Any time you want to fill out send certified coverage online, there's no need to download any programs - just use our online tool. FormsPal development team is always working to develop the tool and insure that it is much better for clients with its handy features. Discover an endlessly innovative experience now - check out and uncover new possibilities along the way! With some basic steps, you can begin your PDF journey:

Step 1: Open the PDF inside our tool by clicking the "Get Form Button" at the top of this page.

Step 2: The editor gives you the ability to work with PDF forms in many different ways. Modify it by including personalized text, adjust existing content, and add a signature - all possible within a few minutes!

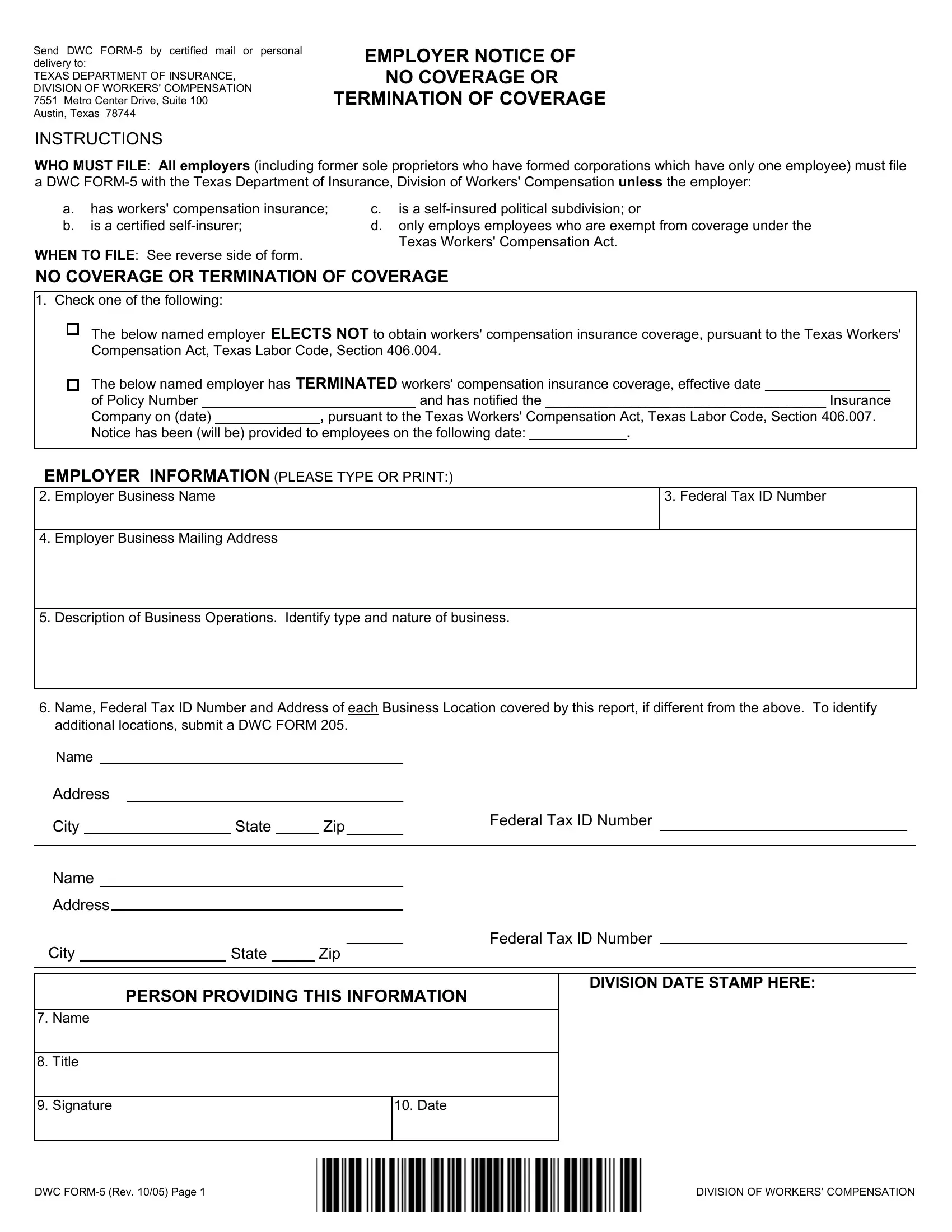

This PDF form will require particular data to be filled out, therefore ensure you take whatever time to enter what's requested:

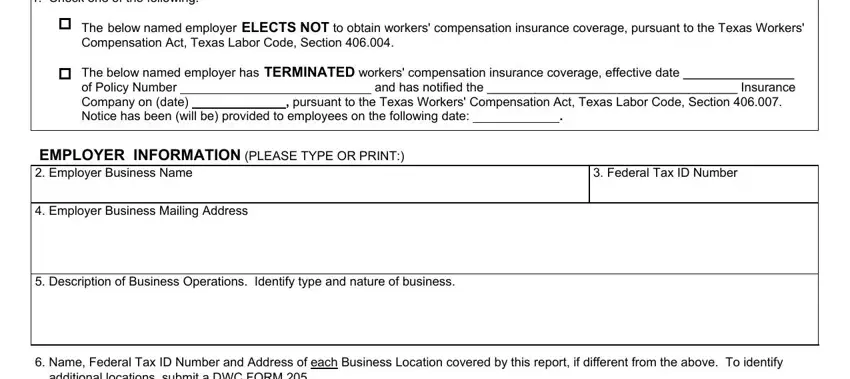

1. Fill out your send certified coverage online with a number of essential blanks. Gather all of the required information and make certain absolutely nothing is overlooked!

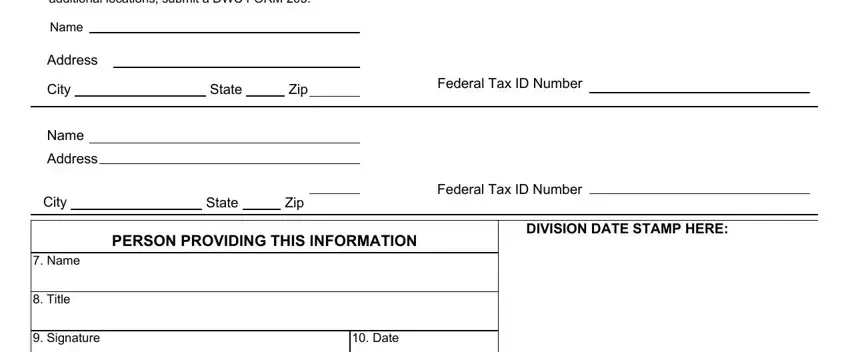

2. Once your current task is complete, take the next step – fill out all of these fields - Name Federal Tax ID Number and, Address, City State Zip, Federal Tax ID Number, Name Address, City State Zip, Federal Tax ID Number, PERSON PROVIDING THIS INFORMATION, Date, Name, Title, Signature, and DIVISION DATE STAMP HERE with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

People generally get some points wrong while completing DIVISION DATE STAMP HERE in this section. Be sure you revise everything you enter right here.

Step 3: Just after double-checking the entries, click "Done" and you're done and dusted! Right after setting up a7-day free trial account with us, you will be able to download send certified coverage online or send it through email directly. The PDF document will also be easily accessible from your personal account with your each and every change. We do not share any information that you provide when filling out documents at our site.