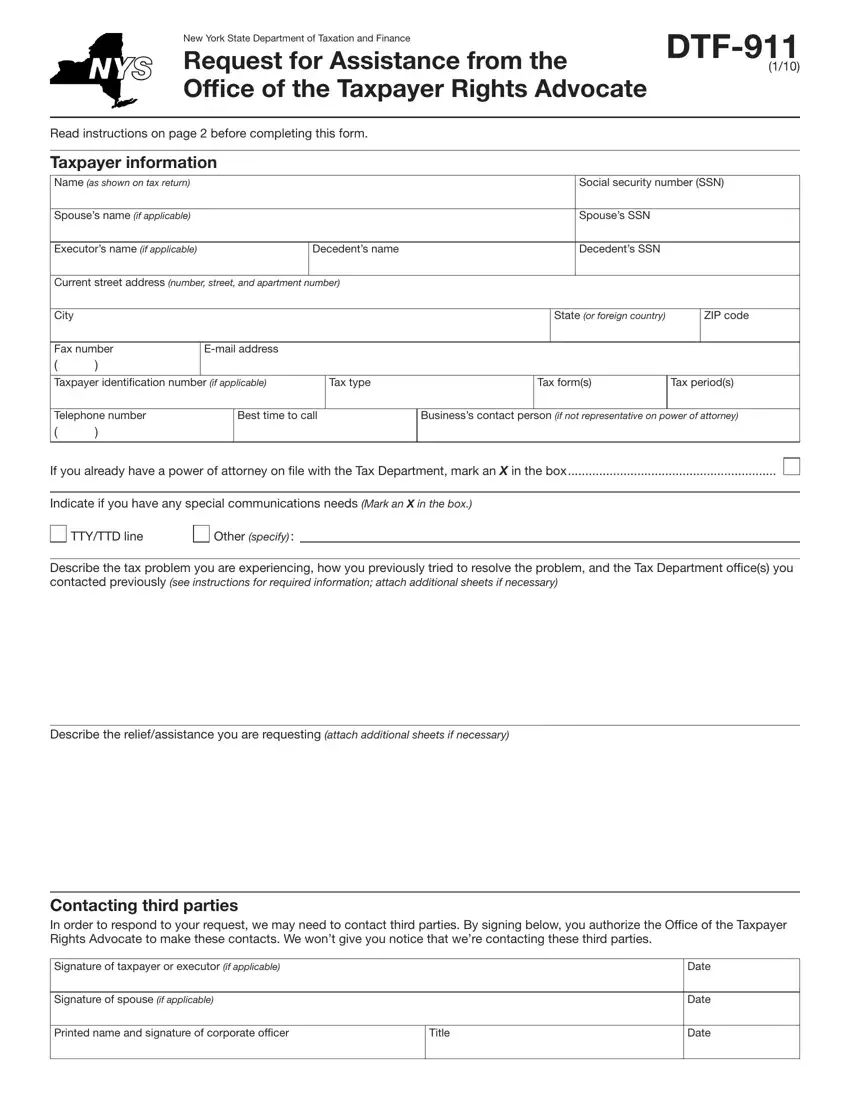

The Ofice of the Taxpayer Rights Advocate (OTRA) is an independent organization within the New York State Department of Taxation and Finance. OTRA was created to safeguard taxpayer rights and to assist taxpayers who are experiencing problems with the Tax Department.

When to use this form

Use this form if you are experiencing any of the following problems:

•You are facing a threat of immediate adverse action

(e.g., seizure of an asset) for a debt you believe is not owed or where the action is, in your view, unwarranted, unfair, or illegal.

•You are experiencing undue economic harm or are about to suffer undue economic harm because of your tax problem.

•You believe there has been an undue delay by the Tax

Department in providing a response or resolution to your problem or inquiry.

•You believe the tax laws, regulations, or policies are being administered unfairly or have impaired (or will impair) your rights.

•You believe a Tax Department system or procedure has failed to operate as intended, or has failed to resolve your problem or dispute.

•You believe that the unique facts of your case or compelling public policy reasons warrant assistance.

When not to use this form

•If you haven’t exhausted all reasonable efforts to obtain timely relief through normal Tax Department channels.

•To seek legal or tax return preparation advice.

•To seek review of an unfavorable administrative law judge, Tax Appeals Tribunal, or judicial determination.

