Dealing with PDF forms online is actually easy with this PDF editor. Anyone can fill in e104 form ireland here effortlessly. In order to make our editor better and less complicated to use, we consistently work on new features, with our users' feedback in mind. Getting underway is simple! All that you should do is take the following basic steps down below:

Step 1: Click the orange "Get Form" button above. It is going to open our tool so that you can start filling out your form.

Step 2: When you start the PDF editor, you'll see the document made ready to be filled out. Aside from filling in various blanks, you may as well perform several other things with the Document, including adding your own text, editing the initial text, inserting images, signing the form, and a lot more.

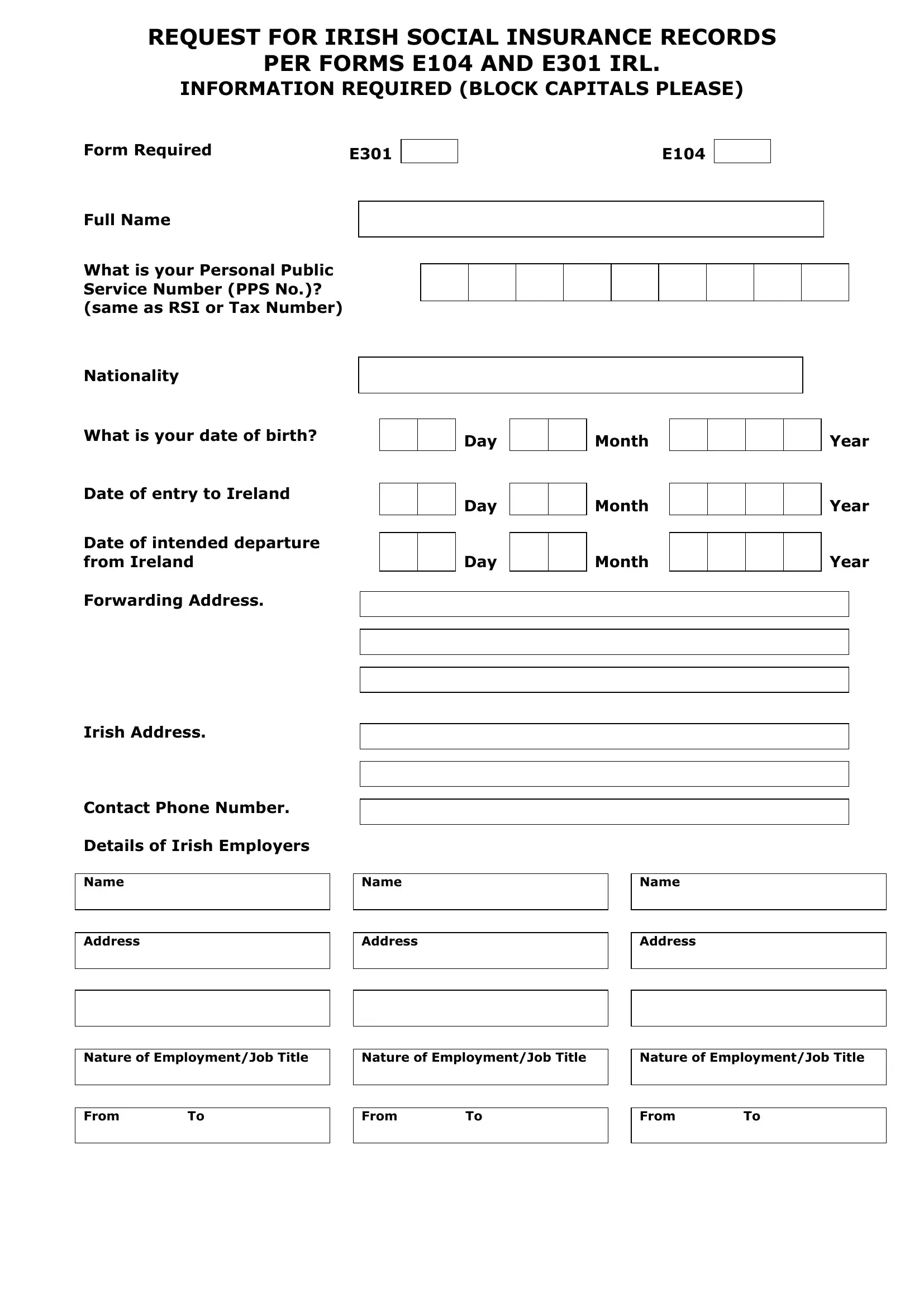

This form requires particular info to be entered, hence ensure you take the time to fill in precisely what is required:

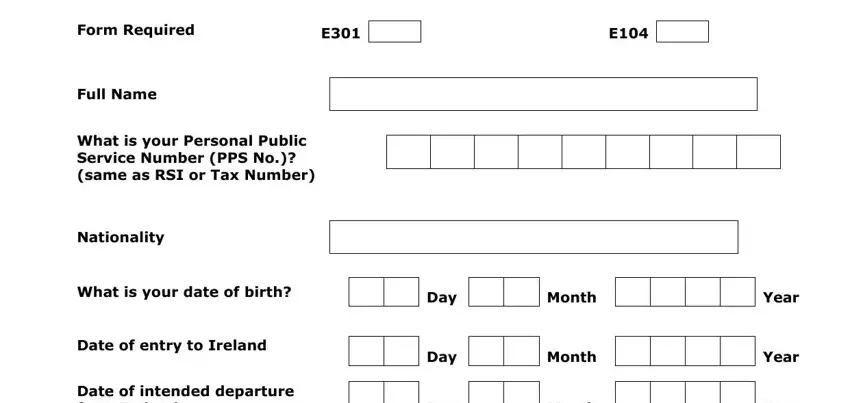

1. The e104 form ireland will require particular information to be entered. Make sure the following blank fields are filled out:

