You could fill in dwc form 6 easily using our PDFinity® online PDF tool. Our team is constantly endeavoring to improve the tool and insure that it is much easier for users with its multiple features. Uncover an ceaselessly progressive experience today - check out and discover new opportunities along the way! With a few simple steps, you'll be able to begin your PDF journey:

Step 1: Click on the "Get Form" button above on this page to access our PDF tool.

Step 2: This tool offers you the opportunity to customize the majority of PDF documents in a range of ways. Change it by writing personalized text, correct existing content, and add a signature - all close at hand!

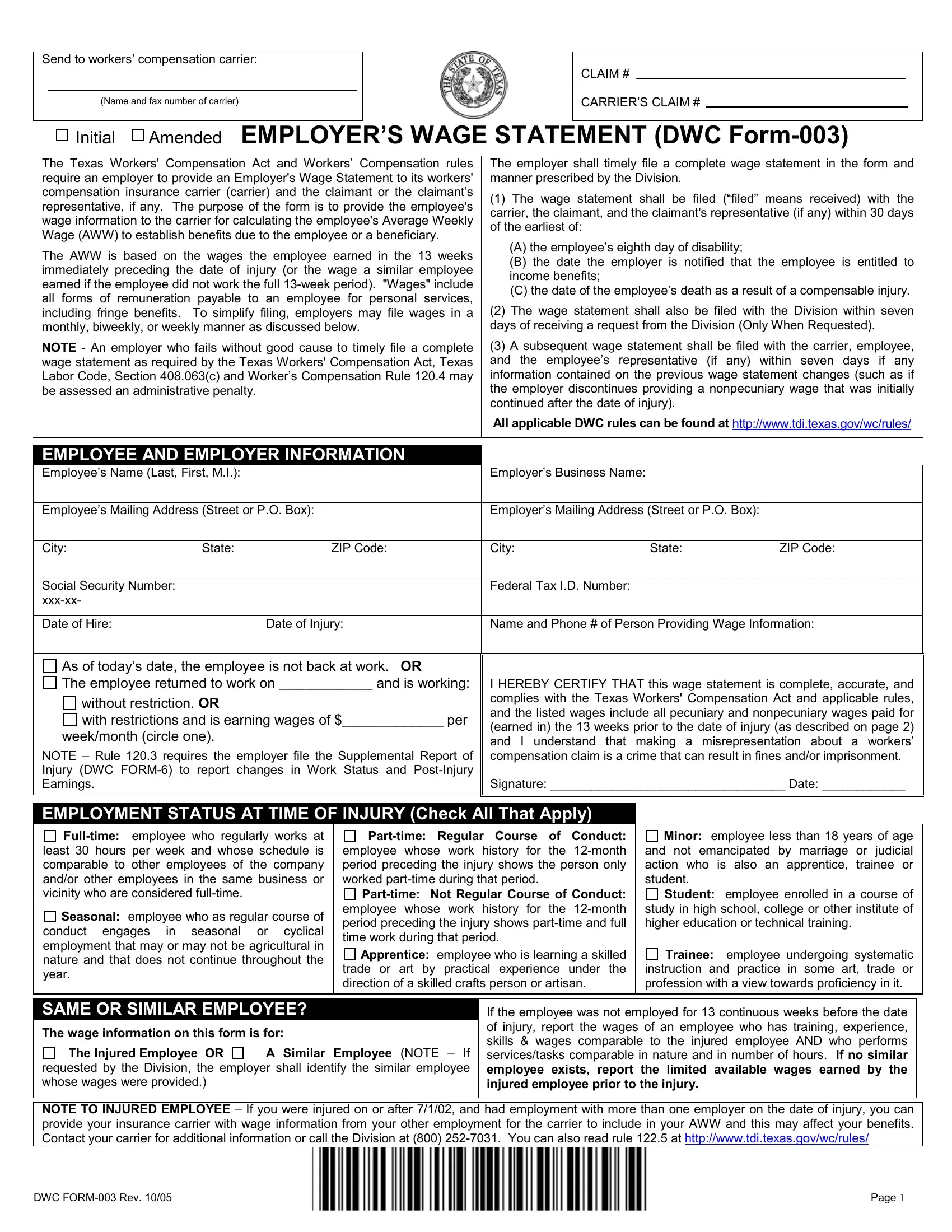

To be able to finalize this PDF document, make sure that you type in the right information in every blank:

