form 3 employer can be completed without any problem. Just open FormsPal PDF tool to do the job fast. Our tool is consistently developing to present the very best user experience possible, and that's thanks to our commitment to continuous improvement and listening closely to customer opinions. Here is what you would want to do to get going:

Step 1: Click the "Get Form" button above. It is going to open up our pdf tool so that you could start completing your form.

Step 2: This editor provides you with the ability to modify your PDF in a variety of ways. Change it with your own text, correct what is originally in the PDF, and add a signature - all close at hand!

Filling out this form demands focus on details. Make sure all required fields are completed accurately.

1. Begin completing the form 3 employer with a number of necessary blanks. Note all of the important information and be sure absolutely nothing is missed!

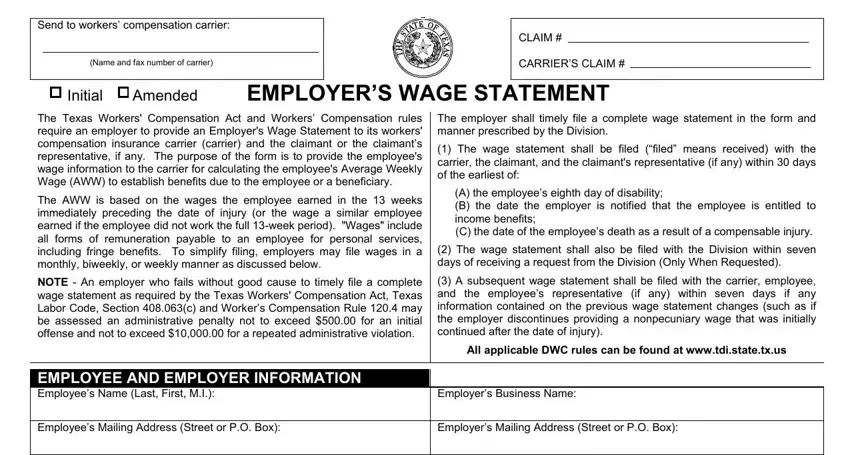

2. Once this section is filled out, go to type in the suitable information in these: City State ZIP Code, City State ZIP Code, Social Security Number, Federal Tax ID Number, Date of Hire, Date of Injury, Name and Phone of Person, As of todays date the employee is, without restriction OR with, weekmonth circle one, NOTE Rule requires the employer, I HEREBY CERTIFY THAT this wage, EMPLOYMENT STATUS AT TIME OF, Fulltime employee who regularly, and Seasonal employee who as regular.

It's easy to get it wrong while completing your I HEREBY CERTIFY THAT this wage, thus make sure you reread it prior to deciding to finalize the form.

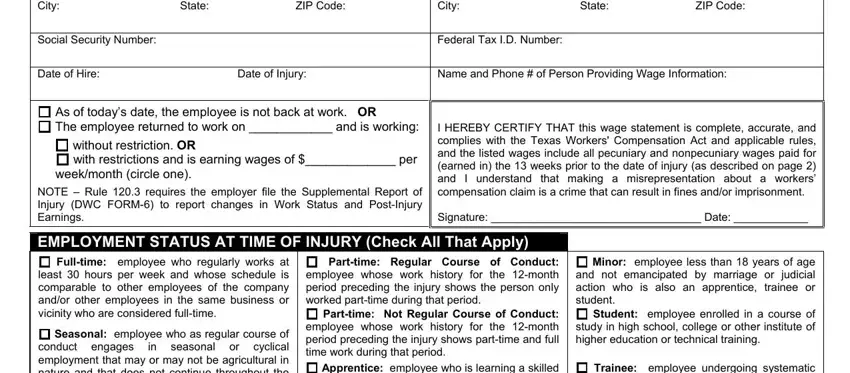

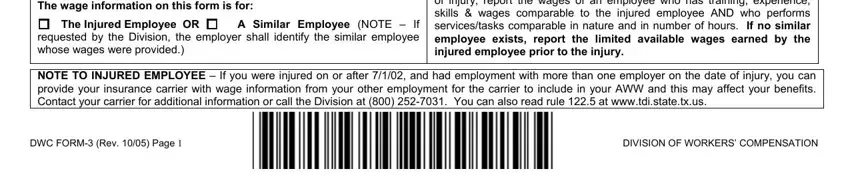

3. In this part, take a look at The wage information on this form, The Injured Employee OR, A Similar Employee NOTE If, If the employee was not employed, NOTE TO INJURED EMPLOYEE If you, DWC FORM Rev Page, and DIVISION OF WORKERS COMPENSATION. Every one of these will have to be filled in with utmost focus on detail.

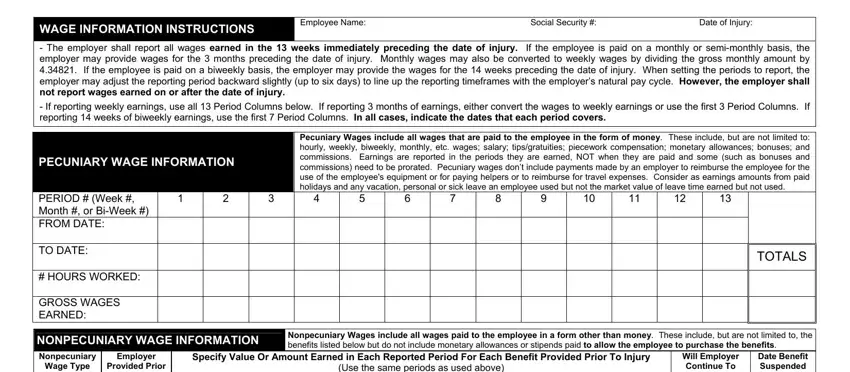

4. This specific section arrives with all of the following blanks to complete: WAGE INFORMATION INSTRUCTIONS, Employee Name Social Security, The employer shall report all, If reporting weekly earnings use, PECUNIARY WAGE INFORMATION, Pecuniary Wages include all wages, PERIOD Week Month or BiWeek, TO DATE, HOURS WORKED, GROSS WAGES EARNED, Wage Type, Provided Prior, To Injury YES NO, TOTALS, and NONPECUNIARY WAGE INFORMATION.

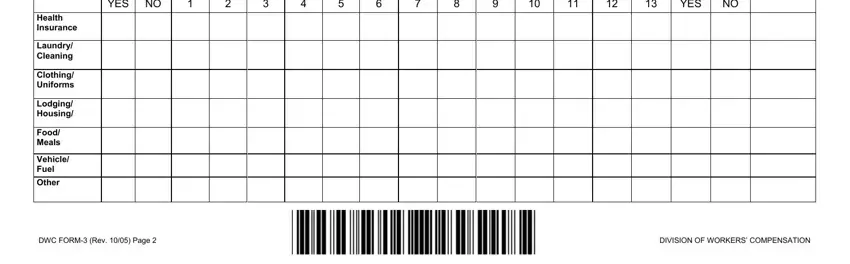

5. To finish your form, the final section requires a few extra fields. Entering Health Insurance, Laundry Cleaning, Clothing Uniforms, Lodging Housing, Food Meals, Vehicle Fuel Other, To Injury YES NO, YES, DWC FORM Rev Page, and DIVISION OF WORKERS COMPENSATION should conclude everything and you're going to be done very quickly!

Step 3: Go through what you have inserted in the blanks and click on the "Done" button. Grab your form 3 employer the instant you sign up for a free trial. Readily gain access to the form inside your personal cabinet, with any edits and changes being all saved! Here at FormsPal, we do everything we can to make sure your information is kept secure.