form 4669 can be filled in online effortlessly. Simply use FormsPal PDF editing tool to complete the task right away. The editor is consistently upgraded by us, getting handy features and growing to be much more convenient. Here's what you will need to do to start:

Step 1: Simply hit the "Get Form Button" above on this webpage to launch our pdf file editor. This way, you'll find everything that is required to work with your file.

Step 2: Once you start the editor, you will find the form ready to be filled in. In addition to filling in various fields, you can also do several other things with the file, such as writing custom text, editing the initial textual content, inserting images, placing your signature to the PDF, and a lot more.

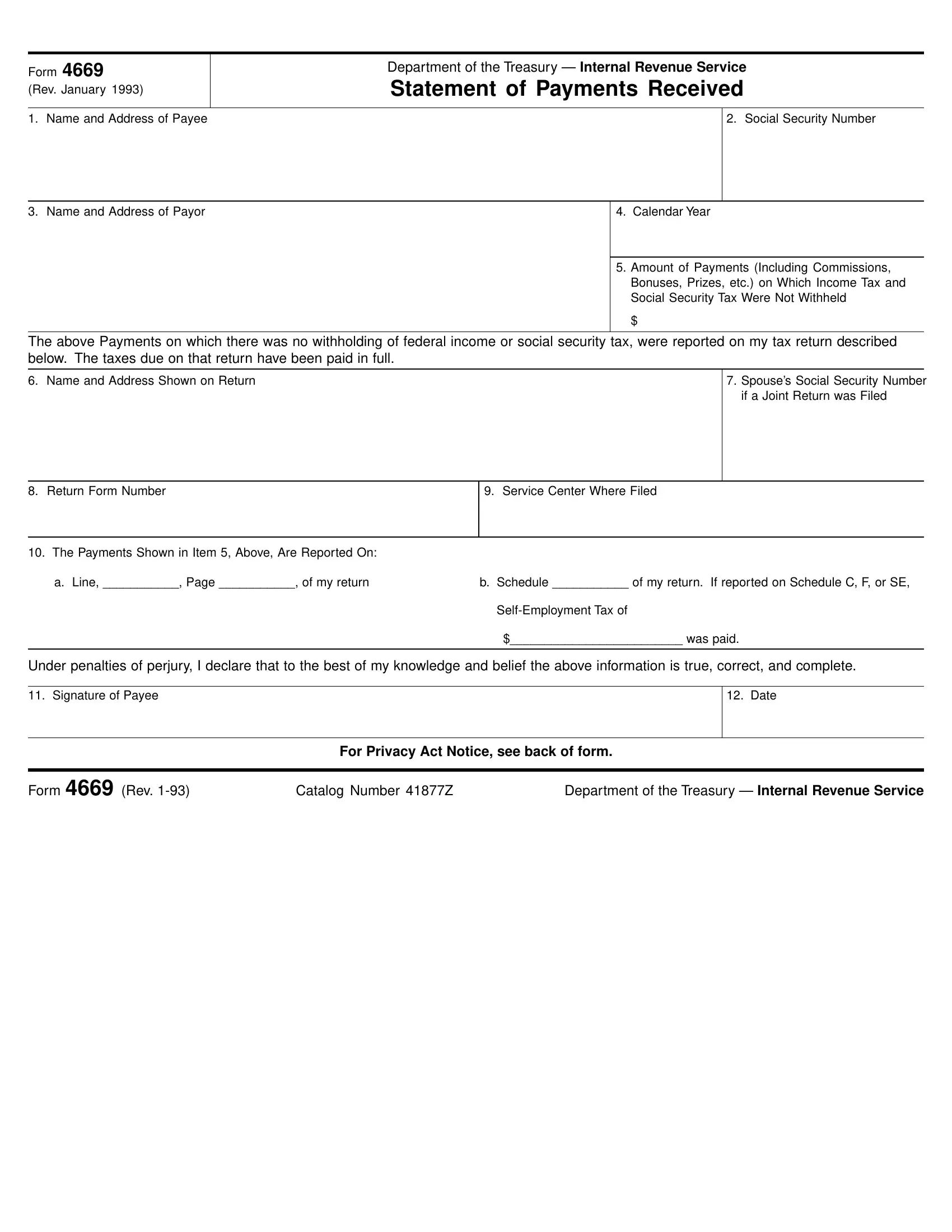

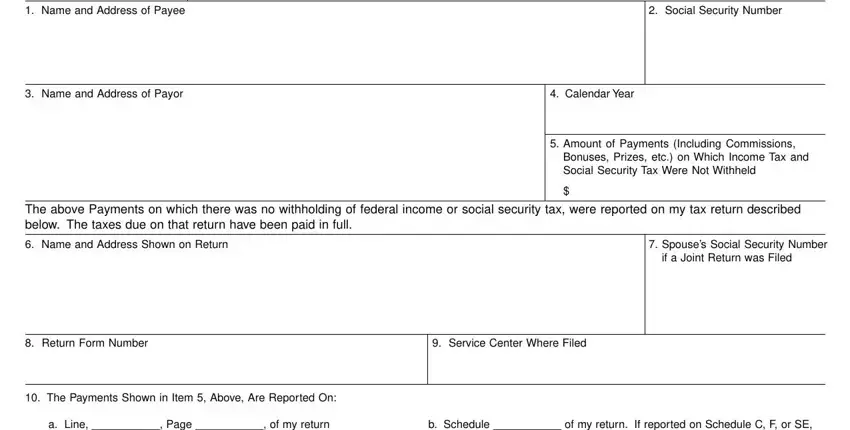

In order to fill out this PDF document, ensure you type in the necessary information in every blank field:

1. You should fill out the form 4669 properly, hence take care when filling in the parts comprising all these fields:

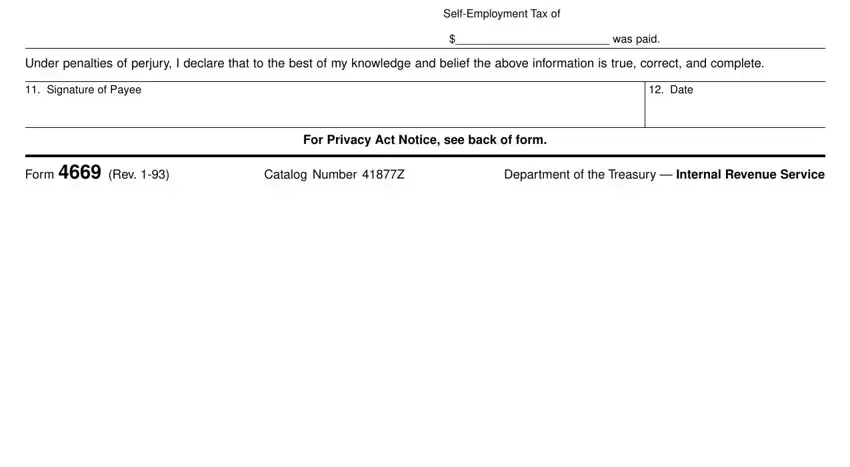

2. Immediately after this section is done, proceed to type in the applicable details in these: Under penalties of perjury I, Signature of Payee, Date, SelfEmployment Tax of, was paid, Form Rev, Catalog Number Z, Department of the Treasury, and For Privacy Act Notice see back of.

Regarding For Privacy Act Notice see back of and was paid, make sure that you don't make any errors in this section. Both of these are the most significant fields in this file.

Step 3: You should make sure your details are correct and click "Done" to complete the process. Find your form 4669 after you join for a free trial. Conveniently view the form within your FormsPal cabinet, with any edits and adjustments being automatically kept! At FormsPal, we do everything we can to make sure that all your information is kept private.