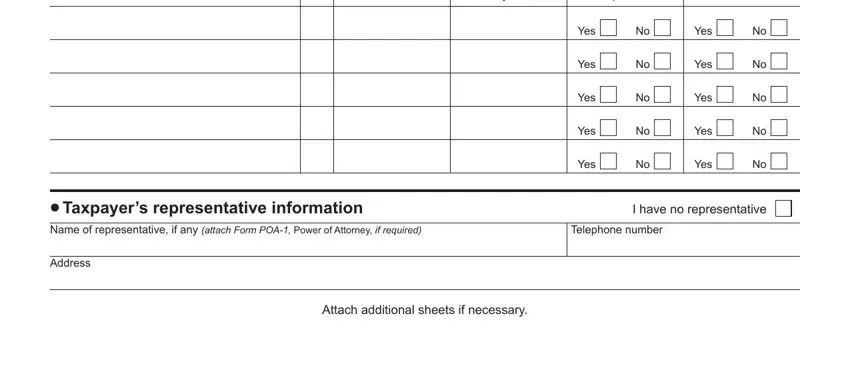

Inside the area Social Security number, Can be claimed as a dependent, Contributes to household income, Yes, Yes, Yes, Yes, Yes, Yes, Yes, Yes, Yes, Yes, Taxpayers representative, and Name of representative if any write down the particulars which the platform asks you to do.

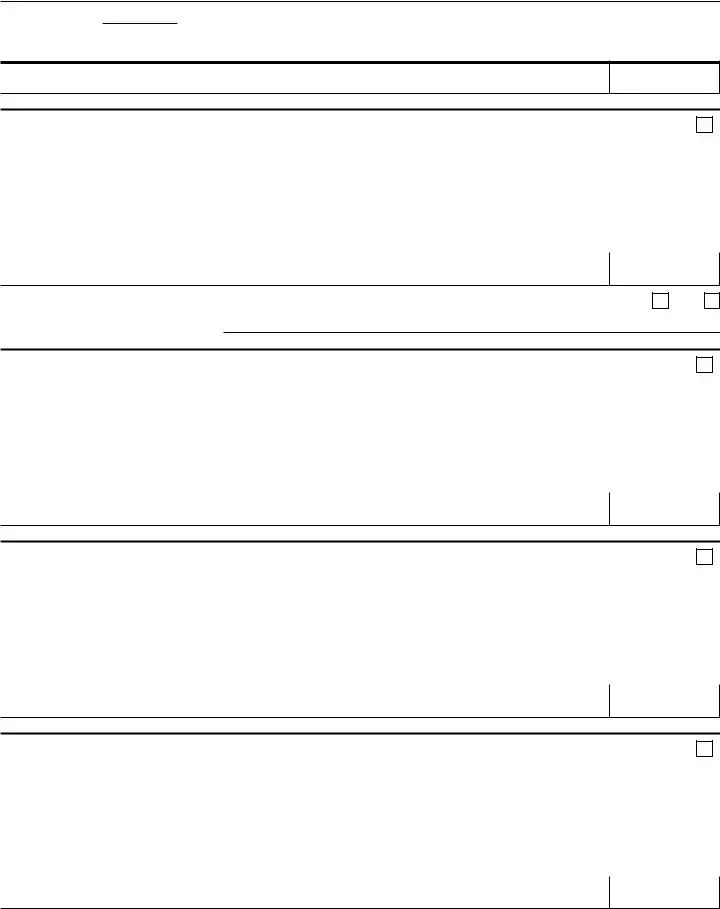

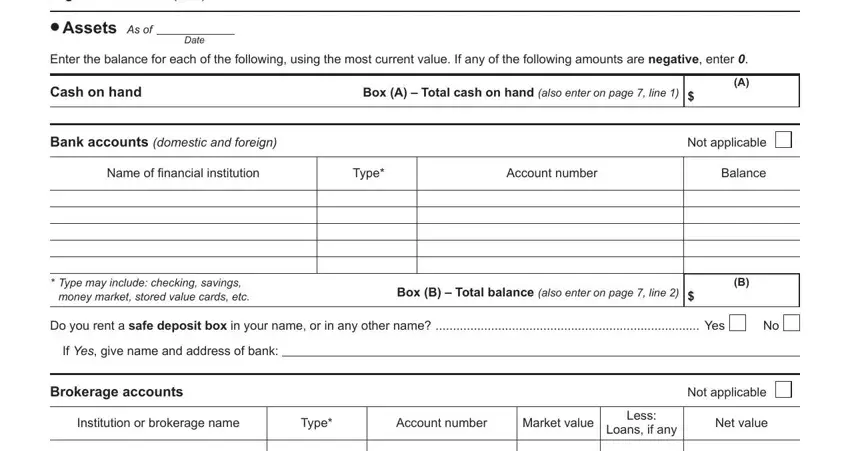

The program will ask you for details to instantly prepare the section Page of DTF, Assets As of, Date, Enter the balance for each of the, Cash on hand, Box A Total cash on hand also, Bank accounts domestic and foreign, Not applicable, Name of financial institution, Type, Account number, Balance, Type may include checking savings, Box B Total balance also enter on, and Do you rent a safe deposit box in.

