In an effort to ensure that employees who suffer work-related injuries receive prompt and fair compensation, the Texas Workers' Compensation Act, along with corresponding rules, mandates that employers, including school districts, submit a wage statement, known as the DWC 3Sd form, to their workers' compensation insurance carrier and the injured employee or their representative. This form plays a crucial role in determining the employee's Average Weekly Wage (AWW), which is fundamental in calculating the benefits owed. The requirement stipulates that employers provide detailed information regarding the employee's earnings, thereby enabling the insurance carrier to accurately assess the benefits due. Specifically, it calls for the submission of the form under various circumstances such as the employee's eighth day of disability, or upon the employer becoming aware of the employee's entitlement to income benefits, or in the unfortunate event of the employee's death due to a compensable injury. Employers face significant fines for failing to comply with these submission guidelines. Additionally, the DWC 3Sd form requires information about the employment status, distinguishing between contracted and non-contracted employees, and outlines specific reporting periods for wage calculation. This process not only safeguards the rights of the injured employee but also ensures clarity and transparency in the administration of workers' compensation benefits.

| Question | Answer |

|---|---|

| Form Name | Dwc Form 3Sd |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | dwc3sd dwc 3sd wage statement for school districts form |

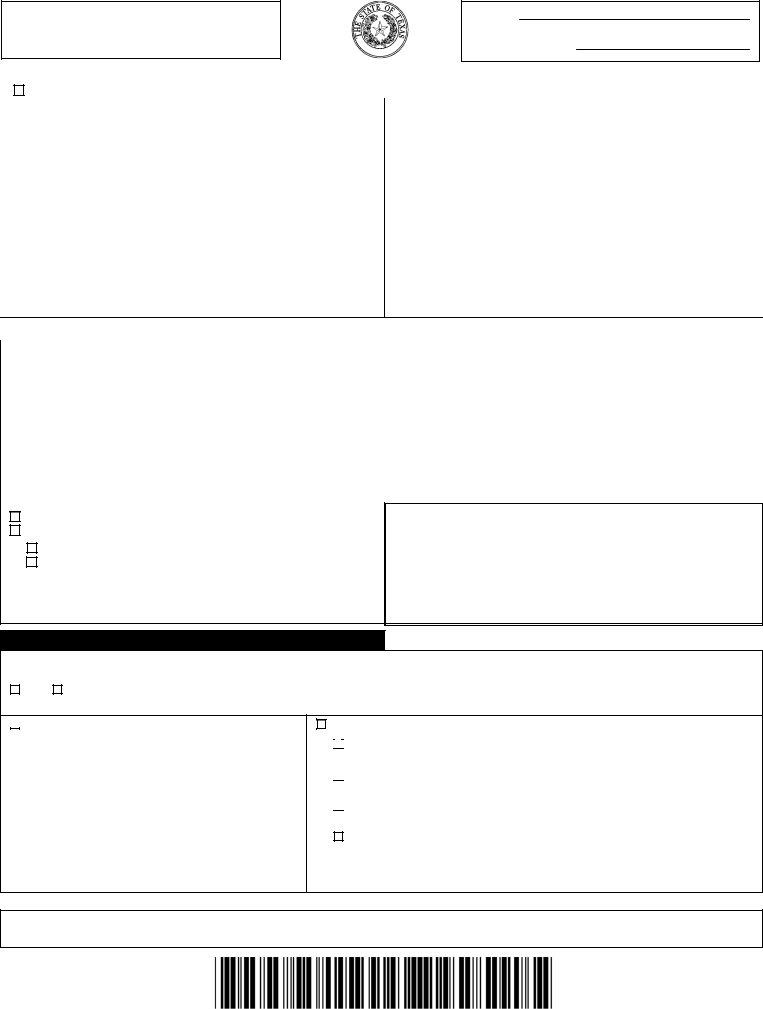

Send to workers’ compensation carrier:

_______________ |

_______ |

___ |

|

(name and fax number of carrier) |

|

CLAIM #

CARRIER’S CLAIM #

Initial EMPLOYER’S WAGE STATEMENT FOR SCHOOL DISTRICTS

Amended

The Texas Workers' Compensation Act and Workers' Compensation rules require an employer to provide an Employer's Wage Statement to its workers' compensation insurance carrier (carrier) and the claimant or the claimant’s representative, if any. The purpose of the form is to provide the employee's wage information to the carrier for calculating the employee's Average Weekly Wage (AWW) to establish benefits due to the employee or a beneficiary.