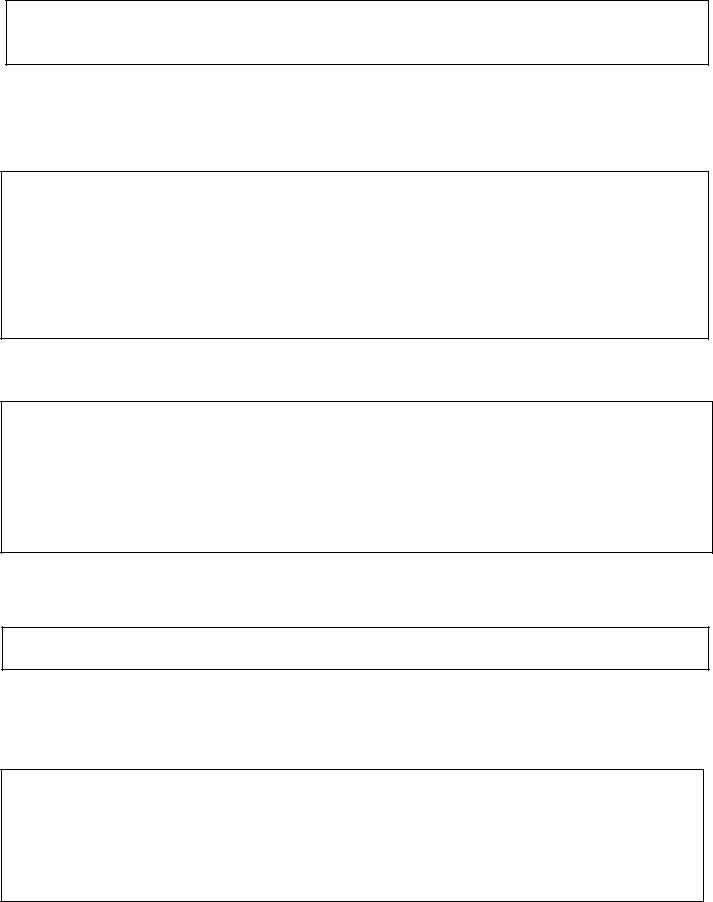

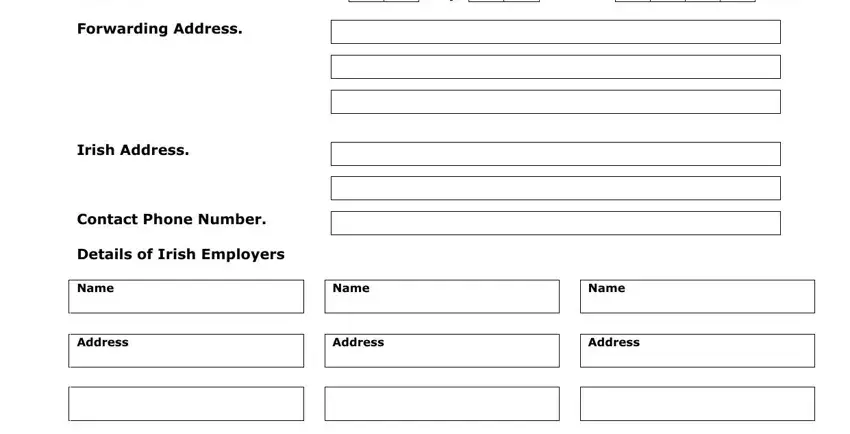

2. Given that the previous section is finished, you need to insert the required details in Date of intended departure from, Address, Day, Month, Year, Name, Address, Name, and Address so you're able to go to the 3rd step.

It's easy to make errors when filling in the Date of intended departure from, thus be sure you take another look prior to when you finalize the form.

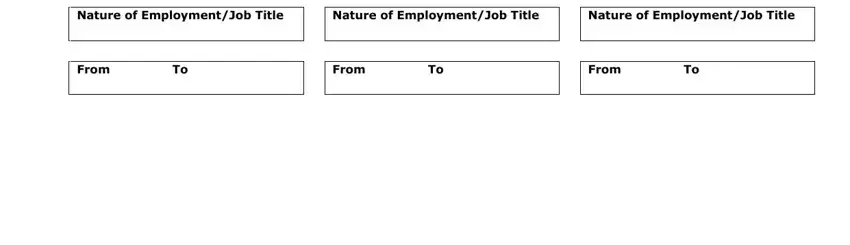

3. In this specific stage, review Nature of EmploymentJob Title, Nature of EmploymentJob Title, Nature of EmploymentJob Title, From To, From To, and From To. All these should be filled in with highest accuracy.

Step 3: Proofread what you've entered into the form fields and then click on the "Done" button. Join FormsPal right now and immediately get e104 form ireland, all set for download. Every last modification you make is handily preserved , which enables you to customize the file at a later stage anytime. We do not share the information that you enter while dealing with documents at our website.