Handling PDF documents online is surprisingly easy with our PDF editor. Anyone can fill out dwc 11 form ri here effortlessly. Our tool is consistently developing to grant the very best user experience attainable, and that is because of our resolve for continuous improvement and listening closely to user comments. It just takes a few basic steps:

Step 1: Press the "Get Form" button in the top area of this page to access our editor.

Step 2: As soon as you launch the tool, you will see the document all set to be completed. Besides filling out various blank fields, you could also perform other things with the Document, namely writing any textual content, modifying the initial text, inserting graphics, affixing your signature to the document, and much more.

This PDF doc requires specific details; in order to guarantee accuracy and reliability, be sure to bear in mind the subsequent tips:

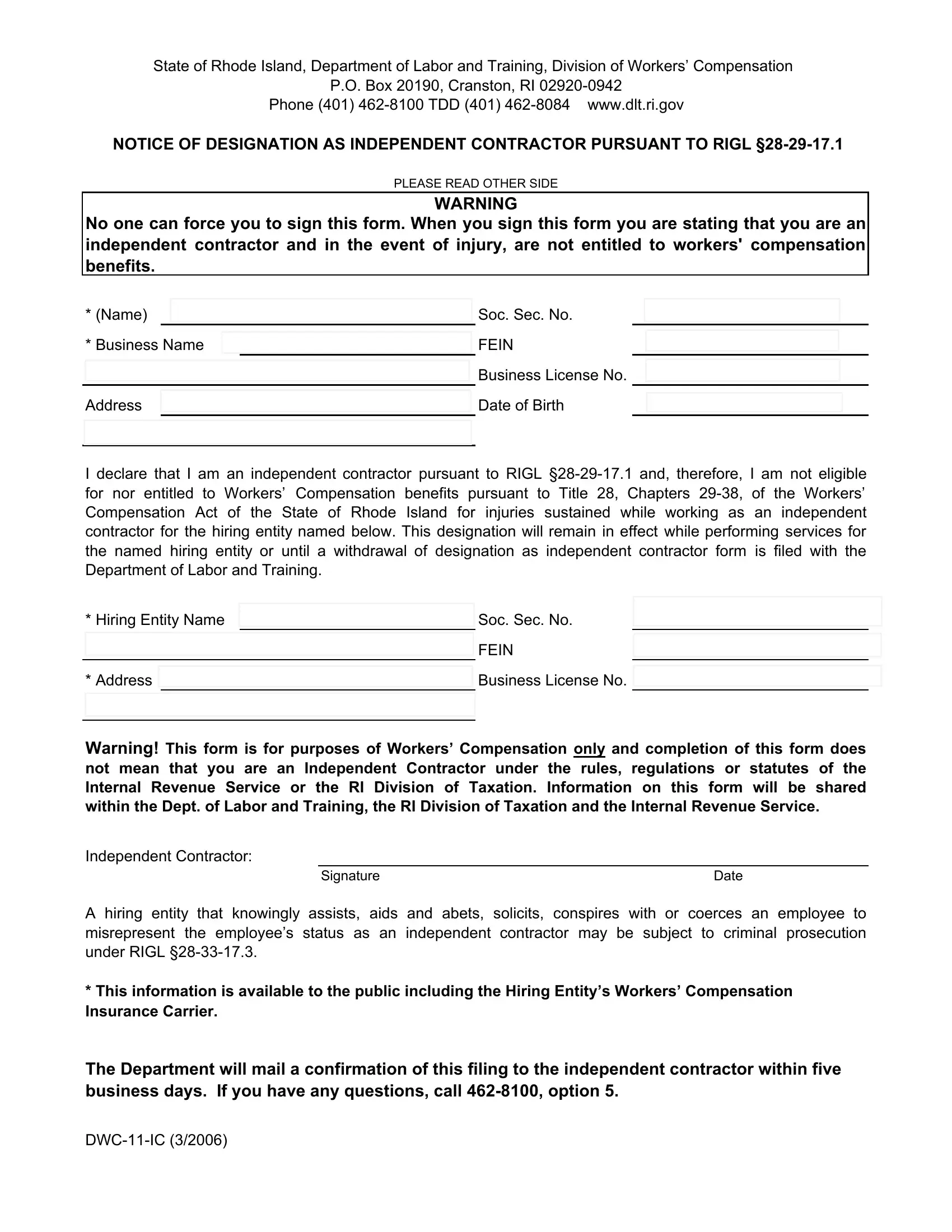

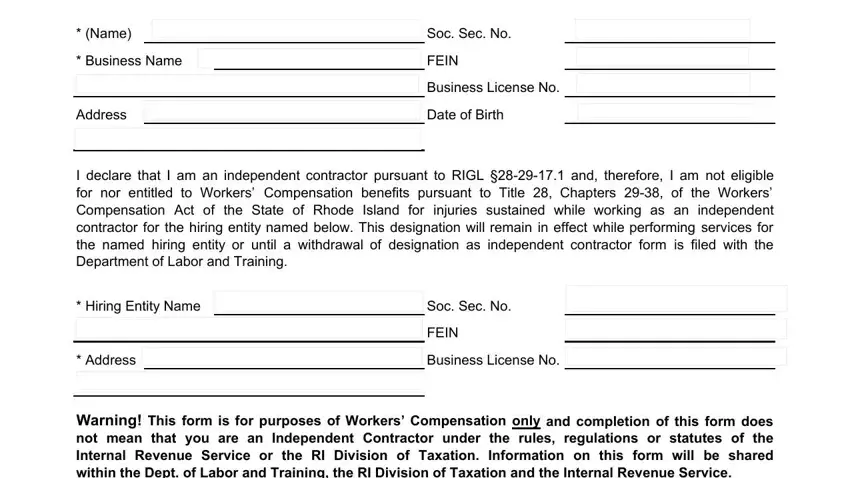

1. The dwc 11 form ri will require particular details to be typed in. Ensure that the next blank fields are completed:

Step 3: Check the details you've inserted in the form fields and press the "Done" button. Join FormsPal today and immediately get dwc 11 form ri, ready for downloading. Every single edit made is conveniently preserved , which enables you to edit the form at a later point as required. Here at FormsPal.com, we do our utmost to make sure that all your details are stored private.