The AWW for a school district employee is computed based upon the wages earned in a week. “Wages earned in a week” are equal to the amount that would be deducted from an employee’s salary if the employee were absent from work for one week and the employee did not have personal leave to compensate the employee for the lost wages from that week.

NOTE - An employer who fails without good cause to timely file a complete wage statement as required by the Texas Workers' Compensation Act, Texas Labor Code, Section 408.063(c) and Workers' Compensation Rule 120.4 may be assessed an administrative penalty not to exceed $500.00 for an initial offense and not to exceed $10,000.00 for a repeated administrative violation.

The employer shall timely file a complete wage statement in the form and manner prescribed by the Division.

(1)The wage statement shall be filed (“filed” means received) with the carrier, the claimant, and the claimant's representative (if any) within 30 days of the earliest of:

(A)the employee’s eighth day of disability;

(B)the date the employer is notified that the employee is entitled to income benefits;

(C)the date of the employee’s death as a result of a compensable injury.

(2)The wage statement shall also be filed with the Division within seven days of receiving a request from the Division (Only When Requested).

(3)A subsequent wage statement shall be filed with the carrier, employee, and the employee’s representative (if any) within seven days if any information contained on the previous wage statement changes.

All applicable DWC rules can be found at www.tdi.state.tx.us

EMPLOYEE AND EMPLOYER INFORMATION |

|

|

|

||

Employee’s Name (Last, First, M.I.): |

|

Employer’s Business Name: |

|

|

|

|

|

|

|||

Employee’s Mailing Address (Street or P.O. Box): |

Employer’s Mailing Address (Street or P.O. Box): |

|

|||

|

|

|

|

|

|

City: |

State: |

ZIP Code: |

City: |

State: |

ZIP Code: |

|

|

|

|

|

|

Social Security Number (last 4 digits): |

|

Federal Tax I.D. Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Date of Hire: |

|

Date of Injury: |

Name and Phone # of Person Providing Wage Information: |

||

|

|

|

|

|

|

The employee has not returned to work. OR The employee returned to work on __________

without restriction. OR

with restrictions and is earning wages of $_____________ per

week/month (circle one).

NOTE – Rule 120.3 requires the employer file the Supplemental Report of Injury (DWC

I HEREBY CERTIFY THAT THIS WAGE STATEMENT is complete, accurate, and complies with the Texas Workers' Compensation Act and applicable rules; and the listed wages include all pecuniary wages and stipends as required by statute and rule and I understand that making a misrepresentation about a workers’ compensation claim is a crime that can result in fines and/or imprisonment.

Signature: __________________________________ Date: ____________

EMPLOYMENT STATUS

Does the employee work continuously through the calendar year for the school district (i.e. does the employee work in the summer?) The answer to this question is not affected by whether the employee is paid over a 12 month period or over a shorter period.

YES

NO. |

If no, what were the dates and the number of days or months the employee was scheduled to work in the current school year? |

|

From _____/______/______ to _____/______/______ which requires the employee to work ________ days OR _____ months. |

WRITTEN CONTRACT EMPLOYEE: an employee who has a written contract of employment with the school district that specifies amount that will be paid for completion of the contract and either the number of days the employee is required to work or the period of the contract.

If the employee is employed through a written contract, complete the “Written Contract Wage Information” and the “Annual Wage Information” sections on page 2.

EMPLOYEE WITHOUT A WRITTEN CONTRACT:

Salaried: an

Hourly: an

Daily: an “at will” employee employed and paid on a daily basis (generally substitute teachers).

Other: (specify)

If the employee is NOT employed through a written contract, complete the “Wage Information for Salaried, Hourly, Daily, And Other

NOTE TO INJURED EMPLOYEE – If you were injured on or after 7/1/02, and had employment with more than one employer on the date of injury, you can provide your insurance carrier with wage information from your other employment for the carrier to include in your AWW and this may affect your benefits. Contact your carrier for additional information or call the Division at (800)

