Understanding the complexities and benefits provided by the DVLA V188 form is essential for individuals with certain mobility allowances or those who possess an invalid carriage, as it opens the path to obtaining a free tax disc for their vehicle. This exemption from vehicle tax is a valuable privilege that underscores the government's recognition of the challenges faced by disabled people. The form itself serves as a gateway for both new applicants aiming to secure their first free tax disc in the disabled tax class and for those seeking to renew or replace their disc. It meticulously outlines the necessary qualifications, the process of application, and the specific documents required, like the Certificate of Entitlement or the Disability Living Allowance (DLA404) Certificate among others, which validate an individual's eligibility. Furthermore, it delineates the conditions under which the vehicle can be used, emphasizing that it should primarily serve the needs of the disabled person. The form also provides guidance for when a refund on the current tax disc might be warranted and what actions to take if the vehicle's use changes or if it no longer qualifies for the exemption. By detailing the procedural steps for both initial and subsequent applications, and offering additional resources and contact information for further assistance, the V188 form stands as a critical document for disabled individuals aiming to navigate the exemptions available to them efficiently.

| Question | Answer |

|---|---|

| Form Name | Dvla V188 Form |

| Form Length | 12 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 3 min |

| Other names | exemption from vehicle tax for disabled v188, v188, a offices v188, dvla v188 form |

V188

Exemption Vehicle Tax

FROM

FOR

Disabled People

For more information go to www.direct.gov.uk/vehicletax

If you have been granted certain mobility allowances or have an invalid carriage you may be entitled to a FREE TAX DISC.

This leaflet explains how to claim the exemption from vehicle tax.

9/11

2

Contents |

|

|

1. |

How to get a free tax disc |

4 |

2. |

Applying for your first free tax disc |

|

|

in the disabled tax class |

5 |

3. |

How to get a refund on your |

|

|

current tax disc |

7 |

4. |

When you need to renew your free |

|

|

tax disc |

7 |

5. |

When you need to apply for a new |

|

|

exemption certificate |

8 |

6. |

What to do if you need further |

|

|

advice on the qualifying benefits |

9 |

7. |

General information |

9 |

8. |

Further information on registering |

|

|

and taxing a vehicle |

10 |

9. |

Finding your nearest Post Office® |

|

|

or DVLA local office |

10 |

1. How to get a free tax disc

You (the disabled person) can get a free tax disc if you have been granted:

•Disability Living Allowance (it must be the higher rate of the mobility component), or

•War Pensioners Mobility Supplement.

Before applying for your first free tax disc you will need to have either a:

•Certificate of Entitlement to Disability Living Allowance (DLA)

•Certificate of Entitlement •DLA404 Certificate

•WPA0442 War Pensioners Mobility Certificate, or •MHS330 Certificate.

(Throughout this leaflet these certificates will be referred to as exemption certificates.)

You can get these from the relevant issuing authority:

For Disability Living Allowance (DLA) you will need to contact the Pension Disabilities and Carers Service (see section 6 for the address details).

For War Pensioners you will need to contact the Service Personnel and Veterans Agency (see section 6 for the address details).

Who can apply for a free tax disc

The registered keeper can apply for a free tax disc to display in their vehicle. The vehicle’s registered keeper could be:

•the person with the disability, or

•someone who uses their vehicle only for the purposes of the disabled person.

The use of the vehicle while taxed in the disabled class

The vehicle must either be used by the disabled person or someone else who uses their vehicle to help them, for example to get prescriptions or shopping for the disabled person.

If the vehicle is ever used in a way which is not directly for the purposes of the disabled person or the disabled person is no longer entitled to the higher rate mobility component of the DLA, you must tax the vehicle in the appropriate tax class at a DVLA local office. You will need:

•the Registration Certificate (V5C) •insurance certificate

•MoT/GVT (if needed)

•a filled in ‘Application for a tax disc’ (V10) or ‘Application for a tax disc for a Heavy Goods Vehicle’ (V85), and the fee.

4

The free tax disc previously issued must be returned on an ‘Application for a refund of vehicle tax when you have the tax disc’ (V14) along with the exemption certificate.

You can also have a free tax disc if you drive an invalid carriage or a Motability contract hire vehicle:

For Invalid Carriages: You do not need an exemption certificate. The vehicle must:

•be registered in your name •weigh less than 509kg, and

•be adapted for a disabled person and used or kept on a public road.

To find further information go to www.direct.gov.uk/vehicletax or from your nearest DVLA local office (see section 9 for address details).

For Motability contract hire vehicles: Motability will arrange to tax your vehicle each year and send the tax disc to you. As Motability registers the vehicle and holds the Registration Certificate (V5C) for the duration of your contract you must tell them of any changes to your address to ensure you get the disc on time.