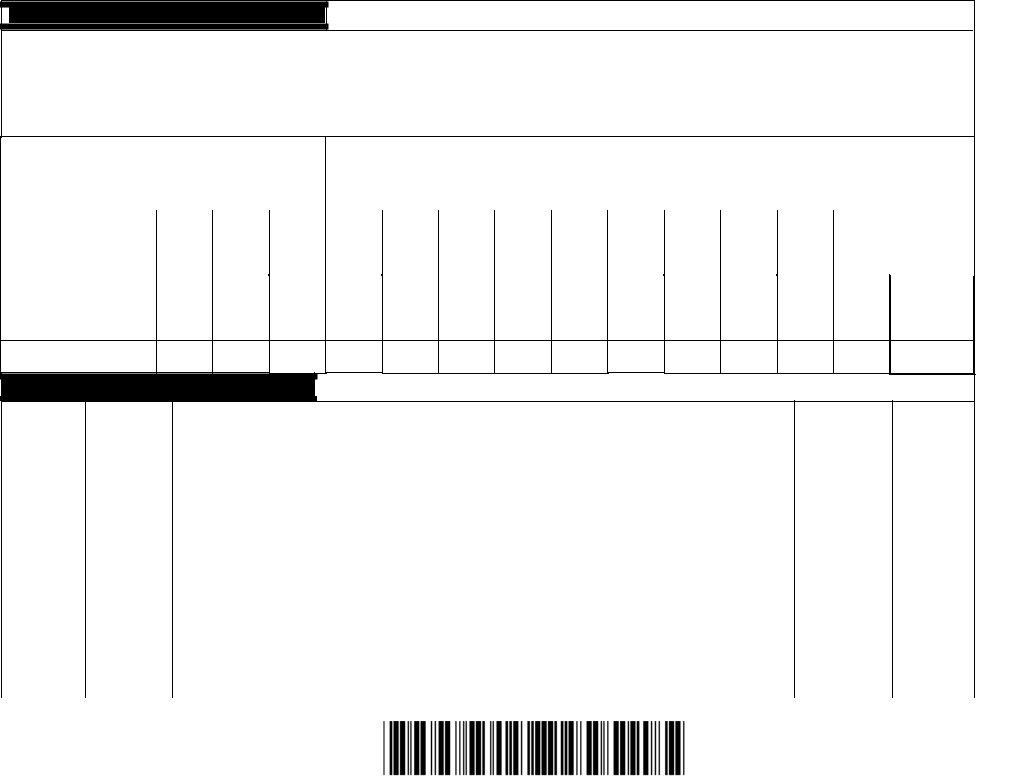

1. The dwc form 6 will require certain information to be typed in. Make sure the following fields are finalized:

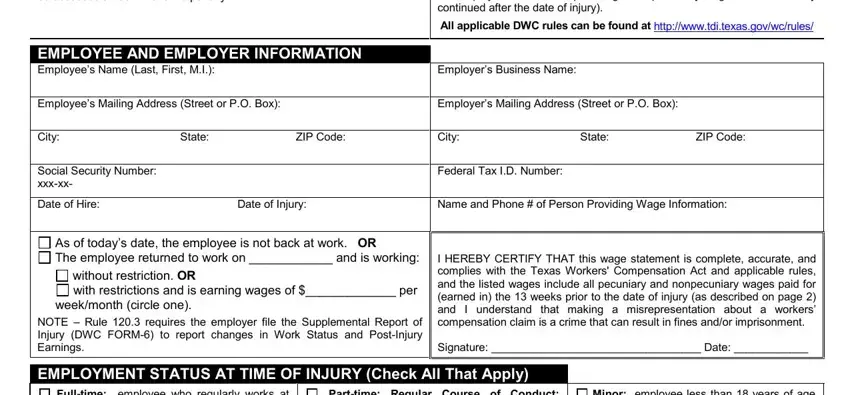

2. Immediately after this section is done, go on to enter the applicable details in all these: NOTE TO INJURED EMPLOYEE If you, and DWC FORM Rev Page.

Always be really careful when completing DWC FORM Rev Page and NOTE TO INJURED EMPLOYEE If you, as this is the part in which most users make mistakes.

Step 3: When you've reread the information you filled in, press "Done" to finalize your FormsPal process. Try a 7-day free trial account with us and acquire direct access to dwc form 6 - download or edit from your FormsPal cabinet. Whenever you work with FormsPal, you're able to fill out forms without the need to be concerned about database breaches or records being shared. Our protected software makes sure that your personal data is maintained safe.