DWC |

DIVISION OF WORKERS’ COMPENSATION |

|

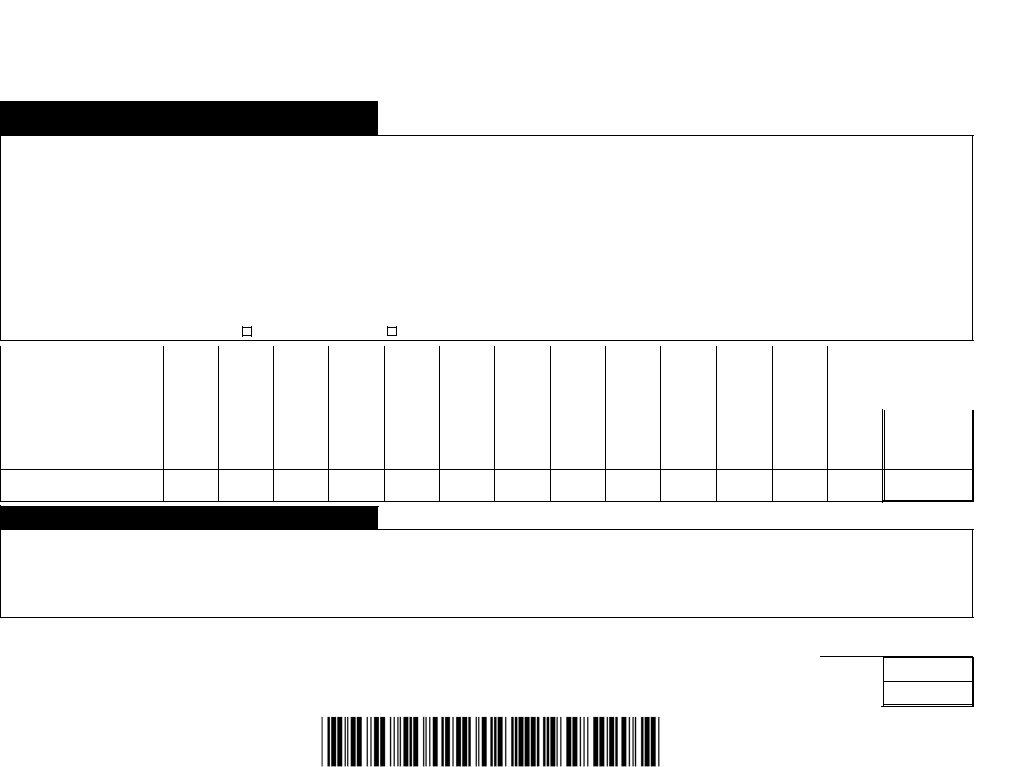

PAGE 2 WAGE INFORMATION |

|

Employee Name: |

Social Security #: |

Date of Injury: |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WRITTEN CONTRACT WAGE INFORMATION |

|

|

|

|

|

|

Total Gross Value of Written |

|

Number of Work Days |

OR |

Number of Months in |

|

|

Contract (including stipends): |

|

in Written Contract: |

Written Contract: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WAGE INFORMATION FOR SALARIED, HOURLY,

DAILY, & OTHER

-Report the Gross Pecuniary Wages earned in the 13 weeks immediately prior to the date of injury. Consider as earnings amounts from paid holidays and any vacation, personal or sick leave an employee used but not the market value of leave time earned but not used.

-Pecuniary Wages include all wages that are paid to the employee in the form of money. These include, but are not limited to: hourly, weekly, biweekly, monthly, etc. wages; salary; tips/gratuities; piecework compensation; monetary allowances; bonuses; and commissions. Earnings are reported in the periods they are earned, NOT when they are paid and some (such as bonuses and commissions) need to be prorated. Pecuniary wages don’t include payments made by an employer to reimburse the employee for the use of the employee's equipment or for paying helpers or to reimburse travel expenses.

-If the employee is paid on a monthly or

-If reporting weekly earnings, use all 13 Period Columns below. If reporting 3 months of earnings, either convert the wages to weekly earnings or use the first 3 Period Columns. If reporting 14 weeks of biweekly earnings, use the first 7 Period Columns. In all cases, indicate the dates that each period covers.

-If the employee was not employed for 13 continuous weeks before the date of injury, report the wages of an employee who has training, experience, skills & wages comparable to the injured employee AND who performs services/tasks comparable in nature and in number of hours. If no similar employee exists, report the limited available wages earned by the injured employee prior to the injury.

The wage information in this section is from:

the Injured Employee OR

a Similar Employee (If requested by the Division, the employer shall identify the similar employee whose wages were provided.)

PERIOD # (Week #, |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

13 |

|

Month #, or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FROM DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# HOURS WORKED: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS WAGES

EARNED:

ANNUAL WAGE INFORMATION

-If the employee did not work for your district for one of the months indicated below, insert the letters “NE” to indicate “not employed.”

-If the employee did work for your district during the month, but did not earn any wages please insert a “0”.

MONTH # |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

11 |

12 |

FROM DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TO DATE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WAGES EARNED: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL

DWC |

DIVISION OF WORKERS’ COMPENSATION |