Note: this does not apply to a vehicle that has been obtained on hire purchase from Motability.

2.Applying for your first free tax disc in the disabled tax class

Applying for the first free tax disc is different from renewing it every year.

For new vehicles, the exemption certificate and insurance certificate should be taken to the dealership in order to claim the free tax disc.

For used vehicles, please see table over the page.

5

6

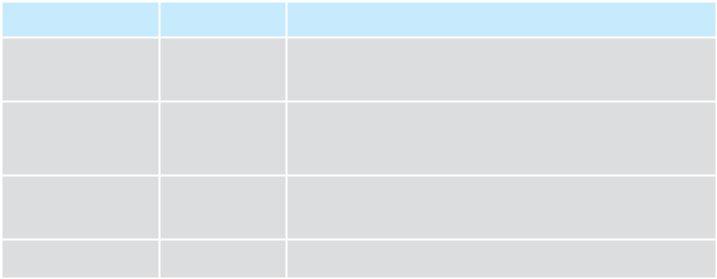

Applying for a free tax disc for the first time for used vehicles

What part of the Registration |

Where and how you |

All the documents you need to tax |

Certificate (V5C) do you have for |

can apply |

|

the vehicle? |

|

|

1. Full Registration Certificate (V5C). |

In person at a Post Office® |

• V5C |

|

branch that issues tax discs. |

• Exemption certificate |

|

By posting your application |

• Insurance certificate or cover note (not a policy, schedule, renewal notice, or receipt). Must be valid on |

|

to a selected postal Post |

the date the tax date starts, or when the tax disc is issued, whichever is the later. |

|

Office® branch. |

• MoT certificate (if needed) |

|

|

• If applying by post you will need an ‘Application for a tax disc’ (V10). |

2. New keeper’s details (V5C/2) |

In person or by post at a |

• V5C/2 |

section of the V5C. |

DVLA local office. |

• An ‘Application for a vehicle registration certificate’ (V62) |

You have 13 months from the date |

|

• Exemption certificate |

you bought the vehicle to use the |

|

• Insurance certificate or cover note (not a policy, schedule, renewal notice or receipt). Must be valid on |

unstamped V5C/2. |

|

the date the tax date starts, or when the tax disc is issued, whichever is the later. |

|

|

• MoT certificate (if needed) |

|

|

• An ‘Application for a tax disc’ (V10). |

3. No V5C or V5C/2. |

In person or by post at a |

• An ‘Application for a vehicle registration certificate’ (V62) |

You have previously had a V5C in |

DVLA local office. |

• Exemption certificate |

your name, for the vehicle. |

|

• Insurance certificate or cover note (not a policy, schedule, renewal notice or receipt). Must be valid on |

|

|

the date the tax date starts, or when the tax disc is issued, whichever is the later. |

|

|

• MoT certificate (if needed). |

|

|

• An ‘Application for a tax disc’ (V10). |

4. No V5C or V5C/2. |

You need to apply for a V5C |

• An ‘Application for a vehicle registration certificate’ (V62) |

You have never had a V5C or V5C/2 |

by post to DVLA Swansea |

• When you get your V5C you will need to follow the advice in point 1. |

in your name, for the vehicle. |

SA99 1DD. |

|

Note: All certificates and cover notes must be originals, not photocopies. However, downloaded or faxed copies of downloaded insurances certificates will be accepted.

All forms are available to download from www.direct.gov.uk/motoringforms or from Post Office® branches that issue tax discs or DVLA local offices.

3.How to get a refund on your current tax disc

When you get your first free tax disc, fill in an ‘Application for a refund of vehicle tax when you have the tax disc’ (V14) immediately. You can get this from www.direct.gov.uk/motoringforms, Post Office® branches that issue tax discs and DVLA local offices.

Note: To get a refund for each full calendar month left on the tax disc, you must post a filled in V14 form to DVLA before the first day of the month you want the refund from.

4.When you need to renew your free tax disc

The registered keeper should get a ‘Renewal reminder to get a tax disc or make a Statutory Off Road Notification (SORN)’ (V11), approximately two weeks before the current tax disc runs out.

Renew your tax disc with the V11 or V5C (which shows the tax class as disabled) online at: www.direct.gov.uk/taxdisc or phone 0300 123 4321.

You will need:

•the reference number shown on your V11 or the document reference number shown on your V5C

•the date of birth, surname and National Insurance number of the holder of the Certificate of Entitlement to DLA, Certificate of Entitlement, DLA404 certificate, MHS330 certificate or WPA0442 certificate, and

•the serial number of the exemption certificate.

Renew at the Post Office® in person or by post

In person at a Post Office® branch that issues tax discs or by posting your application to a selected postal Post Office® branch.

You will need to take or send the following documents: •V11 or V5C.