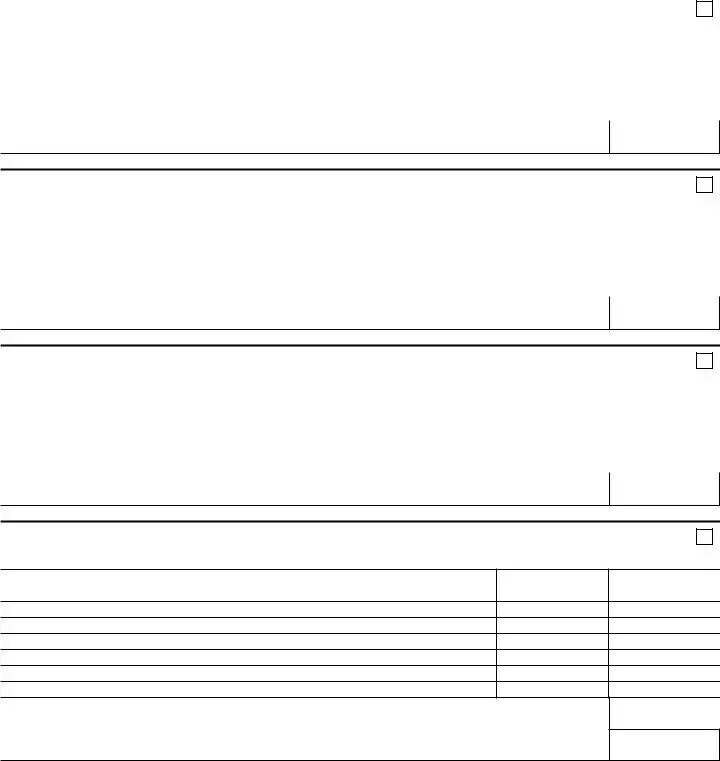

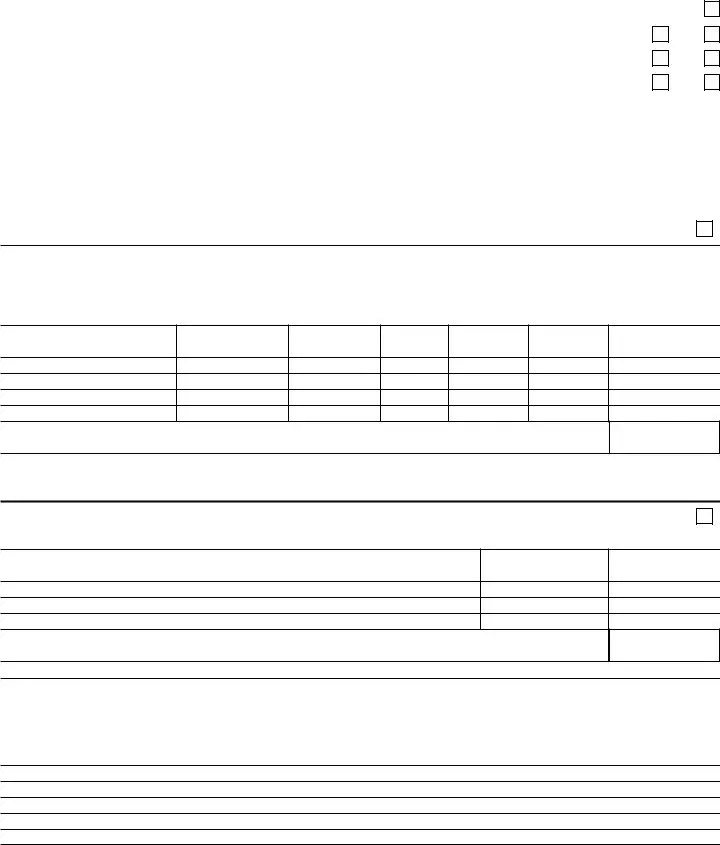

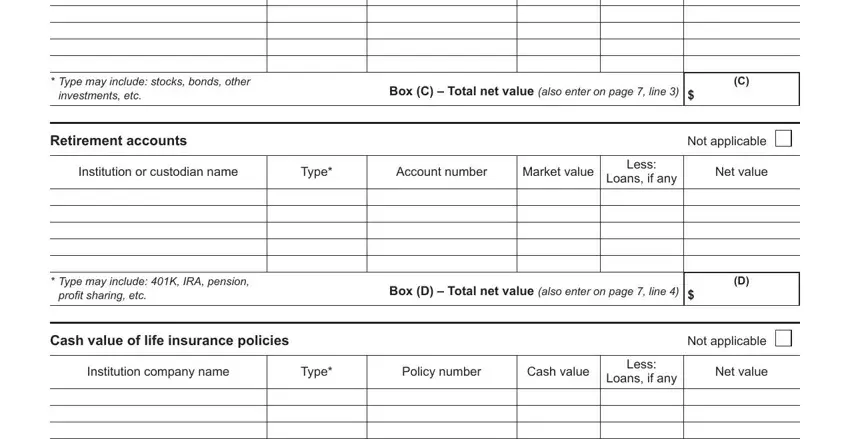

The Type may include stocks bonds, investments etc, Box C Total net value also enter, Retirement accounts, Institution or custodian name, Type, Account number, Market value, Not applicable, Less Loans if any, Net value, Type may include K IRA pension, profit sharing etc, Box D Total net value also enter, and Cash value of life insurance area may be used to indicate the rights and responsibilities of all sides.

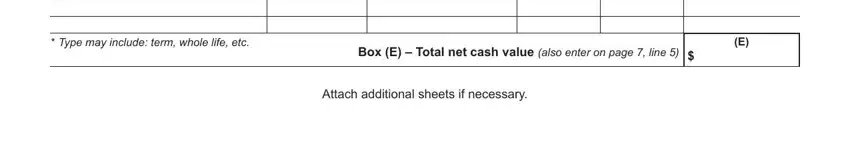

Finish by reading the next areas and preparing them correspondingly: Type may include term whole life, Box E Total net cash value also, and Attach additional sheets if.

Step 3: When you select the Done button, your completed file is conveniently transferable to every of your devices. Or, you might send it by means of email.

Step 4: Create a copy of any form. It would save you time and enable you to prevent challenges in the future. Also, your details isn't distributed or checked by us.