Specific instructions

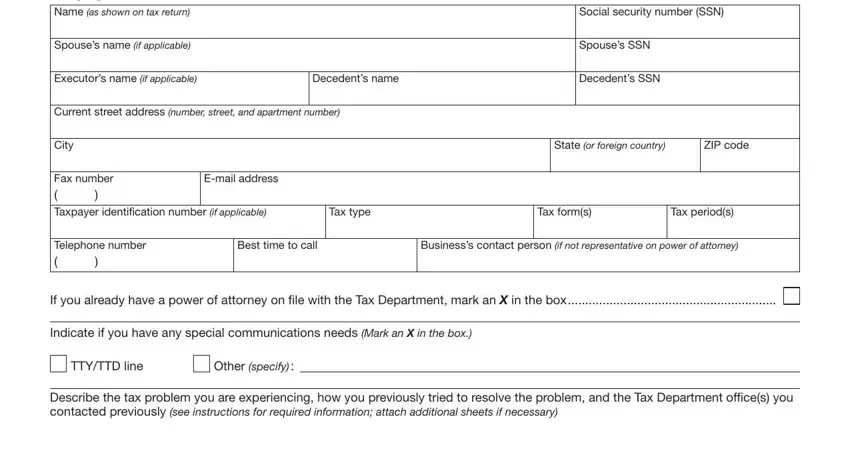

Taxpayer information

E-mail address — We may contact you by e-mail if we’re unable to reach you by telephone. We won’t use your e-mail address to discuss the speciics of your case.

Taxpayer identification — Enter your taxpayer identiication number if this request involves a business or non-individual entity (e.g., a partnership, corporation, trust, or self-employed individual).

Tax type — Enter the tax type (for example, personal income tax, corporation tax, sales tax, etc.) that relates to this request.

Tax form(s) — Enter the form number(s) that relates to this request. For example, an individual taxpayer with an income tax issue might enter FORM IT-201.

Tax period(s) — Enter the quarterly, annual, or other tax period(s) that relates to this request. For example, if this request involves an income tax issue, enter the calendar or iscal year; if an employment tax issue, enter the calendar quarter.

Business contact person — If a business entity is iling this form, enter the name of the person to contact about the request. This may be the corporate oficer signing the request, or another person authorized to discuss the matter.

Power of attorney

If you choose to have a representative act on your behalf, you must complete a power of attorney form.

Businesses: use Form POA-1, Power of Attorney

Individuals: use Form POA-1-IND, Power of Attorney for Individuals

Estates: use Form ET-14, Estate Tax Power of Attorney

You can get these forms from our Web site at www.nystax.gov.

Include the power of attorney form when you submit this form.

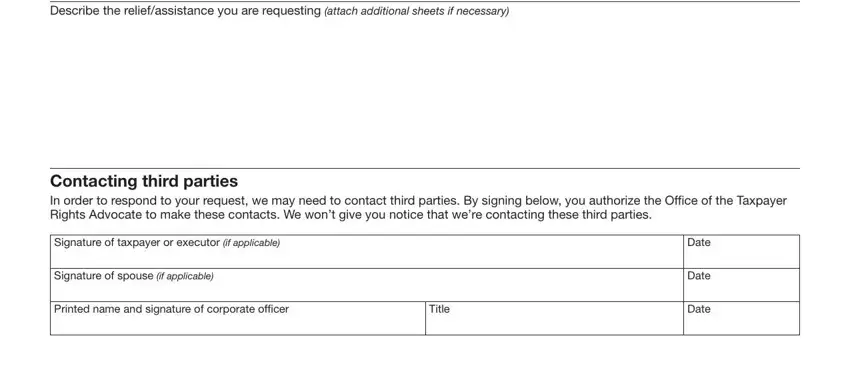

Describe the tax problem you are experiencing

Enter any detailed information necessary to describe the tax problem you are experiencing. If you have been involved with a Bureau of Conciliation and Mediation Services conference, a small claims hearing, the Tax Appeals Tribunal, a courtesy conference, an administrative law judge, an Offer in Compromise, or an audit or other collection action, include the dates of such activity, as well as the following information (if applicable):

•BCMS number

•DTA number

•audit case number

•assessment or collection case number

•formal or informal protest number

Where to file

Send your completed Form DTF-911 and any required attachments to:

By mail — NYS TAX DEPT

OTRA

W A HARRIMAN CAMPUS

ALBANY NY 12227

By fax — (518) 435-8532

Privacy notification — The Commissioner of Taxation and Finance may collect and maintain personal information pursuant to the New York State Tax Law, including but not limited to, sections 5-a, 171, 171-a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security numbers pursuant to 42 USC 405(c)(2)(C)(i).

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax offset and exchange of tax information programs as well as for any other lawful purpose.

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

This information is maintained by the Manager of Document Management, NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone (518) 457-5181.