•Exemption Certificate.

•Insurance certificate or cover note (not a policy, schedule, renewal, notice or receipt). Must be valid on the date the tax disc starts, or when the tax disc is issued, whichever is the later.

•MoT certificate (if needed).

•V10 (together with the V5C) if you are applying by post and you do not have a V11.

To find your nearest tax disc issuing Post Office® go to www.postoffice.co.uk or phone 0845 722 3344 giving your postcode.

7

5.When you need to apply for a new exemption certificate

•When your WPA0442 certificate is full, ask the Service Personnel and Veterans Agency for a replacement (see section 6). You will need a new certificate to tax your vehicle.

•If your name or address has changed, send your WPA0442 certificate to the Service Personnel and Veterans Agency (see section 6). You cannot change any details on the certificate.

•If you have a DLA404, when this is full ask the Pension, Disability and Carers Service (see section 6) for a Certificate of Entitlement. You will need a new certificate to tax your vehicle.

•If your name or address has changed, send your DLA404 certificate to the Pension, Disability and Carers Service (see section 6). You cannot change the certificate.

•If you have a Certificate of Entitlement (issued between May 2010 and October 2011) you can only use this once to get a free tax disc at a Post Office® branch that issues tax discs or a DVLA local office. The Pension, Disability and Carers Service will automatically send you a new certificate around six weeks before your tax disc runs out. If you do not get your new certificate, you will need to contact them or you will not be able to get a free tax disc.

•If you have a Certificate of Entitlement to DLA (issued from October 2011) you will only need a replacement when the registered keeper or their vehicle has changed or when the certificate has been lost, stolen or damaged.

8

6.What to do if you need further advice on the qualifying benefits

Write to or phone the relevant agency shown below:

Type of Allowance |

Type of exemption |

Who issues |

|

certificate |

the exemption |

|

|

certificate |

Disability Living |

Certificate of |

Pension, Disability |

Allowance: The |

Entitlement to |

and Carers Service, |

higher rate of |

DLA, Certificate of |

Disability Living |

the mobility |

Entitlement or DLA |

Allowance Unit, |

component |

404 Certificate |

Warbreck House, |

|

|

Warbreck Hill, |

|

|

Blackpool |

|

|

FY2 0YE |

|

|

Phone: |

|

|

0845 712 3456 |

|

|

Textphone: |

|

|

0845 722 4433 |

War Pensioners |

WPA0442 |

Service Personnel |

Mobility |

|

and Veterans |

Supplement |

|

Agency, |

|

|

Norcross, |

|

|

Thorton Cleveleys, |

|

|

Blackpool |

|

|

FY5 3WP |

|

|

Phone: |

|

|

0800 169 2277 |

|

|

Textphone: |

|

|

0800 169 3458 |

7. General Information

•Exemption from vehicle tax for disabled people can only be claimed for one vehicle at a time. You must tax any other vehicle in an appropriate tax class.

•An exemption certificate is only valid until the expiry date shown on it. If your DLA404 or WPA0442 certificate has run out, is full or has been lost you must apply to the relevant agency.

•If you sell your vehicle, you should return your free tax disc on a V14 application form to DVLA, Swansea SA99 1AL. You will also need to fill in the relevant section of your V5C.

•If your entitlement ends you should return your free tax disc on a V14 application form and your exemption certificate along with a covering letter to DVLA, Swansea.

•If you are entitled to an exemption from vehicle tax and are in hospital for more than 28 days (84 days for children), the exemption from vehicle tax still applies. The vehicle must continue to be used only for the purpose of the disabled person.

9

8.Further information on registering and taxing a vehicle

•Visit the website at www.direct.gov.uk/motoring

•See leaflet ‘What you need to know about registering and taxing your vehicle’ (V100) which is available in all Post Office® branches and from DVLA local offices.

•Phone DVLA Customer Enquiries on 0300 790 6802 quoting the vehicle’s registration number. (If you are deaf or hard of hearing and have a textphone, phone 0300 123 1279. This number will not respond to ordinary phones).

•Write to Vehicle Correspondence, DVLA, Swansea SA6 7JL.

•Fax us on 0300 123 0798.

9.Finding your nearest Post Office® or DVLA local office

To find your nearest tax disc issuing Post Office® go to www.postoffice.co.uk or phone 0845 722 3344 quoting your postcode.

To find your nearest Post Office® branch that deals with postal applications go to www.direct.gov.uk/postalapp

To find your nearest local office go to www.direct.gov.uk/dvlalocal or phone 0300 123 1277.

DVLA local offices are open between 9am and 5pm Monday to Friday and between 9.30am and 5pm on the second Wednesday of each month.

Find out about DVLA’s online services

Go to: www.direct.gov.uk/onlinemotoringservices

10

11